Buy more as it dips! Ethereum falls below the ETF entry price, with whales contrarily accumulating 40,000 coins

Ethereum has fallen over 30% since the beginning of the year, with the price dropping below $2,000 and trading below the average entry price of accumulated addresses and ETF holders. BitMine’s unrealized losses surged from $6 billion to $7 billion, yet on Tuesday, they still bought 40,000 ETH and staked 140,400 tokens, with total staked ETH reaching 2.97 million. Despite the losses, net holdings on exchanges have turned negative, indicating withdrawals exceeding deposits, and Ethereum whales continue to accumulate.

$7 Billion Unrealized Losses: BitMine’s Accounting Disaster

(Source: CryptoQuant)

Currently, Ethereum’s trading price is below the average entry price of accumulated addresses and ETF holders, causing significant losses for major holders. The overall bearish crypto market has extended ETH’s downtrend into 2026, with a decline of over 30% year-to-date. As the second-largest market cap cryptocurrency, ETH fell below $2,000 last week. Although it briefly rebounded, the rally was short-lived, and ETH fell below that level again.

According to BeInCrypto Markets data, ETH has dropped 4.58% in the past 24 hours. At press time, its trading price is $1,971. The weak price has caused many holders to incur losses. BeInCrypto previously reported that the world’s largest Ethereum treasury, BitMine, saw its unrealized losses spike to $6 billion last week. CryptoQuant data shows that with recent price declines, these paper losses have now exceeded $7 billion.

The $7 billion unrealized loss is staggering—equivalent to the annual GDP of many mid-sized countries or the market cap of a large publicly traded company. For BitMine, this paper loss, while unrealized (not actual unless sold), can negatively impact financial statements and investor confidence. If BitMine were a publicly listed company, such losses would appear in quarterly reports, potentially causing stock price declines and investor skepticism.

However, BitMine’s response has been remarkably resolute. The company purchased 40,000 ETH yesterday. Additionally, Lookonchain announced that BitMine staked 141,000 ETH. This brings BitMine’s total staked ETH to 2.97 million, worth approximately $6.01 billion, accounting for 68.7% of its total ETH holdings, indicating a commitment to long-term network participation rather than short-term trading.

This “adding to losses” strategy is often called dollar-cost averaging or “buying the dip” in investment circles. The logic is: if you believe in the long-term value of an asset, then a price decline is an opportunity to buy rather than a reason to panic. BitMine’s actions send a strong signal to the market: they believe Ethereum’s current price is severely undervalued and has enormous upside potential. This institutional-level conviction provides a crucial confidence anchor for retail investors.

From CEO Tom Lee’s public statements, BitMine’s long-term outlook on Ethereum includes: Ethereum’s fundamental role as a smart contract platform remains unshakable, DeFi and NFT ecosystems continue to grow, Ethereum 2.0 upgrades will improve performance, and upcoming innovations like Danksharding will further reduce transaction costs. These fundamentals underpin BitMine’s decision to continue accumulating despite the $7 billion paper loss.

Accumulated Addresses’ Actual Cost Discrepancy: Ethereum Whales’ Collective Trapping

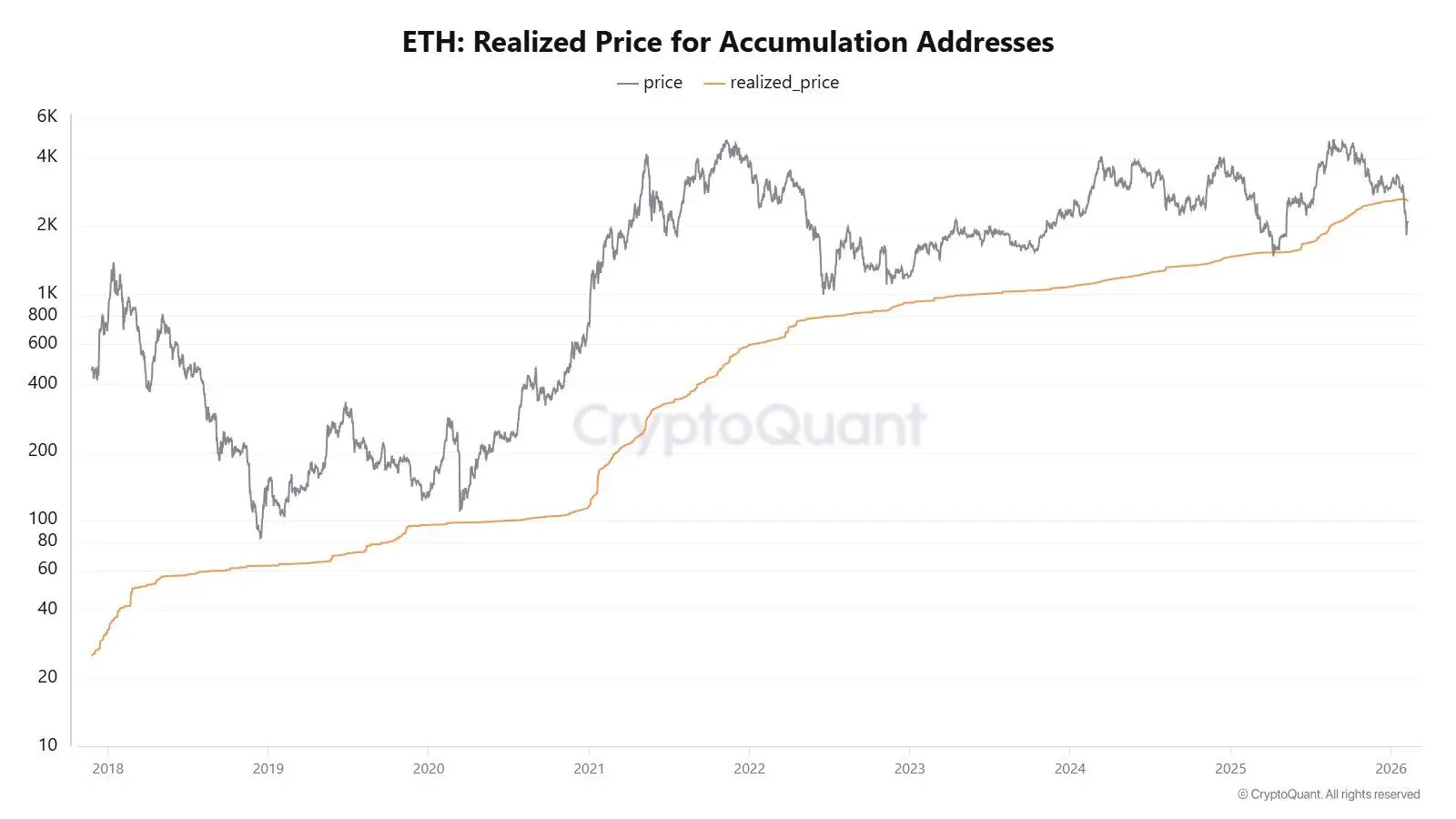

On-chain data shows that the group of accumulated addresses is under pressure. Recently, an analyst known as CW8900 pointed out in a blog post that ETH’s price has fallen below the realized price of these addresses. Accumulated addresses refer to wallets that hold ETH long-term with minimal or no selling, often seen as steadfast long-term investors or institutions.

Massive Ethereum whales began accumulating in June 2025. Currently, the market price is below the average cost basis of these wallets. In June 2025, ETH traded around $3,200–$3,500. If whales started buying in batches then and continued until the peak in October, their average cost could be above $3,000. The current price of $1,971 means these whales are generally sitting on 30–40% losses.

The realized price of accumulation addresses is a key on-chain indicator provided by platforms like Glassnode. It calculates the average purchase cost of ETH held by these addresses. When the market price drops below this realized price, even the most steadfast long-term holders are in loss. This is often a highly pessimistic market signal, but historical data suggests it’s also close to the bottom.

Three Major Implications of Whales’ Trapped Positions

Bottom Signal: Historically, when accumulation addresses are in loss, the market is near a cycle bottom.

Limited Selling Pressure: Long-term holders tend not to panic-sell even at a loss, reducing downward pressure.

Contrarian Indicator: When the most committed bulls are trapped, it often signals a good buying opportunity.

However, analyst CW8900 notes that Ethereum whales have not been retreating; instead, they are increasing their holdings. “Their accumulation is becoming more aggressive. The current price may be very attractive to Ethereum whales,” the analyst said. Continuing to buy in a loss state requires strong conviction and capital. Only institutions truly confident in Ethereum’s long-term value would keep investing billions in paper losses.

Ethereum ETF Holders’ Grim Situation: Trading Price Below Entry Price

Meanwhile, ETF investors are also under increasing pressure. Senior analyst James Seyffart of Bloomberg Intelligence pointed out that ETH ETF holders are in a worse position than Bitcoin ETF holders. ETH’s price hovers below $2,000, far below the estimated average ETF cost basis of around $3,500. Seyffart added, “The recent bottoming saw a decline of over 60%, roughly matching the percentage drop in ETH in April 2025.”

An average cost basis of $3,500 implies that ETH ETF holders are currently experiencing an average loss of about 43.7%. This is an extremely painful loss, far beyond most traditional investors’ tolerance. For conservative investors who invested via retirement accounts or wealth management channels, such losses could trigger panic and trust issues.

However, Seyffart emphasized that despite the decline, most ETF investors are still holding. The net assets of Ethereum ETFs have fallen from about $15 billion to less than $12 billion. While this represents a more severe sell-off compared to Bitcoin ETFs, he notes that most ETF holders are still holding their positions. “From a relative perspective, this is much worse than Bitcoin ETF sell-offs, but overall, it’s still a pretty solid stock,” the analyst said.

“Diamond Hands” is a popular term in crypto communities, referring to investors who hold steadfast during major price drops. Seyffart’s use of the term indicates his recognition of ETF holders’ resilience. The decline from $15 billion to $12 billion means a outflow of only $3 billion, or 20%. Given the loss of over 40%, a redemption rate of only 20% shows most holders have chosen to stay.

BeInCrypto also reported that the net holdings change indicator for Ethereum exchanges has turned negative. This means more ETH has been withdrawn from exchanges than deposited. Such a pattern is often associated with accumulation. When investors withdraw ETH from exchanges to personal wallets or cold storage, it generally indicates long-term holding intentions. Conversely, depositing ETH into exchanges is usually a sign of preparing to sell.

Currently, Ethereum appears to be in a phase of “belief compression”: prices reflect pressure, but capital flows show major participants are choosing to hold, and in some cases, are still increasing their positions. Whether this resilience can translate into a sustained recovery may depend on broader market conditions and whether Ethereum can reclaim key technical levels in the coming weeks.

Related Articles

What to do after the crypto market crashes? Tom Lee provides a "new buying logic" for Bitcoin and Ethereum

Whale 0x28eF Stakes 60,073 ETH Worth $117.08M After Recent Purchase