Tron (TRX) is poised for a breakout thanks to partnerships with Wirex and a series of bullish signals

The price of Tron (TRX) remains on an upward trend above the 0.29 USD level on Wednesday, approaching a key resistance zone. If it can convincingly close above this level, the market is likely to see an initial signal for a new bullish rally. The growth momentum was further strengthened in the previous session, as optimistic sentiment surrounding the strategic partnership with Wirex, combined with on-chain indicators and positive derivatives data, suggests that TRX is accumulating enough strength to enter a notable upward phase in the near future.

Increasing Acceptance of the Tron Network

Wirex – a global digital payment platform with stablecoin infrastructure – announced on Tuesday a strategic partnership with TRON DAO. Under this agreement, both parties will develop a new payment layer that enables real-time, automated, and global on-chain value transfers, integrated directly into the Tron network.

This move is seen as a clear bullish signal in the medium and long term for the native token TRX, as it helps expand network adoption, improve liquidity, and increase TRX’s role within payment ecosystems.

However, in the short term, the market remains somewhat cautious. The TRX price showed only a slight increase after the announcement, fluctuating around the 0.29 USD mark.

On-chain and Derivatives Indicators Show Positive Signs

Data from DefiLlama indicates that the total stablecoin supply on the Tron network has steadily increased since late December, currently reaching 81.79 billion USD — close to the all-time high of 83 billion USD recorded in early August. The strong growth in stablecoin flows reflects increasingly active operations and continuous value accumulation within the Tron ecosystem. This is viewed as a positive sign for price prospects, as network usage improves and the ability to attract new users becomes more evident.

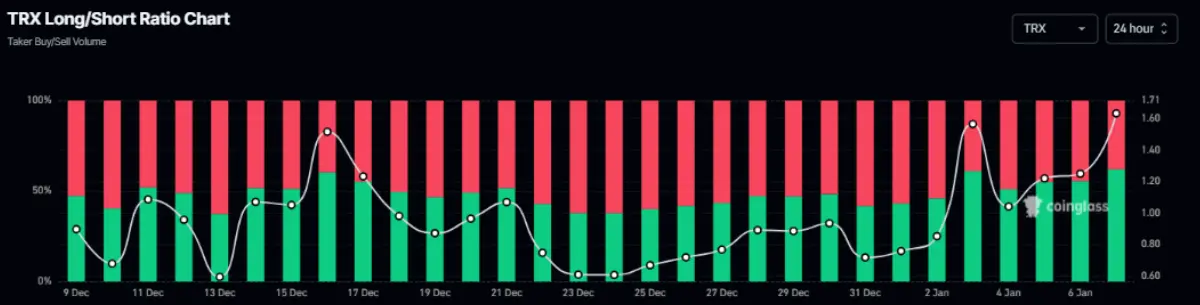

Source: DefiLlama On the other hand, derivatives market indicators also support the bullish scenario for TRX. According to data from Coinglass, the long/short ratio for TRX surged to 1.60 on Wednesday — the highest in over a month. Maintaining this ratio above 1 indicates that most traders are expecting TRX’s price to continue rising in the short term.

Source: DefiLlama On the other hand, derivatives market indicators also support the bullish scenario for TRX. According to data from Coinglass, the long/short ratio for TRX surged to 1.60 on Wednesday — the highest in over a month. Maintaining this ratio above 1 indicates that most traders are expecting TRX’s price to continue rising in the short term.

Source: Coinglass## Tron Price Forecast: TRX Could Rise if It Closes Above 0.29 USD

Source: Coinglass## Tron Price Forecast: TRX Could Rise if It Closes Above 0.29 USD

TRX’s price made a significant breakout by surpassing the 50-day EMA at around 0.28 USD on Thursday, then increased by over 3% through Saturday and retested the resistance zone near 0.29 USD. However, selling pressure at this level remains substantial as TRX has yet to close decisively above the resistance, leading to a slight correction in the following two sessions. At the time of writing on Wednesday, TRX is trading around the 0.29 USD mark, indicating that the bulls are still persistently seeking a clearer breakout.

In a positive scenario, if TRX successfully closes above the 0.29 USD resistance, the upward momentum is likely to extend, pushing the price toward the October 22 high of 0.32 USD.

Daily TRX/USDT Chart | Source: TradingView Technical indicators continue to support the bullish trend. The daily RSI is at 64, well above the neutral 50 level, reflecting strengthening buying momentum. Additionally, the MACD has formed a bullish crossover, with expanding green histogram bars above the neutral line, further reinforcing short-term positive outlook.

Daily TRX/USDT Chart | Source: TradingView Technical indicators continue to support the bullish trend. The daily RSI is at 64, well above the neutral 50 level, reflecting strengthening buying momentum. Additionally, the MACD has formed a bullish crossover, with expanding green histogram bars above the neutral line, further reinforcing short-term positive outlook.

Nevertheless, the risk of a correction remains. If TRX faces profit-taking pressure, the price could retreat to test the 50-day EMA around 0.28 USD — an important support zone that must be maintained to preserve the current bullish structure.

SN_Nour

Related Articles

XRP Yearly Returns Hit Lowest Point Since 2023 - U.Today

Mike Novogratz Says Crypto’s Age of Speculation May Be Ending as Institutions Take Lead

Bitcoin Moves With Tech Stocks, Not Gold, Grayscale Research Shows

Bitcoin Sees $2.3B in Realized Losses As Capitulation Intensifies