Gate Research: PayFi: Redefining Web2–Web3 Integration

Abstract

- PayFi is evolving into a next-generation payment–finance engine. Its core value lies not in crypto payment formats themselves, but in using the time value of money as an entry point to restructure the relationship between payments, settlement, and financial services.

- Stablecoins have gradually become high-frequency global payment instruments. In 2025, annual stablecoin transaction volume reached approximately $33 trillion, surpassing the combined transaction volume processed by Visa and Mastercard, underscoring their increasingly strong payment attributes.

- Cross-border payments represent the most mature PayFi use case to date. Settlement cycles have been compressed from several days to minutes, with overall costs reduced by an order of magnitude compared with traditional systems, making large-scale deployment viable.

- Web2 and Web3 are accelerating toward bidirectional integration. Traditional and emerging payment gateways—such as Visa, PayPal, and neobanks—are becoming key bridges for PayFi to enter mainstream payment systems and everyday commercial scenarios.

- Stablecoins, RWAs, and AI are jointly shaping PayFi’s foundational architecture. Stablecoins are evolving into a universal settlement layer across chains and systems; RWAs are bringing real-economy assets on-chain, enabling 24/7 settlement and liquidity; AI is driving upgrades toward dynamic risk control and automated decision-making in payment systems.

- Regulatory progress, the practical scalability of RWA deployment, and the maturity of AI applications will jointly define the competitive landscape in 2026. Clear regulatory frameworks, scalable asset tokenization capabilities, and AI-driven dynamic financial functions are reshaping PayFi’s core competitive moats.

1. Introduction: From Substitution to Integration — Web3’s Value Reconfiguration

1.1 The 2026 Industry Inflection Point: From Speculation-Driven to Utility-Driven Growth

Since the publication of the Bitcoin whitepaper, the evolution of Web3 has been marked by cyclical volatility and shifting narratives. In its early stages, value was largely driven by speculative expectations, characterized by high volatility and concept-driven trading. Entering 2026, however, the industry stands at a structural inflection point. The defining signal of this shift is no longer short-term price movements in crypto assets, but the systematic outperformance of utility value over speculative value.

Several factors have jointly driven this historic transition. First, global regulatory frameworks have become increasingly mature. The full implementation of the Markets in Crypto-Assets Regulation (MiCA) provides a clear compliance pathway for the industry, significantly lowering entry barriers for institutional participants. Second, the approval and successful operation of spot Bitcoin ETFs in 2024 marked the formal acceptance of crypto assets as a legitimate alternative asset class within the traditional financial system. Finally, after years of technological iteration, blockchain infrastructure has achieved meaningful improvements in scalability, security, and user experience, laying a solid foundation for mass adoption.

Against this backdrop, market attention is shifting from “the next 100x token” to “the next application with millions of users.” Capital, talent, and innovation resources are increasingly flowing away from purely speculative financial protocols toward application layers that address real-world problems. This transition—from “building castles in the air” to “grounded execution”—represents an inevitable step in Web3’s maturation and provides a critical lens for understanding its future trajectory.

1.2 The Dissolving Boundary Between Web2 and Web3: From a Narrative of “Disruption” to One of “Integration” and Symbiosis

For a long time, one of the dominant narratives in Web3 has been “disruption”—the idea that decentralized technologies would completely replace the centralized Web2 platforms represented by large technology companies. The industry reality in 2026, however, presents a very different picture: integration and symbiosis are replacing disruption as the main theme of interaction between the two ecosystems. The boundaries of Web2 are becoming increasingly blurred, and Web3 is no longer an isolated “parallel universe.”

This trend is evident on two levels:

- The proactive embrace by Web2 incumbents: Traditional financial and technology giants such as Visa, JPMorgan, and PayPal no longer view Web3 as a threat, but rather as a core technological driver for improving efficiency and expanding business boundaries. Visa is evolving from a traditional card network into a multi-chain settlement “network of networks”; JPMorgan, through JPM Coin and its Kinexys platform, is actively exploring institutional-grade DeFi services; and PayPal has seamlessly integrated stablecoins into its vast global payments network. These moves indicate that Web2 leaders are leveraging their massive user bases, brand trust, and compliance capabilities to become key “on-ramps” guiding Web3 technologies into the mainstream market.

- The “real-world grounding” of Web3-native protocols: At the same time, Web3-native protocols are actively extending into the real economy. Rather than remaining satisfied with building closed on-chain economies, they are increasingly focused on addressing real-world financial and commercial pain points—such as high-cost cross-border payments, inefficient supply-chain finance, and underserved inclusive finance markets. This process requires direct integration with real-world assets, data, and regulatory frameworks.

This bidirectional convergence marks the emergence of a new paradigm: the value of Web3 no longer lies solely in the technical purity of “decentralization,” but increasingly in the powerful synergies unlocked through its integration with the Web2 ecosystem.

1.3 Core Thesis: Crypto PayFi as the Financial Infrastructure Bridging Two Worlds

If the convergence of Web2 and Web3 is a secular trend, what is the core engine driving it? This paper argues that Crypto PayFi serves as the key “integration layer” connecting the two worlds and as a foundation for next-generation financial infrastructure.

The concept of PayFi was proposed by Lily Liu, Chair of the Solana Foundation. Its core idea is to build a new financial market that goes beyond simple crypto payments and is centered on the time value of money. Unlike traditional payments, which merely transfer value, PayFi leverages blockchain programmability and instant settlement to deeply integrate payments with financial services. In the PayFi paradigm, every payment can itself be a financial activity embedded with smart contracts, capable of generating yield and executing complex logic automatically.

This paper positions PayFi as the core of integration for three key reasons:

- The most fundamental and highest-frequency entry point: Payments underpin all economic activity. By combining fiat on- and off-ramps with efficient on-chain payment networks, PayFi provides billions of Web2 users with a low-friction, high-efficiency gateway into the Web3 world.

- A perfect alignment of mutual needs: For Web2 institutions, PayFi offers a technological upgrade path for payment systems, significantly reducing costs and improving efficiency—especially in cross-border payments. For Web3 applications, PayFi addresses the long-standing challenge of disconnect from real-world economic cycles and enables true mainstream adoption.

- Built on stablecoins as its cornerstone: Stablecoins, as value-anchored and low-volatility digital assets, are a prerequisite for PayFi’s scalability. With global stablecoin market capitalization surpassing $300 billion in 2025, they have become the most reliable value bridge between the crypto ecosystem and the real economy.

Accordingly, this paper moves beyond an isolated discussion of Web3 technologies and instead places PayFi at the center of analysis, examining how it functions as financial infrastructure to systematically drive deep integration between Web2 and Web3.

2. Crypto PayFi: The Core Engine of Next-Generation Payment Finance

2.1 The Emergence of PayFi and Its Core Philosophy

2.1.1 Definition: Beyond Crypto Payments—Building a New Financial Market Around the “Time Value of Money”

PayFi is not equivalent to crypto payments. Traditional crypto payments simply use digital assets as a medium of exchange, whereas PayFi (Payment Finance), as defined by Solana Foundation President Lily Liu, represents a new financial market built around the “time value of money.” It deeply integrates payments with financial services, enabling every payment to generate financial value intrinsically.

PayFi introduces three core innovations: first, payments are upgraded from “peer-to-peer transfers” to “programmable financial activities,” allowing conditions to be attached and smart contracts to be triggered; second, “time value” is directly encoded into the payment process, enabling funds to generate yield while in motion; third, it breaks down the boundary between payments and finance, turning payment networks themselves into financial markets.

At its core, PayFi represents a paradigm shift in financial infrastructure—from fragmented financial services provided by different institutions to a unified, programmable, and natively digital financial ecosystem.

2.1.2 Core Mechanisms: Instant Settlement, Programmability, and Native Yield

Three core mechanisms drive PayFi’s competitiveness over traditional payment systems:

- Instant settlement: Traditional international wire transfers take 3–5 days, while PayFi can settle within 10 minutes. This eliminates counterparty risk, improves liquidity efficiency, and reduces costs to less than 10% of traditional methods.

- Programmability: Payment flows can be complexly programmed via smart contracts, enabling conditional payments, automated investing, and multi-routing payments.

- Native yield: During payments, stablecoins can simultaneously be deployed into DeFi lending protocols to generate returns. For example, holders of PayPal’s PYUSD can earn an annualized yield of 3.7% (subject to real-time platform disclosures). This reverses traditional payment economics—users shift from “fee payers” to “yield earners,” significantly enhancing user stickiness and capital efficiency.

2.2 The Relationship Between PayFi and DeFi: Complementary, Not Competitive

A common question when discussing PayFi is: what is its relationship with DeFi? Will PayFi replace DeFi?

The answer is that PayFi and DeFi are complementary rather than competitive. To understand this, we must first clarify their fundamental differences.

- DeFi focuses on the decentralization of financial services. Its goal is to deliver services traditionally provided by financial institutions—such as lending, trading, and derivatives—through smart contracts and blockchain technology in a decentralized, permissionless manner. Typical DeFi applications include DEXs (decentralized exchanges), Aave (lending protocols), and Curve (stablecoin trading).

- PayFi, by contrast, focuses on the integration of payments and finance. Its goal is to embed financial services natively into programmable payment infrastructure. Typical PayFi applications include stablecoin payments, cross-border remittances, and supply chain finance.

Their relationship can be understood as follows: DeFi is the “financial market,” while PayFi is the “financial infrastructure.” DeFi provides financial products and services, whereas PayFi provides the infrastructure that supports them. In traditional finance terms, DeFi is analogous to stock exchanges and bond markets, while PayFi is analogous to payment and settlement systems. DeFi targets “financial participants,” whereas PayFi targets “payment participants.” DeFi users are typically those actively seeking financial services, while PayFi users include everyone who makes payments—meaning PayFi’s potential user base is far larger than that of DeFi.

Integration between the two is the future direction. Within a PayFi framework, payment participants can seamlessly access DeFi services. For example, a user making a cross-border payment via PayFi could automatically participate in a DeFi lending protocol during the payment process and earn yield. This integration allows DeFi to expand from a relatively niche market of “financial enthusiasts” into the mass payment market.

From a market size perspective, the implications are profound. While DeFi’s total value locked currently exceeds $100 billion, the global payments market amounts to tens of trillions of dollars. As PayFi natively embeds DeFi financial services into payment flows, DeFi’s potential market size could expand by an order of magnitude.

2.3 Market Landscape and Key Data

2.3.1 Stablecoin Market Size and Transaction Volume

Stablecoins are the cornerstone of PayFi. Without stablecoins, PayFi cannot deliver its core value proposition—instant, low-cost, and programmable payments. Therefore, understanding the current state and trends of the stablecoin market is essential to assessing PayFi’s growth potential.

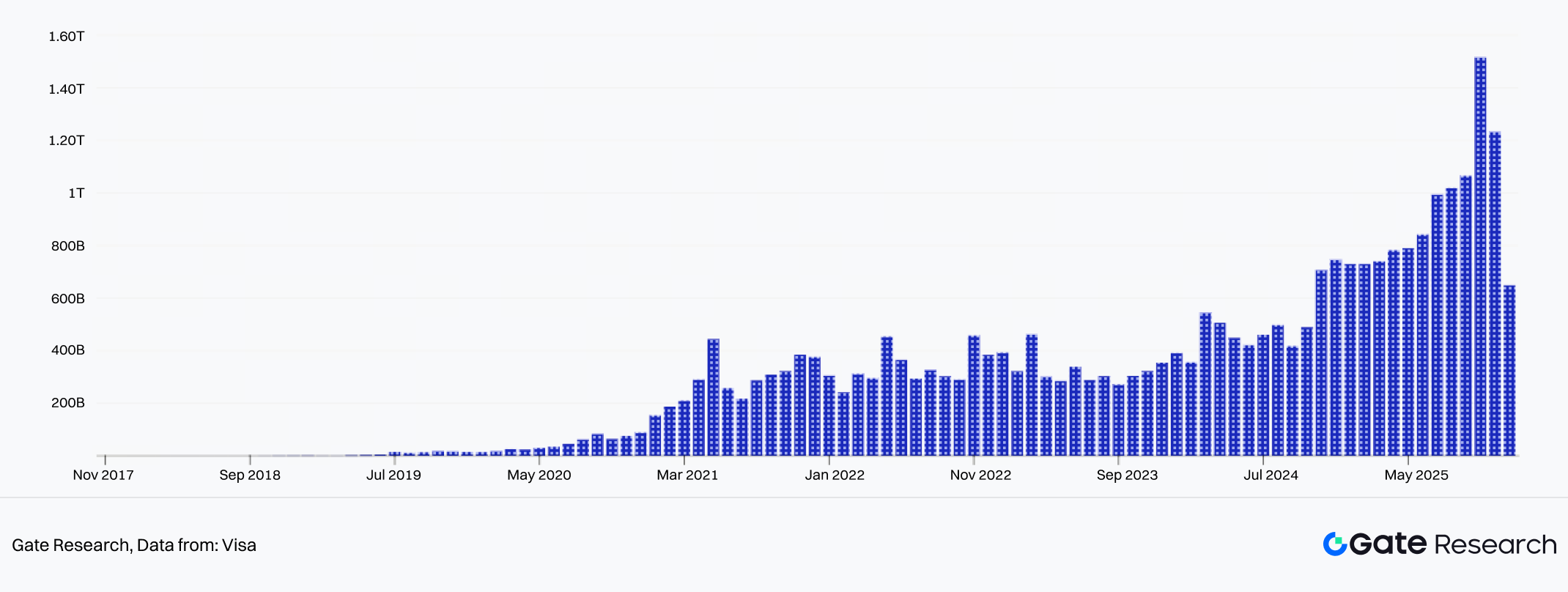

According to DefiLlama, as of January 19, 2026, the global stablecoin market capitalization reached $311.5 billion, representing an increase of over 50% from approximately $200 billion in January 2025. Data from Artemis shows that total global stablecoin transaction volume reached $33 trillion in 2025, up 72% year over year from 2024. This figure exceeds the combined annual transaction volumes of Visa and Mastercard, indicating that stablecoins have already become one of the highest-frequency payment instruments globally.

Figure 1: Global stablecoin transaction volume reached $33 trillion in 2025, up 72% year over year

2.3.2 User Distribution and Market Opportunities for PayFi

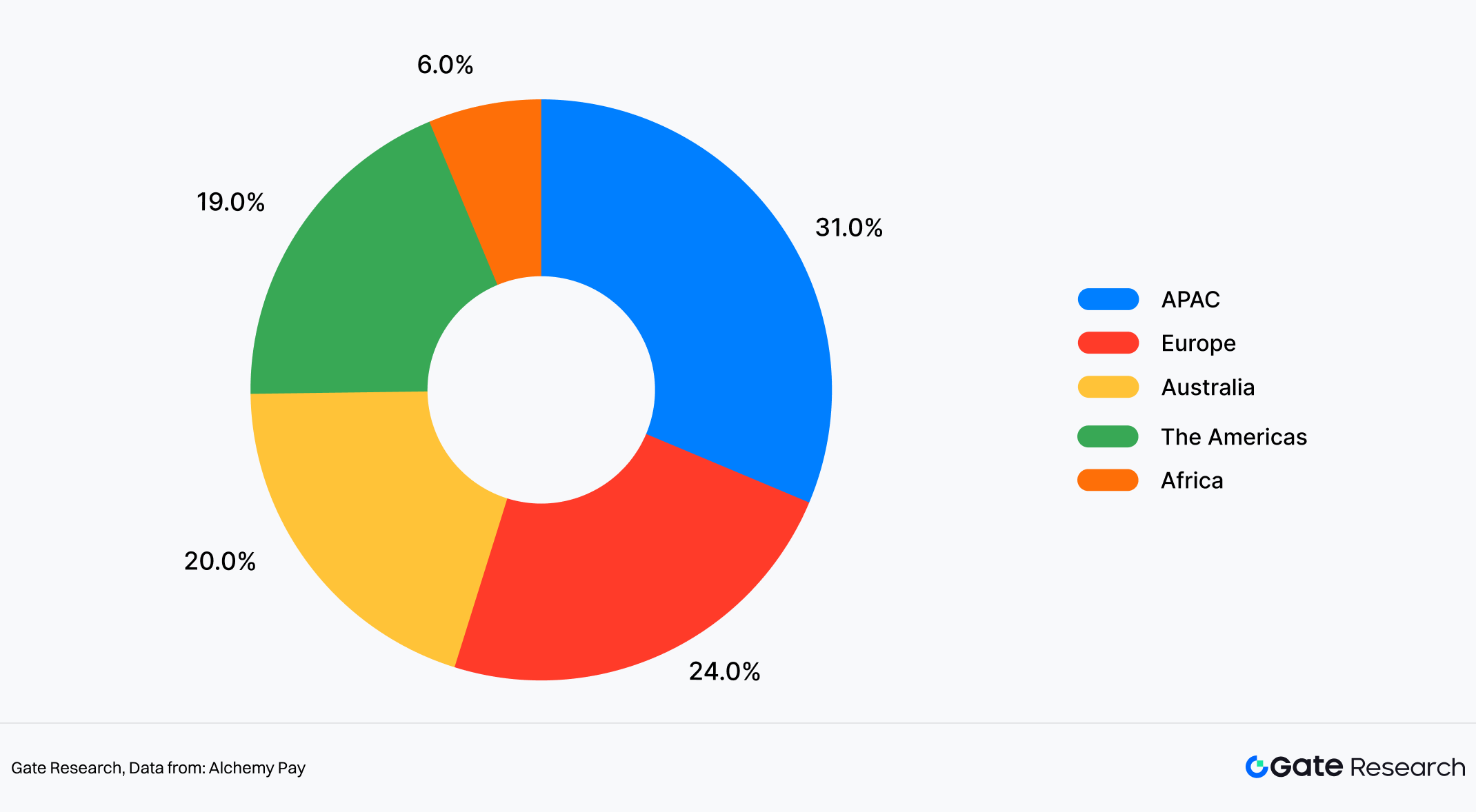

From the perspective of user geographic distribution, taking the user data of Alchemy Pay—a third-party fiat on- and off-ramp service provider—as a reference sample, its users are primarily concentrated in regions with relatively high digital payment penetration. Among these, the Asia-Pacific region accounts for approximately 31% of its user base, making it the largest segment in its current user structure. This is followed by Europe (around 24%) and the Americas (about 19%). The Australian market, counted separately, represents roughly 20%, while Africa accounts for a comparatively smaller share of about 6%.

It should be noted that, due to Alchemy Pay’s relatively mature business presence, payment channel coverage, and user acquisition capabilities in the Asia-Pacific region, this distribution does not directly represent the global user structure of the broader PayFi industry. Instead, it serves more appropriately as a reference perspective for observing differences in PayFi adoption stages across regions.

This distribution reflects differing stages of PayFi adoption across regions. In markets where digital payment habits are well established and e-wallets and mobile payments are widely used, a relatively stable user base has already formed, making it easier for PayFi to integrate into existing payment scenarios and expand further. In contrast, in regions where traditional banking systems and card-based payments dominate, PayFi currently plays more of a complementary role or is adopted in specific use cases, resulting in a more gradual pace of expansion.

In regions with structurally uneven access to financial services, current user penetration remains low, but demand for payment efficiency improvements is significant. For PayFi, these markets align more with a long-term infrastructure-building strategy. Their development path is likely to be characterized by a “low base, gradual expansion” pattern rather than rapid, short-term scaling.

Figure 2: In terms of digital payment penetration, the Asia-Pacific region accounts for approximately 31% of users, the highest share globally

2.3.3 PayFi Penetration in Real-World Use Cases

The diversity of payment methods and regional differences are directly reflected in PayFi’s real-world applications.

- Cross-border payments are the most mature PayFi use case to date. According to data from platforms such as Stripe and Polygon, traditional international wire transfers typically take 3–5 days to complete and cost $20–50 per transaction. In contrast, PayFi-enabled cross-border payments are completed in an average of 10 minutes, with fees of approximately $0.3–0.5. Based on the latest data from Yahoo Finance, global annual remittance flows total around $900 billion, with average fees exceeding 6%. If just 10% of these remittances were to shift to low-cost solutions such as PayFi (with per-transaction fees of roughly USD 0.3–0.5), the reduction in fees—compared with the current average cost structure of over 6%—could result in tens of billions of dollars in potential savings. For low-income populations that rely heavily on cross-border remittances, such cost savings would have immediate and meaningful real-world impact. (These estimates are scenario-based calculations derived from publicly available market size and fee data, rather than official forecasts from any single institution.)

- Supply chain finance represents the second major PayFi application. Traditional supply chain financing involves multiple intermediaries, each adding cost and delay. With PayFi, entire supply chains can be “intelligently automated.” Exporters can issue programmable payment instructions in stablecoins, triggering payment automatically when goods arrive at the destination port, and releasing final settlement once receipt is confirmed. Industry research suggests that PayFi-enabled supply chain finance can reduce average settlement times from 30 days to 3 days, while lowering costs from 2–3% to below 0.5%.

- Financial inclusion in emerging markets may be PayFi’s most far-reaching impact. Globally, approximately 1.7 billion adults remain unbanked, concentrated primarily in Africa, South Asia, and Southeast Asia. Traditional financial institutions face prohibitively high costs in serving these markets, whereas PayFi requires little more than a smartphone and an internet connection.

3. A Two-Way Convergence: The Integration Paths of Web2 Giants and Web3-Native Forces

In 2026, the payments and financial sectors are witnessing a clear “two-way convergence.” On one side, traditional financial giants are proactively embracing blockchain and crypto technologies, elevating them from peripheral experiments to core business infrastructure. On the other, Web3-native payment protocols and neobanks are expanding toward the mass market, no longer confined to a niche audience of crypto enthusiasts. This bidirectional integration is reshaping the foundations of global payments and financial infrastructure.

3.1 The “Web3-ification” of Traditional Finance: From Experimentation to Core Business

Over the past five years, traditional financial institutions have evolved in their stance toward blockchain—from observation, to experimentation, and then to strategic investment. By 2026, however, a clear inflection point has emerged: blockchain-based payments are no longer a “toy” of innovation labs, but a core component of institutional competitiveness.

3.1.1 Case Study: Visa — From a Traditional Payment Network to a Multi-Chain Settlement Platform

Visa is the world’s largest payment network, processing hundreds of millions of transactions daily. For decades, its business model was built on a centralized network in which all transactions flowed through Visa’s own clearing system. Starting in 2024, however, Visa began a deliberate “decentralization” experiment. The launch of USDC settlement marked a turning point. According to Visa’s announcement in December 2025, USDC settlement services have been officially rolled out in selected countries. This allows financial institutions to settle transactions directly in stablecoins (USDC) via Visa’s platform, without relying on traditional interbank clearing systems.

Even more notable is the scale of settlement growth. According to Reuters, Visa’s stablecoin settlement volume has reached an annualized run rate of $4.5 billion. This is far from trivial—it signals that Visa’s blockchain settlement business has moved beyond the experimental phase into one of meaningful scale. The tokenization of payment cards has further accelerated this trend. An increasing number of consumers and merchants are using stablecoin-linked payment cards, which allow users to pay directly in stablecoins while Visa converts them into fiat currency for settlement. This innovative model enables Visa to retain its central clearing role while harnessing the efficiency of blockchain technology.

Visa’s third major innovation lies in its multi-chain strategy. In addition to supporting USDC settlement on Ethereum, Visa is expanding to other major blockchains such as Solana and Polygon. The objective is clear: regardless of which chain gains traction, Visa aims to maintain its position as a core payment network. Collectively, these initiatives indicate that traditional payment networks are evolving from “centralized clearing intermediaries” into “multi-chain settlement platforms.” Visa is not relinquishing its role—it is redefining it, shifting from an exclusive clearing house to an open infrastructure provider.

3.1.2 Case Study: JPMorgan — JPM Coin and the Exploration of Institutional-Grade DeFi

If Visa represents the Web3 transformation of payment networks, JPMorgan offers a representative example of the banking system’s Web3 evolution. As one of the world’s largest banks, JPMorgan launched JPM Coin as early as 2019, long regarded as a prototype of bank-issued stablecoins or deposit tokens. The real inflection point, however, arrives in 2026. According to recent announcements from Digital Asset and Kinexys by JPMorgan, JPM Coin is set to expand onto the Canton Network, marking a transition from a single-asset issuance tool to a component of institutional-grade blockchain financial infrastructure.

On the Canton Network, JPM Coin will support issuance, transfers, and near-instant redemption. Compared with traditional banking settlement processes—constrained by multiple clearing layers and limited operating hours—this architecture is designed for near real-time, 24/7 operation. The result is a structural improvement in capital efficiency rather than a mere technical optimization. Building on this foundation, JPMorgan is actively exploring institutional DeFi. Rather than replicating permissionless protocols, its approach emphasizes compliance, access control, and privacy, enabling institutional clients to more directly access on-chain settlement, lending, and liquidity management while gradually reducing reliance on crypto-native platforms.

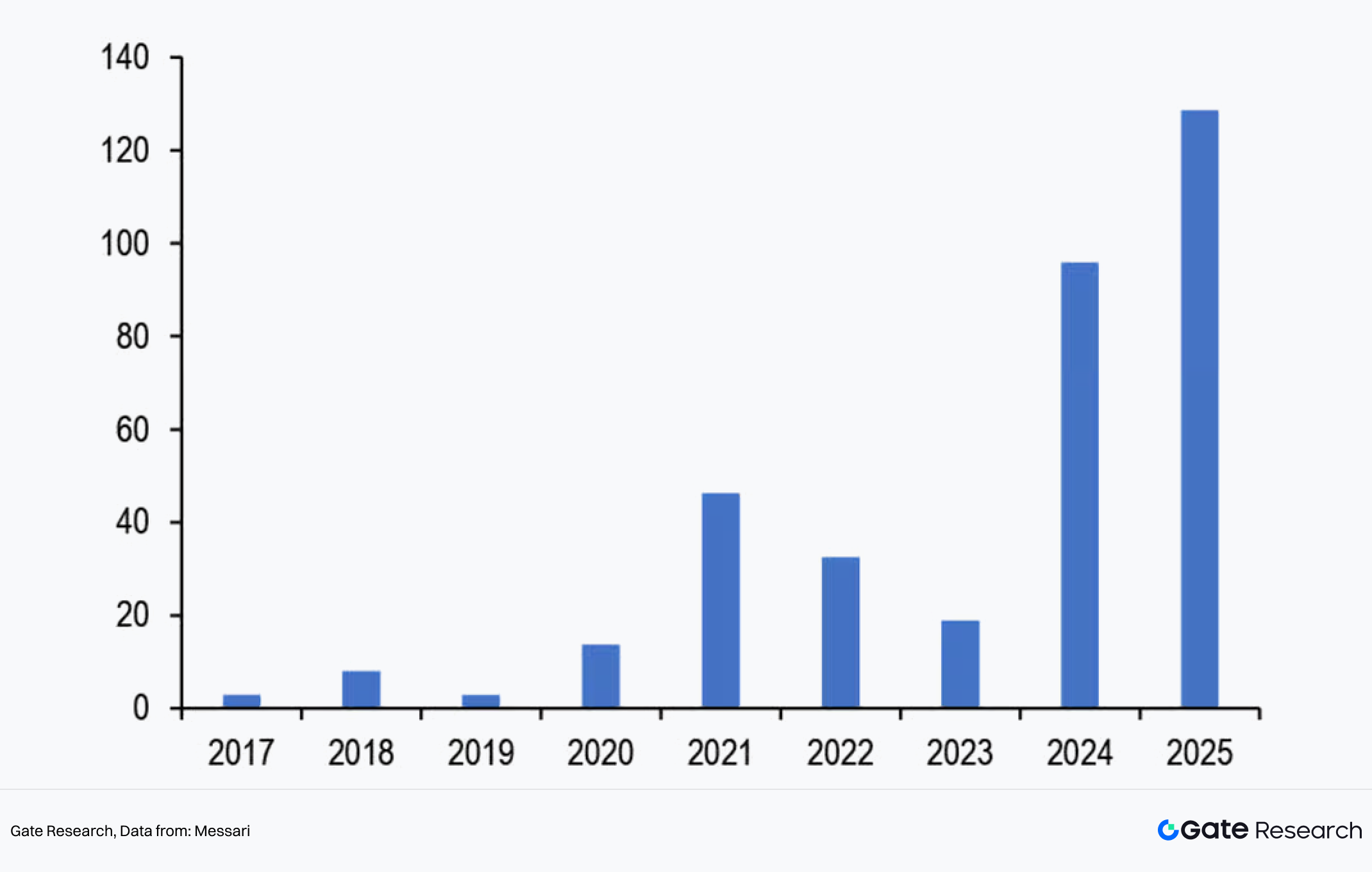

From a capital flow perspective, JPMorgan research indicates that digital asset markets recorded approximately $130 billion in net inflows in 2025, with further expansion expected in 2026 as regulatory pathways become clearer. While parts of on-chain finance have historically offered returns exceeding those of traditional low-risk assets, institutional focus is increasingly shifting toward risk-adjusted returns and long-term sustainability. Within this strategy, the Kinexys platform serves as a critical foundation layer. By preserving institutional-grade security and compliance, while extending deposit tokens, tokenized assets, and inter-institutional settlement processes into composable blockchain networks, JPMorgan is effectively bridging traditional finance and on-chain infrastructure.

Figure 3: Net inflows into digital asset markets reached approximately $130 billion in 2025, with further growth expected in 2026 amid clearer regulatory pathways

Overall, JPMorgan’s actions signal that large financial institutions are moving beyond proof-of-concept toward deep operational integration with blockchain technology. This is not a marketing narrative, but a long-term commitment grounded in real capital, system capabilities, and institutional credibility—a tangible bet on the role of blockchain in institutional finance.

3.1.3 Case Study: PayPal — Seamlessly Integrating Crypto into a Global P2P Payment Network

PayPal is one of the world’s leading digital payment platforms, with hundreds of millions of users and a vast global merchant network. Historically, its core business model centered on transaction facilitation and fee-based revenue. In recent years, however, PayPal has been pursuing a more strategic transformation: systematically integrating crypto asset capabilities into its broader payment and financial services stack.

A key manifestation of this shift is the “Pay with Crypto” feature. According to disclosures released by PayPal in early 2026, this functionality has now been rolled out to merchants, supporting payments in over 100 cryptocurrencies. Consumers can pay with assets such as Bitcoin, Ethereum, and USDC, while merchants receive fiat currency or PayPal USD (PYUSD) instantly—without bearing crypto price volatility or on-chain operational complexity.

While seemingly straightforward, this design directly addresses two longstanding bottlenecks in crypto payments: limited acceptance scenarios and high usage friction. By leveraging PayPal’s existing global merchant network, crypto assets can be embedded into mainstream payment flows without altering merchants’ settlement habits, providing a realistic path toward large-scale adoption.

Beyond payments, the expansion of PYUSD represents PayPal’s second major strategic pillar. As PayPal’s USD-denominated stablecoin, PYUSD has been deployed across multiple blockchains and is integrated into PayPal’s platform with a stablecoin rewards mechanism, currently offering annualized yields of approximately 3.7%–4.0% (subject to real-time platform disclosures). This positions PYUSD not only as a payment and settlement medium, but increasingly as a vehicle for idle capital and account-based asset management.

A third strategic direction lies in PayPal’s exploration of a more bank-like operating model. Public reports indicate that PayPal is pursuing relevant banking licenses, aiming to offer deposit-taking and lending services within regulatory frameworks. If successful, PayPal could reduce its dependence on traditional banks as intermediaries and form a more tightly integrated structure spanning payments, stablecoins, and core banking services.

Taken together, PayPal’s initiatives illustrate how traditional payment platforms are evolving from simple “payment tools” into fintech-driven integrated financial service providers. Crypto assets are not treated as isolated innovations, but as core components embedded within account systems, payment networks, and potential banking operations—playing a central role in redefining the boundaries of financial services.

3.2 The Rise of Neobanks: Web2.5 as a Bridge to the Mass Market

If Visa, JPMorgan, and PayPal represent the “upward evolution” of traditional finance—moving from centralized financial systems toward structures that more closely resemble decentralized frameworks—then neobanks can be seen as Web3’s “downward reach” into the mass market. Rather than focusing primarily on high-net-worth individuals or institutional clients, neobanks bring financial products and services directly to a broad base of everyday users.

Neobanks are a new category of digital financial institutions, typically founded by technology companies. They deliver financial services via mobile applications without relying on traditional brick-and-mortar banking networks. Their defining characteristics include fully digital operations, low cost structures, high usability, and rapid iteration cycles.

The convergence of neobanks with PayFi and blockchain-based services has emerged as a major trend by 2026. An increasing number of neobanks are exploring the integration of stablecoin payments, on-chain value transfer, and access to DeFi-related services into their platforms. Examples include enabling users to hold stablecoins directly within apps, conduct cross-border payments, or access on-chain asset services. This reflects a broader shift in digital financial services toward more open and composable architectures.

In terms of financial inclusion, neobanks play a particularly important role. In many emerging markets, traditional banking penetration remains low while smartphone adoption is high. This creates favorable conditions for digital banking services to provide basic financial access to underserved populations. Through tools such as stablecoins, neobanks can also connect users to global payment networks, reducing reliance on local financial intermediaries. At the same time, neobank business models are evolving. Historically reliant on transaction fees or subscriptions, many are now expanding into investment, lending, and insurance offerings, aiming to cover a broader portion of users’ financial lifecycles.

Regulatory progress has further supported this trend. The GENIUS Act, passed in 2025, established a federal regulatory framework for payment stablecoins, clarifying issuance requirements and supervisory standards. This has helped advance the integration of stablecoins into mainstream financial services under a more predictable legal environment. While it does not eliminate regulatory obligations, it significantly reduces long-term uncertainty.

Overall, neobanks hold strategic significance in delivering more open and digital financial services. As they broaden access to financial opportunities for the mass market, they also continue to absorb and integrate Web3’s underlying value transfer capabilities.

3.3 The “Real-World Turn” of Web3-Native Protocols: Building the Integration Layer

Over the past several years, Web3 has functioned largely as a self-contained financial experimentation ground, where assets, trading, and settlement occur entirely on-chain. The system is logically coherent and technically sophisticated, but its participant base is highly homogeneous—largely confined to a relatively small group that understands blockchain, can use wallets, and is willing to tolerate price volatility.

While this model has been effective in validating technical feasibility, it is increasingly approaching its ceiling in terms of growth and universality. A review of the development paths of DeFi, NFTs, and GameFi reveals a common constraint: their growth limits are shaped less by technology itself and more by real-world To B and To C conditions. These include high user acquisition costs, long-standing separation between fiat and crypto, and fragmented compliance and payment experiences. According to a Gemini Global survey, 38% of potential crypto users cited the difficulty of purchasing crypto with fiat as one of the primary barriers to entering the ecosystem.

Meanwhile, demand on the Web2 side is clear and concrete: inefficient cross-border payments and settlements, strong demand for small-value, high-frequency, and automated transactions, and the need to support multiple currencies, payment methods, and regulatory jurisdictions. For most Web2 users, the underlying technology is irrelevant—they care about only three things: speed, cost, and reliability. If Web3 cannot be meaningfully embedded into Web2 payment and commercial workflows, its long-term growth potential is likely to remain constrained.

Against this backdrop, PayFi functions less as a disruptor and more as a coordination layer connecting Web3 and Web2. From an architectural perspective, the PayFi technology stack can typically be decomposed into four layers:

- Value Layer: Addresses the question of “what money is used.” This may include fiat currencies, stablecoins, or other widely accepted digital value units. The key considerations are stability, ease of pricing, and regulatory and auditability.

- Payment and Settlement Layer: Handles transfers, collections, clearing, and reconciliation. Compared with traditional payment systems, this layer features shorter settlement paths, greater transparency of fund status, and easier programmability.

- Financial Function Layer: Funds are no longer simply transferred “from A to B.” Additional financial capabilities can be embedded during circulation, such as automatic yield generation, credit or pre-credit lines, installment or deferred payments, and integrated risk control and limit logic.

- Application Layer: The product experiences directly perceived by users. Developers no longer need to build a full financial system from scratch; instead, they can leverage pre-packaged capabilities within the PayFi ecosystem.

For Web3-native protocols, the critical question becomes: at which layer should they position themselves, and what role should they play, in order to become truly usable in the real world?

3.3.1 Case Study: XRP Ledger — From On-Chain Payments to Real-World Commercial Adoption

XRP was originally positioned to address the slow and costly nature of traditional cross-border payments. The design of the XRP Ledger (XRPL) emphasizes low latency and low transaction costs. Compared with conventional cross-border remittance systems, XRPL’s consensus mechanism enables transaction confirmation within seconds at minimal fees, providing a solid foundation for real-world payment use cases.

What has truly driven XRP’s transition toward real-world adoption, however, is not performance alone, but Ripple’s deliberate strategic shift over recent years—from a crypto-asset narrative toward enterprise-grade payment and settlement infrastructure.

On one hand, Ripple has moved away from retail-focused trading scenarios and instead prioritized integration of XRP Ledger with banks, payment institutions, and large enterprises, targeting cross-border settlement, intercompany payments, and capital efficiency. On the other hand, Ripple has actively embraced regulatory frameworks by pursuing licenses, compliant custody solutions, and enterprise-grade risk controls across major jurisdictions. This positions XRP not as a speculative asset, but as a payment rail embedded within real commercial workflows.

In practical terms, in August 2025, Ripple acquired the stablecoin payment infrastructure platform Rail, strengthening its capabilities in compliant global stablecoin payments and settlements for enterprise clients, while accelerating adoption of RLUSD and blockchain payment networks in large-scale commercial scenarios. Also in August 2025, Nasdaq-listed pharmaceutical distributor Wellgistics Health began deploying a payment system based on XRP Ledger, covering approximately 6,500 pharmacies and manufacturers. The goal is to increase payment speed, reduce settlement costs, and expand the application of blockchain within healthcare supply chain finance.

3.3.2 Case Study: Solana — Connecting High-Performance Blockchains with Real-World Payment Infrastructure

As a high-throughput, low-fee blockchain, Solana not only supports applications such as DeFi and NFTs, but has also achieved tangible adoption in payment scenarios. For example, a leading global crypto payment processor now supports Solana ecosystem assets—including SOL, USDC, and USDT—as merchant payment options. This integration allows users to pay with these assets at real-world merchants, settle bills, or convert funds into fiat currency.

Beyond payment acceptance, Solana has also made progress in bridging on-chain activity with Web2 payment ecosystems. Some solutions enable users to purchase USDC on Solana directly via local payment methods—such as India’s UPI or Brazil’s PIX—effectively connecting fiat on-ramps with on-chain payment rails. These integrations have increased wallet top-up conversion rates by over 20% while significantly reducing payment failure rates.

Taken together, cases such as Solana and XRP demonstrate how Web3-native protocols are progressively embedding themselves into real commercial processes across the value, payment, and application layers. Through this evolution, they are becoming practical, indispensable components of real-world capital flows.

3.4 Global PayFi Convergence Trends: Reshaping Payment and Settlement Pathways

As payment and settlement systems become embedded in everyday user behavior and real corporate workflows, PayFi is no longer merely a functional module within the Web3 ecosystem. Instead, it is increasingly participating in real-world capital flows. This section draws on the latest survey data to analyze the global PayFi convergence trend from multiple dimensions, including changes in user behavior across fiat on- and off-ramps and the actual adoption of crypto payments in mainstream commercial scenarios.

3.4.1 User Behavior in Fiat On- and Off-Ramp Channels

Different user groups exhibit markedly different behaviors when it comes to fiat on- and off-ramps. According to a 2025 survey by Chainalysis and The Block Research, 55% of new crypto users—primarily from Web2 backgrounds—did not make their first crypto purchase through traditional crypto exchanges. Instead, they preferred familiar payment entry points such as mobile banking apps and fintech platforms. For these users, the smoothness of the payment flow and the success rate of transactions often directly determine whether they complete registration and their first transaction.

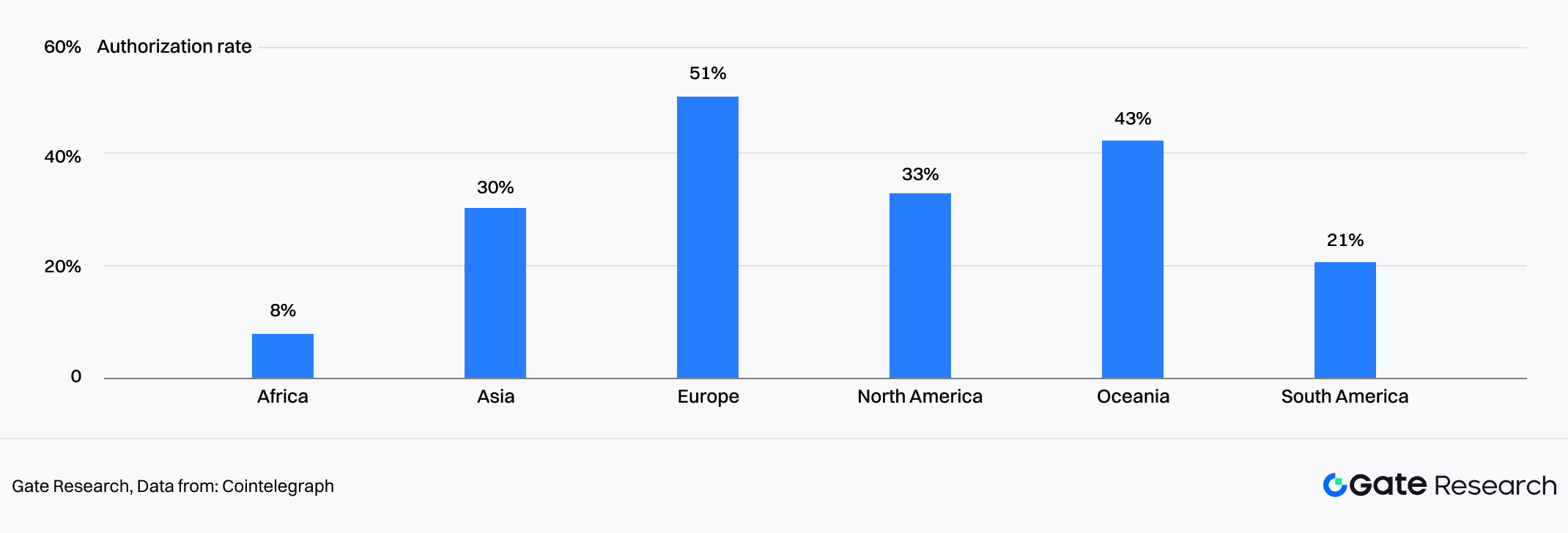

In practice, however, fiat on-ramps involve substantial hidden friction. Reports by Cointelegraph Research and Onramper show that performance varies significantly across entry points due to differences in user geography, payment methods, and channel infrastructure. Europe records the highest transaction success rates, while Africa and South America show the lowest. Across multiple mainstream fiat-to-crypto on-ramp channels, around 50% of transactions still fail even after KYC is completed. Throughout the entire payment process, as many as 90% of users may abandon the flow due to complexity, high failure rates, or long waiting times. This has become one of the primary reasons why many Web2 users drop off at the very first step.

Figure 4: Payment authorization success rates are highly dependent on end-user geography, with Europe showing the highest transaction success rate.

Once users successfully complete their first fiat on-ramp, their asset preferences tend to shift rapidly. Whether for cross-border payments, settlements, or fund transfers, users generally prefer stablecoins as intermediary assets due to their lower price volatility, stronger liquidity, and ease of conversion. The continuously rising penetration of stablecoins in cross-border settlement scenarios further corroborates this behavioral trend.

By contrast, the priorities of Web3-native users are almost the inverse. According to a survey by PYMNTS and Deloitte, 41% of Web3-native users consider fast and reliable conversion of crypto assets into fiat—rather than purchasing crypto—to be their most urgent need. Having already adapted to on-chain operations, they focus more on the efficiency, cost control, and certainty of fund inflows and outflows across different channels.

Overall, fiat on-ramp experiences vary widely across user segments. For new entrants in particular, channel efficiency and the breadth of supported payment methods are decisive factors.

3.4.2 Adoption of Crypto Payments in Mainstream Commercial Scenarios

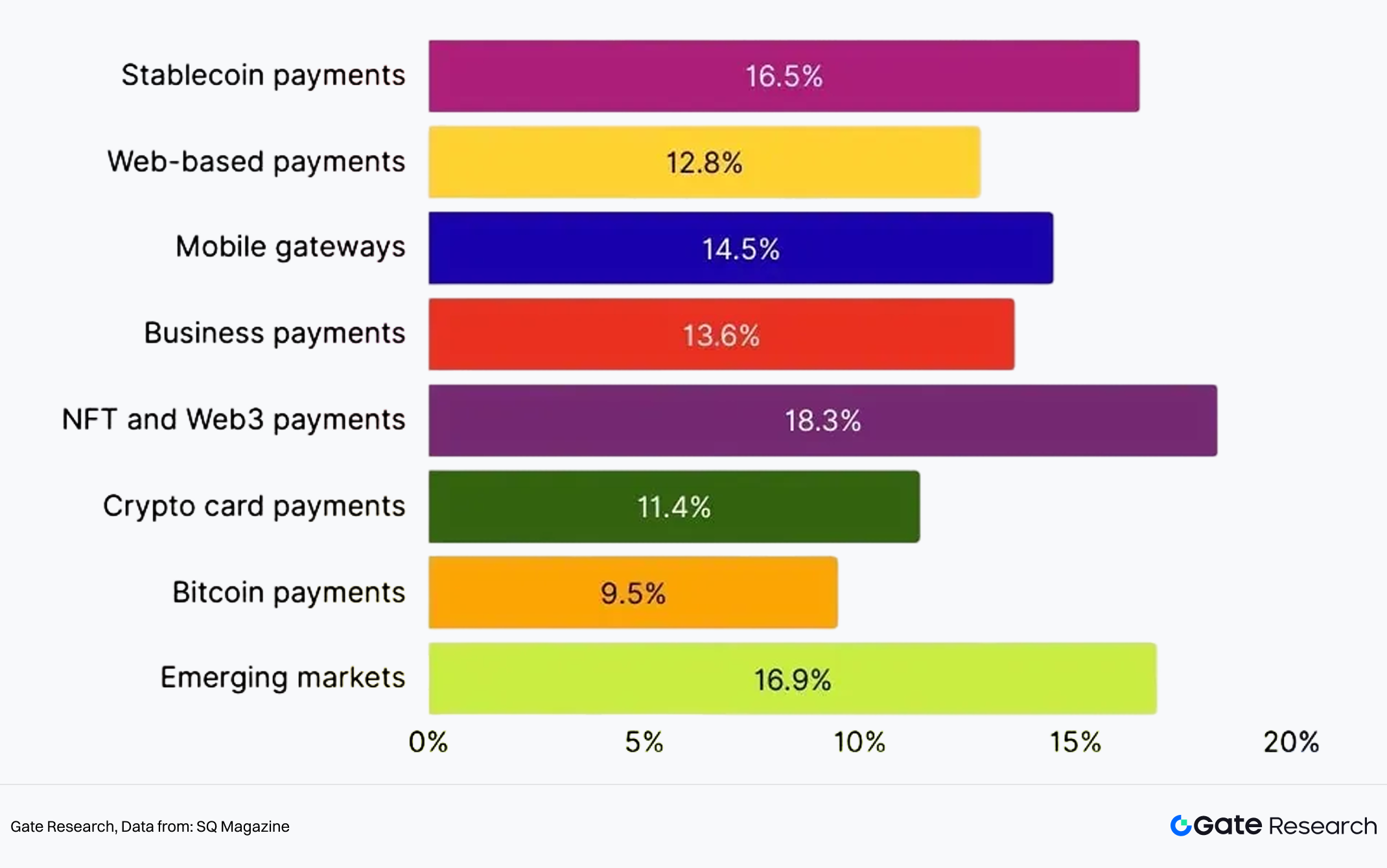

According to growth projections for crypto payment sub-segments by SQ Magazine, stablecoin payments are expected to grow at a 16.5% compound annual growth rate (CAGR), driven primarily by remittances and cross-border e-commerce. By 2030, network-based crypto payment solutions are projected to grow at 12.8%, while mobile crypto payment gateways are expected to expand at 14.5% alongside broader mobile wallet adoption. Enterprise-grade crypto payments—such as corporate treasury management and settlement tools—are projected to grow at 13.6%. NFT and Web3 payments overall are expected to grow at 18.3%, with growth largely concentrated in gaming and digital goods. Crypto card payments linked to Visa and Mastercard are projected to grow at 11.4%, while Bitcoin-only payment solutions are expected to grow at 9.5%, lagging behind stablecoins. In emerging markets, crypto payment adoption is projected to grow at 16.9%, primarily in Africa and Southeast Asia.

Figure 5: CAGR of crypto payments by segment, with stablecoin payments growing at 16.5%.

In real commercial environments, crypto payment adoption does not typically begin in idealized financial use cases, but rather in areas where pain points are most concentrated. Cross-border e-commerce is a prime example, characterized by long settlement cycles, high fees, and the compounded costs of multi-currency handling and compliance.

3.4.3 E-Commerce: A Practical Solution for Cross-Border Settlement

From both market size and usage perspectives, crypto payments are accelerating their penetration into e-commerce. According to SQ Magazine, cryptocurrencies are expected to account for approximately 3% of total global cross-border payments in 2025. With e-commerce penetration growing 38% year over year, around 32,000 merchants now accept crypto payments, with retail accounting for roughly 60% of crypto payment transaction volume. In cross-border transactions, 48% of users cite “payment speed” as the core advantage of stablecoins—an attribute that closely aligns with e-commerce merchants’ need for efficient capital turnover.

From a revenue and operational standpoint, PayFi delivers clear positive feedback for merchants as well. 77% of merchants report that crypto payments significantly reduce transaction costs, with stablecoins cutting cross-border fees by 30%–50%. When using crypto through channels such as PayPal for international transactions, fee savings can reach as high as 90%. Meanwhile, 85% of merchants say that crypto payments help them attract new customers. After integrating Bitcoin payments, merchants have reported an average return on investment of 327%, alongside an overall e-commerce revenue increase of approximately 10.5%.

Taken together, these data points indicate that in high-friction scenarios such as cross-border e-commerce, PayFi is no longer optional. It is increasingly becoming a practical tool for improving efficiency and competitiveness. For most cross-border sellers, the primary concerns remain pragmatic: how quickly funds are settled and whether overall costs are meaningfully reduced.

4. Key Drivers: Technologies and Asset Paradigms Accelerating Convergence

If the convergence of Web2 and Web3 is an accelerating main thoroughfare, what truly continues to widen this road is not a single company’s breakthrough, but the simultaneous force of several structural drivers. Among them, RWA (Real-World Asset tokenization), AI, and stablecoins are systematically reshaping PayFi from the asset layer, the intelligence layer, and the settlement layer, respectively.

4.1 RWA: Injecting Trillion-Dollar Real-Economy Value into PayFi

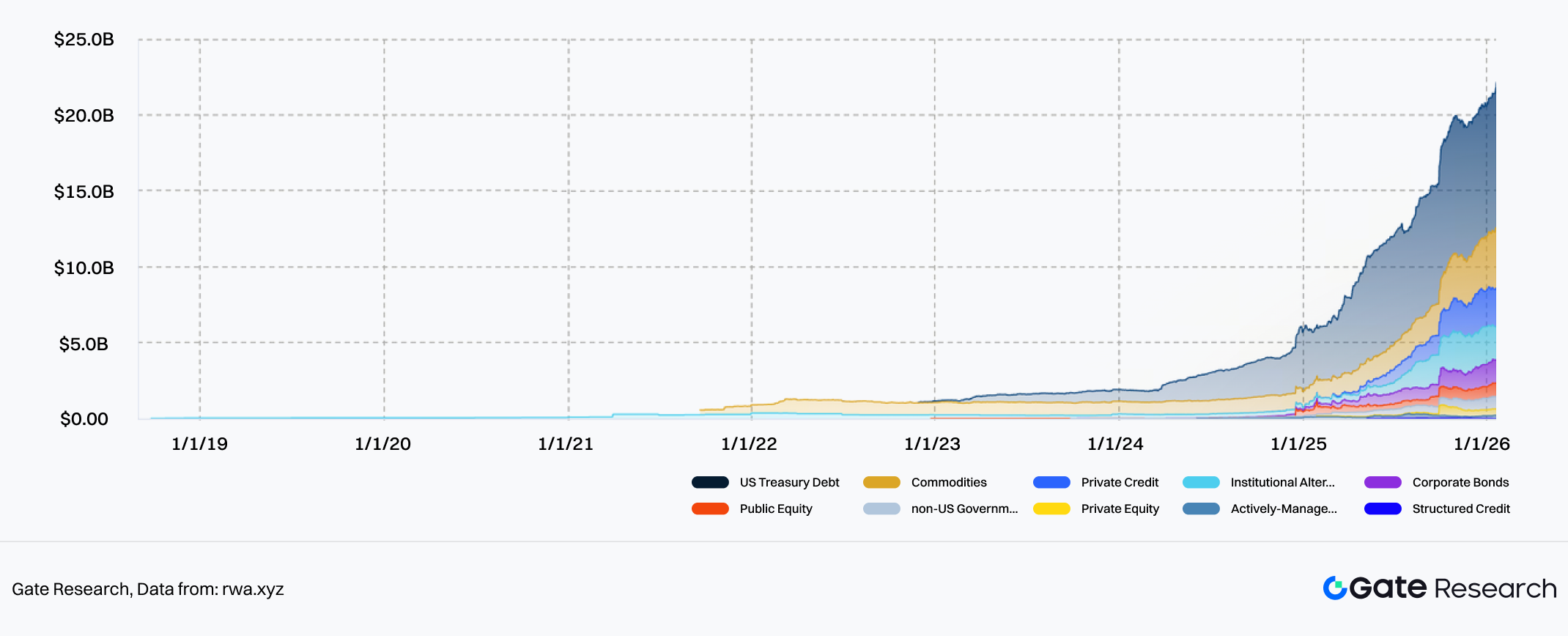

On the asset side, RWA has become a core lever for deep integration between Web3 and the real economy, opening up a trillion-dollar capital space for PayFi. By the end of 2025, on-chain RWA had grown from an early proof-of-concept stage to a scale exceeding $20 billion, covering asset types such as government bonds, corporate bonds, fund shares, accounts receivable, and real estate income rights.

Figure 6: On-chain RWA scale exceeded $20 billion by the end of 2025

From a global perspective, the ceiling for the RWA market is extremely high. Multiple institutional estimates suggest that by 2026, the value of tokenized assets on-chain could surpass $100 billion. Over the medium to long term, the pool of real-world assets that could theoretically be tokenized is measured in tens of trillions of dollars, while the portion that has actually moved on-chain remains at a very early stage. Importantly, this growth is not driven primarily by crypto-native users, but by incremental demand from traditional financial institutions, enterprises, and high-net-worth individuals—seeking higher settlement efficiency, lower cross-border costs, and more flexible portfolio construction without changing the fundamental nature of the assets themselves.

As a result, the core question for RWA is not merely how assets move on-chain, but whether on-chain financial and payment capabilities can ultimately serve real economic activity. For most institutions and users, the first step in participating in RWA investment is not understanding blockchain technology, but answering a far more practical question: how to convert fiat currency into investable, settleable on-chain assets in a safe, compliant, and efficient manner. This is precisely where PayFi plays a critical role within the RWA framework.

Take Ondo Finance as an example. It is one of the most active RWA projects today, and its flagship product OUSG grew into one of the world’s largest tokenized U.S. Treasury products in 2025, with TVL reaching several hundred million dollars. By issuing RWA assets on-chain and relying on a stablecoin-based settlement system to support 24/7 minting, redemption, and settlement, Ondo enables investors to enter or exit Treasury exposure at any time using stablecoins—free from the traditional T+2 settlement cycle. This model of “assets on-chain, capital flowing in real time” is a textbook example of PayFi–RWA synergy.

A more real-economy-oriented case comes from real estate. Propy, a platform focused on real estate tokenization and on-chain transactions, had facilitated over $4.5 billion in on-chain real estate transactions by November 2025, with tokenized property value exceeding $1.2 billion across multiple countries. By putting property ownership on-chain in the form of NFTs and combining ERC-20 tokens to separate capital and ownership flows, Propy compressed average property transfer times from 45 days to as fast as 24 hours, while reducing overall transaction costs by approximately 70%.

These cases show that RWA is not an isolated asset innovation, but a new financial form that is deeply bound to PayFi—more efficient, closer to real economic use, and capable of sustained utilization.

4.2 The Convergence of AI and Blockchain: Toward “Dynamic DeFi” and Autonomous Economies

As real-world assets continue to move on-chain, the introduction of AI ensures that these assets no longer exist merely as static representations, but begin to participate in financial operations in smarter and more dynamic ways.

In today’s on-chain environment, AI is no longer just a data analysis tool—it is increasingly involved in the dynamic adjustment of strategies themselves. In lending and market-making scenarios, for example, AI can continuously assess system-wide risk exposure and automatically raise margin requirements, lower leverage caps, or even proactively guide capital out of high-risk pools when liquidity tightens or volatility spikes. When conditions stabilize and capital flows back in, efficiency-oriented parameters can be gradually restored. With AI participation, DeFi is evolving from static protocols into adaptive financial systems—systems that do not rely on governance votes for every upgrade, nor wait for risks to materialize before triggering liquidations, but instead learn continuously and adjust in advance.

This capability is especially important for PayFi. What payment and settlement systems fear most is not low yield, but errors under conditions of high concurrency, cross-market interaction, and multi-asset complexity. AI-driven dynamic risk control and path optimization directly address this vulnerability.

In PayFi scenarios, AI agents are emerging as potential default participants. Future payment flows may no longer require users to manually confirm every transaction. Instead, within authorized and compliant boundaries, AI agents can automatically handle subscription payments, cross-border settlements, FX selection, and routing across chains.

Since 2025, the rising attention around agent payment protocols such as x402 reflects this trend. Rather than creating new payment assets, these protocols provide standardized interfaces that allow machines to execute payments on behalf of humans—covering requests, settlement, and confirmation within a fully closed loop under explicit authorization. Payments are no longer merely passively triggered actions, but behaviors that systems can understand and execute autonomously.

In enterprise scenarios, the value of this model is even clearer. Multinational companies no longer need to manually manage accounts across countries or navigate complex settlement processes. Instead, AI agents can automatically select optimal payment routes and allocate capital based on real-time FX rates, on-chain liquidity, and settlement costs. In this context, PayFi gradually evolves into a truly back-end financial infrastructure.

4.3 Stablecoins: The Cornerstone of a Global Unified Settlement Layer

If RWA brings real assets on-chain and AI enables on-chain finance to “think,” then stablecoins are what allow value to truly flow and settle—representing the critical step that moves Web2–Web3 convergence from concept to sustainable reality.

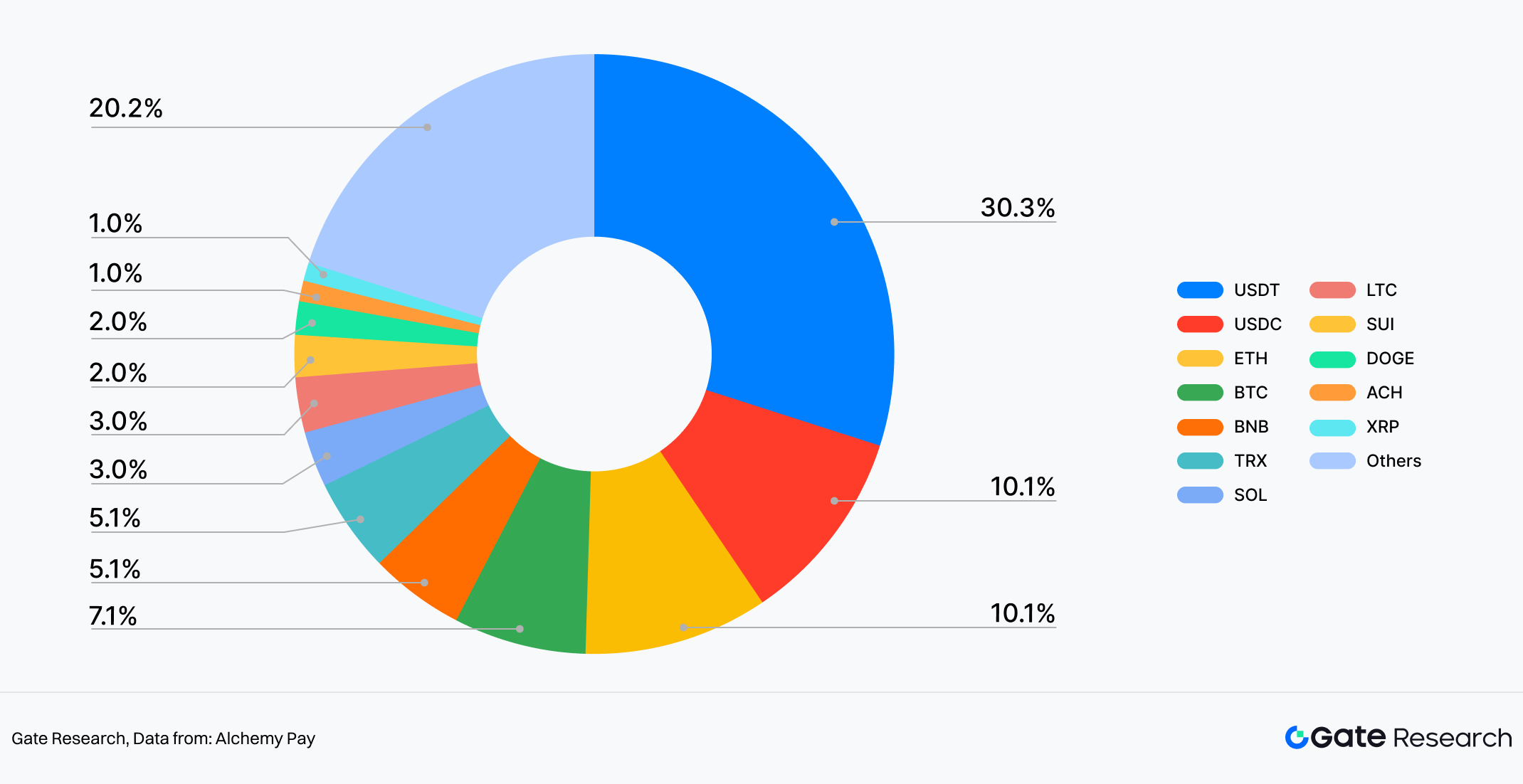

Within the PayFi system, stablecoins are not merely another asset category. They function more like a universal settlement language that transcends blockchains, applications, and national borders. From a usage perspective, stablecoins have clearly shifted from being on-chain trading media to mainstream payment instruments. Using Alchemy Pay’s fiat on- and off-ramp data as an example, USDT accounts for 30% of the most frequently used assets—significantly higher than BTC at 7% and ETH at 10%. USDC accounts for around 10%, on par with ETH. This structure intuitively reflects real user preferences: in payment and fund transfer scenarios, price stability and certainty of settlement matter far more than long-term value narratives.

Figure 7: In fiat on- and off-ramp usage, USDT accounts for 30%, significantly higher than USDC, BTC, and ETH

The data also suggest that most users entering the PayFi system are not there to speculate on asset price movements, but to accomplish very concrete tasks—transfers, settlements, collections, and FX conversion. In these scenarios, stablecoins naturally function more like “digital cash” than investment assets. This is why stablecoin usage frequency consistently exceeds that of Bitcoin in real on- and off-ramp flows.

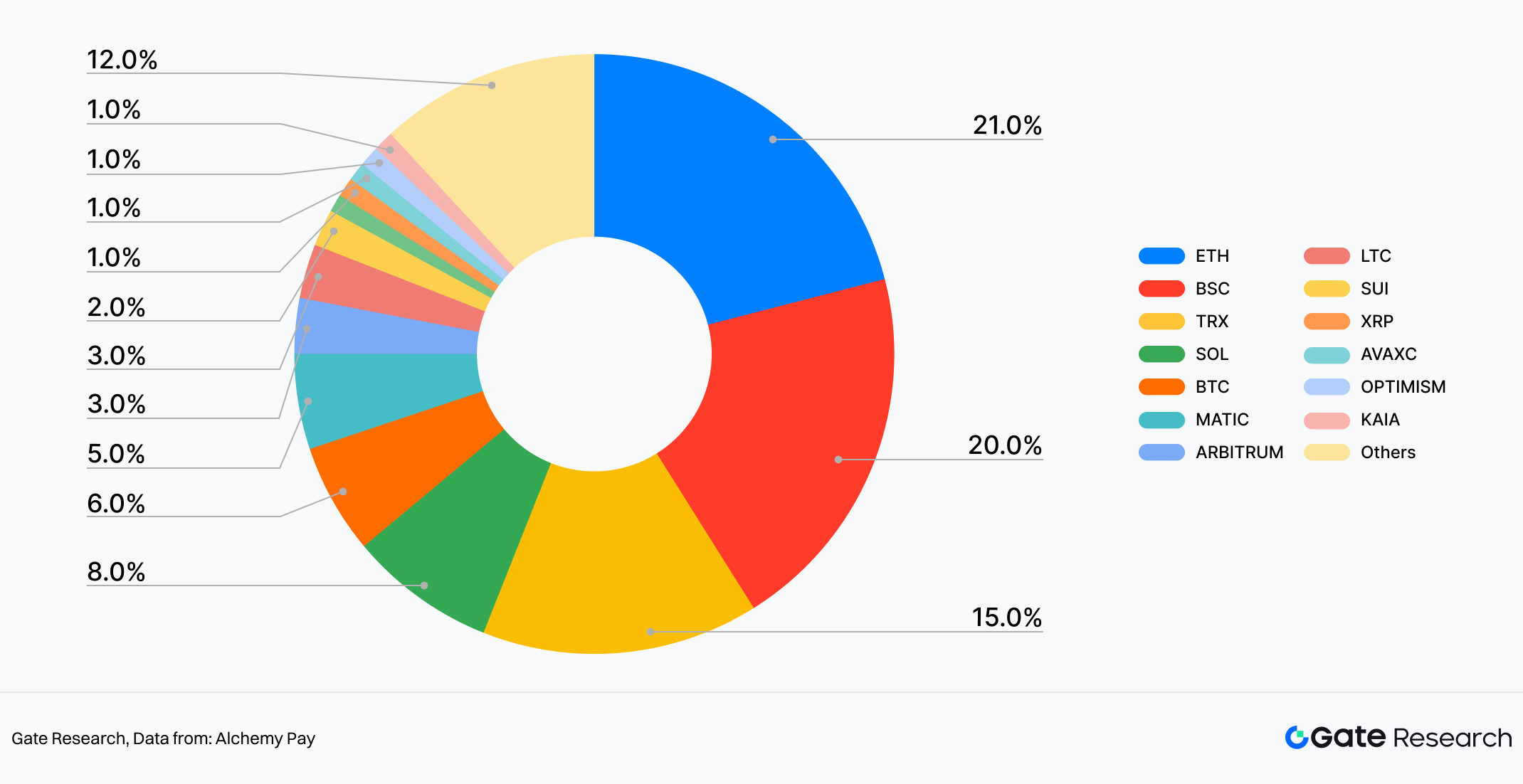

More importantly, the advantage of stablecoins extends beyond the asset layer to network-level adaptability. From this concrete sample of Alchemy Pay’s multi-chain transaction structure, stablecoins are deeply embedded across major public blockchains, with Ethereum accounting for 21%, BSC 20%, TRON 15%, Solana 8%, and Bitcoin approximately 6%. This indicates that stablecoins are not locked into a single chain, but instead serve as liquidity connectors across multi-chain ecosystems.

Figure 8: In multi-chain transaction share, Ethereum ranks first with 21%

This multi-chain distribution is critical for PayFi, because real-world payment networks have never been monolithic. Banks, e-commerce platforms, payment institutions, and clearing channels are all highly fragmented. The value of stablecoins lies precisely in their ability to move freely across chains and applications, providing a unified unit of account and settlement foundation for higher-layer applications. For merchants and users, there is no need to understand which chain is operating in the background—what matters is fast settlement and controllable costs.

In this process, the role of stablecoins is quietly evolving. In the past, they primarily served internal trading on crypto exchanges. Today, they are entering real commercial scenarios such as e-commerce, cross-border payments, subscription services, and corporate settlements. This evolution also explains why stablecoins are often the first stop for Web2 users entering Web3. Compared with volatile crypto assets, stablecoins have a lower cognitive barrier and a user experience closer to traditional electronic payments. Users enter through familiar bank cards or payment apps and receive not a high-risk asset, but immediately usable digital funds.

In short, without stablecoins, PayFi would remain at the conceptual level. With stablecoins, the integration of payments and finance gains, for the first time, a practical and usable foundation.

5. The Evolution of Global Regulatory Frameworks and Their Market Impact

Unlike the early Web3 trajectory, which prioritized decentralization above all else, the development logic of PayFi is undergoing a clear shift. Whether a model can be understood, accepted, and ultimately integrated into existing regulatory and financial frameworks is increasingly becoming a decisive factor for its commercial viability and competitive positioning.

5.1 The EU’s Markets in Crypto-Assets Regulation (MiCA): Setting the “Gold Standard” for Stablecoin Regulation

The European Union’s Markets in Crypto-Assets Regulation (MiCA) is widely regarded as one of the most comprehensive and clearly defined regulatory frameworks for crypto assets worldwide. Its purpose is not to suppress the crypto industry, but to provide clarity to the market—what is allowed, how it can be done, and to what extent compliance is required. At its core, MiCA is less about constraining innovation and more about establishing clear, predictable boundaries that allow crypto assets to enter the mainstream financial system.

In the area of stablecoin regulation, MiCA clearly differentiates between types of crypto assets and imposes higher compliance standards on fiat-referenced stablecoins. These include requirements for clearly defined reserves, transparent disclosures, auditable structures, and safeguards to ensure they do not pose systemic risks to the financial system. While this approach objectively raises the entry threshold for stablecoins in the EU market, it also removes key institutional barriers for compliant stablecoins to be used in cross-border payments, commercial settlement, and other real-world scenarios.

This is particularly critical for PayFi. Once stablecoins are brought under a clear regulatory framework, banks, merchants, and enterprises are far more willing—and confident—to adopt and integrate them into their systems. What MiCA effectively does is transform the question from “can stablecoins be used?” into “how can they be used more effectively,” thereby laying a solid foundation for PayFi’s expansion.

5.2 Regulatory Developments in Other Major Economies: Balancing Innovation and Risk

Unlike the EU’s unified legislative approach, other major economies exhibit a more fragmented regulatory landscape for crypto assets. Broadly speaking, markets are exploring a bank-style regulatory path, gradually bringing stablecoin issuers and payment-oriented crypto infrastructure into existing financial supervisory systems. This includes requirements around reserve management, anti-money laundering (AML), and consumer protection. While such measures increase compliance costs in the short term, they help reduce systemic risk over the long run and facilitate deeper integration between PayFi and traditional financial systems.

At the same time, several international financial hubs have adopted more flexible regulatory strategies. Many Asian jurisdictions follow a model of “compliance-first plus regulatory sandboxes,” where baseline compliance standards are clearly defined, while companies are allowed to test cross-border payments, stablecoin settlement, and enterprise-grade PayFi applications within controlled environments. A common feature of these regulatory innovations is that they do not rush to provide definitive answers; instead, they rely on pilot programs to observe how risks and benefits play out in real commercial use cases.

For PayFi projects, these jurisdictions are becoming critical bridges between Web3 and Web2. Their regulatory stance itself has effectively become a form of competitive advantage.

5.3 How Regulation Will Reshape the PayFi Landscape and Competitive Strategies in 2026

Looking ahead to 2026, regulation will no longer be a simple binary question of “compliant or not.” Instead, it will deeply shape the structure of the PayFi market and the nature of competition. First, compliance capability itself will become a core barrier to entry. PayFi infrastructure providers that can meet regulatory requirements across multiple jurisdictions, integrate with local payment networks, and deliver reliable settlement experiences will be far more attractive to institutional clients and large-scale merchants.

Second, competition will increasingly shift from pure technical performance to a combined contest of compliance and integration capabilities. Low fees and high performance will remain important, but they will no longer be the sole deciding factors. The players best positioned to embed themselves efficiently into banking systems, corporate treasury workflows, and local payment ecosystems are more likely to dominate the next phase of market evolution.

Finally, greater regulatory clarity will accelerate industry stratification and specialization within PayFi. Some participants will focus on foundational clearing, settlement, and compliant payment rails—taking on roles akin to financial infrastructure providers—while others will build differentiated applications and services around specific regions or use cases. Overall, regulation is not constraining PayFi’s growth; rather, it is providing the institutional support needed for PayFi to move from the margins of innovation into the core of mainstream finance.

6. Conclusion and Outlook

6.1 PayFi as an Inevitable Outcome—and Core Catalyst—of Web2–Web3 Convergence

PayFi is not a simple replacement for traditional payment systems. Rather, it is the natural result of the convergence between Web2 payment infrastructures and Web3 financial capabilities, driven by the gradual maturation of stablecoins, blockchain-based settlement, and regulatory frameworks.

For traditional financial institutions, blockchain is no longer merely an experimental tool; it has become a practical solution to long-standing pain points such as slow settlement, high costs, and complex cross-border processes. For Web3, sustainable growth in on-chain finance is only possible when it is embedded in real payment flows and capital movements.

Visa’s adoption of USDC settlement and its expansion across multiple blockchains demonstrate that traditional card networks are not being displaced by decentralization. Instead, JPMorgan’s integration of bank deposits, clearing, and institutional-grade DeFi on a unified on-chain infrastructure reflects a PayFi-driven reconstruction of both internal bank flows and interbank capital movements. PayPal, meanwhile, has chosen a more consumer-oriented path, enabling crypto assets and stablecoins to enter global payment networks without changing merchant or user behavior.

At the same time, Web3-native protocols are actively “de-emphasizing crypto” by shifting their focus from on-chain performance metrics to real-world payment and settlement needs. The XRP Ledger continues to integrate with bank and enterprise cross-border settlement systems, while Solana extends its high-performance infrastructure directly into real-world consumption and cash-flow scenarios through integrations with local payment channels and merchant networks. Driven jointly by RWA, AI, and stablecoins, assets are increasingly being tokenized, funds are circulating in real time via stablecoins, and payments and finance are naturally converging into a single value channel.

As regulatory pathways become clearer and stablecoins increasingly function as de facto settlement layers, PayFi is no longer merely a transitional bridge between Web2 and Web3. It is evolving into a core catalyst for deep integration between the two, with a development logic closer to infrastructure upgrading than to isolated financial innovation.

6.2 Key Trends for 2026–2030: The Phased Evolution of Three Core Drivers

Based on recent research and publicly available data from leading institutions such as ARK Invest, McKinsey, and Citibank, RWA, AI, and stablecoins are expected to jointly push PayFi into a phase of large-scale adoption between 2026 and 2030.

On the asset side, broad consensus suggests that the tokenized RWA market will expand from its current tens or hundreds of billions of dollars toward the trillion-dollar range. McKinsey estimates that, under a baseline scenario, tokenized assets across major categories could reach approximately USD 2 trillion by 2030, while more optimistic scenarios from institutions such as ARK Invest suggest a significantly higher upper bound. Highly compliant assets with clear cash flows—such as government bonds, fund shares, and private credit—are expected to achieve scale first. Over time, RWA is likely to shift from an “on-chain experiment” to a form of collateral and allocation that is widely accepted by mainstream financial systems.

On the intelligence side, forecasts from institutions such as Grand View Research suggest that the AI-in-finance market could reach approximately USD 41.16 billion by 2030, becoming a core technological capability within payment and settlement systems. AI will be deeply involved in payment route optimization, risk detection, and compliance management, and will increasingly support AI agents with limited autonomous execution capabilities. Within predefined rules and risk boundaries, these agents will be able to conduct asset allocation and transaction execution, pushing PayFi networks toward greater automation and intelligence.

On the settlement side, research from institutions including Citibank generally agrees that stablecoins will accelerate their evolution into payment and clearing infrastructure over the coming years. Estimates for stablecoin circulation by 2030 range from approximately USD 1.9 trillion to USD 4 trillion, with growth primarily driven by cross-border payments, online commerce settlement, and use cases in emerging markets. As usage frequency increases, the payment attributes of stablecoins are likely to strengthen, and in some emerging markets they may begin to function as quasi “second currencies,” serving as key settlement media across networks and asset classes.

Under the combined influence of these three drivers, multiple research institutions expect the Web3 payments market to continue expanding over the next five years and to assume a meaningful role within the global payments landscape. By 2030, PayFi is likely to evolve from a peripheral innovation into one of the key financial infrastructures underpinning Web2–Web3 convergence.

6.3 Strategic Implications for Enterprises and Investors

In light of these trends, PayFi should not be viewed merely as an additional payment option, but as an infrastructure upgrade with the potential to reshape payment, settlement, and asset flow logic. For enterprises involved in payments and capital settlement—particularly cross-border e-commerce platforms, fintech companies, and multinational corporations—the priority is to evaluate and pilot stablecoin-based settlement solutions early. Doing so can reduce cross-border costs, improve capital turnover efficiency, and preserve technical flexibility for future business innovation.

In practice, enterprises should focus less on blockchain technology itself and more on how PayFi, as an integration layer, can address concrete business pain points. Compared with building proprietary base-layer networks, partnering with mature PayFi infrastructure providers and rapidly integrating stablecoin capabilities into existing systems often offers higher efficiency and greater certainty. Over the longer term, competitive advantages are likely to emerge from the ability to coordinate RWA and AI via PayFi networks: asset holders can explore tokenization to enhance liquidity and financing flexibility, while technology firms can develop new intelligent service models around on-chain asset management and optimization.

For investors, in the early stages of Web2–Web3 convergence, structural opportunities are more likely to be concentrated at the infrastructure and platform layers rather than in isolated application-level innovations. Key areas to watch include: PayFi payment and settlement infrastructure with strong compliance and scalability; RWA platforms focused on high-quality asset tokenization and liquidity management; and AI agent platforms that provide tools and operating environments for on-chain economic activity. As RWA adoption progresses, the liquidity and composability of traditional financial assets may be repriced, making it worthwhile to monitor traditional financial institutions that are actively advancing tokenization and technological upgrades. Overall, the PayFi convergence process is inherently long-term in nature, and investment decisions should emphasize durable value creation and structural moats rather than short-term market fluctuations.

6.4 Structural Advantages and Key Constraints of PayFi: From Efficiency Gains to Institutional Infrastructure

Taken together, PayFi’s core value does not stem from a single technological breakthrough, but from the compounding effect of multiple efficiency gains: faster settlement, lower cross-border costs, and the ability to reuse capital during the payment process. These advantages transform payments from a “cost center” into a “capital efficiency tool.” This structural strength gives PayFi long-term substitution potential in global trade, cross-border e-commerce, and financial services in emerging markets, while also offering a practical technological pathway toward financial inclusion.

However, whether these efficiency gains can translate into a stable, long-term infrastructure role depends on three key constraints. First, the degree of regulatory coordination will directly determine PayFi’s global expansion ceiling. As long as significant divergences remain across jurisdictions in the regulation of stablecoins and cross-border payments, PayFi’s scaling is more likely to proceed region by region rather than through immediate global rollout. Second, systemic risk management will be unavoidable. As stablecoins increasingly take on settlement and clearing functions, their credit robustness, reserve transparency, and mechanisms for isolating DeFi-related risks will directly affect the credibility and financial stability of PayFi networks. Third, the scalability of underlying technology and the cognitive cost for users will continue to limit PayFi’s ability, in the short term, to fully replicate the breadth of coverage achieved by traditional payment networks.

Accordingly, PayFi’s evolutionary path more closely resembles gradual infrastructure upgrading rather than disruptive replacement. Its success will not be measured by whether it fully displaces traditional payment systems, but by whether it can achieve a dynamic balance between compliance, security, and efficiency—while consistently demonstrating superior performance in key scenarios. Once such a balance is established, PayFi will represent not just a payment innovation, but a foundational component of the next-generation global settlement system.

References:

- ESMA, https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica

- Visa, https://usa.visa.com/about-visa/newsroom/press-releases.releaseId.21951.html

- JPMorgan, https://www.jpmorgan.com/insights/payments/blockchain-digital-assets/introducing-kinexys

- PayPal, https://www.paypal.com/us/digital-wallet/manage-money/crypto/pyusd

- Bloomberg, https://www.bloomberg.com/news/articles/2026-01-08/stablecoin-transactions-rose-to-record-33-trillion-in-2025

- The Block, https://www.theblock.co/data/decentralized-finance/total-value-locked-tvl

- Visa, https://visaonchainanalytics.com/transactions

- Stripe, https://stripe.com/resources/more/stablecoins-vs-traditional-payments

- Yahoo Finance, https://finance.yahoo.com/news/stablecoins-shake-900-billion-remittance-113000383.html?guccounter=1

- United Nations, https://policy.desa.un.org/publications/world-economic-situation-and-prospects-november-2025-briefing-no-196

- Visa, https://www.blockchain-council.org/cryptocurrency/visa-usdc-settlement-united-states/

- Visa, https://corporate.visa.com/content/dam/VCOM/corporate/services/documents/vca-ten-payment-priorities-shaping-2026.pdf

- Visa, https://www.pymnts.com/visa/2026/visa-says-stablecoin-linked-payments-cards-drive-demand-for-settlement-platform/

- Messari, https://messari.io/report/in-the-stables-jpmorgan-takes-jpm-coin-beyond-walled-gardens

- The Block, https://www.theblock.co/post/385670/jpmorgan-crypto-inflows-2026-record-130-billion-2025

- Yahoo Finance, https://finance.yahoo.com/news/paypal-stripe-other-fintech-giants-080456699.html

- Tearsheet, https://tearsheet.co/blockchain-crypto/how-paypal-is-bridging-crypto-and-commerce-through-payments/

- Yahoo Finance, https://finance.yahoo.com/news/xrp-rwa-tokenization-surged-2-155100226.html

- CoinDesk, https://www.coindesk.com/zh/business/2025/08/16/xrp-ledger-used-by-nasdaq-listed-pharma-distributor-to-power-payment-system-for-pharmacies

- SQ Magazine, https://sqmagazine.co.uk/cryptocurrency-payment-adoption-by-merchants-statistics

- SQ Magazine, https://sqmagazine.co.uk/crypto-payments-industry-statistics

- Cointelegraph, https://cointelegraph.com/research/crypto-transaction-success-rate-hinges-on-user-location-report

- TransFi, https://www.transfi.com/ph/blog/how-solana-dapps-are-using-transfi-to-onboard-users-with-usdc-via-local-payment-methods

- Prnewswire, https://www.prnewswire.com/news-releases/bitpay-brings-real-world-utility-to-the-solana-network-with-support-for-sol-and-stablecoins-302526655.html

- rwa.xyz, https://app.rwa.xyz/

- The Block, https://www.theblock.co/post/386588/tokenization-outlook-ark-invest

- McKinsey, https://www.fool.com/investing/2026/01/08/4-industries-real-world-asset-tokenization-could-t/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

This content may contain or reference third-party information or viewpoints and is provided solely for convenience. Gate makes no representations or warranties regarding the accuracy, completeness, or timeliness of such information. Gate may also restrict or prohibit users in certain jurisdictions from accessing all or part of its services; please refer to the User Agreement for details: https://www.gate.com/legal/user-agreement.

If you believe this content involves any infringement or rights-related dispute, please contact: research@gate.me.

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

NFTs and Memecoins in Last vs Current Bull Markets