Bitcoin Dips to 10-Month Low Support — Could This Pattern Trigger a Rebound?

Key Takeaways

-

Bitcoin has dropped into a major 10-month support zone between $74,500–$78,600

-

The weekly chart shows a developing head and shoulders structure

-

BTC has corrected nearly 40% from its all-time high near $121,900

-

Reclaiming the 100-week MA around $87,263 could trigger a move toward $109,568

-

A breakdown below support may expose BTC to deeper downside toward the $49,000 region

Bitcoin has entered a critical phase in early February 2026, sliding into a zone that hasn’t been meaningfully tested in nearly ten months. After weeks of sustained selling pressure, BTC has dropped into the $74,500–$78,600 support range, an area that previously acted as a strong base during April-2025.

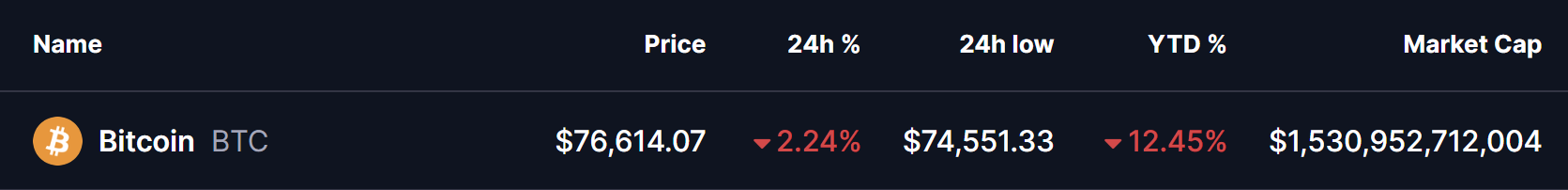

As of February 2, 2026, Bitcoin is trading near $76,614, down 2.24% over the past 24 hours, with an intraday low touching $74,551. On a broader scale, BTC is now down 12.45% year-to-date, erasing a large portion of the late-2025 rally and pushing market sentiment back into caution mode.

Source: Coinmarketcap

Yet, while price action looks heavy on the surface, the weekly chart structure suggests this move may be more than just panic-driven selling.

A Head and Shoulders Structure Near Completion

On the weekly timeframe, Bitcoin is carving out a developing head and shoulders pattern, a classic structure that often marks a major transition in trend. The “head” of the pattern formed near Bitcoin’s all-time high region around $121,900, from where BTC has corrected roughly 40% at its worst point.

The recent breakdown below the 100-week moving average, currently near $87,263, accelerated downside momentum and dragged price directly into the neckline support zone between $74,500 and $78,600.

Bitcoin (BTC) Weekly Chart/Coinsprobe (Source: Tradingview)

This neckline is not just a random horizontal level. Historically, it has acted as a high-demand area, absorbing selling pressure and triggering strong rebounds. The latest weekly candle shows a clear downside wick into this zone, hinting that selling momentum may be weakening as buyers cautiously step in.

Liquidity Clusters Hint at a Potential Upside Magnet

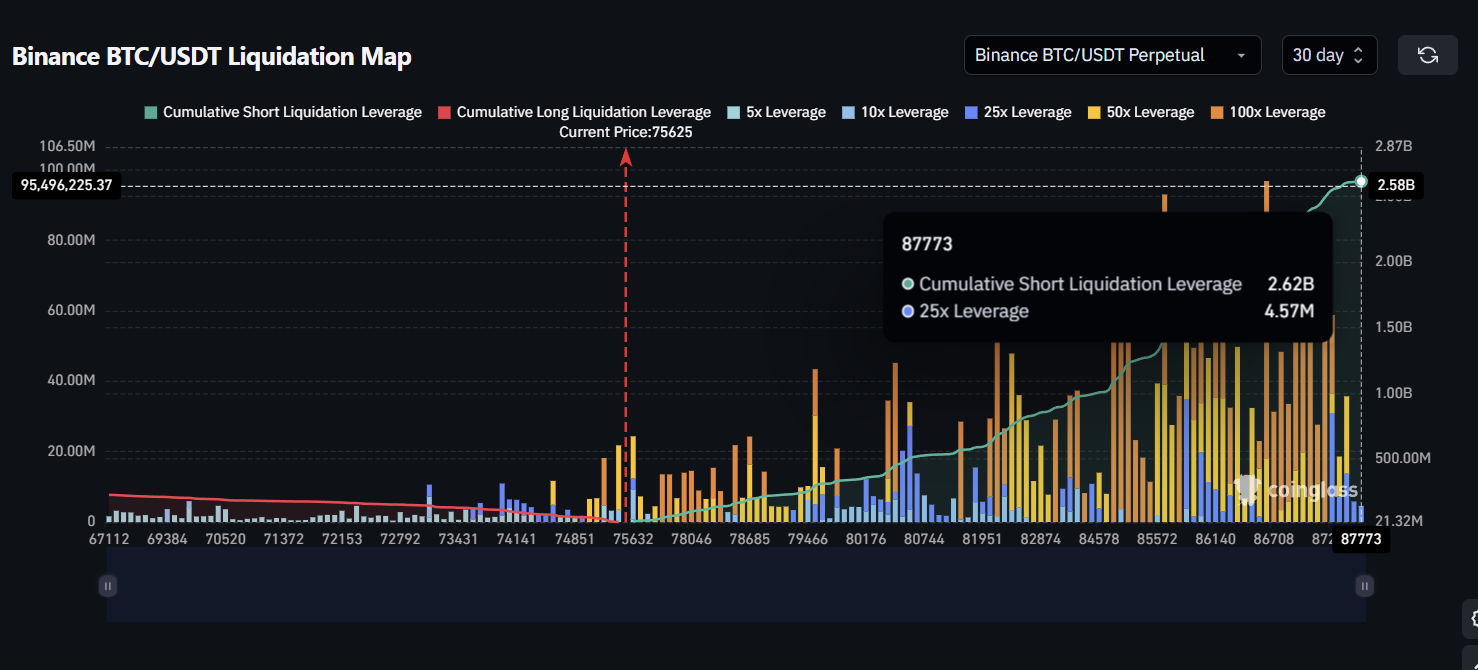

Adding weight to the rebound narrative, Coinglass data highlights over $2.60 billion in liquidity stacked above the $87,000 region. This cluster creates a potential upside magnet if price manages to stabilize and reclaim key resistance levels.

Source: Coinglass

From a market mechanics perspective, such liquidity zones often attract price once downside pressure cools, especially after a prolonged corrective move like the one Bitcoin has just experienced.

What the Chart Suggests Going Forward

If Bitcoin manages to defend the neckline support and reclaims the 100-week MA near $87,263, momentum could shift meaningfully in favor of bulls. In that scenario, a recovery toward the $109,568 region becomes technically plausible — representing a potential 40%+ upside move from current levels.

Such a rally would likely form the right shoulder of the larger head and shoulders structure, leaving BTC at a critical decision point between trend continuation or renewed consolidation.

On the flip side, failure to hold the $74,500–$78,600 zone would significantly weaken the structure. A clean breakdown below this area could open the door to a deeper correction toward the $49,000 region, where the next major liquidity pocket and historical support reside.

The Market’s Defining Moment

For now, Bitcoin is sitting at a make-or-break level. The neckline zone remains the battlefield where bulls and bears are actively fighting for control. How price reacts here will likely set the tone for the next major trend — whether that’s a relief rally driven by liquidity hunts or a continuation of the broader corrective phase.

One thing is clear: this is not a level the market can ignore.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

The risk of a US government shutdown and its impact on Bitcoin

Strategy Perpetual Preferred Stock STRC returns to $100 par value for the first time since mid-January

Strategy Perpetual Preferred Stock STRC returns to $100, opening a new round of Bitcoin "financing buy-in" channel

Bitwise CEO reveals that their clients bought $11 million worth of Bitcoin during the market downturn

Bitcoin Teeters Above $60K as $350M in Leveraged Longs Face Liquidation — Is the Bottom Really In?

Nancy Guthrie Case: Bitcoin Wallet Moves $300, Polymarket Traders Now 78% Certain of Arrest