How Does Stable (STABLE) Work? A Technical Deep Dive Into Tether's Stablecoin Payment Layer

This article explains how Stable works by examining its core technical components, including the USDT0 native gas mechanism, sub second transaction finality, and EIP 7702 account abstraction. It also introduces STABLE token use cases and reviews Stable’s real world adoption and progress within the stablecoin payment sector.

Project Positioning And Core Advantages

Stable is positioned as a “Stablechain,” a dedicated blockchain optimized specifically for USDT payments. It receives direct support from Bitfinex and Tether and aims to become a foundational infrastructure for global digital dollar settlement.

Stable is deeply customized to address pain points commonly found in traditional blockchains, such as gas fee volatility and slow settlement. Its main advantages include:

- Single USDT experience: Users do not need to hold a native token. All operations are conducted entirely using USDT.

- Institution-friendly design: Gas-free transfers combined with fast finality make it suitable for merchants and enterprises handling batch settlements.

- EVM compatibility: Developers can migrate Ethereum tools and dApps with minimal friction.

USDT Native Gas: A Shift In Payment Experience

Stable’s key differentiator is its USDT0 native gas mechanism, activated after the v1.2.0 mainnet upgrade. Users can pay transaction fees directly with USDT, without requiring token conversion or cross-chain bridging.

- Gas-free peer-to-peer transfers: Merchant payments and internal institutional transfers can be executed with zero fees, absorbed or optimized by the network.

- Fully predictable fees: By removing reliance on volatile assets such as ETH or BTC, transaction costs remain anchored to USDT’s one-dollar peg.

- Account abstraction support: Through integration with the EIP-7702 standard, smart contract accounts can batch-sign transactions and customize gas payment logic, improving operational efficiency for institutions.

This design enables practical “scan-to-pay with USDT” use cases, particularly suited for high-frequency, low-value payment scenarios in emerging markets.

Core Operating Mechanisms

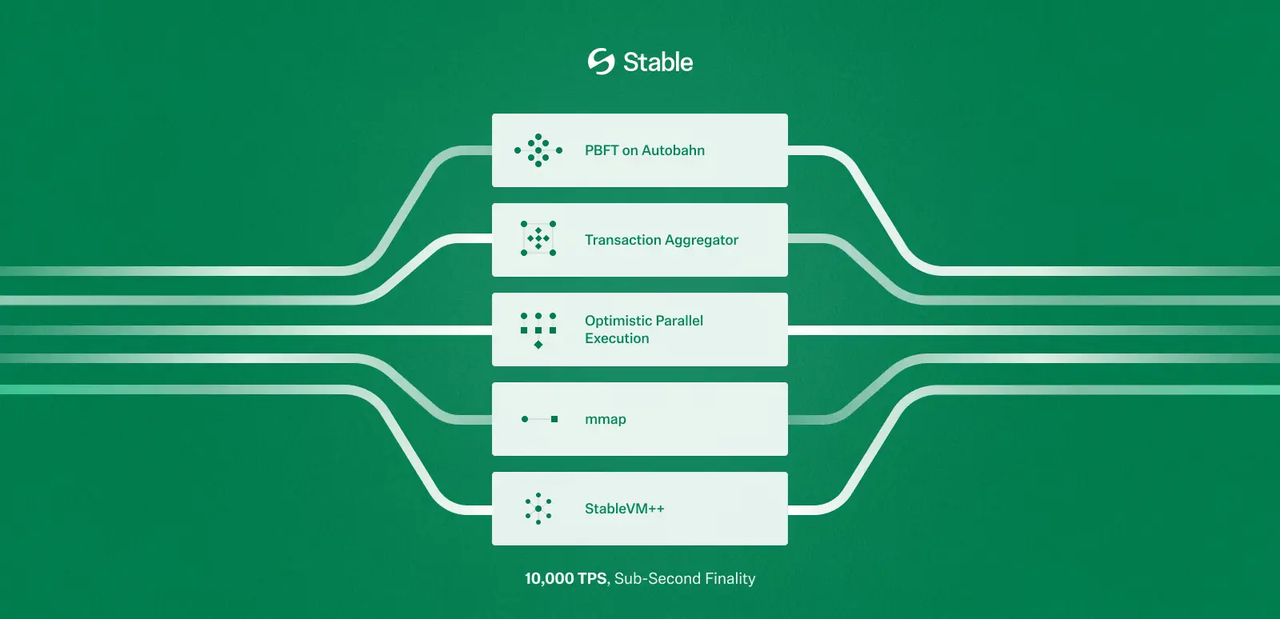

Stable achieves sub-second finality by optimizing both its consensus and network architecture, making transactions irreversible in under one second after submission. The system architecture is composed of the following core components:

- Consensus layer: A fast and secure mechanism for transaction finality

- Execution layer: An EVM-compatible smart contract execution environment

- State management: Efficient storage and management of blockchain state

- Network layer: Peer-to-peer communication and data propagation

To bring Stable’s payment focused vision into practice, multiple technical components must operate in coordination. The following sections explain how Stable implements gas free USDT0 transfers, sub second transaction finality, and a simplified user experience at the protocol level.

Gas Free USDT0 Transfers Through EIP 7702 and Account Abstraction

To support gas free peer to peer transfers, Stable adopts EIP 7702 and account abstraction. Users only need to hold USDT0 to perform all transactions.

On Stable, wallets natively support EIP 7702, meaning smart wallet functionality works by default without additional configuration. This allows payment logic, fee handling, and authorization rules to be embedded directly into wallet behavior while remaining transparent to end users.

Sub Second Transaction Finality

Stable uses the StableBFT consensus algorithm, producing a new block approximately every 0.7 seconds. Transactions achieve finality after a single confirmation, eliminating the pending state common on many blockchains and delivering an experience similar to instant payment authorization at a point of sale terminal.

To further improve throughput, Stable is developing Block STM parallel execution, which allows independent transactions to be processed simultaneously. These independent transactions typically represent between sixty and 80% of network activity. Conceptually, this is similar to opening multiple checkout lanes in a supermarket to reduce waiting time during peak usage.

Simplified User Experience by Design

Stable removes the need for gas estimation and native gas token management while maintaining compatibility with the Ethereum ecosystem.

USDT0, implemented using LayerZero’s OFT standard, serves as Stable’s native gas asset. This approach fundamentally simplifies cross chain complexity by eliminating traditional bridge flows.

For enterprise users, Stable plans to introduce guaranteed block space, reserving dedicated transaction capacity to ensure consistent throughput during periods of congestion. This functions similarly to dedicated express lanes on highways. In parallel, a confidential transfer feature is under development, designed to hide transaction amounts while remaining compliant with AML and KYC requirements.

STABLE Token Use Cases And Ecosystem Incentives

STABLE functions as the network’s governance and security token. Its primary use cases focus on several key dimensions:

- Network staking: Validators stake STABLE to participate in consensus and earn block rewards.

- Governance voting: Token holders participate in decisions on parameter adjustments and upgrade proposals.

- Fee priority and discounts: Advanced users may receive trading fee reductions or access to priority execution channels.

- Ecosystem funding: Incentives are provided to developers deploying payment dApps and merchants integrating with the protocol.

Real-World Use Cases And Ecosystem Adoption Of Stable

Stable positions itself as a high-performance Layer 1 designed specifically for institutional settlement and B2B cross-border payments. By differentiating from general-purpose blockchains, it aims to address stablecoin payment challenges faced by merchants and financial institutions.

Typical scenarios where Stable may play a role include:

- Cross-border e-commerce: Merchants receive USDT with zero gas fees and near-instant settlement.

- Institutional treasury management: Enterprises use Stable to manage on-chain dollar reserves.

- Emerging markets: Integration with wallets such as Opera MiniPay to serve users in regions including Africa and Latin America.

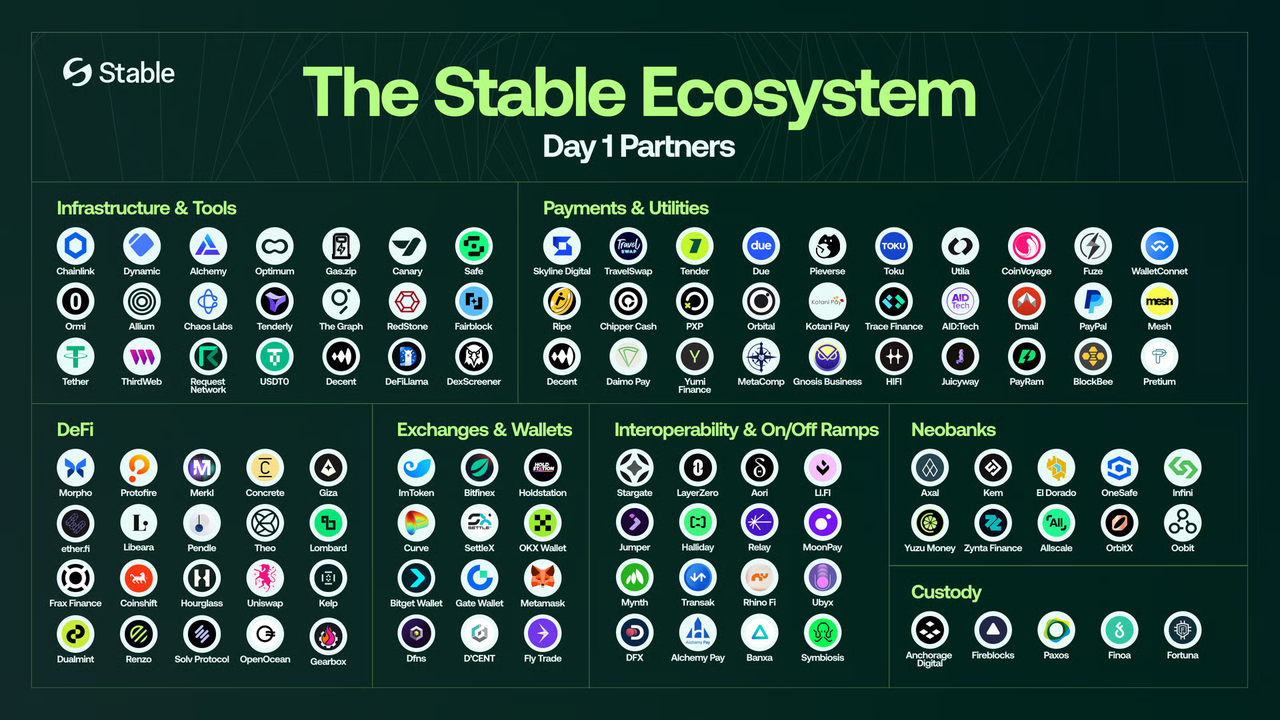

Since the second half of 2025, Stable’s ecosystem has expanded to include projects such as Oobit, Orbital, Anchorage Digital, Concrete, Hourglass, Frax, Morpho, and Pendle. These integrations support the use of Stable’s gas-free transfer functionality across a range of products and services.

On January 23, Stable announced that the mainnet would upgrade to version 1.2.0 on February 4, transitioning the native gas asset to USDT0 and fully removing wrap and unwrap flows.

On January 26, PayPal announced that its regulated dollar stablecoin PYUSD had launched on the Stable mainnet. This marked an important step in bringing compliant dollar stablecoins into a high throughput, stablecoin native settlement layer designed for real payment use cases.

Conclusion

Within the competitive landscape of stablecoin payment infrastructure, Tether supported networks such as Plasma, Circle’s Arc, Stripe’s Tempo, and Stable are all pursuing similar goals. Stable’s advantage lies in its deep alignment with Bitfinex and Tether and the network effects of USDT, although its technical execution and ecosystem growth will require time to validate.

From a technical perspective, Stable aims to differentiate itself through gas free USDT0 transfers, sub second finality, and a simplified user experience optimized for payments.

Following its mainnet launch and completion of the community airdrop, Stable’s long term growth depends on whether it can attract real institutional adoption and sustain large scale stablecoin transaction volume that translates into recurring network revenue.

FAQs

What is the relationship between Stable and Tether?

Stable is officially backed by Tether and uses USDT as its native gas asset, making it a core component of the Tether ecosystem.

Where can STABLE tokens be traded?

STABLE is listed on centralized exchanges such as Bybit and Gate and also has liquidity available on Uniswap and PancakeSwap.

Is Stable mainnet live?

Yes. The mainnet is live and was upgraded to version 1.2.0 on February 4, 2026, transitioning to USDT0 native gas.

How does Stable compare with Plasma?

Stable focuses more on payment infrastructure such as gas free transfers, while Plasma emphasizes DeFi integration and yield generation. Stable’s sub second finality may provide an advantage in payment speed.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

Sui: How are users leveraging its speed, security, & scalability?

What Is Copy Trading And How To Use It?

What Is Technical Analysis?