Sentient Tokenomics Explained: How the Ecosystem Incentive System Works

Amid the rising wave of decentralized artificial general intelligence (AGI), Sentient aims to build an open-source, community-driven AGI protocol. Through on-chain collaboration, it enables fair participation and governance across AI models, data, and computing resources.

Sentient’s native token, SENT, plays a central coordinating and incentive role within the ecosystem. Through carefully designed tokenomics and incentive mechanisms, it encourages long-term contribution and collaboration among ecosystem participants, ultimately supporting the sustainable growth of the network. Based on the latest updates and official tokenomics disclosures, the following sections provide a detailed explanation of how Sentient’s token mechanism and incentive system operate.

Why Sentient Needs an Incentive Mechanism

The complexity of a decentralized AGI protocol lies in its reliance on long-term collaboration among multiple parties. These include developers contributing models and algorithms, data providers optimizing training datasets, users participating in usage and feedback, and compute providers supplying effective computing power. Without a well-designed incentive system, it is difficult for these participants to commit resources and time over the long term.

Sentient’s incentive mechanism is designed to address several key challenges:

- Stimulating community participation by ensuring contributors receive fair compensation.

- Enabling equitable value distribution and increasing overall ecosystem activity.

- Aligning participant interests with governance and development through token-based rights, further decentralizing decision-making.

- Reducing short-term speculative behavior through long-term design, thereby strengthening ecosystem sustainability.

Sentient Token Allocation Structure: Numbers and Design Logic Explained

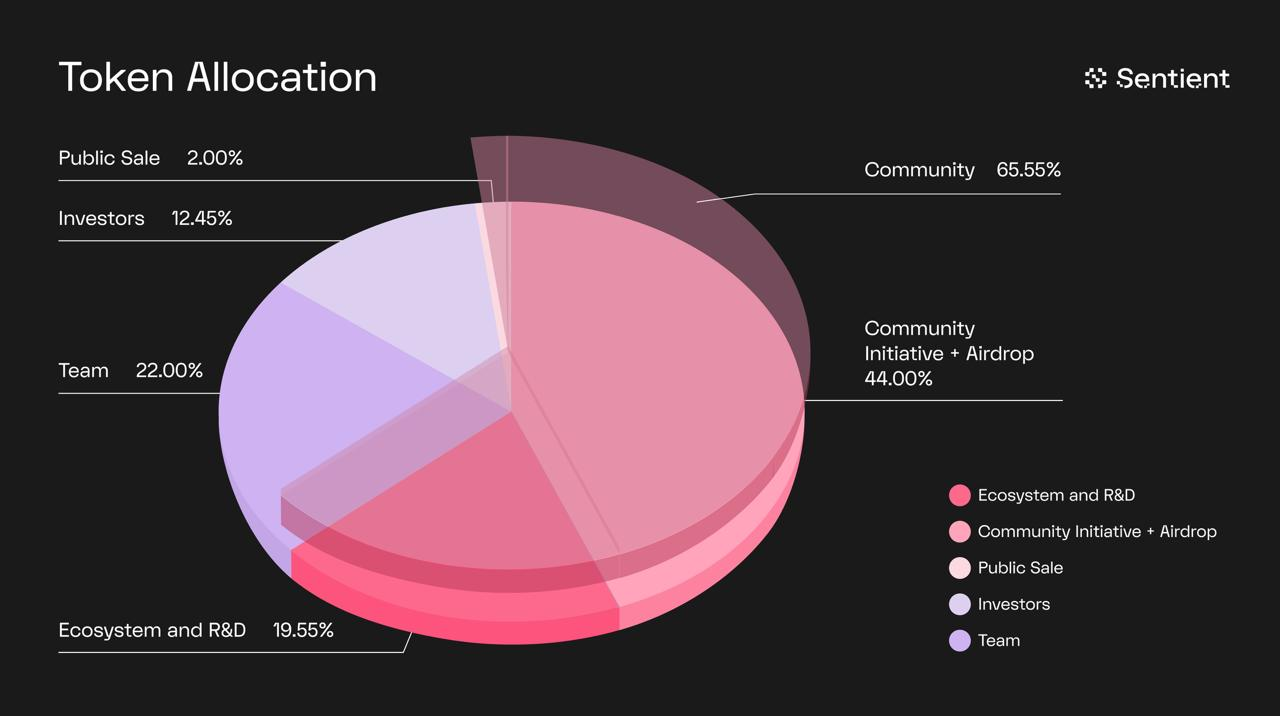

Image source: Sentient official materials

Under Sentient’s tokenomics design, the total supply is fixed at 34,359,738,368 SENT tokens, approximately 34.36 billion. The allocation plan was clearly disclosed by the project at the time of release, reflecting a design philosophy that prioritizes the community while maintaining long-term incentives.

| Allocation Category | Proportion | Main Uses |

|---|---|---|

| Community Incentives and Airdrops | 44.00% | Airdrops, user incentives, and ecosystem participation rewards |

| Ecosystem and Research & Development | 19.55% | Ecosystem application development, protocol research and development, and infrastructure support |

| Public Sale | 2.00% | Public participation and broader token distribution |

| Core Team | 22.00% | Core development and long-term operational incentives, including lock-ups |

| Investors | 12.45% | Early strategic support and resource onboarding |

| Total | 100% | — |

This allocation structure ensures that the community holds the largest share of ecosystem control. At the same time, vesting and gradual release mechanisms align team and investor incentives with the project’s long-term health. This helps reduce short-term sell pressure and speculative behavior.

According to official information, as much as 30 percent of the community incentive and airdrop allocation will be unlocked at the token generation event, or TGE. The remaining portion will be released linearly over the coming years. This approach balances early-stage incentives with the need to avoid sudden market shocks from large-scale token releases.

Core Uses of the Sentient Token Within the Ecosystem

Sentient’s native token, SENT, is not merely a tradable asset. It serves as the core economic vehicle of the ecosystem, with several primary functions:

- Governance rights. Token holders can participate in DAO governance through staking, voting on major matters such as protocol upgrades, fee distribution, and the use of community funds.

- Staking and access rights. Users can stake SENT to unlock access to specific AI models, datasets, tools, or other artifacts, along with associated reward entitlements.

- Service payments. Within the ecosystem, users pay SENT to access AI models and data services, creating revenue streams for compute providers and model owners.

- Incentive distribution. SENT is also the medium for ecosystem rewards, with an annual emission of 2 percent allocated to incentivize contributors and participants.

This multi-purpose design enhances the token’s practical utility while tightly linking incentives to real contributions across the ecosystem.

How Users Can Earn Rewards by Participating in the Ecosystem

Within the Sentient network, ordinary users are not limited to passively consuming resources. They can earn incentives through multiple channels:

- Airdrops and campaign rewards. The project has designed Sybil-resistant airdrop programs that distribute tokens to genuine participants in recognition of their engagement and contributions.

- Staking rewards. Users can stake their SENT tokens in specific contracts or models and earn rewards based on usage metrics or shared network revenue.

- Ecosystem contribution rewards. Users who provide valuable feedback, help build community consensus, or promote ecosystem initiatives may also receive allocations from designated reward programs.

This incentive structure emphasizes meaningful participation rather than simple token holding, encouraging users to actively contribute to ecosystem development.

How Data Contributors and Compute Providers Are Incentivized

For contributors of data and computing power, both of which are essential to AGI development, Sentient’s mechanisms are particularly critical:

- Data contribution incentives. Contributors involved in data collection, filtering, cleaning, and labeling are rewarded through smart contracts based on the value and scale of their contributions.

- Compute incentive mechanisms. Compute providers can connect their resources to the network to support model training and inference tasks, receiving token rewards based on the amount of computing power supplied and the quality of task outcomes.

By quantifying contribution and performance, the token mechanism provides sustained incentives for these key resource providers, improving overall AI development and operational efficiency within the protocol.

Incentive Models for Developers and the Application Ecosystem

One of Sentient’s core strengths lies in its open architecture. Developers can build applications, models, tools, or services on top of the protocol. Their incentives include:

- Ecosystem fund grants. Funding from the ecosystem and research allocation pools can support developers in launching projects or conducting experiments.

- Contribution-based rewards. Developers may receive ongoing token incentives based on their level of contribution and actual product usage.

- Governance incentives. By participating in governance decisions, developers can also earn governance-related rewards or enhanced voting influence.

This model encourages developers to continuously innovate and iterate within the network, increasing the ecosystem’s overall attractiveness and diversity.

How the Token Mechanism Supports Long-Term Ecosystem Growth

Sentient’s tokenomics are designed with a long-term perspective, including several key elements:

- Long-term vesting and lock-up mechanisms. A majority of tokens are allocated to community and ecosystem-related uses, accounting for 65.55 percent, and are released gradually to reduce short-term speculation and supply shocks.

- Controlled annual emissions. A fixed 2 percent of tokens are issued annually for incentives, with any unused portion locked, maintaining sustainability and predictability in token supply.

- Decentralized governance. Token holders have genuine authority over protocol upgrades and resource allocation, ensuring decisions are grounded in decentralization and collective consensus.

These design choices support the ecosystem’s transition from early growth to maturity and encourage long-term value accumulation.

Potential Risks to Consider When Participating in the Sentient Ecosystem

Despite the strengths of the token design, participants should remain aware of potential risks:

- Market volatility risk. As a crypto asset, SENT is subject to significant price fluctuations, which may affect the real value of incentives and participant motivation.

- Adoption uncertainty. The ecosystem’s long-term success depends on sustained participation from developers, data contributors, and compute providers, which is inherently uncertain.

- Sybil attacks and incentive abuse. Although resistance mechanisms are in place, vigilance is still required to prevent non-genuine participants from exploiting reward systems.

Possible Future Adjustments to the Sentient Incentive System

As the ecosystem evolves, Sentient’s incentive system may develop in several directions:

- Dynamic incentive models. Incentive ratios may be adjusted dynamically based on the ecosystem’s growth stage, allowing resource allocation to respond more flexibly to demand.

- More granular contribution assessment. On-chain data analytics and feedback mechanisms could enable more precise measurement of contributor value, improving reward distribution.

- Cross-ecosystem collaboration incentives. To expand ecosystem reach, incentive structures may be introduced to encourage collaboration with external protocols and communities.

These potential adjustments would help maintain ecosystem vitality and competitiveness over time.

Conclusion

Sentient’s token mechanism is far more than a simple incentive tool. It is the core engine that drives ecosystem operations. Through governance, staking, payments, and incentives, SENT tightly aligns the interests of contributors, users, and developers, enabling collective participation in ecosystem growth. Its emphasis on gradual release, decentralized governance, and sustained incentives supports the creation of a sustainable, open, and active decentralized AGI ecosystem. That said, participants should carefully assess both risks and rewards in light of market volatility and the ecosystem’s stage of maturity.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks