Falcon Finance Practical Guide: How To Mint USDf, Buy FF Tokens, And Start A Staking Yield Strategy?

Falcon Finance (FF) is a general collateral protocol designed for the multi-chain DeFi ecosystem. Its core objective is to provide an on-chain combination of a synthetic dollar with sustainable yield and an RWA-based yield engine, offering users and institutions access to stable, transparent returns backed by real assets.

As the governance token of Falcon Finance, FF underpins the protocol’s decision-making and incentive framework. Beyond governance rights, holding or staking FF unlocks benefits such as higher USDf staking yields, reduced overcollateralization ratios when minting, and discounts on swap fees.

This article explains how to mint and stake USDf, how to buy FF tokens, and how to stake FF tokens to earn additional yield with an APR of 12%, providing a step-by-step overview for new users interested in participating in the Falcon Finance ecosystem.

Minting And Staking USDf Synthetic Dollars

USDf is the foundational stablecoin of Falcon Finance. It is minted using an overcollateralized model that combines the robustness of multi-collateral systems such as DAI with an active yield layer.

USDf is an overcollateralized synthetic dollar that allows users to mint by depositing supported collateral assets. In addition, USDf holders can stake their tokens into sUSDf, a yield-bearing version that provides access to institutional-grade strategies such as funding rate arbitrage and cross-market arbitrage. Different vault durations correspond to different yield profiles.

At present, Falcon Finance supports three categories of collateral for minting USDf:

- Stablecoins such as USDT, USDC, and DAI

- Non-stable crypto assets such as BTC, ETH, and XRP

- Real-world assets (RWA), including Tether Gold, Tesla xStock, and Circle xStock

Source: Falcon Finance

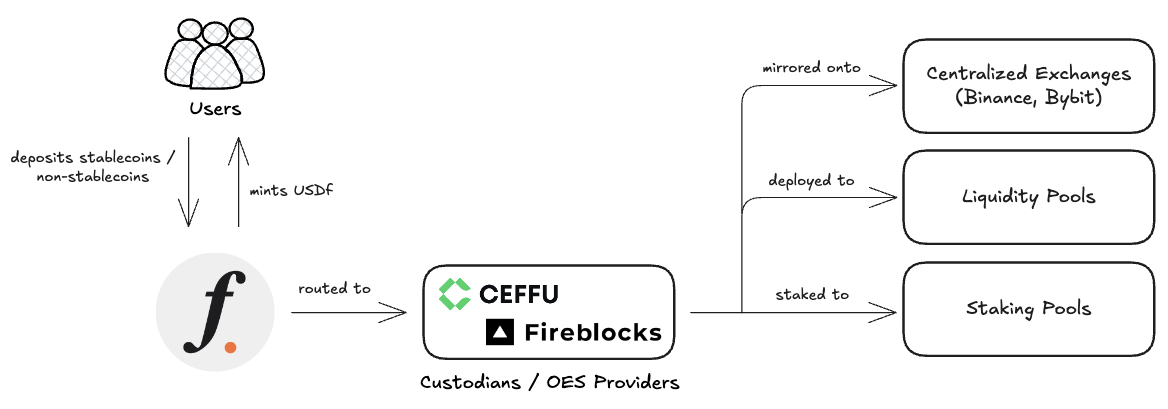

User-deposited collateral is custodied through platforms such as CEFFU and Fireblocks, and managed by professional teams using market-neutral strategies to generate yield. These strategies include:

- Depositing collateral into centralized exchanges for price arbitrage

- Providing liquidity to liquidity pools

- Staking assets to earn staking rewards

According to Dune Analytics data, as of February 4, 2026, the total supply of USDf has reached approximately $2.147 billion and continues to grow. However, the current staking ratio remains relatively low at around 7.4%, and has been declining since April 2025.

Source: Dune Analytics

How to Buy FF on Gate

FF tokens are currently listed on multiple major exchanges, including centralized exchanges such as Binance and Gate, as well as decentralized exchanges such as Uniswap and PancakeSwap.

Using Gate as an example, as of February 4, 2026, the price of FF is $0.078, with a 24-hour trading volume of approximately $37 million.

Source: Gate trading platform

To buy FF on Gate, users can follow these steps:

- Open Gate and log in. New users need to register and complete basic security setup.

- Enter “FF” in the search bar on the trading page and select the corresponding result.

- Review the project overview, official information, platform announcements, and risk disclosures.

- Scroll down to view market data such as price trends, trading volume, and historical performance.

- Gate supports FF spot trading. Users can review available trading pairs, trading modes, and rules.

- Enter the trading interface and proceed according to the on-screen instructions. Actual features are subject to the platform’s current interface.

Advanced Strategy: Staking FF To Earn Yield

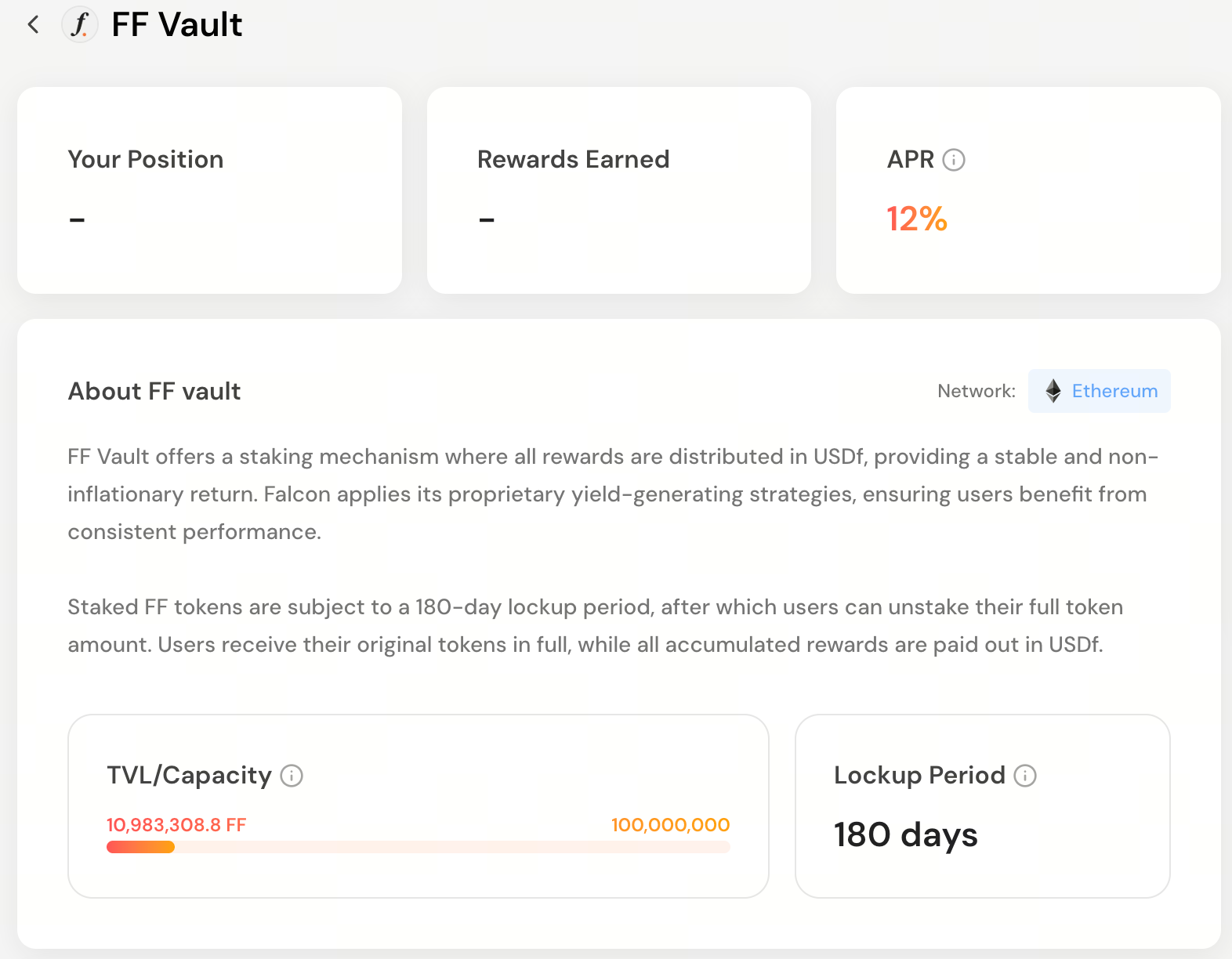

In addition to holding FF for potential appreciation, FF holders can deposit their tokens into the FF Vault through the “Earn” module to earn additional yield with an APR of 12%.

Source: Falcon Finance

Key details of the staking product include:

- Asset requirement: FF

- Lock-up period: 180 days

- Yield: 12% annualized yield, with rewards paid in USDf

- Capacity: Total vault size of 100 million FF, with approximately 1 million FF currently deposited

Summary

As an RWA-driven general collateral protocol, Falcon Finance allows users to mint the synthetic dollar USDf through overcollateralization using stablecoins, major crypto assets, and tokenized real-world assets such as gold and equities.

For users seeking more stable returns, staking USDf into sUSDf provides exposure to delta-neutral arbitrage and cross-market strategies managed by professional institutions such as Fireblocks. Meanwhile, the FF governance token is available on major exchanges, including Binance and Gate. In addition to purchasing FF on secondary markets, users can stake FF through the official Earn module with a 180-day lock-up to earn a 12% annualized return.

This dual-track yield model, combining strategy-based returns from sUSDf with staking rewards from FF, positions Falcon Finance as a DeFi entry point in 2026 that integrates liquidity, real asset backing, and structured yield.

Further Reading

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025

What Is Dogecoin?