Nancy Guthrie's ransom wallet's first activity! Polymarket: 78% betting on someone being arrested before the end of February

“Today Show” host Savannah Guthrie’s mother, Nancy Guthrie, was kidnapped, with a ransom letter demanding $4 million in Bitcoin. If unpaid, the amount would increase to $6 million. TMZ reports recent activity involving hundreds of dollars in transactions from the Bitcoin wallet linked to the ransom. A “Can the kidnapping suspect be apprehended before February 28?” market has appeared on Polymarket, with traders estimating about a 78% chance of an arrest before that date.

Key Clues from Nancy Guthrie’s Bitcoin Ransom Wallet’s First Activity

Savannah Guthrie’s mother, Nancy Guthrie, was kidnapped from her home on Mount Catalina in Tucson, Arizona. She was last seen on January 31 and reported missing on February 1. Bloodstains were found near the residence entrance. Guthrie’s phone, wallet, medications, and car were left at the scene. The FBI is assisting the Pima County Sheriff’s Office with the investigation.

Following the kidnapping, the alleged ransom letter surfaced. People magazine reports that on the evening of February 2, Tucson CBS-affiliated station KOLD received an email containing the ransom note. The message demanded $4 million in Bitcoin be paid before February 5 to ensure Nancy’s safe return; if not paid by then, the amount would rise to $6 million by February 9. Sources say the message warned of serious consequences if the second deadline was missed.

Reports indicate that TMZ also received the same email the next day. The FBI confirmed they are taking the extortion email sent to U.S. media seriously. On February 9, FBI Phoenix spokesperson Connor Hagen stated they are “not aware” of any ongoing contact between Guthrie’s family and the suspects. As the search for Guthrie enters its second week, FBI Director Kash Patel released surveillance footage related to the case.

Timeline of Nancy Guthrie Case

January 31: Last seen

February 1: Reported missing; blood found at scene

February 2: Media receives ransom email demanding $4 million BTC by 2/5

February 5: First payment deadline (unknown if paid)

February 9: Second deadline for $6 million; FBI states no ongoing contact

February 10: Bitcoin wallet shows activity for the first time

TMZ reports that the Bitcoin wallet mentioned in the ransom note has recently seen transactions, though specific amounts are not disclosed. TMZ states, “We first noticed activity in the Bitcoin account listed in the initial ransom note. For various reasons, we will not disclose the ransom amount.” According to People magazine citing sources, a smaller transaction (estimated at “a few hundred dollars”) has reportedly been transferred into the Bitcoin wallet mentioned in the ransom note.

This “few hundred dollars” transaction is highly significant. It could indicate several scenarios: family testing the waters with a partial payment to establish contact, law enforcement tracking the wallet through bait transactions, or kidnappers testing if the wallet is operational. Whatever the case, it confirms the wallet is active and provides new clues for the investigation.

Blockchain Transparency and Tracking: A Double-Edged Sword

While Bitcoin transactions are publicly recorded on the blockchain, tracing ransom payments is not straightforward. Identifying individuals behind wallet addresses often requires additional investigative tools and cooperation from exchanges. Attackers may transfer funds across multiple wallets, convert between platforms, or use crypto mixers to obfuscate transactions. Such techniques aim to hide the trail. Although blockchain transparency aids investigators, layering or disguising transactions complicates tracking and recovery.

The use of Bitcoin in ransom and kidnapping cases highlights the dual nature of cryptocurrencies. On one hand, the public ledger allows law enforcement to trace every transaction—something impossible with cash ransom. Blockchain analysis firms like Chainalysis and Elliptic can track Bitcoin flows, even through mixers, using statistical analysis and pattern recognition.

On the other hand, Bitcoin’s pseudonymity (addresses not directly linked to real identities) and cross-border nature enable kidnappers to receive ransom anywhere globally, increasing law enforcement challenges. If they transfer Bitcoin into privacy coins like Monero or use decentralized exchanges, tracking becomes even harder. This “traceable but difficult to pinpoint” characteristic makes Bitcoin a common tool in modern crime.

Polymarket Betting Market and Ethical Concerns

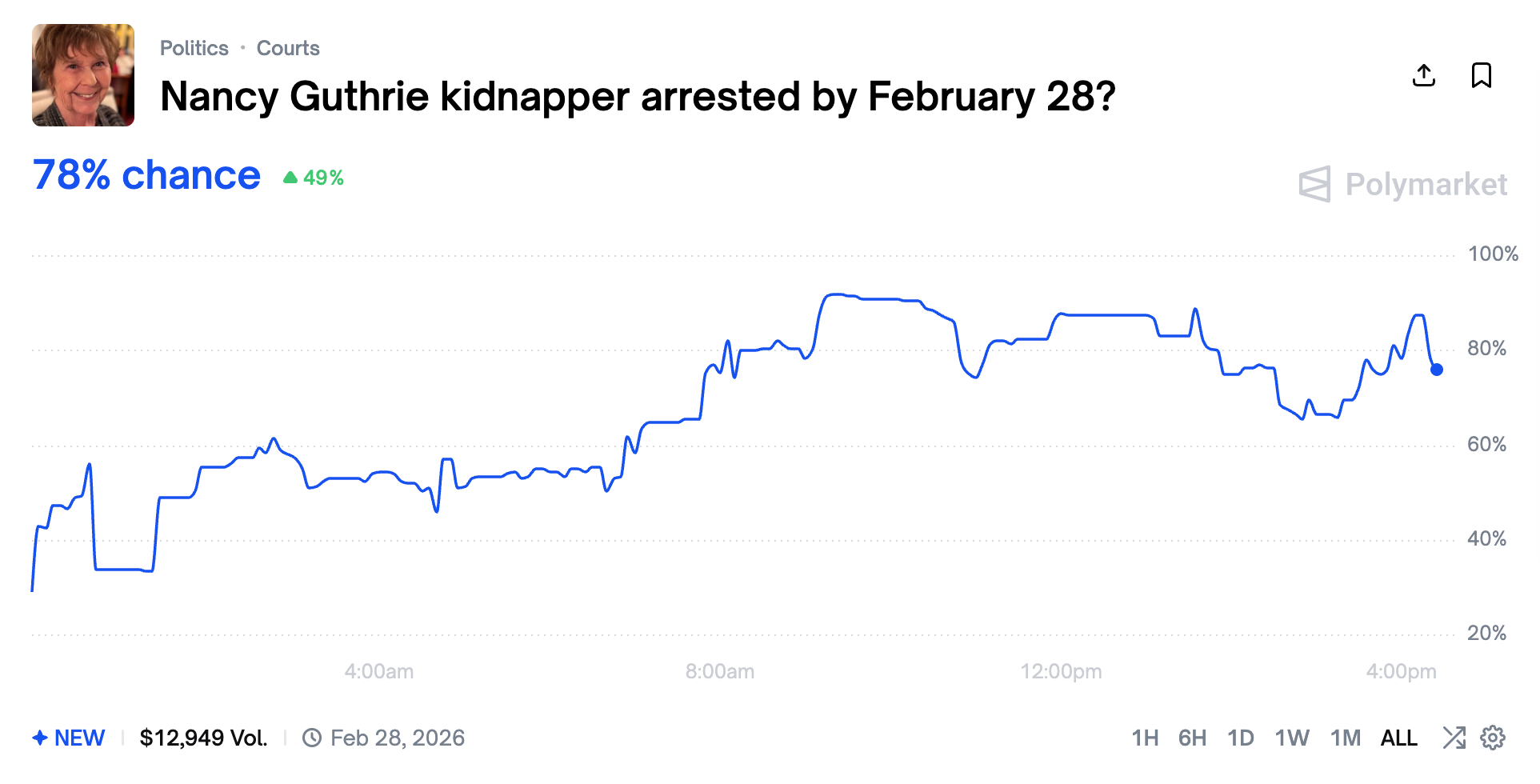

(Source: Polymarket)

The case has also appeared on the prediction market platform Polymarket, where users are betting on the likelihood of an arrest. A market titled “Will the Nancy Guthrie kidnapping suspect be apprehended before February 28?” was created on February 10, 2026, at 1:04 PM ET. Traders currently estimate about a 78% chance of an arrest before that date, though this probability fluctuates rapidly.

The emergence of active markets related to ongoing and sensitive criminal investigations raises broader ethical questions. Turning a live, serious case into a speculative financial instrument risks trivializing the gravity of the event. Moreover, while law enforcement efforts are ongoing, such markets could foster misinformation, amplify rumors, or distort public perception.

This ethical debate has sparked intense discussion on social media. Critics argue that betting on a mother’s life-and-death situation is a secondary harm to the victim’s family and shows a lack of empathy. Savannah Guthrie, a nationally recognized TV host, has already endured trauma from her mother’s kidnapping; seeing strangers treat it as a betting game is emotionally difficult.

Supporters contend that prediction markets are merely tools for aggregating public expectations, unrelated to feelings of sympathy or indifference. The 78% probability reflects collective judgment based on public information (FBI progress, surveillance footage, Bitcoin clues). Such information aggregation might be more accurate than any single expert’s prediction. Additionally, participants’ financial incentives motivate careful analysis, potentially uncovering clues law enforcement might overlook.

While these platforms are often described as expectation aggregators, their use in active criminal investigations remains controversial, especially when outcomes directly impact victims and families. Should Polymarket be allowed to host such markets? This could serve as a critical test for regulation of prediction markets. If public backlash is strong, it might lead to legislation banning markets on ongoing criminal cases.

Related Articles

Strategy Perpetual Preferred Stock STRC returns to $100 par value for the first time since mid-January

Strategy Perpetual Preferred Stock STRC returns to $100, opening a new round of Bitcoin "financing buy-in" channel

Bitwise CEO reveals that their clients bought $11 million worth of Bitcoin during the market downturn

Bitcoin Teeters Above $60K as $350M in Leveraged Longs Face Liquidation — Is the Bottom Really In?

Nancy Guthrie Case: Bitcoin Wallet Moves $300, Polymarket Traders Now 78% Certain of Arrest

Overview of popular cryptocurrencies on February 12, 2026, with the top three being: Bitcoin, Ethereum, and BNB