Brother Ma Ji firmly believes "I can buy the dip"! After increasing his ETH long position by 25 times, he cut losses of 147,000 USD, and has already lost over 1 million USD this week.

Ethereum fell below the $2,000 mark at 1 PM Taiwan time on the 11th, and “Brother Maji” Huang Licheng’s trading actions once again became the focus—he closed out a long position in Ethereum he opened a few hours earlier, incurring a total loss of about $147,000, and has cut losses exceeding $1 million this week.

(Background recap: Brother Maji took losses! This morning, he added to his ETH long position to 1,000 coins, but by night, he cut it down to 250,000 USD.)

(Additional background: Brother Maji lost it all! He fully closed a 25x leveraged Ethereum long position, then immediately reopened it, accumulating losses of $25.88 million.)

Today (11th), the crypto market experienced another sharp decline in the afternoon, with Ethereum (ETH) dropping below the $1,970 level around 3 PM Taiwan time. Along with the market’s rapid decline, Taiwanese artist Huang Licheng, known for his trading on Hyperliquid, once again drew market attention due to his on-chain trading activity.

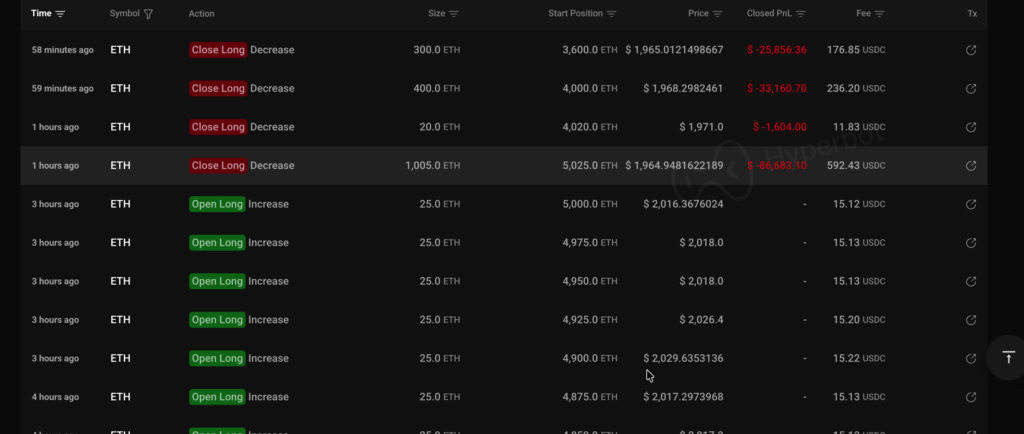

25x Long Position Opened and Closed Again, Nearly $147,300 in Losses

According to real-time monitoring by the on-chain analysis platform Hyperbot, as the market accelerated downward over the past hour, Huang Licheng recognized losses and reduced his ETH long position by 1,725 coins around 1 PM, realizing a loss of approximately $147,304.16.

Notably, Huang Licheng had just liquidated 1,500 ETH longs yesterday and cut 1,650 ETH longs the day before, leaving his holdings at only 3,000 ETH. Yet he still refused to give up, adding to his position again last night, once pushing his holdings back up to 5,025 ETH.

Three consecutive nights of adding to positions and afternoon cut losses—“Stubbornly Betting”

If you follow Brother Maji’s news, most readers probably already know his recent routine: “cut losses in the afternoon, bottom fish at midnight.” This has been happening for three or four consecutive days, with him repeatedly recognizing losses on Ethereum longs in the same pattern. But each time he cuts losses, he remains stubbornly bullish on 25x leveraged ETH, believing his persistence and savings will eventually allow him to bottom fish successfully.

However, this week he has already lost over $1 million. Many commenters in the community suggest that Brother Maji’s routine and tactics may have been targeted by Wall Street and large market makers, turning him into a free ATM.

Related Articles

What to do after the crypto market crashes? Tom Lee provides a "new buying logic" for Bitcoin and Ethereum

Whale 0x28eF Stakes 60,073 ETH Worth $117.08M After Recent Purchase