After the BTC Pullback, How Does GTBTC Help Holders Maintain Steady Yield?

Market Pullback Forces Holders to Reconsider the “Opportunity Cost”

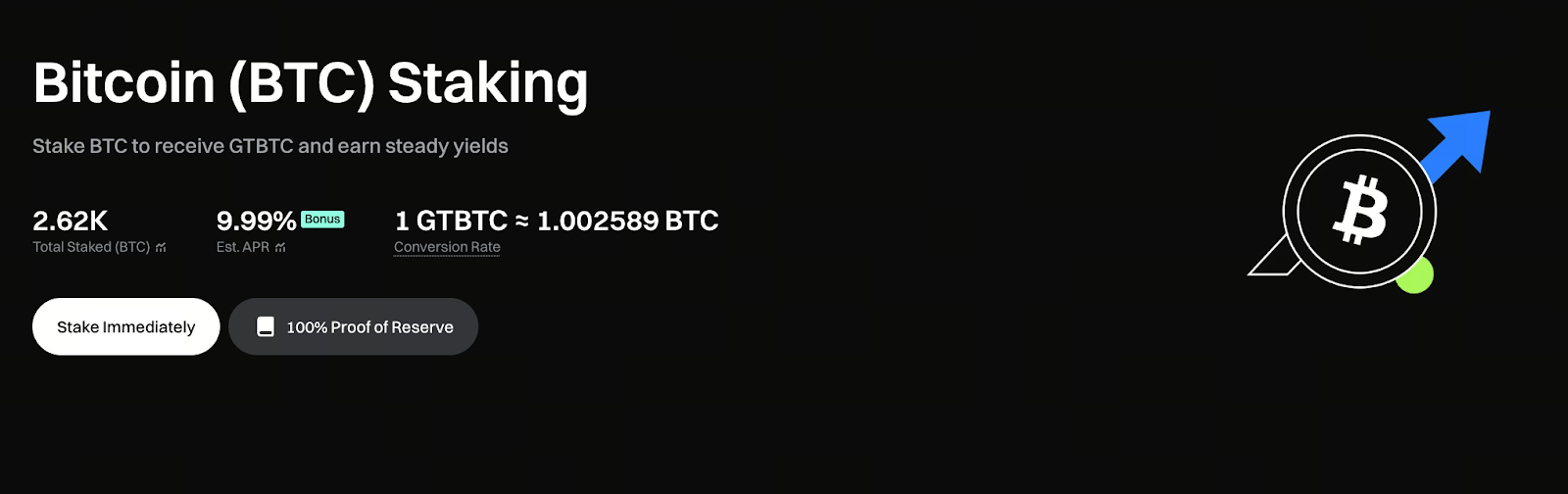

Chart: https://www.gate.com/staking/BTC

BTC has experienced a notable increase in volatility recently, with prices retreating from recent highs and entering a period of consolidation. While many investors remain optimistic about the long-term trajectory, short-term uncertainty is once again forcing holders to confront a familiar issue:

How can assets avoid sitting idle while waiting for the next market rally?

Many continue to hold BTC, but during periods of sideways movement or pullbacks, assets generate no additional returns, making the opportunity cost increasingly apparent.

GTBTC: Keeping BTC Productive During Consolidation

GTBTC is a BTC yield asset launched by Gate. Its primary goal is not to replace BTC, but to maintain BTC’s value peg while generating ongoing returns via a staking rewards mechanism.

When users stake BTC through Gate’s on-chain earning system, they receive GTBTC in return. Earnings are automatically reflected in the asset’s net value and accumulate over time, requiring no frequent action from users.

This model ensures that even during market consolidation, holders can maintain asset growth through the rewards mechanism.

Why Yield Tools Matter More in Sideways Markets

In strong upward markets, price gains often overshadow questions of asset efficiency. But as the market enters a sideways or pullback phase, the importance of yield tools becomes clear.

GTBTC holders continue to accumulate returns while waiting for the market to recover, rather than letting assets remain static.

This approach helps reduce psychological stress during market volatility, encouraging more rational and stable holding behavior.

Yield Does Not Mean Sacrificing Liquidity

Some users worry that staking will restrict asset liquidity. One key advantage of GTBTC is that it exists as an on-chain asset, allowing users to manage and exchange it freely within the platform ecosystem.

This enables assets to earn returns while maintaining liquidity, avoiding the restrictions of traditional lock-up mechanisms.

What Does the Current ~9.99% Annualized Yield Mean?

Currently, BTC staking offers a comprehensive annualized yield of approximately 9.99% (refer to the platform’s real-time data for details). This rate is not a short-term high-return tactic, but rather a stable approach to earning.

For long-term BTC holders, earning steady returns without added operational complexity is often more consistent with long-term investment strategy than frequent trading.

Who Is GTBTC Best Suited For?

GTBTC is best suited for:

- Long-term BTC holders who want their assets to remain productive

- Those who prefer automatic returns over frequent trading

- Users seeking to reduce opportunity cost during periods of consolidation

- Those who want to maintain liquidity while earning returns

GTBTC may be less attractive to short-term traders, but for long-term allocators, it offers a more efficient holding solution.

In Consolidation, Asset Efficiency Matters More Than Market Predictions

Market trends are difficult to predict, but asset efficiency can be actively optimized. Instead of constantly trying to time short-term price swings, keeping assets productive in any market phase is generally more aligned with long-term strategy.

With GTBTC, BTC is no longer just an asset waiting for price appreciation—it now generates ongoing returns.

Summary

The recent BTC pullback reminds investors that volatility is always present. During uncertain market periods, yield-generating tools like GTBTC are becoming the solution for more long-term holders, enabling assets to deliver ongoing returns.

For those who believe in BTC’s long-term value, “holding while growing” may be the most stable strategy in the current market climate.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks