What is Aster? A Complete Guide to a New Generation Decentralized Perpetual DEX Protocol

In 2026, on-chain derivatives have entered a period of intense competition. Aster has gained attention through architecture that combines a dedicated Layer 1 blockchain with multi chain liquidity aggregation.

Aster is a new generation decentralized perpetual exchange, often described as a Perp DEX. It uses a self-developed application specific Layer 1 to target high throughput and low latency execution, while also using smart routing to aggregate liquidity across multiple networks.

This article reviews Aster’s development history and team background, explains its Layer 1 architecture, privacy related trading module plans, and multi chain aggregation design, provides a detailed comparison with Hyperliquid, and outlines ASTER token value capture, recent updates, and roadmap priorities.

What Is Aster?

Aster is a decentralized perpetual exchange that provides on chain derivatives trading with high leverage, deep liquidity goals, and multi chain support. It follows a model built on a dedicated Layer 1 blockchain plus multi chain liquidity aggregation. Matching and settlement are executed on Aster’s own chain, while assets and liquidity are aggregated from networks such as BNB Chain, Ethereum, Solana, and Arbitrum. This design aims to provide multi-chain asset access and a unified DeFi trading experience.

From a product design perspective, Aster targets both retail and professional traders. Retail users can use simplified trading flows, while advanced users can access tools such as grid trading and hidden orders to approximate features typically associated with centralized venues, but executed in an on chain setting.

Aster Development History and Team Overview

Aster was formed through the merger of the yield focused product Astherus and the perpetual trading platform APX Finance, and the combined products were unified under the Aster brand. Key milestones include the following:

- On November 28, 2024, the project received seed funding from YZi Labs.

- On December 5, 2024, it completed the acquisition of APX Finance and integrated its existing perpetual trading business.

- In March 2025, the brand and product lines were restructured, and Aster clarified its shift toward a perpetual focused dedicated DEX model.

- In February 2026, the dedicated Layer 1 testnet launched. The mainnet is planned for Q1 2026, alongside later stage airdrop progress and the rollout of staking functionality.

Aster’s CEO is Leonard, who is responsible for overall strategy, fundraising, and roadmap execution. He has addressed community questions on social media about CZ involvement and project independence. The head of business development is Ember, who focuses on ecosystem expansion, partnerships, and coordination related to exchange listings and market making.

The project’s funding has been led by institutions including YZi Labs, and the operating structure is described as maintaining governance and treasury independence. Binance founder CZ, also known as Changpeng Zhao, is often viewed as a visible supporter. The CEO has stated that CZ acts as an advisor and does not directly control the team or project funds

Aster Core Features and Characteristics

As a decentralized perpetual exchange, Aster provides standard perpetual trading functionality, and highlights several design priorities. These include multi chain liquidity and asset aggregation, liquidity depth optimization through market making, and a planned privacy oriented trading approach.

Perpetual Trading

Aster supports USDT or USDF margined perpetual contracts on major assets such as BTC and ETH. It aims to deliver high leverage and order book depth, with the objective of execution quality similar to centralized matching. The design includes a funding rate mechanism and an automated risk management system intended to balance long and short positioning and keep contract prices aligned with spot index references.

Multi Chain Liquidity and Asset Aggregation

Aster operates on its own Layer 1, and also aggregates assets across networks such as BNB Chain, Ethereum, Solana, and Arbitrum through smart routing and cross chain infrastructure. This is intended to provide an experience where users can trade without manually bridging assets, reducing operational complexity for multi chain participation.

Automated Market Making and Depth Optimization

The protocol aims to maintain continuous two sided quotes and reduce slippage through professional market makers, algorithmic market making, and incentive mechanisms. Combined with tools such as hidden orders and grid trading, Aster positions itself as a venue designed to attract high frequency, quantitative, and professional derivatives traders.

Privacy Oriented Trading

Aster plans to integrate a privacy focused trading module into its Layer 1. The stated goal is to allow users to conceal specific position and strategy details while maintaining verifiability and audit compatibility. This is positioned as a way to reduce MEV related attacks and malicious copy trading. The roadmap indicates testing of privacy related Layer 1 functions around March 2026.

How Does Aster Work?

Aster follows an application specific Layer 1 model, where matching, liquidation, margin accounting, and risk controls are executed on its own chain. This approach is described as delivering three primary benefits:

- First, it can support higher throughput and lower latency, which is relevant for high frequency and large scale perpetual trading.

- Second, fee policy can be more directly controlled, allowing the protocol to allocate fees within its economic model to areas such as buybacks, staking, or ecosystem incentives.

- Third, chain level functions can be customized around perpetual trading needs, including funding settlement and liquidation modules.

At the application layer, Aster integrates multi chain routing. Assets from BNB Chain, Ethereum, Solana, and Arbitrum are abstracted into forms that can be used for margin and collateral. This enables a unified trading view on the dedicated Layer 1 while liquidity sources remain distributed across networks.

Aster vs Hyperliquid: Which Perp DEX May Lead in 2026?

When comparing Aster and Hyperliquid, there are clear differences across metrics such as market capitalization, TVL, open interest, and market position.

| Metric | Aster (ASTER) | Hyperliquid |

|---|---|---|

| Token Market Cap | $1.2B (#59) | $8.3B (#15) |

| TVL | $1.0B | $4.2B |

| Open Interest | $1.7B | $5.2B |

| Market Position | Upper tier within the sector | First tier leader |

Data Note: Sources are CoinGecko and DeFiLlama, as of February 6, 2026.

Overall, Hyperliquid’s advantages are commonly described in three areas. It has first mover and scale advantages, with higher trading activity and TVL that support stronger depth and liquidity quality. Its dedicated chain has operated longer, and its ecosystem around MEV, quantitative strategies, and contract interactions is more mature. It also holds strong user mindshare within the narrative of professional on chain perpetual trading.

Aster’s positioning is described through a different set of advantages. Its token model is presented as more aggressive, with high buyback ratios and a burn mechanism that can amplify value capture if trading volume grows. It emphasizes a multi chain plus privacy narrative, combining multi chain asset support with a planned privacy Layer 1 module. It is also in a growth stage during 2025 and 2026, which is framed as a period where trading and TVL growth rates could exceed those of more mature competitors.

What is the ASTER Token?

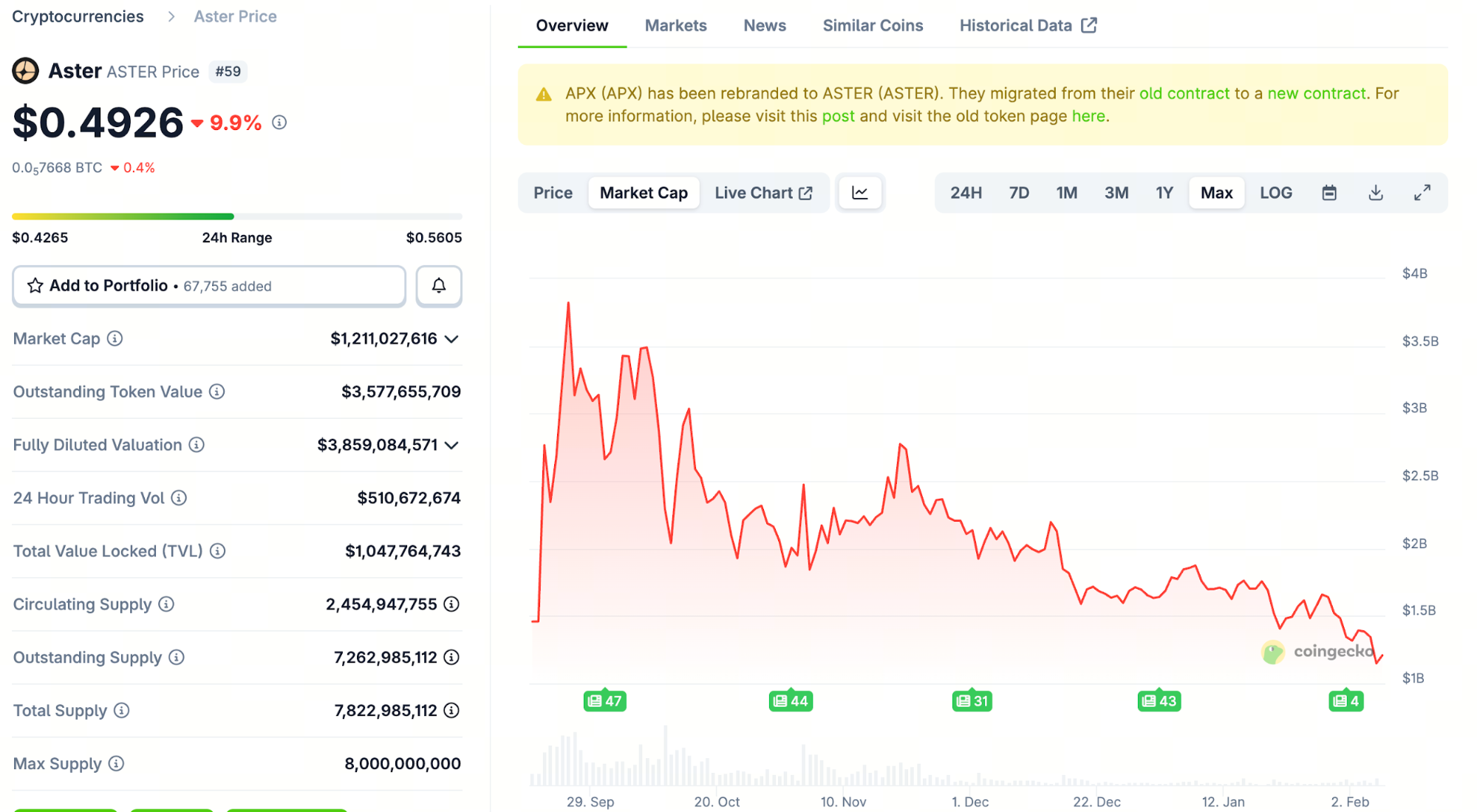

ASTER is the core token of the Aster ecosystem. It is designed to support decentralized governance, incentivize participation, and align long term sustainability. Key token information included in the source is as follows:

- Token symbol: ASTER.

- Current price: $0.49.

- Circulating market cap: approximately $1.207B.

- Market cap rank: 59.

- Twenty four hour change: -9.9%.

- Total value locked: $1.0B.

Screenshot Source: CoinGecko, as of February 6, 2026.

What Are the Use Cases of ASTER?

Based on the protocol design, the described use cases include governance, fee discounts, staking related benefits, and ecosystem incentives.

In governance, holders can vote on proposals such as parameter adjustments, buyback ratios, and treasury allocation plans. In fee discounts, active traders or users who stake may receive maker or taker fee reductions. In staking, once staking is launched, holders may lock ASTER to receive a share of protocol fees, additional airdrop benefits, or access to dedicated events. In ecosystem incentives, airdrops, market making rewards, and ecosystem fund programs are expected to use ASTER as a primary incentive asset.

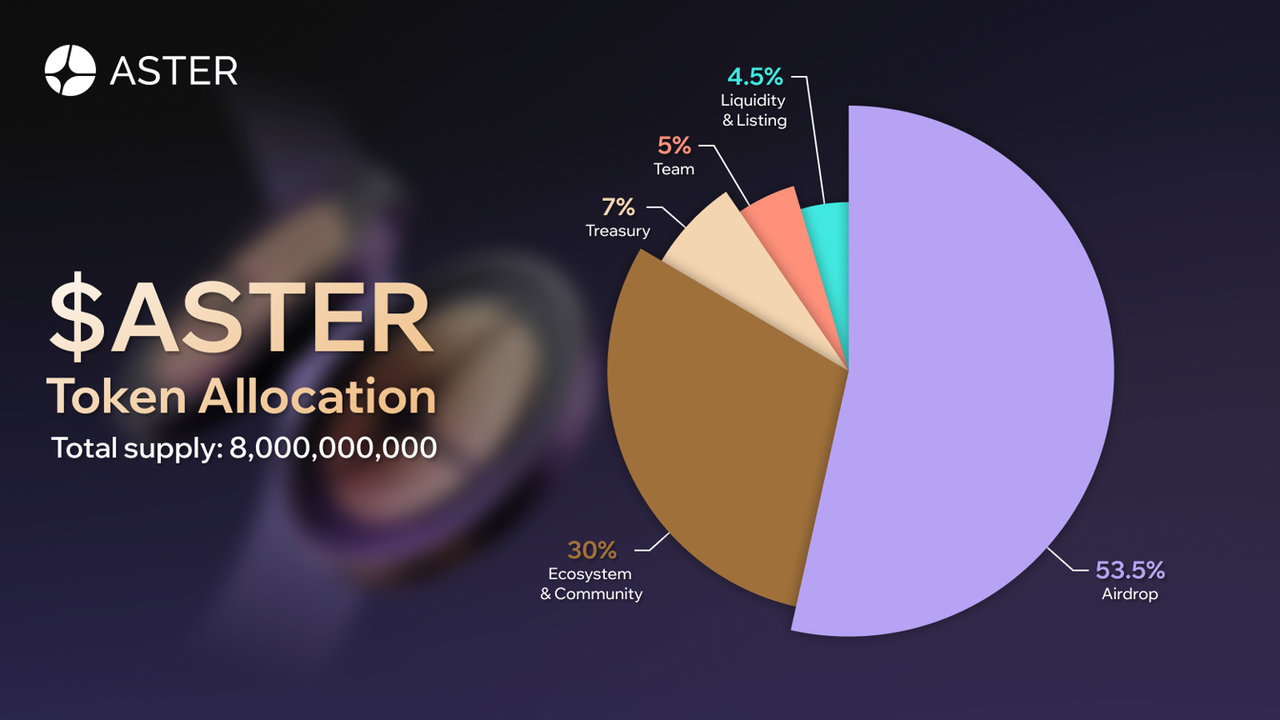

ASTER Tokenomics and Allocation

ASTER has a total supply of 8 billion tokens. As of January 6, 2026, circulating supply is reported at approximately 3.67 billion tokens, which is about 45.9% of total supply. Fully diluted valuation is reported at approximately $3.8B.

In allocation design, Aster assigns a relatively high share to airdrops and ecosystem programs. The figures given are 53.5% and 30% respectively. This is presented as reflecting a community first and liquidity first orientation.

How to Buy ASTER

At the time described in the source, ASTER is listed on multiple mid to large exchanges and several major decentralized exchanges. Users can obtain exposure through spot trading or related derivatives, or use Aster’s aggregated entry points for swapping and cross chain capital routing.

Participation in Aster trading, staking, tasks, and Layer 1 testnet or mainnet activities may also provide eligibility for airdrops or incentives. The Phase 6 airdrop stage called Convergence is described as ongoing, starting on February 2, 2026 and lasting eight weeks.

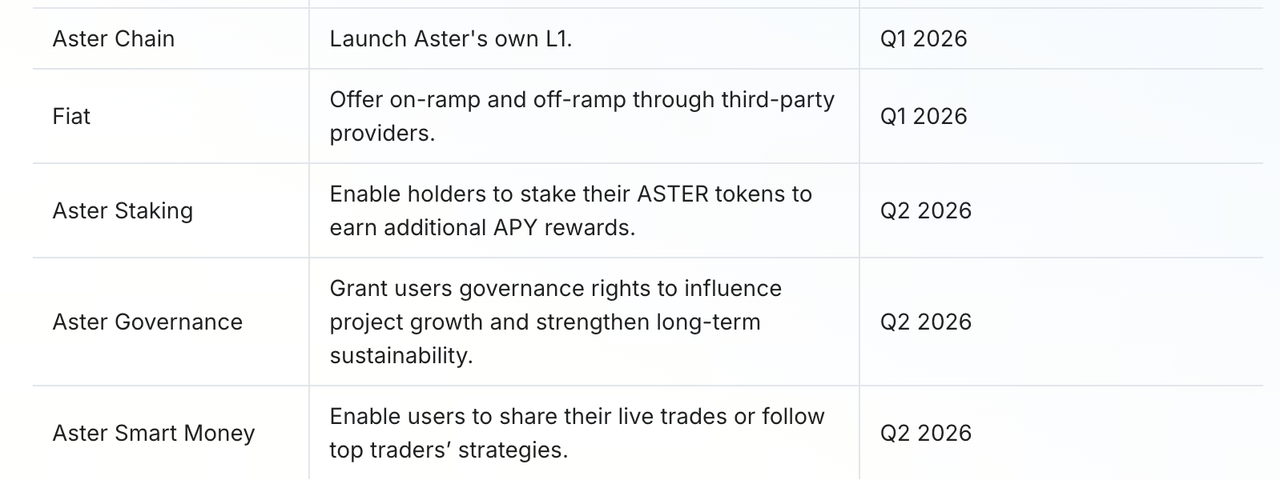

Aster Roadmap and Key Milestones

Since the restructuring, Aster is described as having completed an initial phase that included product integration, brand rebuilding, and early user growth. It is now entering a second phase focused on dedicated chain deployment and ecosystem expansion. Based on official documentation, the key milestones for 2026 are described as follows.

Screenshot Source: Aster official website.

The Layer 1 mainnet launch is intended to complete the shift from multi chain contracts plus aggregation toward a model based on an application specific chain plus multi chain assets. A fiat on ramp is planned to reduce entry barriers for users moving from fiat into perpetual trading. Core code is expected to be open sourced to support developers building secondary applications such as strategies, social trading, and liquidation services. Staking for ASTER and related assets is planned to form a more complete loop for token value capture.

Key Aster Updates in 2026

On January 30, 2026, official updates stated that Stage 6 of the airdrop, Convergence, would open from February 2 and run for eight weeks, allocating 0.8% of total ASTER supply. The airdrop is described as split into 0.4% base allocation and 0.4% locked rewards. Users can claim the base portion immediately, in which case the locked portion is burned, or wait until a six month lock period ends to claim the full allocation.

Image Source: Aster X.

The protocol also stated that ASTER staking was in final preparation, and that future token distribution would transition toward a staking based allocation approach, positioning the ecosystem toward a more deflationary structure.

On February 3, Aster announced that it would launch a Stage 6 buyback plan starting February 4, 2026. The plan states that up to 80% of daily platform fees may be used for ASTER buybacks.

This includes an automated daily buyback component that uses 40% of fees and executes daily through the system, aiming to reduce circulating supply over time and provide on-chain support that is designed to be stable and predictable.

It also includes a strategic buyback reserve that uses 20 to 40% of fees. The team can apply this portion flexibly based on market conditions, using targeted buybacks during volatility or specific windows.

On February 5, Aster announced that after one month of intensive testing and the successful run of Human vs AI Season 2, the Aster Chain testnet was open to all users.

Conclusion

Looking at Aster’s development path, the project has moved from product integration toward a consolidated brand and protocol focus. Entering 2026, with the full opening of the Layer 1 testnet and the launch of the Convergence airdrop stage, Aster is positioned in an early stage relative to more established leaders.

Relative to competitors, Aster’s differentiators in the source are described as strong value capture mechanisms and a multi chain privacy oriented narrative. While it still trails Hyperliquid in TVL and market share, the planned mainnet release of Aster Chain in 2026 is framed as a potential catalyst that could reshape competition in the on chain derivatives market.

FAQs

What is the essential difference between Aster and Hyperliquid?

Both are perpetual DEX platforms that run on dedicated chains. Aster emphasizes multi chain asset access, a privacy Layer 1 module plan, and an aggressive buyback approach. Hyperliquid benefits from larger scale and a more mature ecosystem, which currently supports stronger depth and stability.

What is the current circulating supply situation for ASTER?

Different data sources report ASTER circulating supply in a range of 1.6 to 2.5 billion tokens. The long term target described by official settings is approximately 3.67 billion tokens in circulation, or about 45.9%. The remaining supply is planned to unlock over time through airdrops and ecosystem programs. After Phase 6, additional supply growth is expected to slow.

How can ordinary users participate in the Aster ecosystem?

Users can buy ASTER through centralized or decentralized exchanges, and participate in perpetual trading to build airdrop eligibility. In the future, users may also stake ASTER or related assets such as USDF or ASUSDF for yield. After the Layer 1 mainnet launches, users may participate as developers or strategy providers within the ecosystem.

How is Aster’s privacy feature different from traditional public blockchains?

Aster plans to introduce a trading model at the Layer 1 level that balances verifiability with privacy. The goal is to keep contract state auditable while hiding specific position and strategy details, reducing the impact of MEV and copy trading on professional traders.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What Is a Yield Aggregator?

What is Stablecoin?