Aster vs Hyperliquid: Which Perp DEX Will Prevail?

The decentralized perpetual trading market is entering a new phase of rapid expansion and competitive reshaping. By February 2026, global daily trading volume across perp DEXs had exceeded 28 billion USD. During October and November 2025 alone, cumulative monthly volume surpassed 13 trillion USD. This growth reflects both technical breakthroughs and rising demand for decentralized trading infrastructure.

Within this fast growing market, Hyperliquid continues to lead as one of the earliest and most established perpetual DEXs. At the same time, newer protocols such as Aster and Lighter are gaining momentum by focusing on user experience improvements and differentiated product design.

In 2026, which protocol deserves closer attention from traders and investors? This article compares Aster and Hyperliquid across market share, product features, on-chain metrics, and token performance to help clarify how the Perp DEX landscape may evolve.

Perp DEX Rankings and Market Share

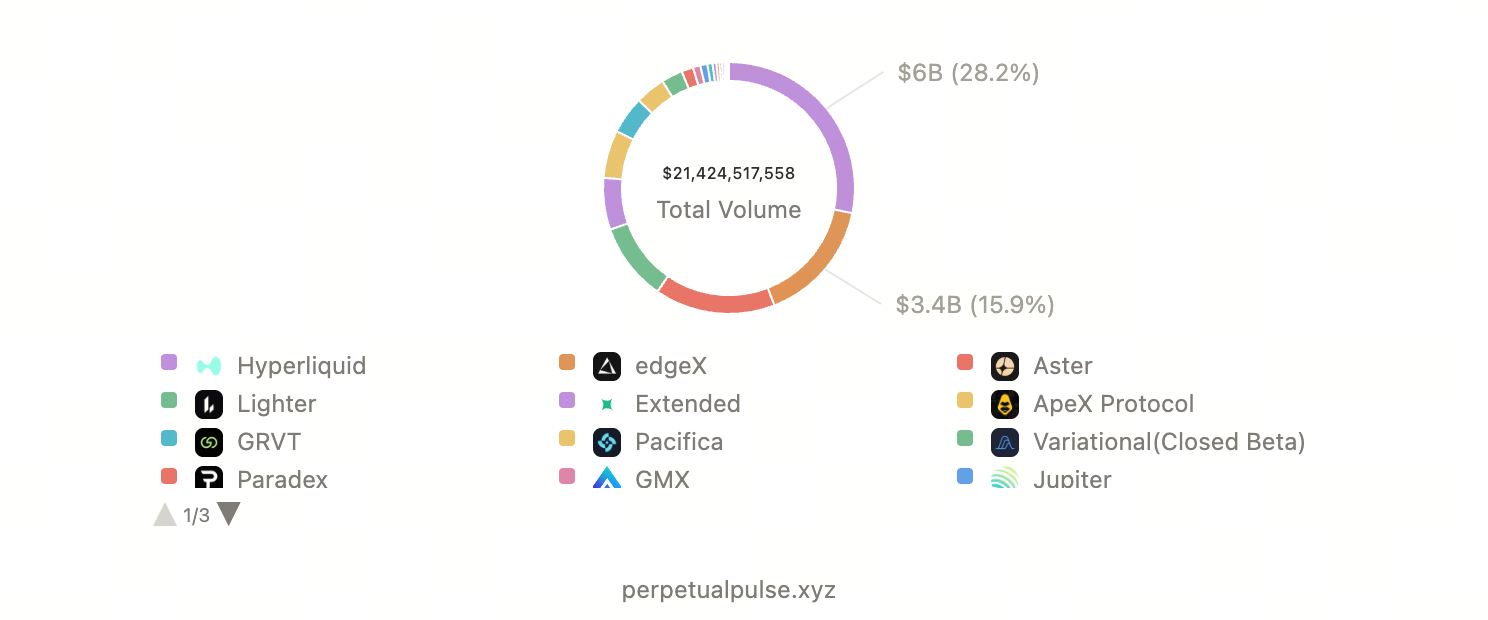

According to the latest data from Perpetualpulse, the current market positioning of major Perp DEX platforms is as follows:

- Hyperliquid holds approximately 28.2% market share, with open interest around 5.6 billion USD.

- Aster accounts for roughly 15.5% market share, with open interest near 1.9 billion USD.

- edgeX represents about 15.9% market share, with open interest of roughly 970 million USD.

- Lighter holds close to 10% market share, with open interest around 950 million USD.

These figures show that Hyperliquid still occupies a leading position in decentralized perpetual trading. Its advantages are most evident in deeper liquidity for major assets, a stable technical foundation, and a more mature ecosystem.

That said, Aster, edgeX, and Lighter are growing quickly as newer entrants and are steadily capturing market share from the incumbent leader.

Community preferences also appear clearly divided. Many professional traders favor Hyperliquid, viewing its one block confirmation and strong liquidity depth as essential for serious trading. In contrast, cross chain users and newer participants often prefer Aster, where multi chain support without manual bridging and a CEX like interface significantly lower the entry barrier.

Aster vs Hyperliquid: A Full Comparison

Aster is a new generation decentralized perpetual exchange designed to support high leverage trading, deep liquidity, and multi chain asset access. Its architecture combines a dedicated Layer 1 blockchain with multi chain liquidity aggregation. Matching and settlement are handled on Aster’s own chain, while assets and liquidity are sourced from networks such as BNB Chain, Ethereum, Solana, and Arbitrum, creating a unified trading experience across chains.

Hyperliquid, as a pioneer in the Perp DEX space, has reshaped expectations for on-chain derivatives through its HyperCore architecture. HyperCore is designed to process up to 200,000 orders per second with latency around 0.2 seconds, performance figures that rival or exceed many centralized trading platforms.

Product Feature Comparison

Both Aster and Hyperliquid aim to combine the smooth execution experience of centralized exchanges with the non custodial security of on-chain trading. The table below highlights their differences across architecture, privacy features, cross chain support, and development stage.

| Feature | Hyperliquid | Aster |

|---|---|---|

| Architecture | HyperCore with HyperEVM | Dedicated Layer 1 Aster Chain |

| Privacy features | Basic privacy protections | Shield Mode with enhanced privacy |

| Cross chain support | Multi chain asset support | Multi chain asset support |

| Development stage | Fully live | Layer 1 testnet, mainnet planned Q1 |

A notable development for Hyperliquid was the HIP 3 upgrade launched in the second half of 2025. This upgrade introduced developer deployed perpetual markets, theoretically allowing almost any asset to be traded as a perpetual contract. This includes not only crypto assets, but also commodities and other synthetic markets.

Following this change, on-chain perpetual trading activity accelerated. On February 2, Hyperliquid reported that open interest across HIP 3 markets reached a new high of 1 billion USD, with 24 hour trading volume of 4.8 billion USD.

Aster’s innovation has focused more heavily on usability and trading workflow. Its Simple mode supports leverage up to 1001 times, which carries extreme risk but appeals strongly to speculative traders. Hidden orders are designed to protect large positions from MEV related exposure, while Shield Mode simplifies position management for both long and short strategies.

At present, Aster continues active development of Aster Chain, with the team targeting a mainnet launch in Q1.

On Chain Metrics: Market Capitalization, Open Interest, and TVL

Below is a comparison of Aster and Hyperliquid across token price, circulating market capitalization, ranking, open interest, and total value locked.

| Metric | Hyperliquid (HYPE) | Aster (ASTER) |

|---|---|---|

| Current Price | $32.02 | $0.62 |

| Circulating Market Cap | $7.629 billion | $1.53 billion |

| Market Cap Rank | #15 | #49 |

| Open Interest | $4.769 billion | $1.851 billion |

| TVL (Total Value Locked) | $4.18 billion | ~$1.08 billion |

Data sources include CoinGecko and DeFiLlama, as of February 8, 2026.

From a relative perspective, Hyperliquid’s market capitalization is roughly five times that of Aster. However, the gap narrows to around 3.5 times when comparing open interest and TVL, suggesting that Aster currently operates with higher capital efficiency and may have greater valuation upside if growth continues.

Fee Structure Comparison

Aster and Hyperliquid both use a maker taker fee model, but the specific fee levels and discount mechanisms differ.

Hyperliquid:

- Fees vary by trading tier, with maker fees ranging from 0% to 0.015% and taker fees ranging from 0% to 0.045%

- Paying fees with the HYPE token allows users to receive discounts of up to 40%

Aster:

- Fees are fixed, with maker fees set at 0.005% and taker fees set at 0.04%

- Paying fees with the ASTER token provides a 5% fee discount

Token Performance and Growth Potential

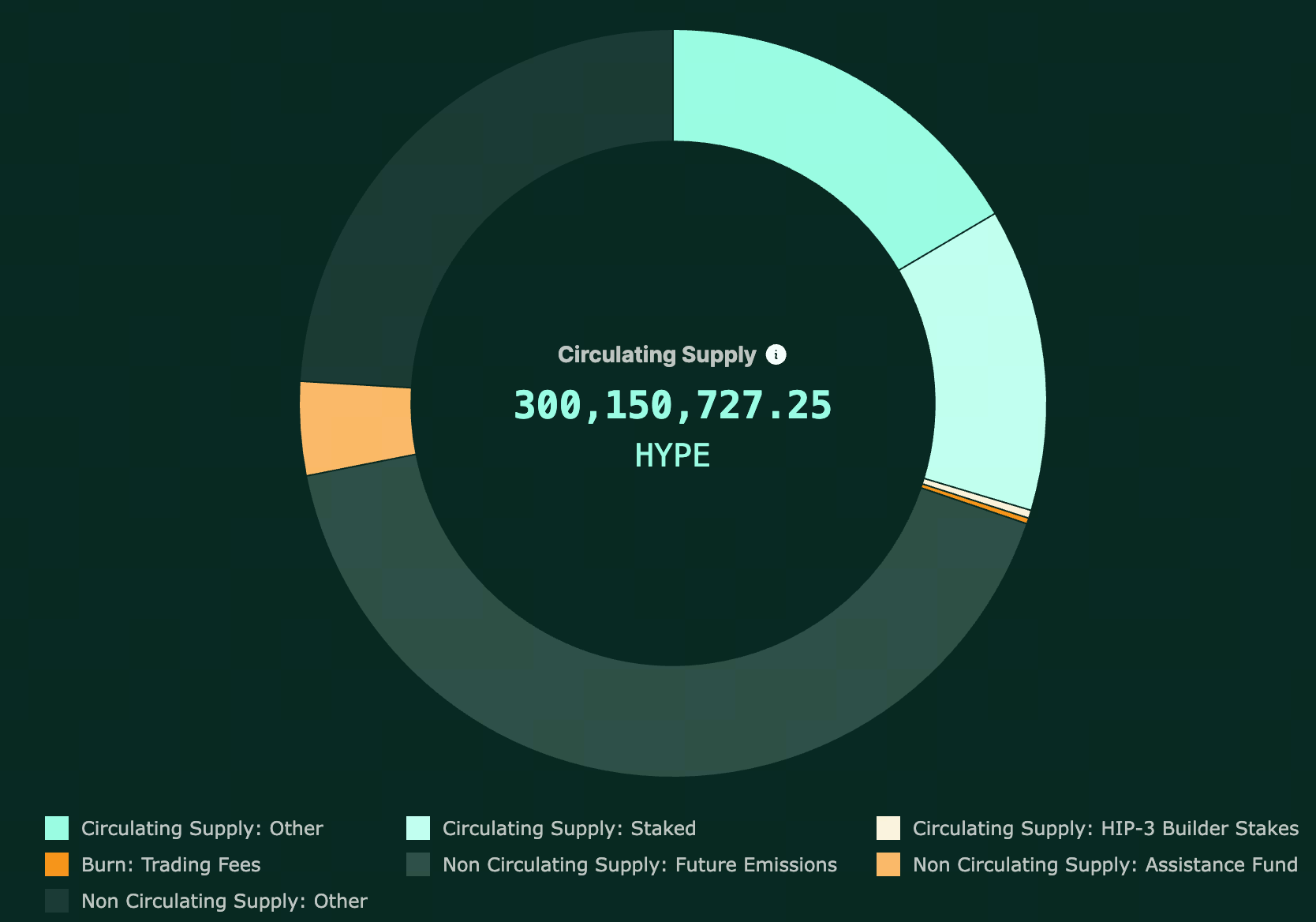

Hyperliquid’s HYPE token has a total supply of 1 billion tokens and a circulating market capitalization of approximately 7.6 billion USD. Its primary functions include governance and ecosystem incentives, with fee discounts used to attract high volume traders and reinforce scale effects.

On December 26, the Hyperliquid Foundation announced that tokens held in an assistance fund system address had been permanently burned, representing 11.068% of the circulating supply.

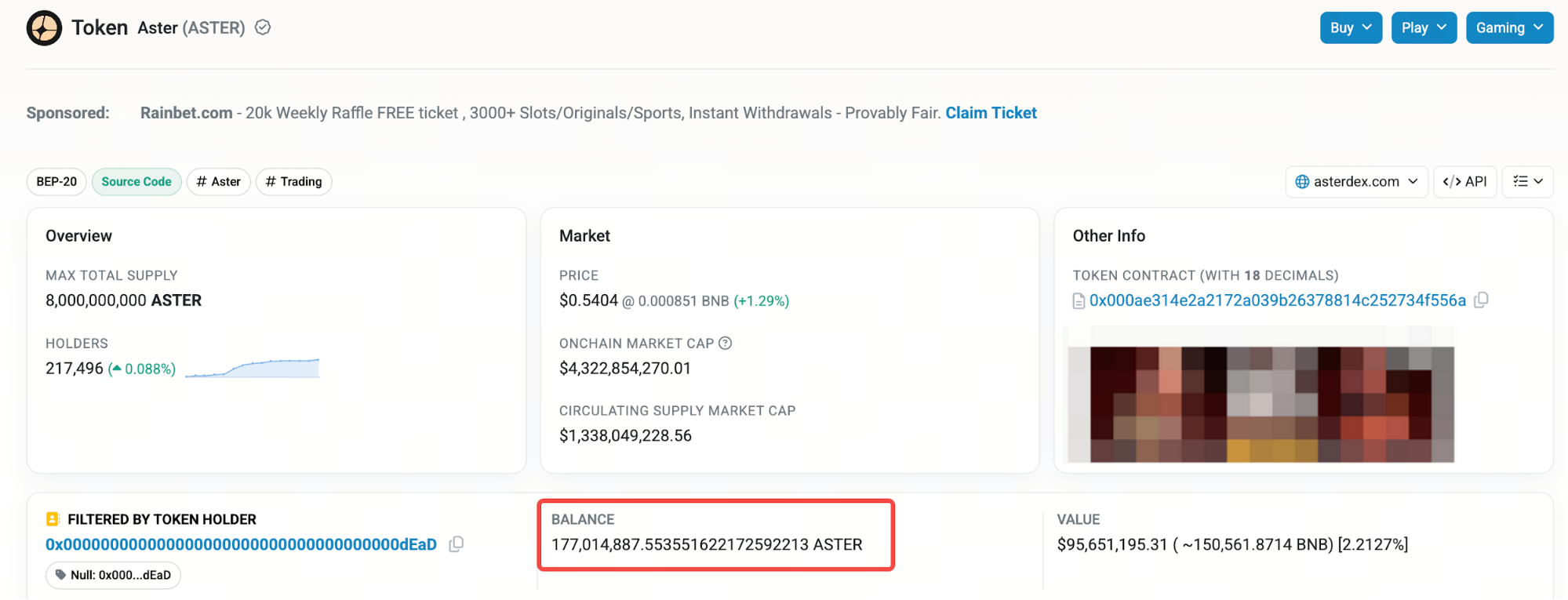

ASTER is Aster’s native token, with a total supply of 8 billion tokens and a circulating market capitalization of roughly 1.5 billion USD. Its value is supported by multiple use cases, including governance, fee discounts, gas payments, and staking rewards.

On February 3, the Aster team announced the launch of the Stage 6 buyback program starting on February 4, 2026, continuing to support ASTER through a structured mechanism. Under this plan, up to 80% of the platform’s daily trading fees will be allocated to ASTER buybacks.

Within this framework, the daily buyback component, representing 40% of platform fees, is executed automatically by the system each day. The strategic buyback reserve, accounting for 20% to 40% of platform fees, is deployed flexibly based on market conditions and specific timing considerations, allowing targeted buybacks during periods of volatility to improve overall value creation efficiency.

On-chain data shows that more than 177 million ASTER tokens have already been burned.

Summary

Based on current data, Hyperliquid maintains a clear short term lead. It benefits from stronger network effects, deeper liquidity, a larger user base, and broader market recognition.

Aster, however, demonstrates strong growth momentum and meaningful differentiation. Its ongoing buyback program, emphasis on privacy focused features, and rapidly increasing trading activity point to continued expansion potential.

At this stage, Hyperliquid is more likely to retain overall leadership. However, if Aster successfully delivers on its roadmap and technical commitments, it may establish dominance in specific segments and gradually narrow the gap. Rather than a winner takes all outcome, the market may evolve into parallel growth paths, with both platforms serving different user profiles and pushing the Perp DEX sector forward together.

FAQs

What are the key technical differences between Aster and Hyperliquid in 2026?

Hyperliquid relies on its mature HyperCore architecture to deliver very low latency and deep native liquidity. Aster differentiates through multi chain liquidity aggregation without manual bridging and Shield Mode for privacy oriented trading. Its dedicated Layer 1 Aster Chain is expected to launch in Q1 2026.

How do ASTER buybacks and burns support token value?

Aster is implementing the Stage 6 buyback program, which allocates up to 80% of daily platform trading fees to repurchase ASTER. Within this structure, 40% of fees are used for automatic system executed buybacks, while 20% – 40% are reserved for strategic buybacks that can be deployed flexibly based on market conditions. As of February 2026, more than 177 million ASTER tokens have already been burned on chain, directly reducing circulating supply and reinforcing the token’s long term value support.

Which platform is more suitable for beginners and cross chain traders?

Community sentiment suggests that Aster is often preferred by beginners and cross chain users due to its integration of assets from BNB Chain, Ethereum, Solana, and Arbitrum and its more CEX like trading experience. Hyperliquid tends to appeal more to professional and institutional traders who prioritize performance and deep liquidity.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

Sui: How are users leveraging its speed, security, & scalability?

What Is Copy Trading And How To Use It?

What Is Technical Analysis?