Breaking Down Strategy’s Latest Earnings: How Long Can the Bitcoin Flywheel Keep Spinning After a $12.4B Loss?

Strategy is becoming the first public company in global capital markets whose fate is entirely determined by the price of a decentralized asset.

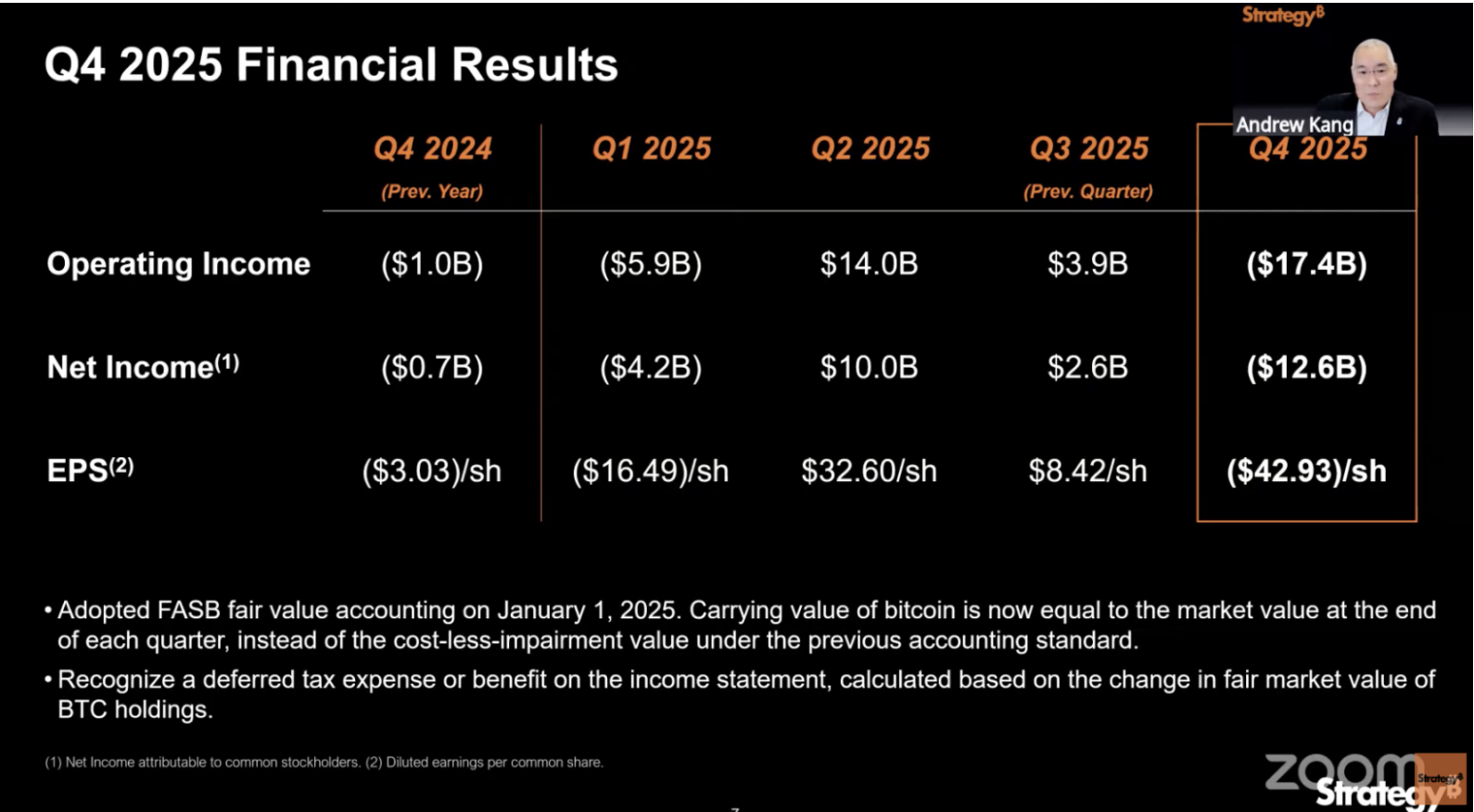

On February 5, the company reported a figure that would devastate any traditional business: a net loss of $12.4 billion in a single quarter.

However, the real point of interest is not the $12.4 billion itself, but what it reveals: Strategy can no longer be evaluated by profit or loss.

The financial report shows an operating loss of $17.4 billion, with gross margin dropping from 71.7% in the same period last year to 66.1%. Nearly all of this $17.4 billion operating loss stems from a single source—the decline in Bitcoin prices during Q4, which triggered an unrealized asset impairment.

Simply put, Bitcoin’s price on December 31 was lower than on September 30.

2025 marks the first year Strategy fully adopts fair value accounting standards. Under these rules, every fluctuation in Bitcoin’s price directly impacts the income statement. In Q3, Bitcoin rose, resulting in earnings of $8.42 per share and broad enthusiasm; in Q4, Bitcoin fell, and losses surged.

Reading Strategy’s financial report feels more like reviewing a quarterly health check for Bitcoin’s price than evaluating a company’s operational performance.

This is where the real issue lies.

Two Ledgers, Two 2025s

After reviewing Strategy’s Q4 financial report, I found a fundamental obstacle:

No matter which standard you use, its financial figures are misleading.

First, the company’s own standard. Strategy invented a metric called BTC Yield, which measures how much the number of Bitcoins per share of MSTR has increased.

For the full year 2025, this figure is 22.8%, which looks impressive.

But this metric only counts the number of Bitcoins, regardless of price. The company can issue shares to raise funds when Bitcoin is at $100,000 and buy coins when it’s at $80,000. BTC Yield remains positive, but shareholders’ actual wealth shrinks.

Additionally, the financial report mentions $8.9 billion in “BTC Dollar Yield,” which is the same issue.

This figure is calculated using the year-end Bitcoin price of about $89,000. By the time the report was released, Bitcoin had already dropped below $65,000. The snapshot from December 31 is outdated and has a lag.

Next, the U.S. Generally Accepted Accounting Principles (GAAP), which every U.S.-listed company must follow.

Under these rules, Q4 saw a loss of $12.4 billion, and the full year a loss of $4.2 billion. The numbers are alarming, but should not be taken at face value.

2025 is the first year Strategy accounts for Bitcoin at fair value. At each quarter’s end, Bitcoin’s market price is assessed. If it rises, record a profit; if it falls, record a loss—regardless of whether any coins were actually sold.

In Q3, Bitcoin rose to $114,000, resulting in a large book profit; in Q4, it fell back to $89,000, leading to a $17.4 billion loss. Not a single dollar actually left the company.

So, the real situation in this financial report is:

Strategy’s own metric avoids price risk, while losses under accounting standards exaggerate the actual danger. Understanding this clarifies the execution in 2025.

About 225,000 Bitcoins were purchased for the year, representing 3.4% of global circulation. Five preferred stock products were launched, and the company’s cash holdings reached $2.3 billion, a historic high. From a capital operations perspective, this was indeed a classic year.

But all these achievements point to one result: Strategy is even more dependent on Bitcoin’s price movements than it was a year ago.

Therefore, the more Strategy does in 2025, the more it needs Bitcoin to rise in 2026. Yet, at present, Bitcoin’s continued decline clearly falls short of Strategy’s expectations.

Spent $25.3 Billion on Bitcoin, but Generates $888 Million in Annual Bills

In 2025, Strategy raised $25.3 billion, becoming the largest equity issuer in the U.S. for the second consecutive year.

A company with quarterly software revenue of $120 million raised funds at 200 times its software income. Nearly all of it was used to buy Bitcoin.

How did they raise it?

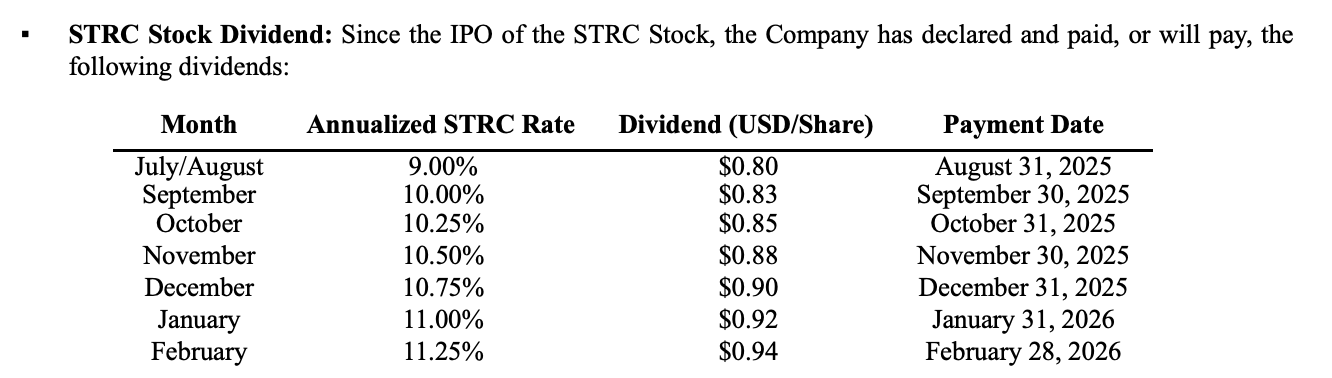

Previously, it was simple: issue shares for cash. In 2025, an extra step was added—the company issued five types of preferred stock products, essentially repackaging Bitcoin as fixed-interest financial products for institutional investors seeking stable returns.

Bitcoin itself generates no interest, but Strategy managed to create a line of financial products with yields ranging from 8% to 11.25%.

So, what’s the cost?

By year-end, these preferred shares plus debt interest generated about $888 million in annual mandatory expenses. The company’s annual software revenue was $477 million, not even half enough to cover it.

Management’s response was to establish a $2.25 billion cash reserve in Q4, claiming it’s enough for two and a half years.

But this money was raised by issuing shares at low prices. Saylor admitted during the earnings call that a few weeks of share issuance early in the year actually reduced the number of Bitcoins per share, diluting shareholders’ holdings.

He said he doesn’t plan to repeat this operation unless it’s to defend the company’s credit. Defending credit means paying the $888 million bill.

This is the core weakness of Strategy’s capital model:

Raising funds to buy Bitcoin requires the stock price to remain at a premium, maintaining the premium requires BTC Yield to look good, and keeping BTC Yield strong requires constant Bitcoin purchases.

When Bitcoin rises, this cycle reinforces itself; when it falls, every link reverses. Now, there’s an added $888 million annual fixed expense that must be covered, regardless of Bitcoin’s price movement.

Unrealized Loss of $9 Billion, but Short-Term Issues Are Minimal

As of February 5, the day the financial report was released, Bitcoin had dropped to about $64,000. Strategy’s average holding cost is $76,052.

With 713,502 Bitcoins, the total cost is $54.26 billion, and the market value is about $45.7 billion. Since it started buying in 2020, this is the first time its holdings have an overall unrealized loss.

Four months ago, Bitcoin was near its all-time high of $126,000, and the unrealized gain on these holdings exceeded $30 billion.

However, an unrealized loss does not equal a crisis.

Strategy has no forced liquidation mechanism, unlike leveraged longs in the crypto market that get liquidated. With $2.25 billion in cash and annual mandatory expenses of $888 million, the company can survive two and a half to three years without raising more funds.

But surviving without raising funds is precisely the situation Strategy cannot afford.

As mentioned earlier, this machine operates by continuous fundraising and Bitcoin purchases. If it stops, BTC Yield drops to zero, and Strategy becomes a passive Bitcoin fund with no management fee but high dividends.

Passive funds don’t need to trade at a premium; investors can simply buy spot ETFs, which have lower fees and more transparent structures.

Therefore, the risk of bankruptcy for Strategy is much lower than the risk of the Bitcoin flywheel stopping.

When might the flywheel be forced to stop? There is a hard deadline.

Strategy holds about $8.2 billion in convertible bonds, with a weighted average maturity of 4.4 years. The earliest investor redemption window is in Q3 2027. If Bitcoin prices are still low then, bondholders can demand early redemption.

In the worst case, Strategy may need to sell large amounts of Bitcoin or find other ways to raise funds during the market’s worst period.

That window is about a year and a half away.

The $2.25 billion cash reserve can last until then, but the question is what happens after that if Bitcoin hasn’t recovered above the cost line—how will Strategy respond?

The Price of Belief

Earlier, we said Strategy won’t die in the short term. But the market clearly disagrees.

MSTR has dropped from its November high of $457 to around $107 now, a decline of more than 76%. In the same period, Bitcoin fell from $126,000 to $65,000, a drop of 48%.

Strategy’s stock price fell 1.6 times more than Bitcoin, and the premium is evaporating rapidly.

However, Saylor himself shows no signs of retreat.

On the earnings call, Saylor admitted the cash reserve might be used for convertible bond redemption and dividend payments, but insisted there are no plans to sell Bitcoin.

As long as Bitcoin rises, this capital machine can reinforce itself, almost like a perpetual motion device. But if prices stagnate or decline for an extended period, it will face the most basic judgment of the capital markets for the first time:

Historically, no financial structure has been able to permanently defy gravity through individual willpower. Will Strategy be any different?

Statement:

- This article is reprinted from [TechFlow], with copyright belonging to the original author TechFlow. If you have any objections to the reprint, please contact the Gate Learn team, who will handle it promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of the article are translated by the Gate Learn team. Without mentioning Gate, it is not permitted to copy, distribute, or plagiarize the translated article.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem

What Is a Cold Wallet?

Blockchain Profitability & Issuance - Does It Matter?

What is the Altcoin Season Index?