2026 GALO Price Prediction: Comprehensive Analysis and Expert Forecasts for Galois Token's Future Market Performance

Introduction: GALO's Market Position and Investment Value

Clube Atlético Mineiro Fan Token (GALO), as a fan engagement digital asset designed to strengthen the relationship between supporters and the club, has been serving the sports blockchain ecosystem since its launch. As of 2026, GALO maintains a market capitalization of approximately $171,014, with a circulating supply of around 4.71 million tokens, and the price holding at $0.03632. This asset, recognized as an innovative fan participation token, is playing an increasingly significant role in connecting football enthusiasts with club governance and exclusive benefits.

This article will comprehensively analyze GALO's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. GALO Price History Review and Market Status

GALO Historical Price Evolution Trajectory

- 2021: GALO reached its all-time high of $2.88 on November 6, marking a significant milestone in the early stages of the token's market presence.

- 2025: The token experienced substantial volatility, declining to its all-time low of $0.01044146 on October 11, reflecting a challenging period for fan token valuations.

- Recent Period: Over the past year, GALO has experienced a significant downturn, with the price declining by approximately 59.019% from previous levels.

GALO Current Market Situation

As of February 9, 2026, GALO is trading at $0.03632, showing mixed short-term performance with a slight increase of 0.25% over the past hour, while experiencing a modest decline of 0.33% in the last 24 hours. The token has demonstrated some weakness over the past week with a 2.29% decrease, and a minor monthly decline of 0.49%.

The current 24-hour trading volume stands at $8,975.76, indicating relatively limited trading activity. GALO's market capitalization is approximately $171,014.83, with a circulating supply of 4,708,558 tokens representing 47.09% of the maximum supply of 10,000,000 tokens. The fully diluted market cap is calculated at $363,200.

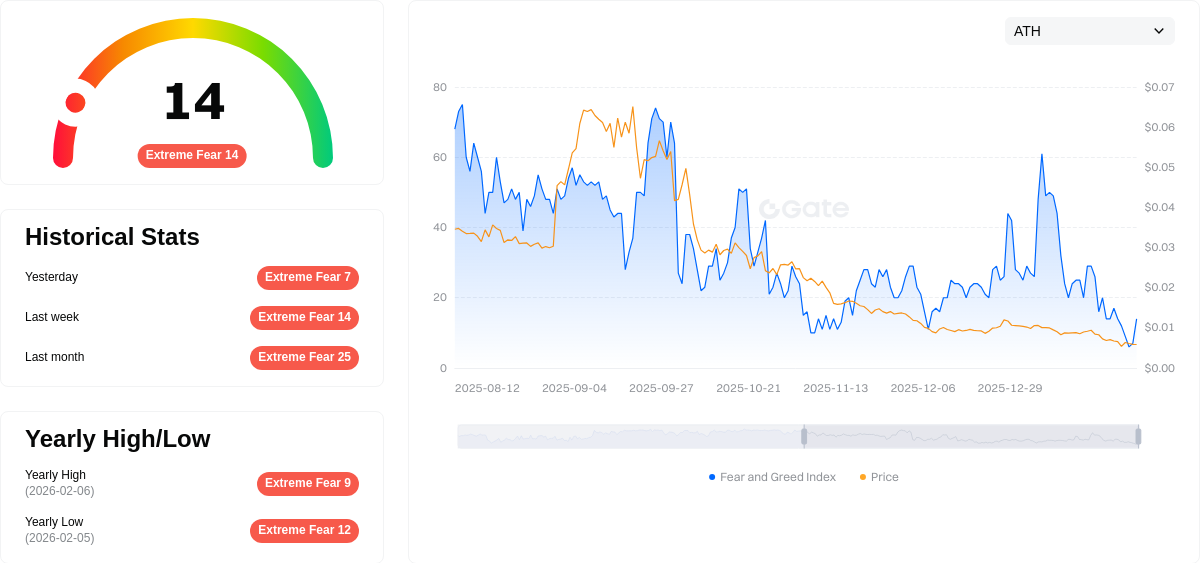

The token's market dominance remains minimal at 0.000014%, reflecting its niche positioning within the broader cryptocurrency landscape. Trading within a 24-hour range between $0.03604 and $0.03649, GALO maintains a relatively narrow price band. The current market sentiment index stands at 14, indicating an "Extreme Fear" condition in the broader market environment.

Click to view current GALO market price

GALO Market Sentiment Index

2026-02-09 Fear & Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear & Greed Index plummeting to 14. This exceptionally low reading indicates heightened market anxiety and pessimism among investors. During such extreme fear periods, risk-averse traders typically reduce positions while contrarian investors may view it as a potential buying opportunity. Market volatility remains elevated, and sentiment is predominantly bearish. Close monitoring of support levels and major news developments is essential. The current conditions suggest careful position management and risk assessment are crucial for navigating this turbulent market environment.

GALO Token Holdings Distribution

According to the latest on-chain data, GALO's token holdings distribution exhibits a relatively concentrated pattern. The top 10 addresses collectively hold a significant proportion of the total token supply, with the largest holder possessing 26.58% of all tokens. The top three addresses alone control approximately 47.36% of the circulating supply, indicating a high degree of concentration at the upper tier. Such distribution patterns are common in early-stage tokens or projects with substantial institutional participation, but they also raise concerns about potential market manipulation risks and liquidity constraints.

From a market structure perspective, this level of concentration may impact price stability and trading dynamics. When large holders decide to sell or redistribute their positions, it could trigger significant price volatility due to the relatively limited liquidity available in the market. Additionally, the substantial holdings by top addresses may create barriers to organic price discovery, as a small number of entities effectively control a large portion of the tradable supply. This structure also affects the token's decentralization level, as true distributed ownership remains limited despite broader wallet distribution at lower tiers.

The current holdings distribution reflects a market structure that prioritizes early investors or strategic partners over retail participation. While the presence of addresses holding smaller percentages (ranging from 0.56% to 4.09% in the top 10) suggests some degree of distribution beyond the top holders, the overall concentration remains elevated. This characteristic indicates that GALO's on-chain structure requires continued monitoring, particularly regarding potential large-scale transfers or sales that could materially impact market sentiment and price stability.

Click to view current GALO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing GALO's Future Price

Supply Mechanism

- Circulating Supply Structure: Based on available data, GALO currently has a circulating supply of 4,708,558 tokens. The supply mechanism appears to follow a fan token model, which typically features controlled distribution to maintain scarcity and value for community participants.

- Historical Patterns: Historical price data indicates frequent fluctuations in GALO's valuation. Over the past seven days, the token experienced a decline of 1.77%, while the past 24 hours showed a minor decrease of 0.07%. Monthly performance revealed a 0.34% reduction compared to the previous period.

- Current Impact: The relatively stable supply combined with market demand dynamics continues to influence short-term price movements. Trading volume volatility, including a significant 57.65% decrease in 24-hour volume, suggests that liquidity fluctuations may contribute to price sensitivity.

Institutional and Major Holder Dynamics

- Market Positioning: While specific institutional holding data was not extensively detailed in the provided materials, GALO operates within the broader fan token ecosystem, which has attracted interest from sports organizations and blockchain platforms seeking to enhance fan engagement mechanisms.

- Adoption Context: Fan tokens like GALO represent a growing trend in bridging traditional sports communities with blockchain technology, potentially attracting partnerships and adoption from entities seeking innovative fan interaction models.

Macroeconomic Environment

- Monetary Policy Influence: According to comparative analysis materials, tokens in similar categories demonstrate sensitivity to interest rate changes and monetary policy adjustments. The correlation with traditional markets may affect investor sentiment toward fan tokens during periods of monetary tightening or easing.

- Inflation Hedge Characteristics: The materials suggest that certain blockchain assets exhibit resilience during inflationary periods due to their utility value and scarcity mechanisms. However, fan tokens primarily derive value from community engagement rather than traditional inflation hedging properties.

- Geopolitical Considerations: Cross-border transaction capabilities inherent in blockchain-based tokens may benefit from increased demand during periods of geopolitical uncertainty, though fan tokens remain more closely tied to their specific community ecosystems.

Technical Development and Ecosystem Building

- Market Analysis Tools: Technical analysis capabilities, including historical price pattern evaluation and trading volume assessment, provide insights into potential price movements. These analytical frameworks help traders identify opportunities within the volatile cryptocurrency environment.

- Ecosystem Integration: Fan tokens like GALO operate within broader blockchain ecosystems that facilitate community interaction, governance participation, and exclusive benefits for token holders. The continued development of these utility features may influence long-term adoption and valuation.

- Trading Infrastructure: The availability of GALO across multiple conversion pairs and trading platforms enhances accessibility for investors, contributing to market depth and liquidity dynamics that influence price discovery mechanisms.

III. 2026-2031 GALO Price Prediction

2026 Outlook

- Conservative Forecast: $0.02288 - $0.03632

- Neutral Forecast: $0.03632 (average scenario)

- Optimistic Forecast: Up to $0.04903 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token is anticipated to enter a gradual growth phase, with potential price appreciation driven by ecosystem development and broader market sentiment

- Price Range Predictions:

- 2027: $0.03414 - $0.05761 (estimated 17% year-over-year change)

- 2028: $0.04463 - $0.05616 (estimated 38% cumulative change from 2026)

- 2029: $0.0489 - $0.0792 (estimated 46% cumulative change from 2026)

- Key Catalysts: Project development milestones, community engagement initiatives, and overall cryptocurrency market recovery could serve as primary price drivers

2030-2031 Long-term Outlook

- Base Scenario: $0.05162 - $0.08007 (assuming steady project progress and moderate market conditions)

- Optimistic Scenario: $0.06618 - $0.08921 (assuming successful ecosystem expansion and favorable regulatory environment)

- Transformative Scenario: Potential to reach $0.08921 by 2031 (estimated 101% cumulative change from 2026, contingent upon breakthrough adoption and sustained bullish market cycles)

- 2026-02-09: GALO trading within early-stage price discovery phase, with baseline predictions suggesting potential for measured appreciation over the multi-year horizon

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.04903 | 0.03632 | 0.02288 | 0 |

| 2027 | 0.05761 | 0.04268 | 0.03414 | 17 |

| 2028 | 0.05616 | 0.05014 | 0.04463 | 38 |

| 2029 | 0.0792 | 0.05315 | 0.0489 | 46 |

| 2030 | 0.08007 | 0.06618 | 0.05162 | 82 |

| 2031 | 0.08921 | 0.07312 | 0.04314 | 101 |

IV. GALO Professional Investment Strategies and Risk Management

GALO Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Fans of Clube Atlético Mineiro seeking long-term engagement with the club

- Operational Recommendations:

- Allocate a portion of your fan token portfolio to GALO for sustained participation in club decision-making processes

- Monitor club announcements and utilize voting rights to maximize fan engagement benefits

- Storage Solution: Use Gate Web3 Wallet for secure storage with easy access to fan-specific features and rewards

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track short-term price movements using 7-day and 30-day moving averages to identify potential entry and exit points

- Volume Analysis: Monitor the 24-hour trading volume (currently $8,975.76) to assess market liquidity and trading activity

- Swing Trading Points:

- Consider the 24-hour price range ($0.03604 - $0.03649) to identify short-term volatility patterns

- Observe price recovery patterns from the historical low of $0.01044146 recorded on October 11, 2025

GALO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: up to 10% of fan token allocation

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple fan tokens and cryptocurrencies to reduce concentration risk

- Position Sizing: Limit GALO exposure given its relatively low market cap of $171,014.83 and limited exchange availability (1 exchange)

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet for seamless integration with Gate.com trading platform

- Cold Storage Option: Transfer long-term holdings to hardware wallets for enhanced security

- Security Precautions: Enable two-factor authentication, regularly update wallet software, and never share private keys or seed phrases

V. GALO Potential Risks and Challenges

GALO Market Risks

- Low Liquidity: With a 24-hour trading volume of only $8,975.76 and availability on just 1 exchange, GALO faces significant liquidity constraints that may result in price volatility

- High Price Decline: The token has experienced a 59.019% decline over the past year, indicating substantial downward pressure

- Limited Circulation: Only 47.09% of the total supply (4,708,558 GALO out of 10,000,000 maximum supply) is currently circulating, which may affect price stability

GALO Regulatory Risks

- Fan Token Classification: Regulatory uncertainty surrounding fan tokens may impact their legal status and trading availability in different jurisdictions

- Football Club Regulations: Changes in sports governance policies or football association rules could affect the utility and value proposition of fan tokens

- Cross-border Trading Restrictions: Potential regulatory limitations on international trading of fan tokens may constrain market growth

GALO Technical Risks

- Smart Contract Vulnerabilities: The token operates on the Chiliz Chain (CHZ2), and any security flaws in the underlying smart contract could pose risks to token holders

- Platform Dependency: GALO's functionality is tied to the Socios platform, and technical issues or platform discontinuation could affect token utility

- Network Congestion: Potential blockchain network congestion on the Chiliz Chain could impact transaction speeds and costs

VI. Conclusions and Action Recommendations

GALO Investment Value Assessment

GALO represents a niche digital asset designed to enhance fan engagement with Clube Atlético Mineiro football club. While the token offers unique benefits such as participation in club decision-making and access to exclusive discounts, it faces significant challenges including low liquidity, limited exchange availability, and substantial price depreciation over the past year. The token's market capitalization of $171,014.83 and minimal market dominance of 0.000014% indicate it remains a highly speculative asset. Long-term value depends heavily on the club's ability to maintain fan engagement and expand the token's utility ecosystem.

GALO Investment Recommendations

✅ Beginners: Consider avoiding GALO until you have gained experience with more liquid and established cryptocurrencies; if interested in fan tokens, start with minimal allocation (less than 1% of portfolio) ✅ Experienced Investors: Allocate no more than 2-3% of your fan token portfolio to GALO, and only if you are a genuine Clube Atlético Mineiro supporter seeking engagement benefits rather than purely financial returns ✅ Institutional Investors: GALO's low liquidity and limited market presence make it unsuitable for institutional-level investment at this time

GALO Trading Participation Methods

- Spot Trading: Purchase GALO directly on Gate.com, currently the primary exchange offering the token

- Fan Engagement: Acquire GALO to participate in club polls, access exclusive rewards, and engage with the Clube Atlético Mineiro community through the Socios platform

- Storage and Holding: Use Gate Web3 Wallet for secure storage while maintaining easy access to trading and fan engagement features

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is GALO token and what is its current price?

GALO token is associated with Clube Atlético Mineiro, a Brazilian football club. It currently trades at dynamic market prices determined by supply and demand. Check official sources for real-time pricing information.

What factors influence GALO price prediction and market trends?

GALO price is influenced by market supply and demand dynamics, trading volume, investor sentiment, blockchain adoption rates, macroeconomic conditions, and regulatory developments in the crypto sector.

What is the price forecast for GALO in 2024 and beyond?

GALO is projected to show strong growth momentum through 2024 and beyond, driven by increasing adoption and market demand. Price appreciation is expected as the project expands its ecosystem and utility, with potential for significant gains in the coming years.

How can I analyze GALO's technical indicators for price prediction?

Monitor GALO's 14-day RSI at 57.694 indicating buy signals. Track MACD crossovers, moving averages, and trading volume for trend confirmation. Combine support/resistance levels with momentum indicators to forecast price movements.

What are the risks and opportunities for GALO price movements?

GALO price risks include market volatility and liquidity fluctuations. Opportunities arise from increased adoption, strategic partnerships, and growing trading volume. Monitor market trends and technical indicators for optimal entry points.

How does GALO compare to other similar tokens in terms of price performance?

GALO has demonstrated resilience with a market cap of BTC2.4209, declining 1.80% weekly. It outperforms the global cryptocurrency market but underperforms similar Chiliz Ecosystem tokens, positioning it as a moderately stable fan token option.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Gate Ventures Weekly Crypto Recap (February 9, 2026)

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology