Gate Ventures Weekly Crypto Recap (February 9, 2026)

TL;DR

- The balance sheet reduction initiative associated with Kevin Warsh is unlikely to be implemented in the near term, though potential pathways remain over the medium to long term.

- This week’s key macro releases include U.S. labor market data, retail sales, import and export figures, home sales, and CPI.

- Last week, BTC declined 8.6% and ETH fell 7.9%, accompanied by record ETF outflows of $689M for BTC and $149Mfor ETH. Market sentiment remains in Extreme Fear (14).

- HYPE gained 7.4%, supported by the rollout of HIP-4, increased trading activity, and expanding institutional integrations.

- Polymarket and Circle announced a partnership to transition settlement to native USDC.

- Tether made a $100M strategic equity investment in Anchorage Digital, reinforcing regulated crypto infrastructure.

- TRM Labs reached a $1B valuation following a $70M Series C, aimed at expanding its crypto intelligence infrastructure.

Macro Overview

The balance sheet reduction initiative by Kevin Warsh may not have room to be implemented in the short-term, but there are paths in the future.

The policy combination of “rate cuts + balance sheet reduction” is the most puzzling aspect of Kevin Warsh’s proposals. Warsh himself explains that balance sheet reduction can lower inflation, thereby creating room for rate cuts. However, balance sheet reduction not only works in the opposite direction of rate cuts but also conflicts with the Trump administration’s goals of boosting economic growth and reducing debt costs. The balance sheet reduction drains liquidity from the financial system. When reserves are insufficient, banks may reduce their market-making activities, leading to a shortage of liquidity and potentially triggering financial risks. Therefore, the current financial situation does not support Warsh initiating a balance sheet reduction process in the short term. A potential path is for the Federal Reserve to focus on rate cuts during the current presidential term and pursue balance sheet reduction in the next presidential term.

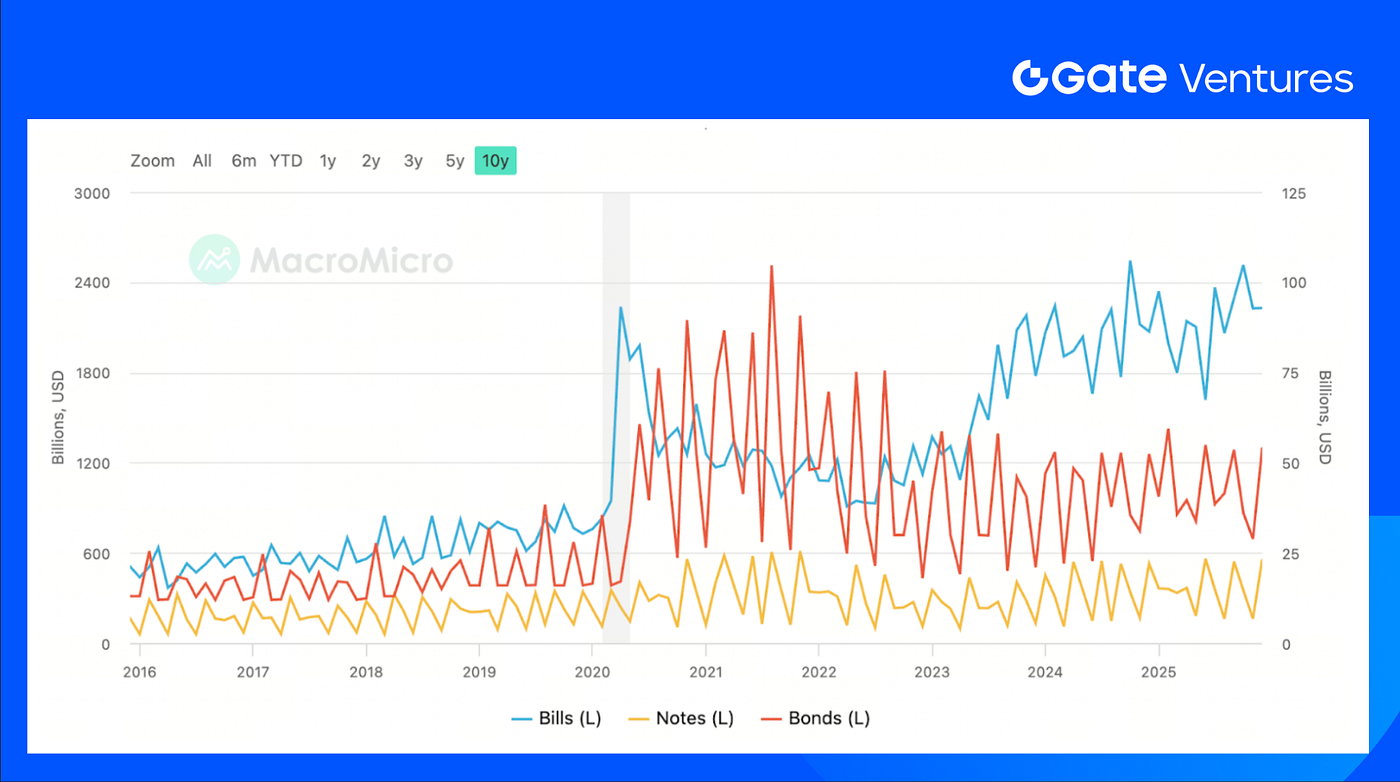

Trump is eager for the Fed to lower interest rates and reduce debt costs. If Kevin Warsh is unwilling to expand the balance sheet, the Fed would no longer subsidize fiscal deficits, breaking the fiscal-monetary expansionary coordination. A potential compromise is for the Fed to implement larger rate cuts while the US Treasury adjusts its debt issuance structure by issuing more short-term bills. Rate cuts would suppress short-term interest rates, and the Treasury could lower financing costs, thus avoiding the negative impact of insufficient balance sheet expansion on long-term financing rates. In fact, the US Treasury has already started increasing the proportion of short-term bill issuance, and there remains room for further increases in the future.

This week’s incoming data includes US job and employment data, retail sales, import and export data, home sales and CPI data. The federal government shutdown means the release of the US employment report has been delayed from 6th February to 11th February, and the inflation (CPI) release has been pushed back to the 13th. Payroll growth is expected to have risen from 50k in December to 70k in January and the unemployment rate to have held at 4.4%, while earnings growth looks to have cooled to 3.6% from 3.8%. (1, 2)

US Securities Issuance data from MacroMicro

DXY

Last week the US dollar index had a steady rise and has approached the $98 level by Friday, marking a gradual market reprice after the new Fed Chair nomination. (3)

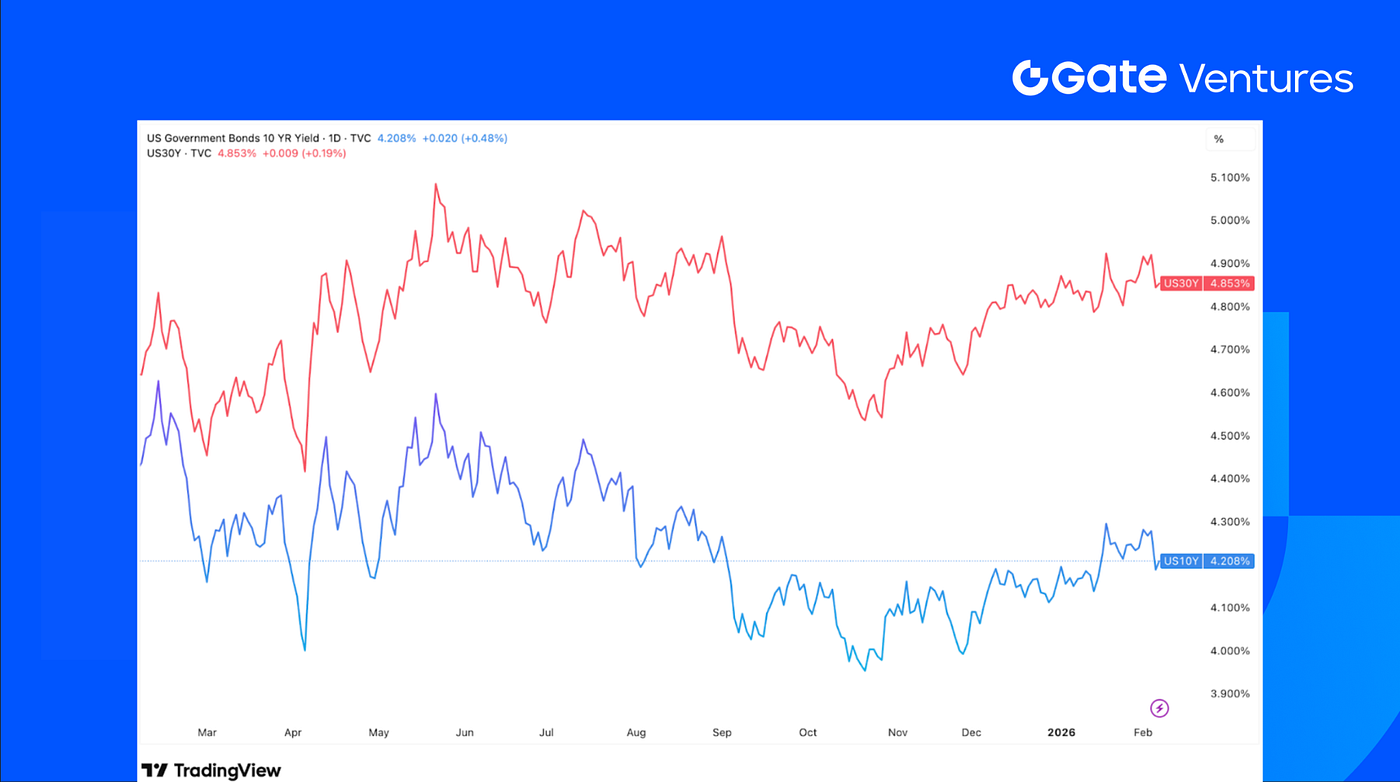

US 10-Year and 30-Year Bond Yields

Last week the yield of US treasuries were little changed as investors are weighing the healthiness of the US economy. The improved consumer sentiment, combined with the weaker-than-expected ADP employment report leaves more room for investors to decide. (4)

Gold

Last week the gold price saw high volatility ranging from $4,400 to $5,000 level, and CME Group raised margin requirements on gold and silver contracts for the third time since Jan 13. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC fell 8.6% last week and ETH dropped 7.9%, with both also seeing record ETF outflows of about $689.2M (BTC) and $149.1M (ETH). The ETH/BTC ratio stayed mostly flat, rising only 0.75%, which suggests there wasn’t a clear rotation into ETH despite the decline. Overall market sentiment remains weak, with the Fear & Greed Index still in the “Extreme Fear” zone at 14. (6) (7)

On the whale side, selling pressure has been notable. Trend Research has fully exited its ETH position over eight days, selling around 658,168 ETH (~$1.35B) at an average price of about $2,058, well below its estimated $3,104 cost. Meanwhile, Bitmine still holds roughly 4.2M ETH bought at around $3,600–3,900 on average. With ETH currently near $2,100, this position is sitting on an estimated $7.5B unrealized loss. (8) (9)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap declined 7.6% over the period. When excluding BTC and ETH, the broader market fell 5.65%, indicating relatively milder downside across non-major assets. The altcoin segment excluding the top 10 by market dominance decreased 4.7%, suggesting smaller-cap tokens also moved lower but with a slightly more contained pullback than the overall market.

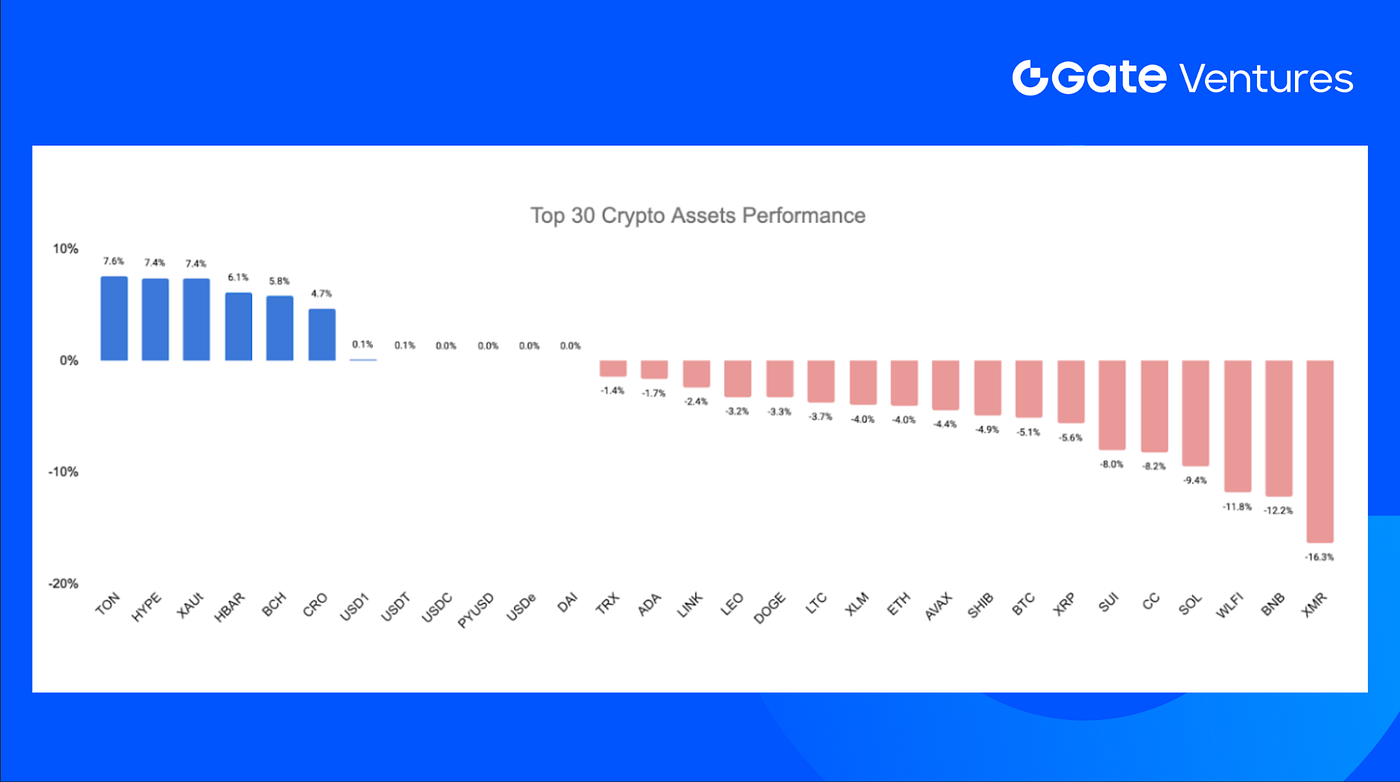

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Feb, 09th 2026

Across the top 30 cryptocurrencies by market cap, prices fell 2.8% on average, TON, HYPE, and XAUt led the gain.

HYPE gained 7.4%, supported by several ecosystem catalysts. The rollout of HIP-4 introduced outcome trading and bounded options, which boosted trading activity, futures open interest, and retail participation. Institutional traction also increased as Ripple Prime integrated Hyperliquid for DeFi derivatives access and cross-margining, expanding liquidity sources. In parallel, Hyperion DeFi’s treasury strategy to use HYPE as collateral for on-chain options is expected to generate additional yield and deepen ecosystem demand. (10) (11)

4. Token Launch

$TRIA (Tria) is the native utility token powering the Tria ecosystem, a self-custodial “crypto neobank” and cross-chain payments infrastructure designed to unify spending, trading, and earning across multiple blockchains within a single account.

$TRIA began trading at $0.014 and is currently around $0.016, implying an FDV of ~$163M. The token is listed on major exchanges including Coinbase, Bybit, and Bitget.

The Key Crypto Highlights

1. Polymarket, Circle partner in shift to native USDC settlement

Polymarket has partnered with Circle to migrate its trading collateral from bridged USDC (USDC.e) on Polygon to Circle-issued native USDC, reducing reliance on cross-chain bridge infrastructure as the prediction market platform scales. Native USDC is issued and redeemable directly by Circle’s regulated entities on a one-to-one basis with U.S. dollars, offering improved capital efficiency, settlement reliability, and reduced bridge-related security risks. The transition aims to establish a consistent dollar-denominated settlement standard as platform participation grows. (12)

2. CFTC expands payment stablecoin criteria to include national trust banks

The U.S. Commodity Futures Trading Commission (CFTC) has reissued and amended its prior guidance to broaden the definition of eligible payment stablecoin issuers, formally recognizing national trust banks as qualified entities. The updated Staff Letter (26–05) clarifies that institutions providing custodial and asset-servicing functions across all 50 states may issue fiat-pegged stablecoins under the regulatory perimeter established by the GENIUS Act, enacted in July 2025. The revision reflects a broader U.S. policy shift toward integrating regulated financial institutions into stablecoin issuance frameworks. (13)

3. Pump.fun moves deeper into trading infrastructure with Vyper acquisition

Pump.fun has acquired crypto trading terminal Vyper, integrating its analytics and execution capabilities into the platform’s broader ecosystem as Vyper winds down its standalone product and migrates users to Pump.fun’s Terminal. The transaction continues Pump.fun’s strategy of consolidating the full trading stack, from token issuance through liquidity, execution, and data tooling. The move follows earlier infrastructure expansion, including the October acquisition of Padre and the launch of Pump Fund, an investment arm targeting early-stage projects beyond memecoins. (14)

Key Ventures Deals

1. Jupiter secures $35M strategic investment as it brings Polymarket to Solana

Solana-based DEX Jupiter announced plans to integrate Polymarket natively onto its platform, positioning prediction markets as a core product pillar alongside swaps and other onchain trading services. In parallel, ParaFi Capital has made a $35 million strategic investment into the JUP token, settled entirely in Jupiter’s dollar-pegged JupUSD with an extended lockup to align long-term incentives. The integration is intended to expand Jupiter into a comprehensive onchain prediction market hub, with upcoming development focused on APIs, enhanced market discovery, and new trading mechanisms. (15)

2. Tether makes $100M equity investment in Anchorage Digital to strengthen regulated crypto infrastructure

Tether Investments has committed $100 million in strategic equity funding to Anchorage Digital, a federally regulated U.S. digital asset bank providing custody, staking, governance, settlement, and stablecoin issuance services. The investment deepens an existing partnership and reflects Tether’s strategy to align more closely with regulated institutional infrastructure as digital assets scale into mainstream finance. Anchorage Digital’s position as the first federally chartered crypto bank offers compliant access for institutions, enterprises, and public-sector participants, making it a critical intermediary for stablecoin issuance and asset servicing. (16)

3. TRM Labs reaches $1B valuation with $70M Series C to expand crypto intelligence infrastructure

Blockchain analytics firm TRM Labs has raised $70 million in a Series C round led by Blockchain Capital, with participation from Goldman Sachs, Bessemer Venture Partners, Brevan Howard, Thoma Bravo and Citi Ventures, valuing the company at $1 billion. The funding will support expansion of TRM’s multi-chain intelligence platform used by governments, law enforcement and financial institutions to monitor illicit finance, compliance risk and transaction activity across digital asset ecosystems. TRM’s growth has been driven by increasing institutional adoption of tokenized assets and rising crypto-related fraud, including a reported surge in AI-enabled scams, positioning blockchain analytics as “table-stakes” infrastructure for regulated participation in digital markets. (17)

Ventures Market Metrics

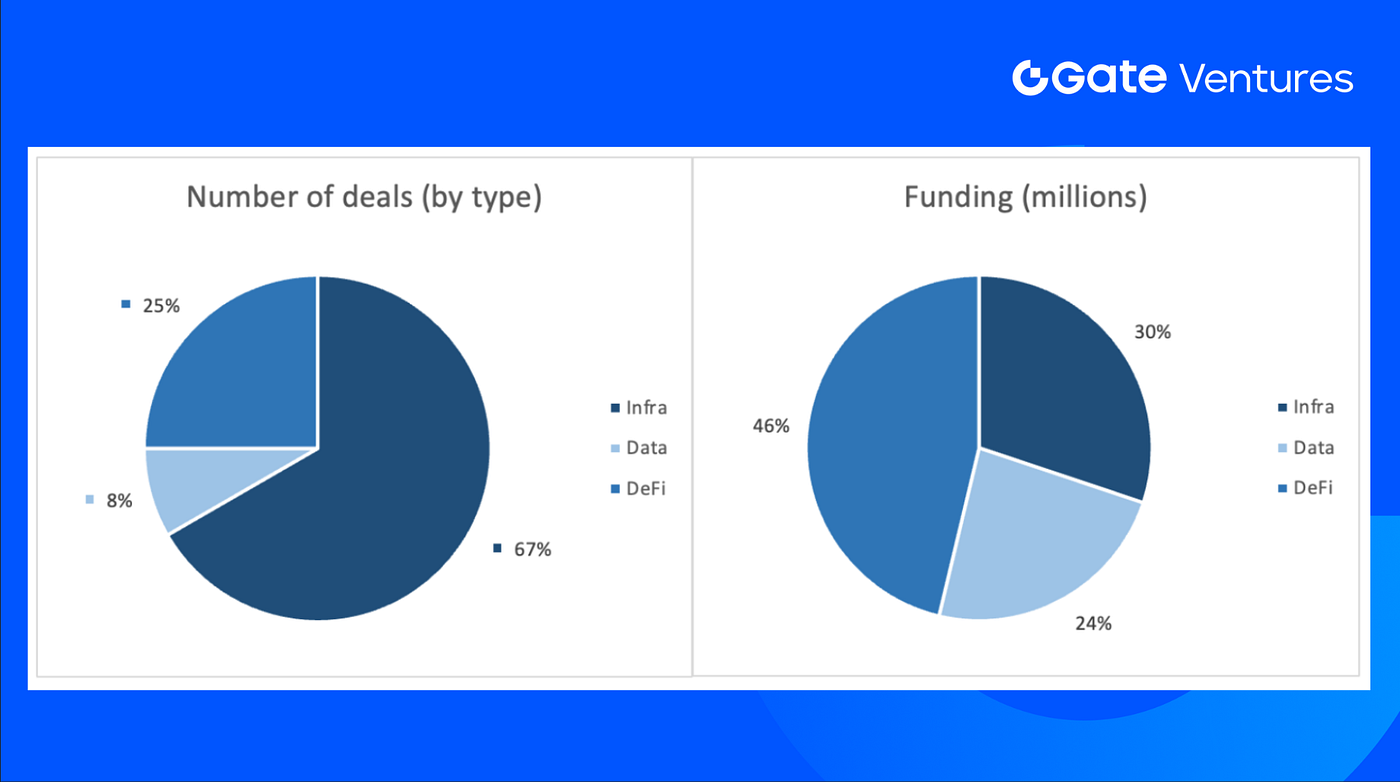

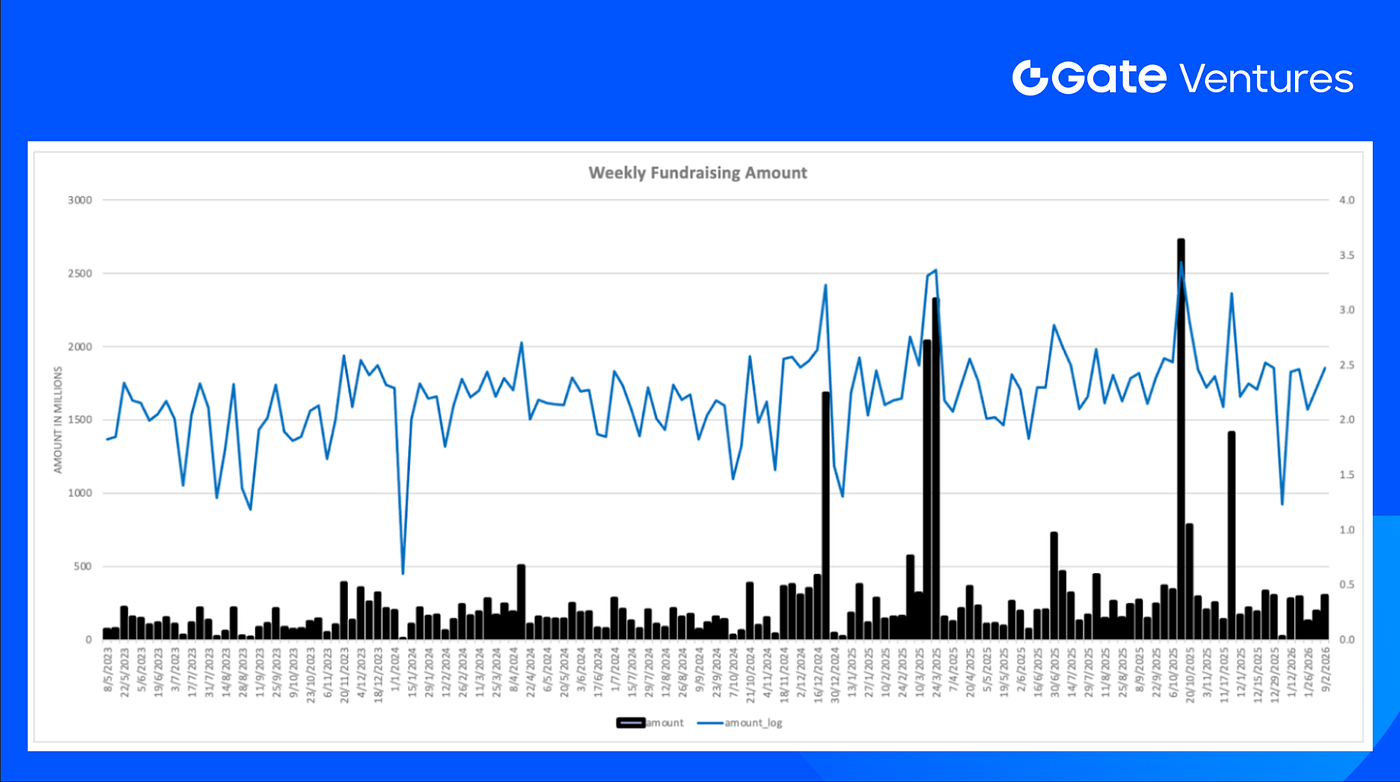

The number of deals closed in the previous week was 12, with Infra having 8 deals, representing 67% of the total number of deals. Meanwhile, Defi had 3 deals (25%), and Data had 1 deal (8%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 9nd Feb 2026

The total amount of disclosed funding raised in the previous week was $296.7M, 1 deal in the previous week didn’t announce the raised amount. The top funding came from the DeFi sector with $137.3M. Most funded deals: Anchorage ($100M).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 9nd Feb 2026

Total weekly fundraising surged to $296.7M for the 2nd week of Feb-2026, an increase of 57% compared to the week prior.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Week Ahead Economic Preview, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-9-february-2026.html

- US Securities Issuance, MacroMicro, https://en.macromicro.me/collections/51/us-treasury-bond/4458/us-treasury-issuance-gross

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Trend Research’s average cost, https://x.com/ai_9684xtpa/status/2020344692831875371

- Bitmine’s average cost, https://x.com/Axel_bitblaze69/status/2020430879617888685

- HIP-4 Launch, https://aicryptocore.com/hyperliquid-hip4-boosts-hype-price/

- Ripple Prime Integration of Hyperliquid, https://coinmarketcap.com/academy/article/ripple-prime-opens-defi-access-through-hyperliquid

- Polymarket, Circle partner in shift to native USDC settlement https://cointelegraph.com/news/polymarket-circle-partnership-usdc-settlement

- CFTC expands payment stablecoin criteria to include national trust banks https://cointelegraph.com/news/cftc-stablecoins-national-trust-banks

- Pump.fun moves deeper into trading infrastructure with Vyper acquisition https://cointelegraph.com/news/pump-fun-vyper-acquisition-trading-infrastructure

- Jupiter secures $35M strategic investment as it brings Polymarket to Solana https://www.coindesk.com/markets/2026/02/02/jupiter-brings-polymarket-to-solana-and-lands-usd35-million-investment-deal

- Tether makes $100M equity investment in Anchorage Digital to strengthen regulated crypto infrastructure https://tether.io/news/tether-announces-100-million-strategic-equity-investment-in-anchorage-digital/

- TRM Labs reaches $1B valuation with $70M Series C to expand crypto intelligence infrastructure https://fortune.com/2026/02/04/trm-labs-blockchain-analytics-funding-round-series-c-unicorn-goldman/

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (November 3 , 2025)

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)