Key Changes Across Major Blockchains Worth Watching in 2026

From 2023 to 2025, the blockchain ecosystem shifted from “infrastructure building” to “application deployment” and “diversified innovation.” As we enter 2026, major public blockchains and Layer 2 ecosystems are seeing new changes in positioning, use cases, and technical capabilities. Below, the latest developments of major public chain ecosystems (Ethereum, Solana, Base, BNB Chain, Sui, Canton, etc.) and Layer 2 ecosystems in 2026 are categorized by blockchain and key trend modules. We compare recent evolution, showcase infrastructure upgrades, stablecoin expansion, privacy transactions, and on-chain compliance trends, striving for comprehensive coverage of each chain’s development priorities. The article is objective and professional, citing public roadmaps and analytical reports from 2025–2026 for evidence.

Ethereum Ecosystem (Mainnet & Layer 2)

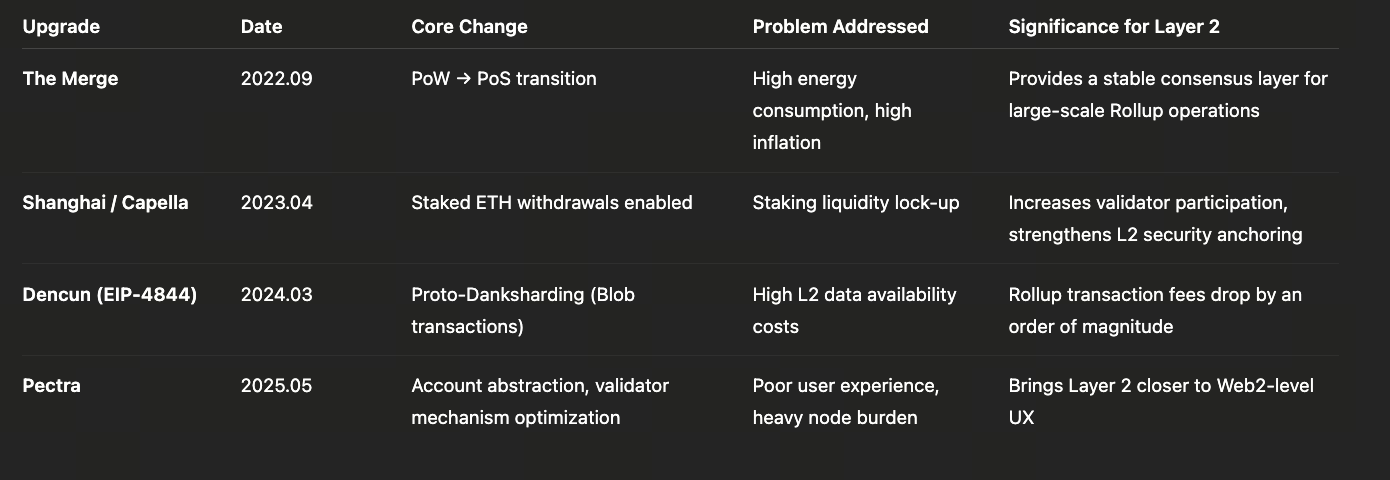

Mainnet Upgrades and Scaling

Between 2023 and 2025, Ethereum completed milestone upgrades including The Merge, Shapella, and Dencun, moving toward PoS and sharding. The Pectra upgrade in April 2025 was the largest overhaul to date, introducing account abstraction (EIP-7702), optimizing EVM execution, and enhancing consensus performance. The focus was on “improving staking experience, boosting Layer 2 scalability, and increasing network capacity.” For example, the new proposal EIP-7251 raises the staking limit from 32 ETH to 2048 ETH; EIP-7002 allows more flexible staking withdrawals, attracting large institutions and improving decentralization. The upgrade also reserves optimization channels for Layer 2, such as PeerDAS (similar to EIP-4844) in Pectra to expand Blob storage and support higher data throughput.

Fusaka and Future Roadmap

The Fusaka upgrade launched at the end of 2025 accelerates Ethereum scaling with 13 EIPs that completely reshape data structure, fees, and throughput. The core is PeerDAS data availability verification: for the first time, each block supports up to 24 Blobs (with plans to increase to 128), with ideal scenarios potentially pushing overall system throughput toward hundreds of thousands TPS. The community expects significant L2 data cost reduction, though the exact decrease will be seen after actual deployment (long-term targets are over 90%). Fusaka also doubles the standard block Gas limit to 60 million (from 30M), allowing L1 blocks to carry more transactions (overall increase of 20–30%), with L1 native TPS rising to 50–100. Additionally, Fusaka introduces features for regular users: widely used mobile P-256 (secp256r1) signatures improve compatibility with mobile devices and hardware security modules (such as Secure Enclave), providing a more user-friendly foundation for biometric and local signature solutions. It also adds multiple security hardening measures (single transaction Gas limit, RLP size restriction, removal of low-fee operations), greatly enhancing network robustness. For specific upgrade details, visit Ethereum’s official website: https://ethereum.org/ethereum-forks/#2025

Privacy & Data

Ethereum officials have also made “privacy and data” a priority. At the Bitcoin Merge conference, Vitalik and others proposed that Ethereum will comprehensively address privacy challenges by 2026. Plans include using ZK-EVM to lower node thresholds, Helios for RPC data authenticity verification, ORAM/PIR technologies for privacy queries, social recovery wallets, time locks, diversified privacy payment options—achieving privacy transactions and data security without sacrificing user experience.

Layer 2 Ecosystem

Ethereum’s L2 networks continue upgrading in 2025. Leading Ethereum Rollup Arbitrum launched “Timeboost” and “BoLD” upgrades in succession in 2025. “Timeboost” improved transaction sequencing, fee pricing, and market mechanisms for better predictability during congestion while generating protocol revenue without increasing base fees. “BoLD” enhanced governance and challenge mechanisms for authentication and verification models—expanding validator participation and strengthening censorship resistance while maintaining security. Arbitrum released “ArbOS Callisto” to keep pace with Ethereum’s Pectra upgrade and ensure synchronized platform-mainnet updates.

Optimism continues building out the OP Stack ecosystem (Superchain), achieving cross-chain token protocols and EIP-4844 support in 2024. In 2025, its focus shifts to tighter interoperability and protocol upgrades. Other ZKRollups like zkSync and StarkNet are also accelerating (zkSync Era testnet is stable with a mainnet launch roadmap; StarkNet mainnet advances steadily).

Base is Coinbase’s Ethereum Layer 2 network that quickly attracted users after launching at the end of 2023. In 2026, its focus shifts from “social & lightweight apps” to “transaction-first.” Base’s co-founders released a new roadmap reaffirming that Base apps should be “transaction-centric,” aiming to become the gateway for on-chain finance. Previously, Base App focused more on social content in 2023–2024; now it prioritizes refining transaction experience and deeply integrating trading features—targeting a one-stop crypto financial marketplace. Coinbase itself is expanding its “universal platform” vision: in 2026, plans include listing spot, futures, stocks, etc., on Base so users can trade crypto, traditional stocks, prediction market products all in one interface.

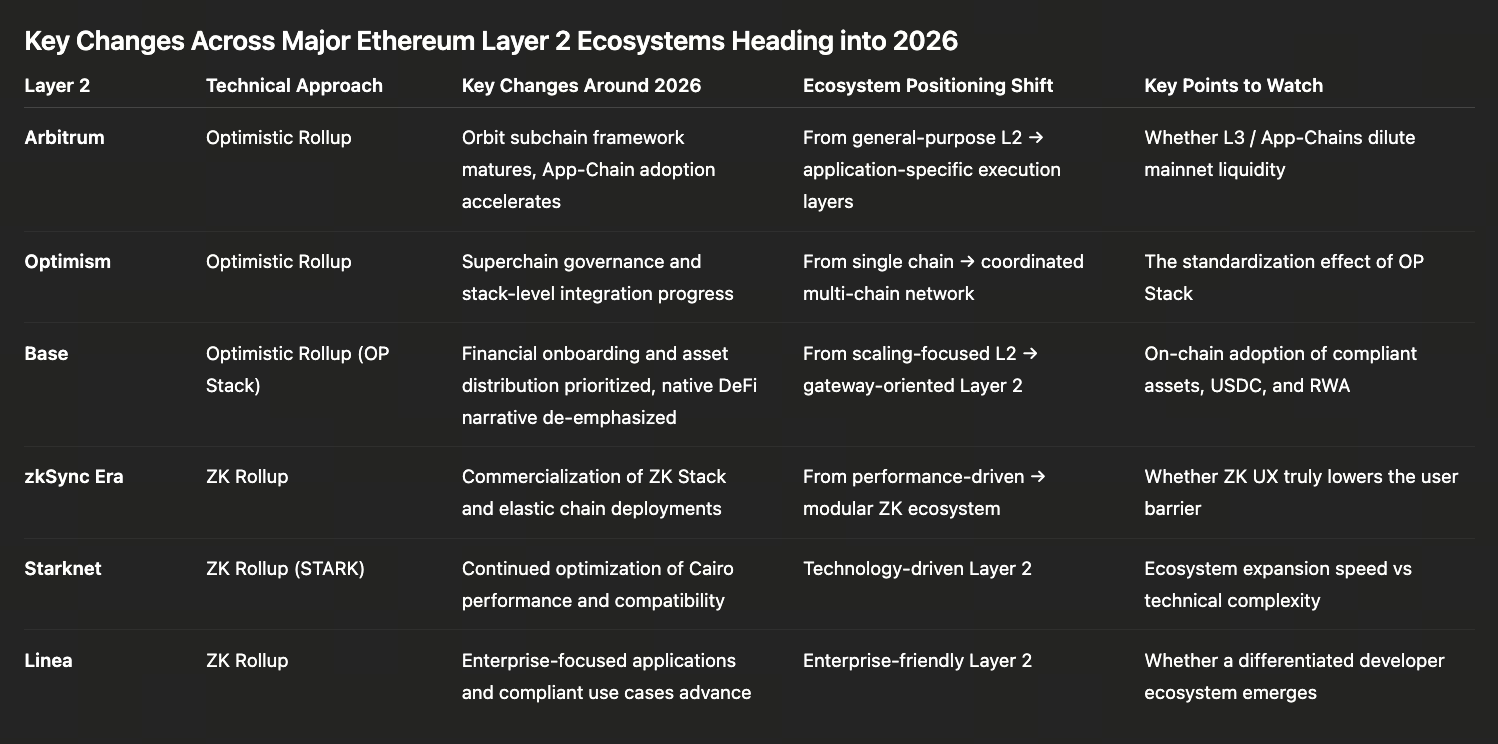

BNB Chain Ecosystem

Image: https://www.bnbchain.org/en

Scale & Performance

BNB Chain (formerly BSC) achieved steady growth in 2025. Its “2025 Ecosystem Report” shows stablecoin market size doubled to a peak of $14 billion with daily active stablecoin users leading all chains; on-chain real-world asset (RWA) cumulative value exceeded $1.8 billion—covering USYC (US Treasury stablecoin) as well as tokenized funds from BlackRock, MassMutual, etc. To support heavy loads, BNB Chain underwent frequent hard forks since 2024: Pascal, Lorentz, Maxwell, Fermi upgrades in 2025 reduced block time from 3 seconds to 0.45 seconds; confirmation time dropped to 1.125 seconds; network bandwidth increased to 133M gas/s; Gas price dropped from 1 Gwei to 0.05 Gwei—reducing transaction costs by about 20x. The 2026 roadmap continues focusing on a “high TPS transaction chain,” targeting over 20K TPS (future goal: million TPS), introducing parallel EVM engines and hybrid computation proofs to meet extreme scenarios like AI and bulk trading.

Privacy & Compliance Features

BNB Chain places special emphasis on privacy and compliance tools for transactions. Its 2026 technical roadmap plans a “privacy framework” and “AI agent framework”: the former offers configurable compliance-friendly privacy features (for protecting data during high-frequency trades or everyday transfers); the latter enables identity, reputation, and verifiable capability registration for smart agents (AI applications). Combined with mature cross-chain bridges and CEX background, BNB Chain aims to attract more institutions and compliant capital while maintaining high availability. The next-gen “transaction chain” design announced at end-2025 even considers integration with traditional clearing systems like DTCC and proof-of-stake alignment—echoing trends from cross-border RWA platforms.

Ecosystem Deployment

BNB’s ecosystem remains centered on DeFi, gaming, and social but will emphasize quality growth in 2026. Officials stress the shift from “rapid onboarding” to “sustainable development,” supporting hundreds of teams from concept to production via BNB Hack, MVB programs etc. Expect more multisig wallets, staking services, decentralized exchanges as infrastructure improves; security audits for on-chain liquidity and cross-chain bridges will be strengthened to ensure stability for large funds.

Sui Ecosystem

Image: https://www.sui.io/

Native Stablecoin Issuance

As a new L1 chain launched in 2023 mainnet, Sui introduced a high-performance programming model; by 2025 its ecosystem pivoted toward stablecoin development. The Sui Foundation announced the launch of USDsui—the chain’s native dollar stablecoin based on Bridge protocol; other projects collaborated with Ethena to launch suiUSDe (planned for Oct 2025) as well as USDi with BlackRock (launching within the year). These stablecoins are designed to generate trading yield (e.g., suiUSDe yield buys back SUI). The surge in stablecoins makes Sui one of few chains with native USD stablecoins by 2026. Leveraging Sui’s high throughput and low latency, these stablecoins significantly enrich ecosystem liquidity and use cases.

Ecosystem Expansion

In infrastructure, Sui continues improving the Move smart contract platform—attracting gaming, NFT, lending projects. By 2025 infrastructure tools from Mysten Labs plus mainstream wallets support Sui network—lowering entry barriers for users and developers. Sui plans future cross-chain bridges with other networks’ assets/protocols. Combined with stablecoin strategy above, Sui’s main use cases are expected to expand from early NFT/Game (2023–2024) into programmable finance, lending, DEXs, tokenized RWA by 2026. In short, Sui is evolving from a “new language chain” toward a “finance chain for token economies.”

Canton Ecosystem

Image: https://www.canton.network/

Canton Network (Wall Street Public Chain)

Another noteworthy new ecosystem is Canton Network (also known as Canton or Canton Network). Built by Wall Street giants including DTCC, BlackRock, Goldman Sachs, Citadel etc., it is an institutional permissioned blockchain network focused on privacy protection and compliance. Canton Network aims to serve traditional financial clearing—targeting DTCC’s future trillion-dollar settlement volumes. At end-2025 it reached cooperation with DTCC—not just a pilot but Canton’s core institutional strategy (planning to onboard DTCC’s $37 trillion annual trading volume onto chain). The chain adopts an auditable privacy layer and permissioned access—complementing existing decentralized frameworks.

Stablecoin Multichain Expansion

Image: https://www.circle.com/

In 2025–2026 the stablecoin landscape continues evolving: large stablecoins like USDC expand cross-chain issuance; native L1 stablecoins proliferate. Circle reports that as of September 2025 USDC is natively issued on 28 mainstream chains including Arbitrum, Optimism, Base, Linea, Starknet, zkSync, Aptos, Solana, Sui etc. PayPal USD (PYUSD) emerged as a heavyweight dollar stablecoin; in 2025 Coinbase announced zero-fee USD/PYUSD trading and partnered with PayPal to promote PYUSD usage among merchants and DeFi applications. On L1 chains besides classic stablecoins (like Ethereum’s DAI or BNB Chain’s USDC/USDT), new chains launched their own dollar stablecoins: Sui’s USDsui/suiUSDe/USDi—all positioned as core liquidity assets seeking yield recirculation. The stablecoin boom shows that by 2026 on-chain finance is connecting with fiat payment channels—laying foundations for cross-border remittance, O2O payments and DeFi integration into real-world finance.

Privacy Transactions & Compliance

Privacy transactions and compliance are priorities for all chains in 2026. Besides Solana’s Private Swaps and Ethereum’s privacy tech roadmap mentioned above, many solutions are emerging: Blockpass On-Chain KYC 2.0 launched in October 2025 offers enterprises on-chain identity verification and compliance credentials—allowing users to generate privacy-protected reusable identity credentials on Ethereum/Solana etc. For chain compliance some adopt “permissioned DeFi”: e.g., ERC-3643 token standard has built-in whitelist functions for real-name or geographic holder restrictions; some chains enforce KYC at cross-chain bridge level so only verified users can participate; others use RPC or consensus layers for real-time screening of large transactions or sanction lists. In short: mainstream chains in 2026 embed compliance rules at multiple levels (asset layer/bridge layer/node layer/consensus layer), enabling applications to meet regulatory requirements while retaining composability and efficiency as much as possible.

Real World Assets (RWA)

On-chain RWA is experiencing explosive growth. In 2025 total tokenized asset value on-chain surpassed $30 billion—growing several times faster than in 2019–2022. Especially fixed-income assets: institutions prefer converting traditional yield products like US Treasuries/money funds/private credit into tokens on-chain. On application side BNB Chain’s RWA total exceeded $1.8 billion—including USYC Treasury stablecoin plus tokenized funds by BlackRock/MassMutual/Blackstone etc.; MakerDAO/other DeFi protocols allocated hundreds of millions of dollars worth of Treasuries as backing for DAI/stablecoins. New chains are also actively participating: Canto introduced T-bills model plus plans yield-bearing cNOTE stablecoin; Solana’s Ondo protocol plans listing over a thousand global stock/ETF tokens; even Canton Network targets global securities clearing as an institutionally focused chain. The RWA wave drives development of on-chain compliance tech (see above) plus infrastructure (trusted settlement nodes/off-chain verification etc.), foreshadowing a shift from “decentralized finance” toward fusion with “centralized asset tokenization.”

Conclusion

In summary: entering 2026 mainstream public chains and Layer2 ecosystems show clear focus on objectives, broader use cases, and enhanced fundamental capabilities. Ethereum’s platform upgrades via Pectra/Fusaka dramatically improve scaling/performance while advancing privacy/node usability; Layer2 like Arbitrum/Optimism pursue higher execution efficiency/security. Solana/BNB maintain high throughput while introducing privacy protocols/improved compliance mechanisms. New market trends include ongoing multichain stablecoin distribution/local innovation (USDC/PYUSD/USDsui etc.), RWA tokenization (Treasuries/private funds etc.), and construction of on-chain compliance pathways—all key signs of changing mainstream chain ecosystems.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?