Three key changes: Analyzing the impact of new Federal Reserve Chairman Kevin Warsh on the crypto market

Summary

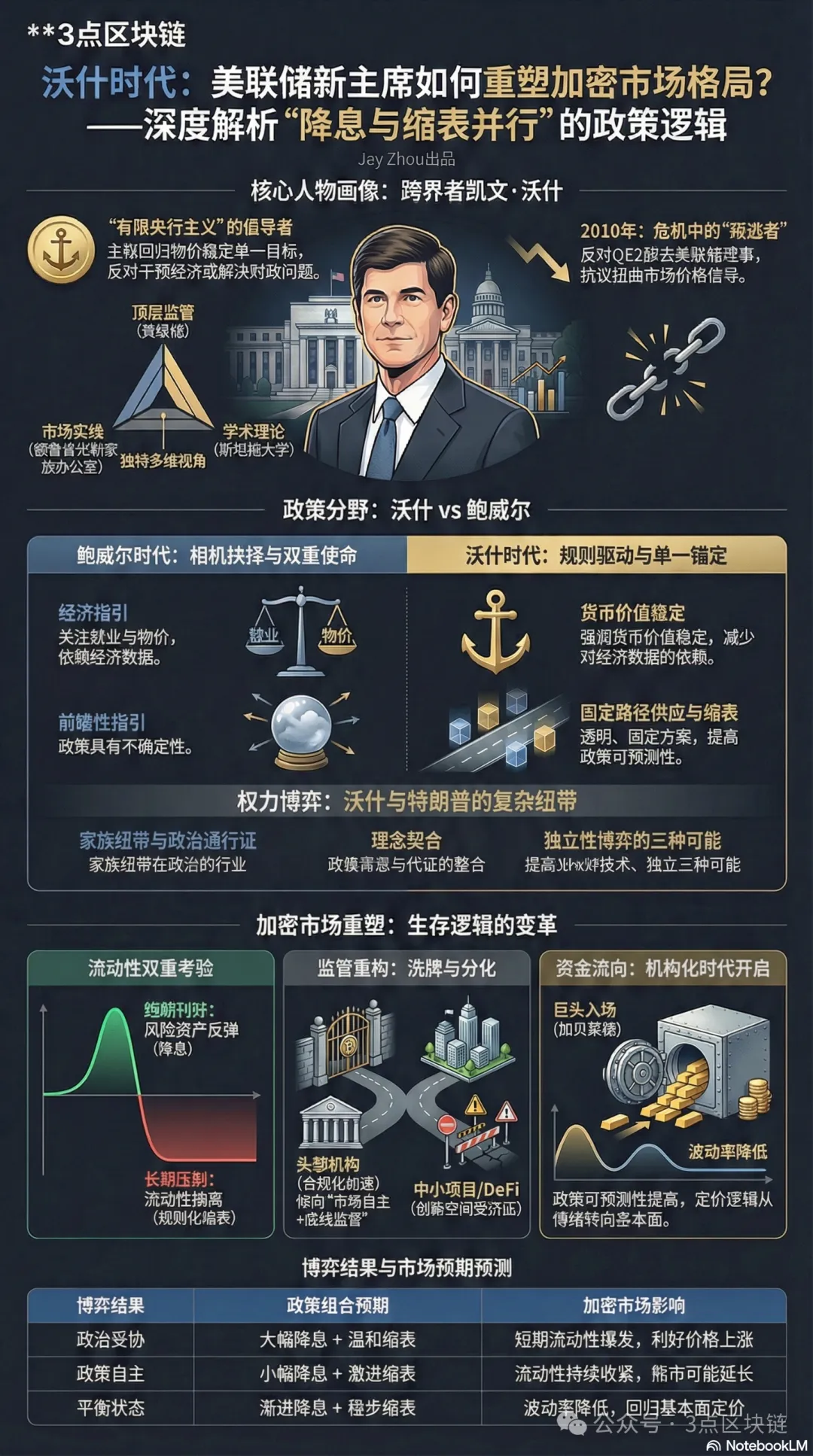

On January 30, 2026, Donald Trump officially nominated former Federal Reserve Governor Kevin Warsh as Chair of the Federal Reserve. This pivotal appointment signals a major shift in US monetary policy and will have deep and lasting effects on the crypto market, which is highly dependent on global liquidity. Warsh’s unique stance—advocating for simultaneous rate cuts and balance sheet reduction—stands in stark contrast to the monetary logic of the Powell era. Amid a 2026 crypto bear market and new annual lows for Bitcoin, this cross-disciplinary leader with experience in academia, regulation, and investment is set to become a decisive factor in reshaping the crypto market landscape.

This article explores Warsh’s background and policy philosophy, contrasts his monetary approach with Powell’s, analyzes the complex relationship between Warsh and Trump and its impact on the crypto market, and reveals the underlying survival logic for crypto in this era of monetary policy transformation.

I. Kevin Warsh’s Background: From Crisis Witness to Policy Critic

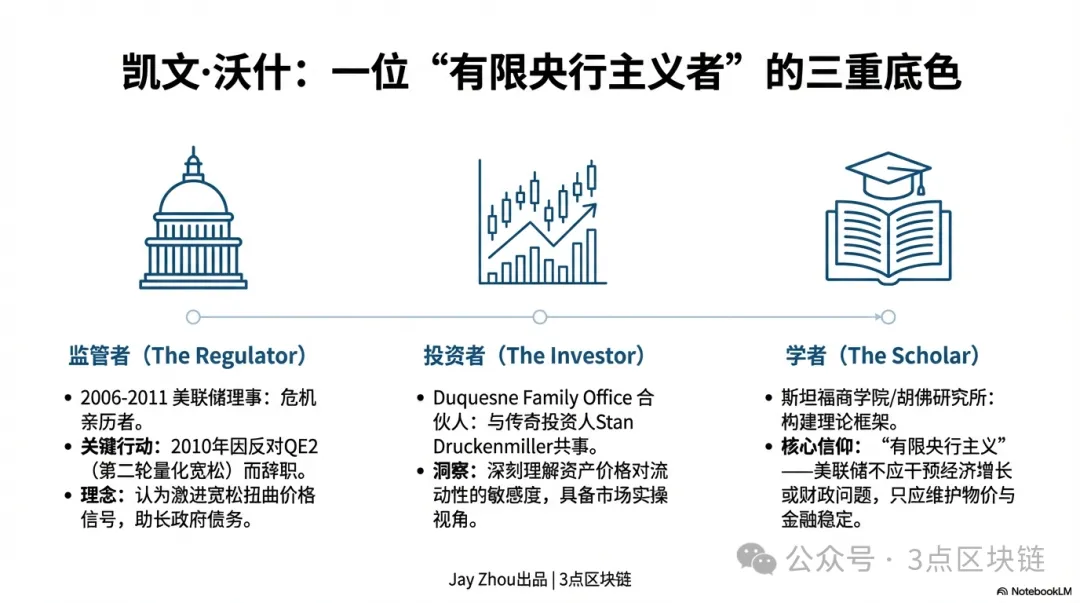

Kevin Warsh’s career has continuously bridged public policy and private markets, shaping his critical perspective on monetary policy and pragmatic style. Understanding Warsh’s policy positions requires recognizing his triple identity as regulator, academic, and investor.

1.1 Fed Governor During Crisis: The “Defector” From Quantitative Easing

From 2006 to 2011, Warsh served as a Federal Reserve Governor, witnessing the entire global financial crisis firsthand. During these years, the Fed shifted from traditional interest rate controls to massive asset purchase programs (QE), expanding its balance sheet from $900 billion to $2.9 trillion. As the Fed’s liaison to the markets, Warsh played a key role in crisis response policy, but he was also among the earliest and most prominent members to oppose quantitative easing.

In 2010, as the Fed prepared for a second round of quantitative easing (QE2), Warsh publicly opposed the move. He believed that continuing to expand asset purchases amid signs of economic recovery would entangle the Fed in fiscal politics and distort market price signals. After QE2’s launch, Warsh resigned in protest—a defining moment in his career. This experience shaped his “limited central banking” philosophy: the Fed’s core responsibilities are to maintain price and financial stability, not to intervene in economic growth or solve fiscal problems through balance sheet maneuvers. Warsh has sharply criticized the Fed’s aggressive policies over the past 15 years, arguing that ongoing quantitative easing created a “monetary dominance” era—artificially low rates inflated asset bubbles and fueled US government debt. By 2026, US federal debt had surpassed $38 trillion, with net interest payments nearly matching defense spending—precisely the scenario Warsh warned against.

1.2 A Cross-Disciplinary Perspective: From Family Office to Stanford Lecture Hall

After leaving the Fed, Warsh entered a “cross-disciplinary” phase. He joined legendary investor Stan Druckenmiller’s family office, Duquesne, as a partner, deeply involved in global macro investment decisions. At the same time, he served as a distinguished visiting fellow at the Hoover Institution and a lecturer at Stanford Business School, building a policy analysis framework that bridges theory and practice.

This experience—spanning regulatory agencies, investment institutions, and academia—gives Warsh’s policy positions both top-level design and market practicality. As a regulator, he understands the spillover effects of Fed policy on financial markets; as an investor, he appreciates asset prices’ sensitivity to liquidity changes; as a scholar, he’s able to step outside short-term policy cycles and examine the long-term logic of monetary policy. Notably, Warsh’s personal network adds a political dimension to his nomination—his father-in-law, Ronald Lauder, is head of Estée Lauder and a close Trump ally. This connection raises concerns about Warsh’s ability to resist Trump’s political pressure, especially given Trump’s explicit calls for aggressive rate cuts. Yet Warsh’s career has consistently emphasized “policy independence.” The tension between political ties and policy autonomy will be a defining feature of his leadership at the Fed.

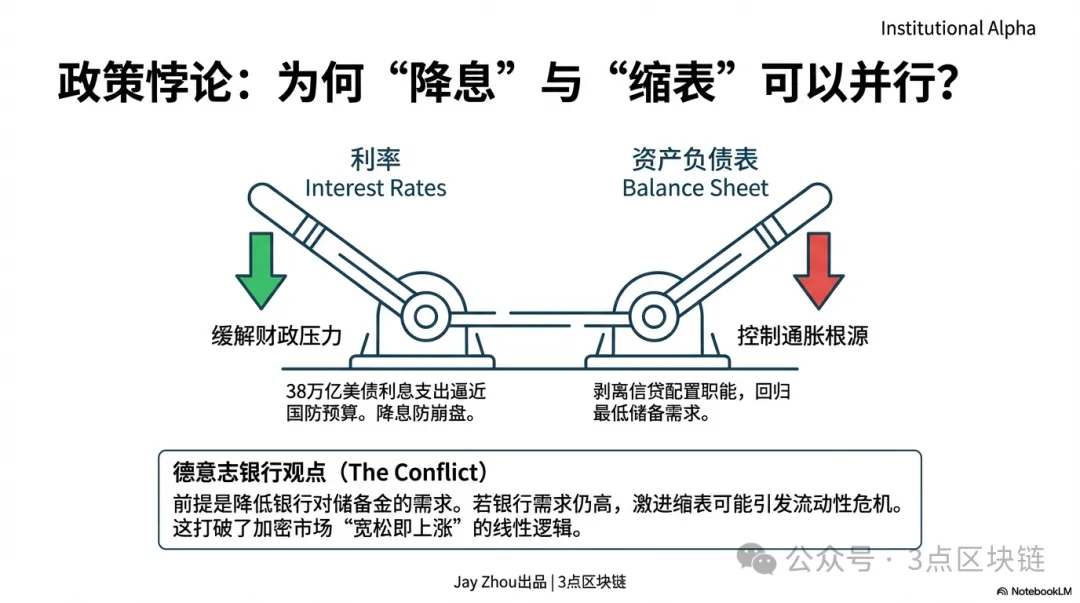

1.3 Policy Philosophy: The “Paradox” of Rate Cuts and Balance Sheet Reduction

Deutsche Bank’s Matthew Luzzetti team describes Warsh’s policy framework as “rate cuts and balance sheet reduction in parallel.” This seemingly contradictory combination targets the Fed’s core dilemma—relieving high interest rate pressure on government debt while avoiding excess liquidity that could reignite inflation.

Warsh’s policy logic operates on three levels:

- Rate cuts: In a slowing economy with mounting debt, moderate rate cuts reduce government interest costs and ease corporate financing burdens. Warsh, however, opposes “unlimited rate cuts”—he publicly disagreed with the Fed’s September 2025 50-basis-point cut, warning that excessive easing would undermine progress on inflation.

- Balance sheet reduction: Warsh aims to shrink the Fed’s balance sheet, stripping away the “credit allocation” role adopted after the financial crisis and returning to traditional monetary policy. He believes the Fed’s balance sheet should be kept at the minimum needed for bank reserves, not as a major force in market liquidity.

- Implementation prerequisites: Running rate cuts and balance sheet reduction in parallel requires regulatory reform to lower banks’ reserve requirements. Only when banks don’t need to hold large excess reserves can balance sheet reduction proceed without a liquidity crisis. Deutsche Bank notes that this prerequisite is questionable in the short term—the Fed has recently restarted reserve management purchases, and banks’ demand for reserves remains high.

This “paradoxical” approach is a sharp departure from the crypto market’s familiar “easing equals rally, tightening equals decline” logic, adding new uncertainty to future market trends.

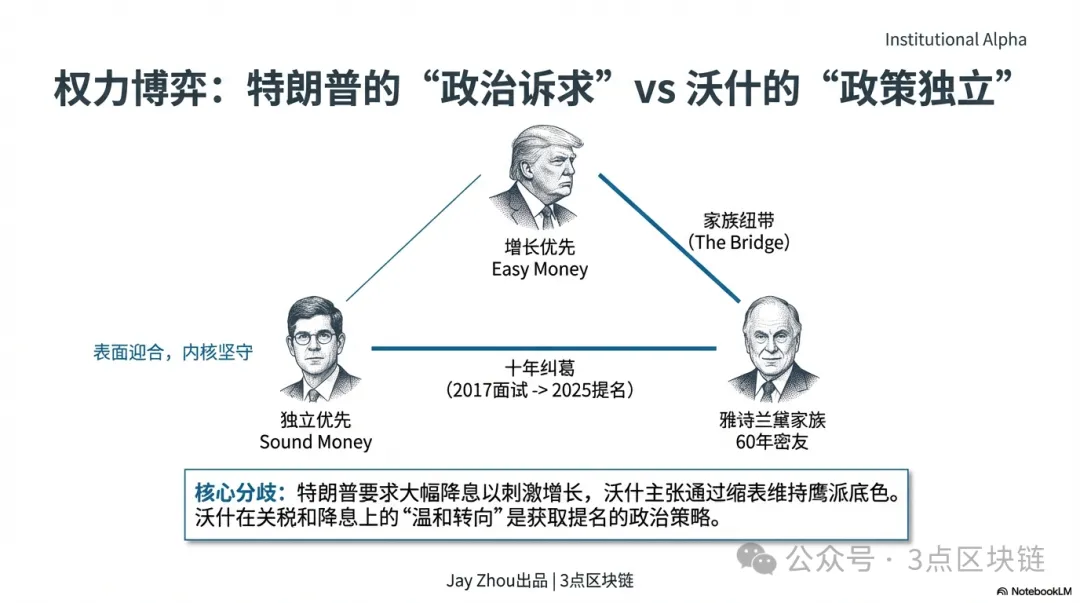

II. Warsh and Trump: A Complex Network from “Old Acquaintance” to “Ally”

Kevin Warsh’s relationship with Donald Trump is central to understanding his nomination and predicting his policy direction. Their connection spans a decade of intertwined political and personal ties, mixing family networks, policy ideas, and power dynamics.

2.1 Family Ties: The Estée Lauder Family as a “Political Bridge”

Warsh’s most direct link to Trump is through marriage—his wife, Jane Lauder, is an Estée Lauder heir, and his father-in-law, Ronald Lauder, is a 60-year friend and core ally of Trump. Their friendship began at New York Military Academy, where they were classmates, business partners, and political supporters. Lauder was a major donor to Trump’s 2016 and 2024 campaigns and was the first to propose the controversial “Greenland acquisition” idea, which became a hallmark of Trump’s first term. As biographer Tim O’Brien notes, Trump values connections to power and fame above all. Lauder’s family background gives Warsh a unique “political passport” in Trump’s inner circle. In Trump’s logic, “acquaintance recommendations” and “family ties” often outweigh professional credentials in appointments. In December 2025, Trump named Warsh his “top candidate” for Fed Chair to The Wall Street Journal—a statement shaped by Lauder’s influence.

2.2 A Decade-Long Game: From “Interview Rejection” to “Handpicked Nomination”

Warsh’s policy interactions with Trump date to Trump’s first term in 2017, when Trump personally interviewed Warsh for Fed Chair but ultimately chose Jerome Powell. Trump later called this a “regret”—in 2020, he told Warsh privately, “Kevin, I really should have used you back then. If you wanted that job, why weren’t you tougher?” After Trump returned to the White House in 2025, their interactions intensified. Warsh advised Trump’s transition team on economic policy and was considered a potential Treasury Secretary. Importantly, Warsh’s “moderate shift” in policy brought him closer to Trump’s demands. While Warsh was known as a hawk at the Fed, he has recently supported Trump’s tariff policies and advocated faster rate cuts—moves seen as positioning for the Fed Chair role. On January 29, 2026, after a White House meeting, Trump moved up the nomination announcement to the morning of the 30th, reflecting their close relationship and rapid decision-making. On Truth Social, Trump wrote, “I’ve known Kevin for years, he’s a true genius, destined for history”—a sharp contrast to his criticism of Powell.

2.3 Ideological Alignment: From “Policy Differences” to “Shared Goals”

The Warsh-Trump relationship is more than political dependence; it’s a strategic alliance built on shared policy views in three areas:

- Criticism of Powell: Trump has long blamed Powell’s “excessive money printing” for inflation, while Warsh faults Powell’s Fed for “mission creep,” focusing too much on non-core issues and weakening monetary policy independence. Their shared view of Powell’s “policy failure” is the foundation of their cooperation.

- Shared call for rate cuts: Since early 2025, Trump has pressured the Fed to cut rates, arguing that high rates cost the US hundreds of billions in debt interest and drag on growth. Warsh’s “rate cuts and balance sheet reduction” framework meets Trump’s demand for lower rates while preserving his own “hawkish” credentials.

- Fed independence: While Warsh values Fed independence, both he and Trump believe the Fed should rely less on economic data and abandon “forward guidance,” which Trump considers meaningless. Their mutual pursuit of “policy simplification” brings them into alignment on operations.

Notably, Warsh’s shift isn’t pure accommodation. According to Pictet’s Chui Xiao, Warsh “very much wants the Fed Chair job,” so he’s turned dovish on rates, but his core framework—“limited central banking” and “balance sheet reduction first”—remains unchanged. This strategy of “surface accommodation, core persistence” is key to balancing political pressure and policy independence.

2.4 Power Balance: The Game Between “Political Appointment” and “Policy Autonomy”

The Warsh-Trump dynamic is a classic struggle between political appointment and central bank independence. For the crypto market, the outcome will directly shape Fed policy and global liquidity.

Trump’s main goal in nominating Warsh is to “control monetary policy.” Since early 2025, Trump has criticized Powell for being slow and argued that high rates hurt the US economy and finances. He wants a Fed Chair who will cut rates and follow his lead, serving his growth-first agenda. Warsh’s family background and policy shift make Trump believe he can “control” the new Chair. Yet Warsh’s career has always emphasized “policy independence.” In 2010, he resigned in protest against QE2—a display of his commitment to central bank autonomy. Deutsche Bank notes that markets will closely watch whether Warsh can maintain independence under Trump—a key factor for confidence. This power balance could yield three outcomes:

For crypto investors, the key signals will be Warsh’s first FOMC statement, details of his balance sheet reduction plan, and his public comments on Trump’s policies. These will shape both short- and long-term crypto market trends.

III. Powell vs. Warsh: Diverging Policy Paths

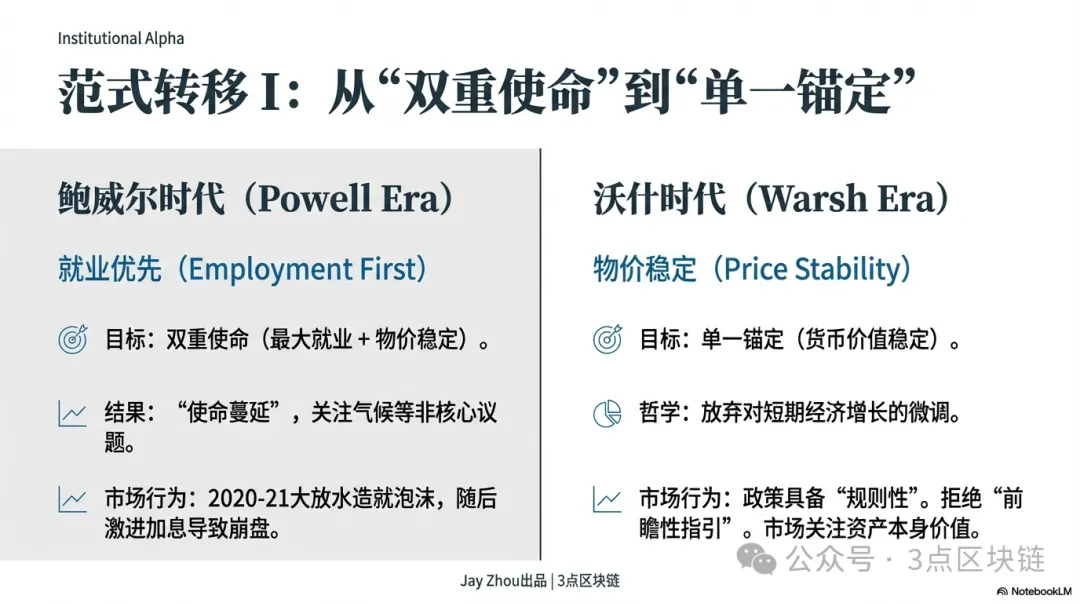

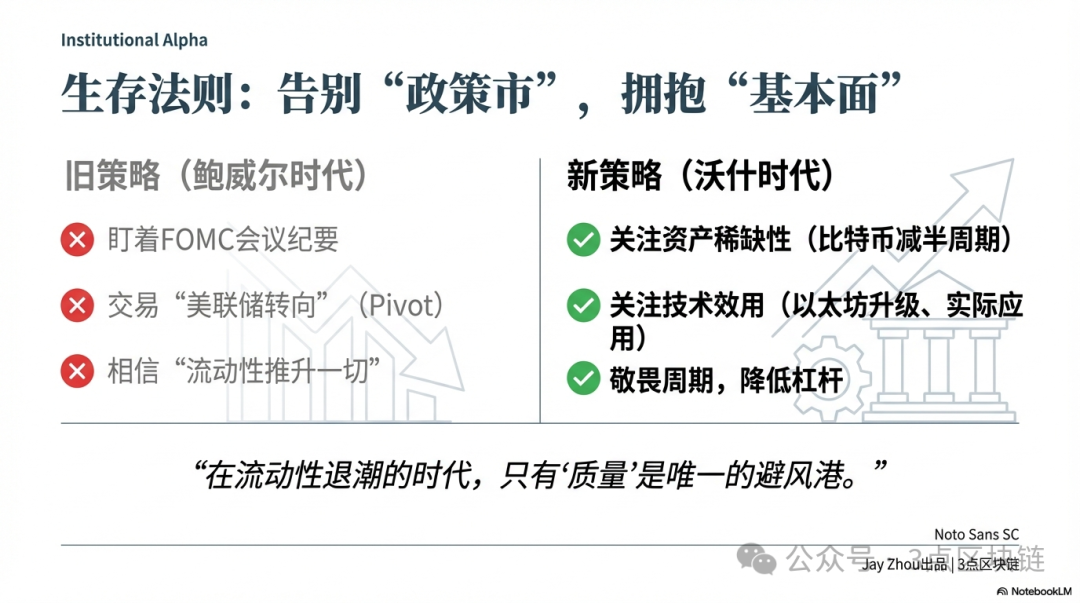

To understand Warsh’s impact on the crypto market, it’s essential to clarify his divergence from Powell’s monetary policy. Powell’s Fed was marked by discretionary decisions closely tied to crypto bull and bear cycles. Warsh’s framework emphasizes rule-based policy and central bank independence—a difference that will reshape crypto asset pricing logic.

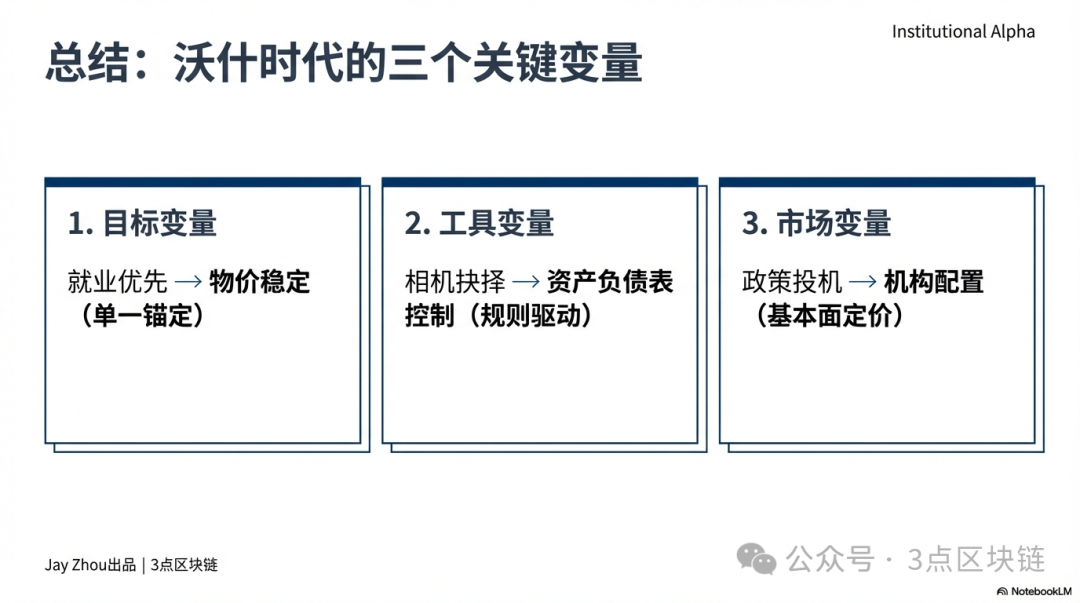

3.1 Policy Objectives: From “Dual Mandate” to “Single Anchor”

Powell’s eight years at the Fed focused on the “maximum employment” and “price stability” dual mandate. After the COVID-19 outbreak in 2020, Powell cut rates to 0–0.25% and launched unlimited QE, expanding the Fed’s balance sheet by nearly $4 trillion in 18 months to $9 trillion. This “employment-first” approach fueled an unprecedented liquidity boom in crypto. From 2020 to 2021, Bitcoin soared from under $10,000 to $69,000, Ethereum from $200 to $4,891, and crypto market cap surpassed $3 trillion. Fed easing was seen as the key driver of crypto rallies, with Bitcoin gaining “digital gold” status. But as inflation hit a 40-year high in late 2021, Powell shifted focus to price stability. In March 2022, the Fed launched its most aggressive rate hike cycle since the 1980s, raising rates by 525 basis points in 17 months and starting balance sheet reduction, shrinking $95 billion monthly. This pivot triggered a crypto crash: $1.45 trillion in market cap evaporated in 2022, Bitcoin fell to $15,000, Ethereum dropped below $900, and leading firms like Three Arrows Capital and FTX collapsed, marking a long bear market.

Warsh’s policy goal is closer to a “single anchor”—restoring the Fed’s core mission of maintaining monetary stability. He criticizes Powell’s “mission creep,” arguing that a focus on employment, climate, and inclusivity undermines monetary policy independence and effectiveness. Warsh advocates less reliance on economic data and abandoning forward guidance, calling it “almost useless in normal times,” and instead controlling monetary supply and balance sheet size for long-term price stability. This difference means Warsh’s Fed will be more rule-based and predictable, possibly at the expense of short-term growth and employment. For crypto, this weakens the “policy-driven” logic, making asset pricing more dependent on fundamentals than Fed policy shifts.

3.2 Policy Tools: From “Discretionary Adjustment” to “Rule-Based Approach”

Powell’s Fed excelled at using forward guidance and data dependence to manage market expectations and guide capital flows. For example, Powell promised in 2020 to keep rates low through 2023 and in 2022 stressed that hikes would continue until inflation returned to the 2% target—clear signals that allowed markets to adjust. Warsh sees forward guidance as a crisis tool, not for normal times, and criticizes Powell’s reliance on “black box DSGE models,” overlooking the importance of monetary supply and balance sheet size for inflation. Warsh prefers more transparent, rule-based tools—such as fixed monetary supply growth rates or predetermined balance sheet reduction paths—to reduce market speculation. This divergence affects crypto volatility: Powell’s Fed often triggered sharp swings, such as in November 2025, when Powell paused balance sheet reduction and cut rates by 25 basis points, causing Bitcoin to drop then rebound by over 5%; in January 2026, Powell said “rate cuts before June are unlikely,” sending the market into a sideways drift and Bitcoin volatility to historic lows.

Another key difference is handling political pressure. Powell resisted Trump’s calls for rate cuts, sticking to hikes to fight inflation and preserve independence. By 2025, with US debt above $38 trillion and net interest payments near defense spending, Powell had to compromise—pausing balance sheet reduction and making modest rate cuts to ease debt service. Warsh will face even greater pressure. Trump has made clear he wants aggressive rate cuts to spur growth and lower debt costs. Warsh has repeatedly emphasized Fed independence and said he won’t yield to political pressure. Deutsche Bank notes that markets will closely watch whether Warsh can maintain independence—a key factor for confidence. For crypto, if Warsh yields and launches “aggressive rate cuts plus mild balance sheet reduction,” short-term liquidity will be released, boosting prices; but if he sticks to “modest rate cuts plus aggressive balance sheet reduction,” liquidity will tighten and the bear market may be extended.

IV. The Warsh Era: Reshaping the Crypto Market and Survival Logic

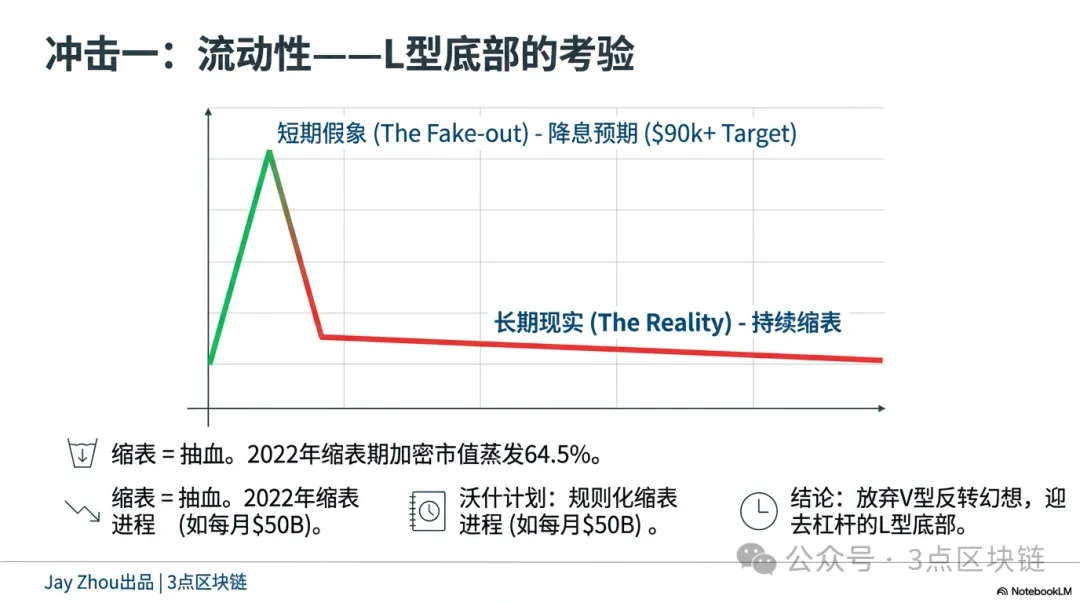

Kevin Warsh’s policies will reshape the crypto market’s structure across liquidity, regulation, and capital flows. Under the “rate cuts and balance sheet reduction” framework, the market will move beyond Powell’s “policy-driven” logic and enter a new “fundamental-driven” stage. For investors, adapting to this shift will be crucial for navigating the bear market.

4.1 Liquidity: Short-Term Tailwinds and Long-Term Headwinds

Warsh’s “rate cuts and balance sheet reduction” mix will deliver both short-term positive shocks and long-term negative pressure to crypto liquidity. In the short run, rate cuts lower dollar funding costs and ease global liquidity strains. Fed rate cuts have historically shifted capital toward risk assets. After Powell cut rates in 2020, crypto boomed; in November 2025, Powell paused balance sheet reduction and cut rates by 25 basis points, with Bitcoin rebounding from $85,000 to $92,000. If Warsh implements rate cuts after taking office in June 2026, crypto may see a short-term rebound, with Bitcoin possibly breaking above $90,000 and Ethereum above $3,000.

Long term, balance sheet reduction will continually drain liquidity and suppress valuations. The Fed’s reduction essentially withdraws liquidity injected during the crisis, shrinking global dollar supply and lowering risk asset valuations. In 2022, crypto market cap shrank by 64.5% during Fed balance sheet reduction, showing its bearish impact far exceeds that of rate hikes. Warsh’s approach is rule-based and ongoing, not a one-off. Deutsche Bank expects Warsh may set a fixed reduction path—shrinking $50 billion monthly until the balance sheet drops to around 20% of GDP. This predictability allows markets to price in liquidity tightening in advance; declines may be less dramatic but more persistent. For investors, “bottom-fishing” will be much harder. Under Powell, investors could anticipate the end of hikes or start of cuts to time the bottom; under Warsh, the long, certain reduction process means an “L-shaped” bottom, requiring a shift from speculative rebound-chasing to long-term value focus.

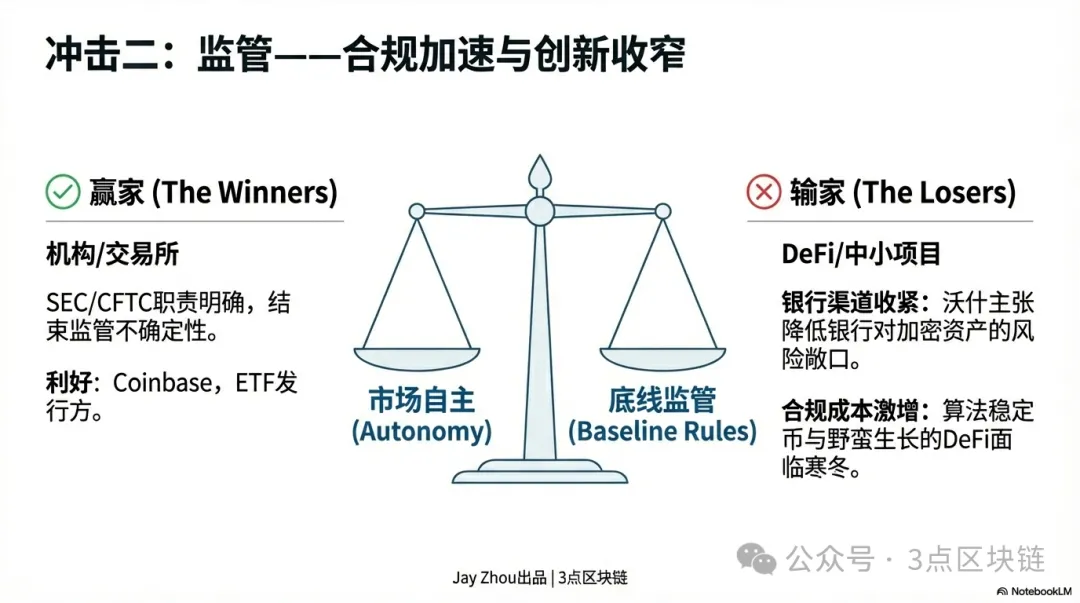

4.2 Regulation: Accelerated Compliance and Narrowing Innovation

Warsh’s policies will accelerate compliance in crypto and shape the industry’s evolution.

Warsh is known for prioritizing financial stability. He has warned that innovation outside regulatory frameworks can trigger systemic risk. On crypto regulation, Warsh advocates “market autonomy plus baseline regulation”—opposing excessive government interference but insisting on compliance with anti-money laundering and anti-terrorist financing rules. In the short term, this may offer the market a “breather.” Compared to Powell, Warsh is more likely to let market forces drive crypto’s development, pushing the SEC and CFTC to clarify legal status and regulatory frameworks. This could resolve regulatory uncertainty and attract more institutional capital.

Long term, Warsh’s approach will drive industry shakeout and differentiation. Accelerated compliance will force leading exchanges and stablecoin issuers to strengthen risk controls. For example, Coinbase and Binance may need to boost transparency and disclose more user and transaction data; USDT and USDC may face stricter reserve audits. Rising compliance costs will squeeze smaller projects, which may struggle to secure bank loans and rely on venture capital or ICOs instead. Warsh is cautious on algorithmic stablecoins and DeFi, likely limiting innovation in these areas. For investors, the “leading effect” will intensify: mainstream assets like Bitcoin and Ethereum with high compliance and liquidity will attract institutions, while altcoins lacking real use cases and facing high compliance risks may be eliminated.

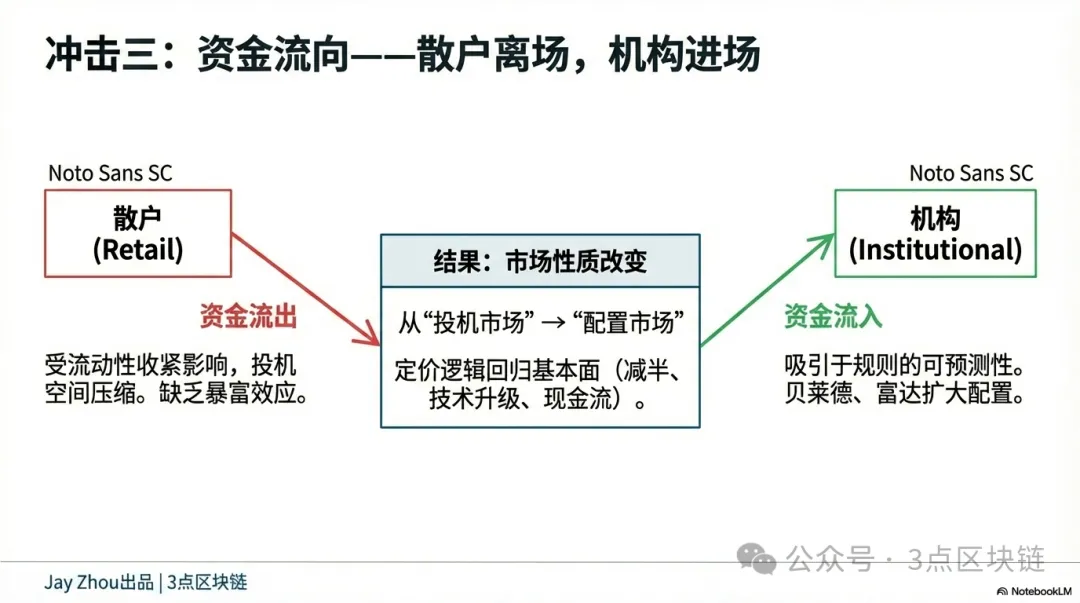

4.3 Capital Flows: Institutional Entry and Retail Exit

Warsh-era Fed policy will drive a split in crypto capital flows—accelerated institutional entry and sustained retail exit. Warsh’s rule-based approach will boost predictability and attract more traditional finance to crypto. Asset managers like BlackRock and Fidelity may expand Bitcoin ETF holdings and add crypto to long-term portfolios; investment banks like JPMorgan and Goldman Sachs may launch more crypto derivatives for institutional hedging.

Institutional entry will bring two major changes: lower market volatility and more rational pricing. Institutions prefer long-term holding, reducing price swings. For example, Bitcoin’s daily volatility may drop from 3% to 1–2%, similar to gold and stocks. Institutions also focus on fundamentals—Bitcoin’s scarcity, Ethereum’s upgrades, and project profitability—rather than sentiment or speculation. For retail investors, Warsh’s balance sheet reduction will keep liquidity tight and squeeze speculative opportunities. The 2022 bear market showed retail investors suffer most when liquidity dries up—buying high, selling low, and losing everything. Under Warsh, the long, predictable reduction process will make short-term speculation unprofitable, prompting retail investors to exit.

This split will push crypto from a retail-driven speculative market to an institutional-driven allocation market, maturing the market and strengthening its links to traditional finance. For retail investors, “get-rich-quick” opportunities will dwindle, and crypto investing will require more expertise and a longer-term approach.

V. Conclusion: Moving Beyond Policy-Driven Markets to Fundamentals

Kevin Warsh’s nomination marks a new era for Fed monetary policy. This leader bridging regulation, investment, and academia—and his complex ties to Trump—will be a key variable shaping US monetary policy. For crypto, this shift is both challenge and opportunity. The challenge is that Warsh’s “rate cuts and balance sheet reduction” could keep liquidity tight and prolong the bear market. The traditional “policy-driven” logic will weaken, and crypto asset pricing will rely more on fundamentals. The opportunity is that Warsh’s rule-based policy will enhance predictability, attract more institutional capital, and drive the transition from retail-driven speculation to institutional-driven allocation. This may be the necessary path to crypto market maturity and the start of true value realization for crypto assets.

In the Warsh era, crypto investors must abandon the “bottom-fishing rebound” mentality and focus on long-term asset value—Bitcoin’s halving cycles, Ethereum’s upgrades, and real-world applications. These are the core factors that will shape crypto’s future. Only by respecting the market and prioritizing value can investors weather the bear market and await the dawn of a new era.

Statement:

- This article is republished from [3点区块链], with copyright belonging to the original author [JayZhou]. If you have any objections to this republication, please contact the Gate Learn team. The team will handle the matter promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, translated articles may not be copied, disseminated, or plagiarized.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

NFTs and Memecoins in Last vs Current Bull Markets