MrBeast, the King of Giveaways, Is Now Targeting Teen Digital Wallets

On February 9, Beast Industries, founded by renowned YouTube creator MrBeast, announced its acquisition of Step—a mobile banking app targeting teens—marking its official entry into the fintech sector. This move follows Beast Industries’ announcement of a $200 million equity investment from Ethereum treasury firm BitMine and represents its first concrete step in financial technology.

Step is an all-in-one financial app designed to help young people begin their financial journey on a digital banking platform. The company has long provided a suite of services for teens and young adults, including savings accounts, a credit-building Visa card with debit-like features, and cash advances. Step itself is not a bank; it delivers banking services through a partnership with Evolve Bank & Trust, a Federal Deposit Insurance Corporation (FDIC) member.

Neither company disclosed the transaction terms. In 2022, Step reported raising $500 million in equity and debt financing from institutional investors such as General Catalyst, companies like Stripe, and individual investors including TikTok influencer Charli D’Amelio.

Expanding Beyond YouTube

MrBeast, whose real name is Jimmy Donaldson, has grown from a single creator into the core of a business organization spanning content, consumer products, and offline experiences. Public records indicate he has more than 466 million YouTube subscribers, with his main channel and multilingual network reaching a massive audience. His content distribution and user mobilization capabilities rank among the top on global internet platforms.

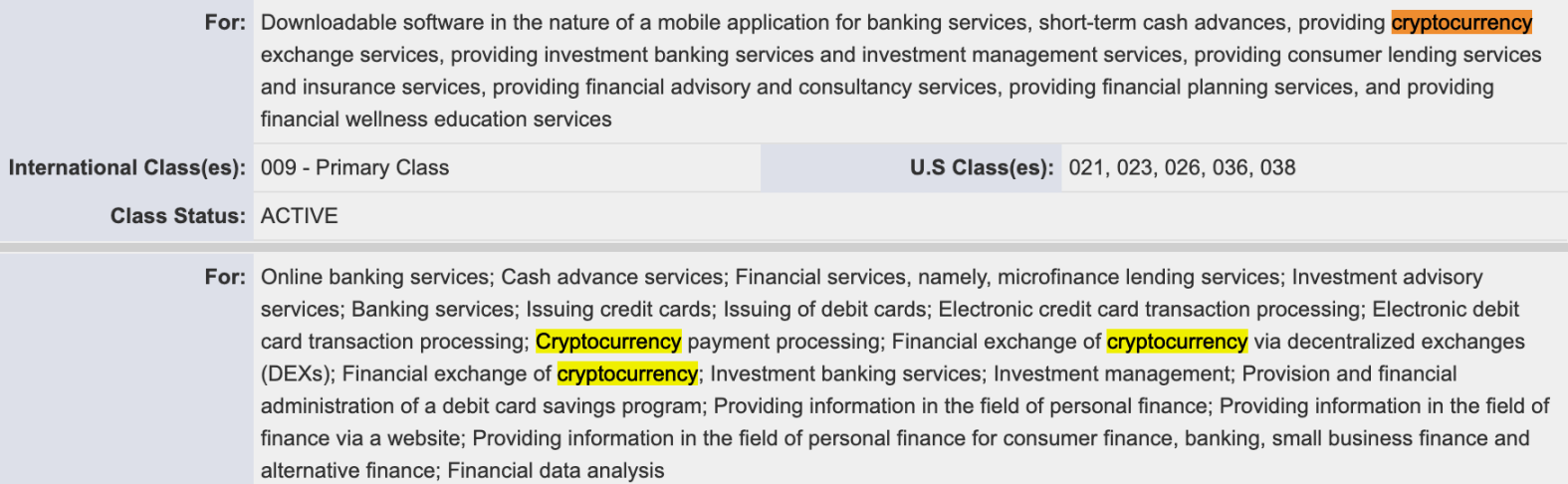

Several months ago, MrBeast began planning his entry into fintech. In October 2025, Beast Holdings, LLC filed a trademark application for “MrBeast Financial” with the U.S. Patent and Trademark Office, intending to offer cryptocurrency trading services, crypto payment processing, and crypto trading via DEX.

While the trademark filing only outlines the intended business scope and does not equate to product launch, there remains a gap between regulatory approval and business rollout. Even so, it is the first time MrBeast’s ambitions in finance and crypto have been formally documented.

One month earlier, in January 2026, BitMine—an Ethereum treasury firm—announced a $200 million equity investment in Beast Industries, with the transaction expected to close around January 19, 2026. Beast Industries CEO Jeff Housenbold stated that the company will explore further collaboration and introduce DeFi into its financial services platform. Both sides plan to integrate DeFi into the upcoming platform. Beast Industries is an entertainment and consumer products company established by MrBeast.

MrBeast has often discussed his personal finances, describing the acquisition of Step as an opportunity to “provide millions of young people with the financial foundation I never had.” As the company prepares to enter the financial sector, MrBeast has expressed interest in producing finance-related videos, such as “teaching people how to invest and showing them what a Roth IRA is.”

Previously Accused of Earning Over $10 Million Through Pump-and-Dump Crypto Schemes

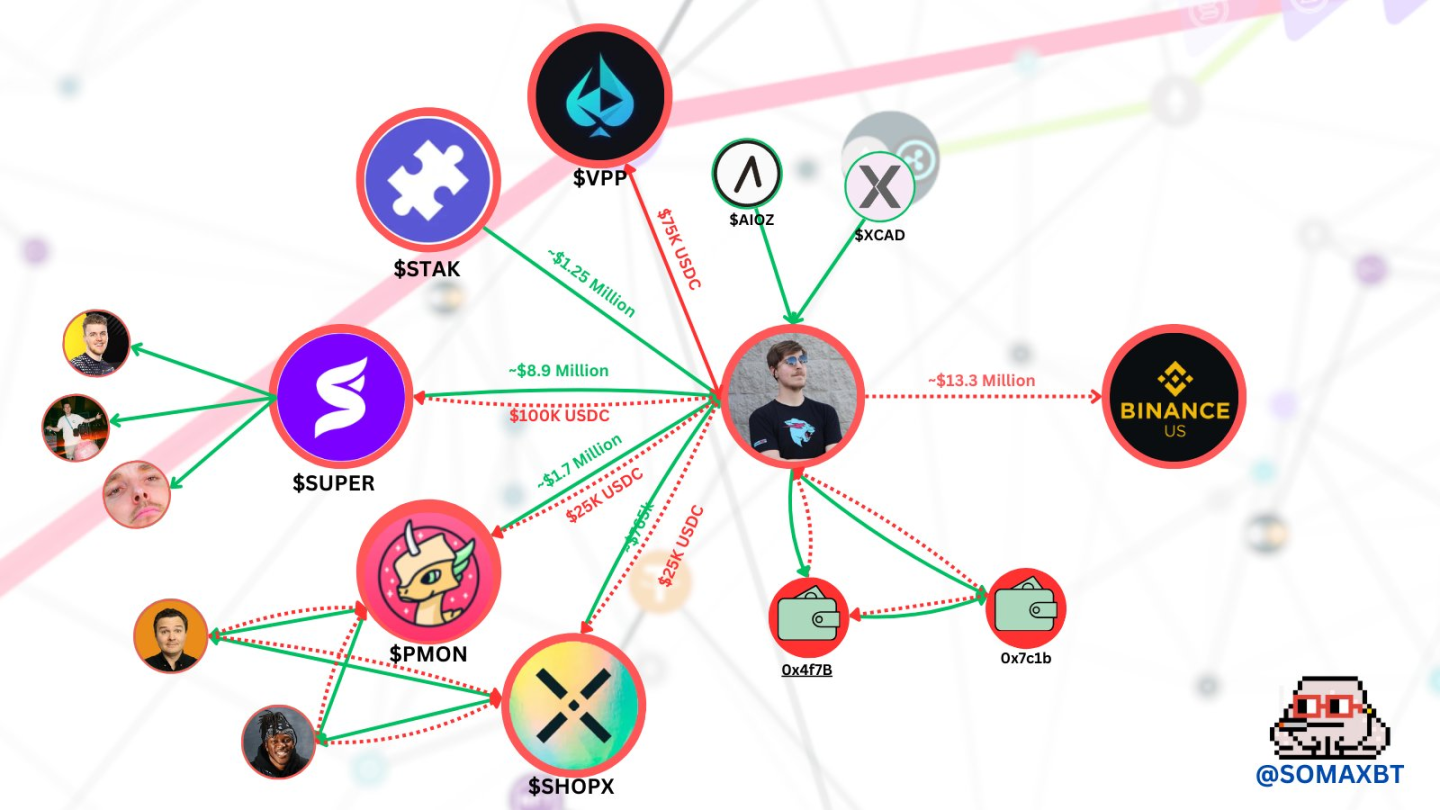

This is not MrBeast’s first venture into crypto. On October 11, 2024, on-chain investigator SomaXBT published an investigation alleging MrBeast participated in several initial DEX offerings (IDOs) and token promotion campaigns, profiting substantially after token prices surged following his endorsements.

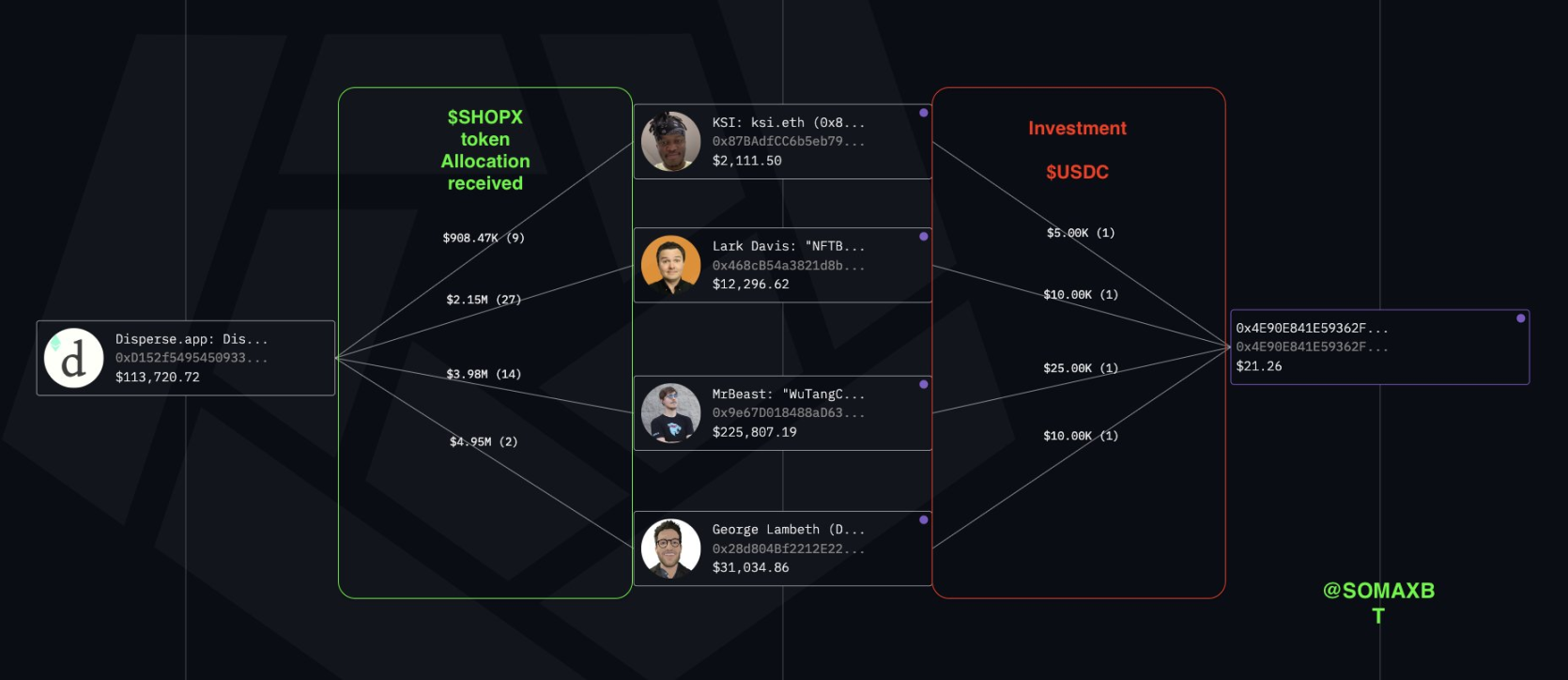

Projects involved include SuperFarm (SUPER), Polychain Monsters (PMON), SPLYT (SHOPX), among others. Some tokens dropped more than 90% in price after MrBeast sold his holdings.

SomaXBT highlighted several cases, using SUPER as an example—a project backed by Elliot Trades.

According to SomaXBT, MrBeast invested $100,000 in the project and received 1 million SUPER tokens. After his investment, the token price surged, and on March 30, 2021, MrBeast transferred his SUPER tokens to a backup wallet, where they were sold through a series of transactions totaling 1,900 ETH (about $3.7 million at the time). MrBeast received additional SUPER tokens under a vesting contract and later sold them for $5.5 million, bringing his total proceeds from the project to approximately $9 million.

SomaXBT’s investigation also spotlighted MrBeast’s involvement with Polychain Monsters (PMON), another low-market-cap token project. In this case, MrBeast invested $25,000 and received 25,000 PMON tokens. On March 31, 2021, his wallet transferred these tokens to another wallet and sold them through a series of transactions, netting 685 ETH (about $1.3 million).

The investigation also included SHOPX, STAK, VPP, and other projects following a similar pattern, suggesting that after MrBeast was accused of selling, these tokens experienced sharp declines—some dropping over 90% from their peak. The report characterized this as “pump-and-dump,” emphasizing that influencer promotion combined with low-liquidity tokens amplifies volatility and shifts risk onto retail investors.

Additionally, in September 2025, MrBeast accumulated 705,821 ASTER tokens, valued at roughly $1.28 million at the time.

In summary, Beast Industries has secured a critical entry point into finance, while its crypto-related capabilities remain in the planning and exploration phase. Historical on-chain controversies may continue to shape external trust in its financial and crypto businesses.

Statement:

- This article is republished from [Foresight News]. Copyright belongs to the original author [ChandlerZ]. If you have any objections to this republication, please contact the Gate Learn team, and the team will address them promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of the article were translated by the Gate Learn team. Without explicit mention of Gate, copying, distributing, or plagiarizing translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?