It is a war of the Bitcoin banana narrative as market veteran Peter Brandt shares conflicting views with an executive from leading asset manager Fidelity.

Brandt particularly called out Jurrien Timmer, who is the director of global macro at Fidelity, for the outlook from his own version of the Bitcoin banana chart. The market veteran called the chart “food from Aruba,” taunting that it looks fabulous.

Key Points

- It is a war of the Bitcoin banana narrative as market veteran Peter Brandt shares conflicting views with an executive at leading asset manager Fidelity.

- Brandt particularly called out Jurrien Timmer, who is the director of global macro at Fidelity, for the outlook from his own version of the Bitcoin banana chart.

- His chart shows that the apex cryptocurrency is near the banana peel—marked in green and has historically aligned with its base—and should fall into it, as in past cycles.

- The Fidelity chart shows that Bitcoin is in a corrective phase but marks $60,000 as a possible bottom.

War of the Bitcoin Banana Chart

Peter Brandt’s Bitcoin Banana ChartThe veteran trader has been big on this structure, as it has formed his narrative that Bitcoin could revisit multi-year lows to find support before any further bullish break. His chart shows that the apex cryptocurrency is near the banana peel—marked in green and has historically aligned with its base—and should fall into it, as in past cycles.

Peter Brandt’s Bitcoin Banana ChartThe veteran trader has been big on this structure, as it has formed his narrative that Bitcoin could revisit multi-year lows to find support before any further bullish break. His chart shows that the apex cryptocurrency is near the banana peel—marked in green and has historically aligned with its base—and should fall into it, as in past cycles.

However, he shared another version of the Bitcoin banana chart from Timmer in the tweet. While the Fidelity exec’s exposition does not explicitly regard the graph as a banana chart, it shared similarities in shape.

Conflicting Stance

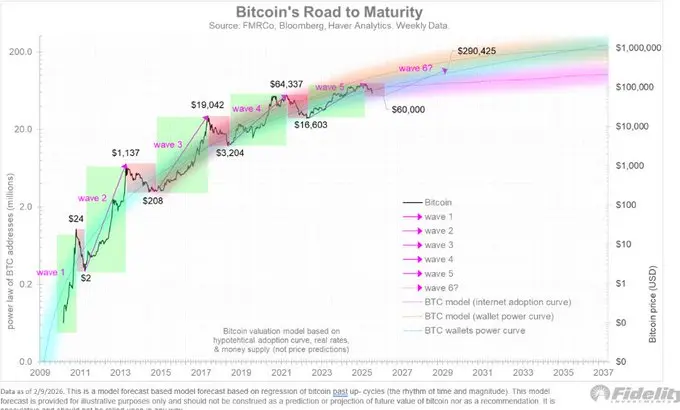

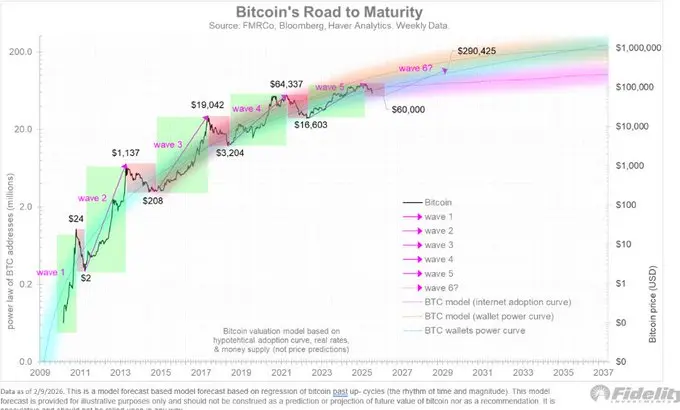

The Fidelity chart, titled “Bitcoin’s Road to Maturity,” highlights how the asset has progressed since its inception. It shows that Bitcoin is currently in a corrective phase but marks $60,000 as a possible bottom.

Fidelity Bitcoin Maturity ChartFrom there, it expects the pioneering cryptocurrency to enter wave 6, targeting a new all-time high of $290,456. While Brandt did not dispute the possibility of this price, he finds its nearly immediate broadening outlook contentious.

Fidelity Bitcoin Maturity ChartFrom there, it expects the pioneering cryptocurrency to enter wave 6, targeting a new all-time high of $290,456. While Brandt did not dispute the possibility of this price, he finds its nearly immediate broadening outlook contentious.

The Fidelity chart suggests an expansion in the near term as BTC nears its bottom, while Bandt predicts a further downward trend. The conflicting views led to Brandt’s “playing around” comment.

$42,000 BTC Target?

From there, he sees a “hop, skip, and jump,” insinuating a massive rebound, possibly to unprecedented prices. Notably, there is no guarantee that BTC will drop that low, as some industry leaders have argued it will not experience a steep decline as in past cycles, given its curtailed uptrend during the bull season.

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

Data: Bitcoin spot ETF experienced a net outflow of $275.81 million yesterday

According to reports, Bitcoin spot ETF net outflows have reached $275.81 million. The outflows from major ETF products include $72.92 million from BlackRock and $92.60 million from Fidelity. Other products also experienced varying degrees of outflows, with only WisdomTree recording inflows of $6.78 million.

GateNewsBot2m ago

JPMorgan Turns Bullish on Crypto 2026: ‘Institutional Flows Will Drive Recovery’ — Despite Bitcoin Below \$67K

JPMorgan has issued its most constructive crypto outlook in two years, predicting institutional inflows and regulatory clarity will fuel a 2026 recovery. The call comes as Bitcoin trades below estimated production cost ($77K) and the Crypto Fear & Greed Index sits at 12. We analyze the bank’s shifting stance, the miner capitulation signal, and the departure of Kinexys co‑head Naveen Mallela—progress, not panic.

CryptopulseElite28m ago

The risk of a US government shutdown and its impact on Bitcoin

The likelihood of a U.S. government shutdown rose to 85%, stemming from budget negotiation deadlock. Potential economic consequences include federal employee furloughs and service interruptions. Financial markets may experience volatility, but Bitcoin shows unusual stability, suggesting investor confidence in its value storage role may depend on the shutdown's duration and impact.

TapChiBitcoin35m ago

Strategy Perpetual Preferred Stock STRC returns to $100 par value for the first time since mid-January

The perpetual preferred stock STRC issued by Strategy has regained the $100 par value during the U.S. trading session. This price level is critical for the company's additional Bitcoin issuance. STRC previously dipped to $93 along with Bitcoin fluctuations, but recent market rebound has restored its par value, with an annualized dividend yield of 11.25%.

GateNewsBot47m ago

Strategy Perpetual Preferred Stock STRC returns to $100, opening a new round of Bitcoin "financing buy-in" channel

Despite the recent continuous pullback in Bitcoin prices, enterprise-level crypto asset deployment has not slowed down. The perpetual preferred stock STRC issued by Strategy (MSTR) returned to the $100 par value range during U.S. trading hours for the first time since mid-January. This key price signal is interpreted by the market as the company's renewed ability to raise capital through the capital markets and continue increasing its Bitcoin holdings.

STRC is a financing tool designed by Strategy for long-term Bitcoin acquisition. When its price approaches or exceeds par value, the company can resume the "at-the-market" (ATM) issuance model to continuously raise cash without significantly diluting common shares. The last time STRC traded above $100 was on January 16, when Bitcoin was still around $97,000. Subsequently, as Bitcoin briefly fell to the $60,000 range in early February, STRC was also dragged down to a low of $93.

GateNewsBot52m ago

Bitwise CEO reveals that their clients bought $11 million worth of Bitcoin during the market downturn

BlockBeats News, February 12 — Bitwise CEO Hunter Horsley stated, "One of Bitwise's wealth management clients had never allocated any assets to cryptocurrencies when they first contacted Bitwise two years ago. Today, as the market retraces, this client has invested $11 million in Bitcoin. For many investors who have yet to enter the crypto market, market retracements present an opportunity."

GateNewsBot1h ago

Peter Brandt’s Bitcoin Banana ChartThe veteran trader has been big on this structure, as it has formed his narrative that Bitcoin could revisit multi-year lows to find support before any further bullish break. His chart shows that the apex cryptocurrency is near the banana peel—marked in green and has historically aligned with its base—and should fall into it, as in past cycles.

Peter Brandt’s Bitcoin Banana ChartThe veteran trader has been big on this structure, as it has formed his narrative that Bitcoin could revisit multi-year lows to find support before any further bullish break. His chart shows that the apex cryptocurrency is near the banana peel—marked in green and has historically aligned with its base—and should fall into it, as in past cycles. Fidelity Bitcoin Maturity ChartFrom there, it expects the pioneering cryptocurrency to enter wave 6, targeting a new all-time high of $290,456. While Brandt did not dispute the possibility of this price, he finds its nearly immediate broadening outlook contentious.

Fidelity Bitcoin Maturity ChartFrom there, it expects the pioneering cryptocurrency to enter wave 6, targeting a new all-time high of $290,456. While Brandt did not dispute the possibility of this price, he finds its nearly immediate broadening outlook contentious.