What is RDNT Coin?

What Is Radiant?

Radiant is an omnichain money market protocol that enables lending and borrowing of assets across multiple blockchains by leveraging the LayerZero cross-chain messaging protocol. In decentralized finance, a money market is a lending protocol where users deposit assets to earn interest and use their deposits as collateral to borrow other assets. "Omnichain" means that a single lending market operates collaboratively across different chains, rather than running isolated markets on each blockchain.

RDNT is Radiant’s utility token, designed to incentivize participants who provide value to the protocol. This includes lenders (who supply funds to earn interest), borrowers (who pay interest for borrowing), and RDNT/WETH liquidity providers (who inject both tokens into pools to enhance trading liquidity). According to official sources, the maximum supply of RDNT is capped at 1.5 billion tokens.

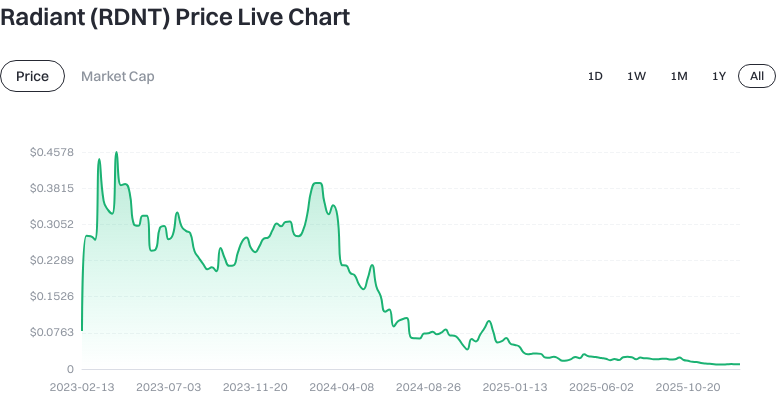

What Are RDNT’s Current Price, Market Cap, and Circulating Supply?

As of January 16, 2026 (based on provided data):

- Latest price: $0.009881 per RDNT.

- Circulating supply: 1,292,073,967 RDNT; Total supply: 1,500,000,000 RDNT; Max supply: 1,500,000,000 RDNT. Circulating supply refers to tokens available for trading in the market; total supply is the aggregate issued amount; max supply is the designed cap.

- Market capitalization (circulating): $14,821,500; Fully diluted market cap: $14,821,500. The fully diluted market cap estimates total valuation based on max supply. The parity between circulating and fully diluted values may indicate similar release states or valuation methodology.

- Market share: approximately 0.00043%.

- Price change: 1 hour +0.01%, 24 hours -3.09%, 7 days -3.23%, 30 days +5.91%.

Click to view latest RDNT price

- 24-hour trading volume: approximately $17,931.11.

Click to view RDNT/USDT price

These data reflect short-term price volatility, with positive returns over 30 days but negative movements in the last 24 hours. Both price and volume fluctuate with market sentiment and liquidity conditions. Always assess your risk tolerance and investment horizon before making decisions.

How Does Radiant (RDNT) Work?

Radiant’s core innovation is cross-chain lending:

- Deposits and interest: Users deposit major assets (such as stablecoins or leading tokens) on supported blockchains. The protocol matches these assets with borrowers, allowing lenders to earn interest.

- Collateralization and borrowing: Deposited assets serve as collateral. The collateral ratio determines how much can be borrowed relative to the collateral’s value—typically set below full value to mitigate risk.

- Cross-chain coordination: Utilizing LayerZero—a foundational protocol for secure message transmission between blockchains—Radiant synchronizes user lending states across chains. This enables experiences like “deposit on Chain A, borrow on Chain B.”

- Liquidation mechanism: If collateral value falls and the collateral ratio becomes insufficient, liquidation is triggered, selling part or all of the collateral to repay debt and prevent bad debt in the system.

- Token incentives: RDNT is distributed according to an emission schedule to lenders, borrowers, and RDNT/WETH liquidity providers (LPs who supply both tokens to pools), encouraging participation and liquidity provision.

What Can You Do With Radiant (RDNT)?

Key use cases for Radiant include:

- Earn interest by lending: Deposit stablecoins or major tokens to earn protocol interest and potentially receive RDNT rewards.

- Cross-chain borrowing: Deposit collateral on one chain and borrow assets on another, reducing the operational cost of moving assets between blockchains.

- Provide liquidity: Supply RDNT/WETH pairs in supported pools to earn trading fees and token rewards (note the risk of impermanent loss).

- Improve capital efficiency: Use idle assets as collateral to access credit lines for short-term liquidity needs.

Example: Deposit USDC on Arbitrum to earn interest while borrowing USDT on BSC for other strategies; always monitor collateral ratios and cross-chain message confirmation times.

Which Wallets and Extensions Support Radiant (RDNT)?

- EVM wallets: Tools like MetaMask can connect to supported networks and Radiant’s interface for deposit and borrowing operations.

- Hardware wallets: Store private keys offline for enhanced security; can be paired with browser wallets for safer signing.

- Cross-chain messaging and bridging: Radiant synchronizes states across chains via LayerZero. For actual asset transfers between chains, bridging tools may be required; always check network fees and transaction times.

- Blockchain explorers: Use relevant explorers to check transaction hashes and account balances, verifying cross-chain activity and lending records.

Always verify official documentation and contract addresses before using any tool to avoid phishing attacks.

What Are the Main Risks and Regulatory Considerations for Radiant (RDNT)?

- Smart contract risk: Code vulnerabilities or oracle malfunctions may lead to fund losses. Pay attention to audit reports and bug bounty programs.

- Cross-chain risk: Failures or attacks in cross-chain messaging or bridging can compromise asset security or state synchronization.

- Liquidation risk: Falling collateral prices trigger liquidation events. Set prudent borrowing limits and maintain buffers to avoid forced liquidations during market turbulence.

- Liquidity and interest rate risk: Changes in pool size affect rates and borrowing capacity; high demand can drive up borrowing costs.

- Regulatory uncertainty: Lending protocols may face scrutiny or restrictions in some jurisdictions. Compliance requirements (such as KYC/AML) may affect user interactions.

- Account and private key security: Enable two-factor authentication for exchange accounts; securely store seed phrases for self-custody wallets; be vigilant against phishing.

What Is Radiant’s (RDNT) Long-Term Value Proposition?

Radiant’s long-term value depends on demand for omnichain lending alongside protocol security, capital efficiency, and user experience:

- Efficiency from cross-chain coordination: A unified lending market reduces redundant asset movement and repeated collateralization across parallel blockchain ecosystems.

- Tokenomics and participation incentives: RDNT rewards core contributors, helping bootstrap liquidity and usage in early stages; monitor emission schedules for long-term sustainability.

- Security and robustness: Compliance progress, audit quality, effective risk controls, and liquidation mechanisms are critical for fund retention and institutional adoption.

If users embrace cross-chain DeFi narratives and manage associated risks effectively, Radiant may prove valuable in multi-chain interoperability scenarios—though ongoing evaluation of capital scale and usage depth is essential.

How Can I Buy and Safely Store Radiant (RDNT) on Gate?

Step 1: Register a Gate account and complete KYC verification; enable two-factor authentication (2FA) for added account security.

Step 2: Search for “RDNT” on Gate, access the spot trading page, review available trading pairs (such as RDNT/USDT), confirm prices and order book depth.

Step 3: Deposit or purchase funds. Add USDT to your Gate account or use fiat channels to acquire USDT; ensure sufficient balance and account for trading fees.

Step 4: Place your buy order. Choose limit or market orders as needed; confirm quantity and price before submitting. Upon execution, check your RDNT balance in the funding account.

Step 5: Withdraw to a self-custody wallet (optional). Copy the correct network and contract address; transfer RDNT from Gate to your personal wallet (e.g., MetaMask), paying attention to network selection and withdrawal fees.

Step 6: Secure your holdings. Backup your seed phrase offline; consider using a hardware wallet. When interacting with DApps, verify website domains and signature prompts to prevent phishing attacks.

Step 7: Cross-chain usage tips. If you plan to use Radiant on different chains, you may need to bridge assets and pay network fees; always confirm collateralization parameters before acting to avoid liquidations.

How Is Radiant (RDNT) Different From Aave (AAVE)?

- Cross-chain model: Radiant focuses on omnichain coordination by syncing lending states across chains via LayerZero; Aave typically deploys separate markets on each chain, relying more on asset migration than unified states.

- Token utility: RDNT primarily incentivizes lending, borrowing, and liquidity provision; AAVE serves governance functions and risk mitigation (e.g., safety module), with distinct incentive structures and risk models.

- Risk focus: Radiant introduces cross-chain messaging for greater efficiency but increased complexity; Aave benefits from longer-term maturity and audits but requires inter-market fund management across chains.

- User experience: Radiant emphasizes seamless “deposit on Chain A, borrow on Chain B” flows; Aave’s experience centers around single-chain lending with external solutions for cross-chain operations.

Both serve as core lending infrastructure—your choice depends on chain preference, asset support, cross-chain needs, and risk model suitability.

Radiant (RDNT) Summary

Radiant (RDNT) positions itself as an omnichain money market protocol powered by LayerZero for unified lending and borrowing experiences across multiple blockchains. RDNT is distributed as incentives for key ecosystem participants. Current market data shows a modest price level and capitalization with notable short-term volatility; its max supply is set at 1.5 billion tokens. For beginners, understanding money market mechanics such as collateralization and liquidation is crucial—start with small amounts on Gate, practice secure withdrawals, and safeguard keys/accounts diligently. Be aware of cross-chain and smart contract risks; long-term value depends on improving security, capital efficiency, and user adoption. Always assess your own risk tolerance and time horizon before making decisions.

FAQ

What Is the Main Utility of the RDNT Token?

RDNT serves as both the governance and incentive token for the Radiant protocol. Holders can participate in major decision-making votes while earning RDNT rewards through lending activities. Staking RDNT also enables additional yield opportunities—making it a core credential within the Radiant ecosystem.

How Can Beginners Start Lending With RDNT?

First, purchase RDNT or other major assets on Gate. Then connect your wallet to the official Radiant platform. Select assets you wish to deposit or borrow and set relevant interest parameters—then start participating in lending. It’s recommended to begin with small amounts to learn the workflow while maintaining healthy collateral ratios to avoid liquidation.

Where Does RDNT Derive Its Value and Yield?

RDNT’s value comes from three sources: governance rights enabling holders to vote on key decisions; incentive rewards from lending activities; staking yields for locked tokens. As Radiant expands across more blockchains and usage grows, long-term demand for RDNT may rise accordingly.

What Sets RDNT Apart From Other Lending Tokens?

RDNT’s standout feature is omnichain deployment—users can access Radiant across multiple blockchains. Compared with single-chain lending platforms, RDNT offers enhanced asset mobility plus a unique incentive structure that encourages diverse contributions through tiered rewards.

What Risks Should RDNT Holders Be Aware Of?

Key risks include smart contract vulnerabilities that could expose the protocol to attacks; market risk due to RDNT price fluctuations; liquidation risk if collateral ratios drop too low resulting in forced liquidations. Regularly monitor your positions’ safety—consider storing tokens on secure exchanges like Gate—and avoid excessive leverage.

Glossary of Key Radiant Capital (RDNT) Terms

- Lending protocol: A smart contract system allowing users to pledge crypto assets as collateral in order to borrow other assets.

- Cross-chain interoperability: The technological ability for assets to move or interact seamlessly between multiple blockchains.

- Staking rewards: Incentive income earned by users who stake tokens—encouraging long-term holding and network participation.

- Liquidation mechanism: Automated asset protection protocol that triggers when collateral value falls below safety thresholds.

- Liquidity pool: Aggregated user funds forming a pool that supports robust liquidity in lending markets.

Radiant (RDNT) References & Further Reading

-

Official Website / Whitepaper:

-

Development / Documentation:

-

Media / Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?