Polymarket partners with Circle! Native USDC replaces bridging tokens to enhance capital efficiency

Circle and Polymarket collaborate to bridge USDC.e from Polygon to native USDC. The native token is issued by Circle and can be exchanged 1:1 for USD without relying on cross-chain bridges to improve capital efficiency. Polymarket founder states this will enhance market integrity. USDC has a market cap of $70.77 billion, making it the second-largest stablecoin.

Secure Upgrade from Bridged Tokens to Native Tokens

(Source: Polymarket)

According to an announcement released on Thursday, Polymarket currently uses bridged USDC (USDC.e) on Polygon as collateral for trading and plans to migrate to Circle-issued native USDC in the coming months. This adjustment will transfer Polymarket’s collateral to a stablecoin directly issued and redeemed by Circle, rather than using bridging mechanisms.

Cross-chain bridges are protocols that lock assets on one network and issue corresponding tokens on another to transfer tokens between different blockchains. However, secure cross-chain communication involves trade-offs in security, trust, or flexibility, which are not present on a single blockchain. Historically, cross-chain bridges have been frequent targets of hacker attacks, with total losses exceeding billions of dollars.

The advantage of native USDC is that it eliminates this cross-chain bridge risk. When users use bridged USDC, they rely on the security of the bridge’s smart contracts; if the bridge protocol is hacked or experiences a technical failure, user assets could be stolen or unrecoverable. Native USDC is issued directly by Circle on Polygon, with each USDC backed by corresponding USD reserves, allowing users to redeem USD 1:1 through official Circle channels at any time. This direct issuance and redemption mechanism offers higher security and trust.

From a user experience perspective, native USDC transfers and settlements are faster. Bridged USDC requires verification and confirmation through the cross-chain bridge, which can take minutes or even hours. Native USDC transfers within a single blockchain typically confirm in seconds. This efficiency boost is crucial for prediction market users who need rapid betting and settlement.

Three Major Differences Between Native USDC and Bridged USDC

Security: Native tokens eliminate cross-chain bridge attack risks; bridged tokens depend on third-party protocols

Redemption: Native tokens can be directly exchanged 1:1 for USD with Circle; bridged tokens require cross-chain transfer

Speed: Native tokens confirm within seconds on a single chain; bridged tokens take minutes to hours for cross-chain transfers

Polymarket founder and CEO Shayne Coplan states, “Using USDC will support a consistent, USD-denominated settlement standard, which will strengthen market integrity and reliability as platform participation continues to grow.” Although this statement is official, the underlying logic is clear: with Polymarket’s explosive trading volume (over $3 billion in total transactions in 2024), the demand for stable, scalable settlement infrastructure is increasing, and limitations of bridged USDC are becoming apparent.

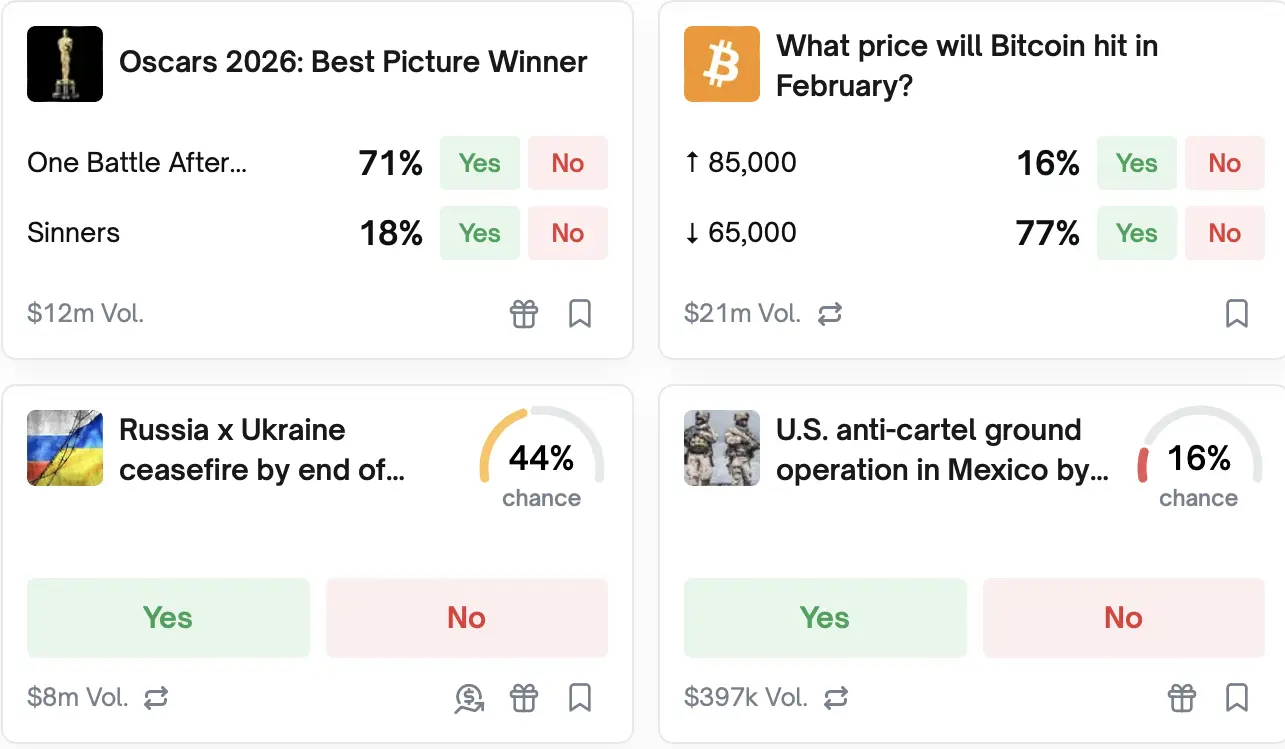

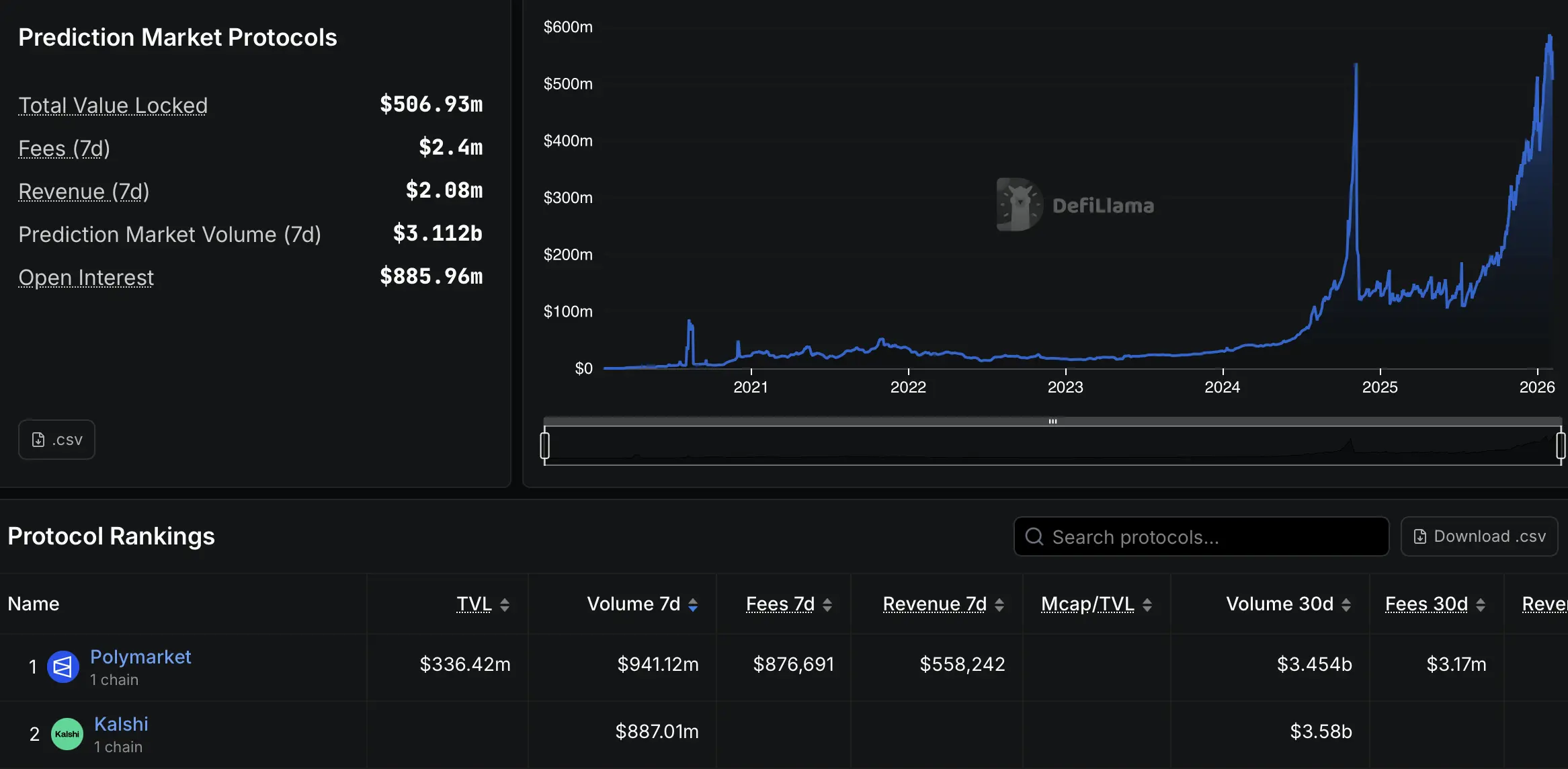

Intensified Competition in Prediction Markets Spurs Infrastructure Arms Race

(Source: DefiLlama)

This upgrade occurs amid fierce competition in prediction markets. While Polymarket and Kalshi remain leading platforms, recent months have seen major crypto exchanges entering the space. In mid-December, Gemini launched its internal prediction market, Gemini Predictions, which, after regulatory approval, offers event-based trading across all 50 US states; a day later, Coinbase announced a partnership with Kalshi to launch a prediction market.

This intensifying competition makes infrastructure a key differentiator. When multiple platforms offer similar event contracts, users choose the one with faster speed, lower costs, higher security, and better liquidity. Polymarket’s early upgrade to native USDC is a strategic move to gain an edge in this infrastructure arms race.

Backed by major exchanges, Coinbase and Gemini’s prediction markets have advantages in liquidity and user base. To maintain its lead, Polymarket must continue innovating its technical infrastructure. Upgrading from bridged USDC to native USDC is just the first step; future upgrades may include faster settlement, lower transaction fees, and more diverse event types.

According to data from Defillama, USDC is now the second-largest stablecoin after Tether’s USDT, with a market cap of approximately $70.77 billion. Polymarket’s choice of USDC over USDT as its settlement currency may be driven by several considerations. First, compliance: Circle, as the issuer of USDC, is under strict regulation in the US with high financial transparency, which is advantageous as prediction markets face increasing regulatory scrutiny. Second, integration with major US exchanges like Coinbase enhances liquidity and acceptance. Third, technical support: Circle provides comprehensive APIs and developer tools, facilitating integration.

Regulatory Scrutiny and Insider Trading Risks

Despite the growing popularity of prediction markets, some analysts worry they may be vulnerable to insider trading, citing examples where traders appear to profit from non-public information or influence data used to set market prices. The “potato” incident at the Grammys is a controversial case; although ultimately confirmed as a marketing stunt, it highlights the potential for manipulation in prediction markets.

State regulators in the US have also raised concerns, with questions about whether event contracts constitute gambling, facing legal reviews from Massachusetts, New York, and other jurisdictions. This state-level regulatory pressure poses a threat to the entire prediction market industry. While the CFTC has withdrawn federal bans, states can impose restrictions based on their own gaming laws.

Polymarket’s upgrade to native USDC may also be motivated by compliance considerations. Using a regulated stablecoin issued by a compliant entity like Circle makes it easier to demonstrate the legitimacy and transparency of funds during regulatory reviews. If prediction markets need to apply for financial licenses or undergo audits in the future, the traceability and compliance of native USDC will be a significant advantage.

For Polymarket users, this upgrade is neutral to slightly positive. In the short term, they may need to adapt to new deposit and withdrawal procedures, but in the long run, they will benefit from safer and more efficient trading experiences. For large traders, eliminating bridging risks is especially important, as cross-chain bridge failures can lock funds for hours or days.

Related Articles

Whale "0x6C8" Deposits $1.99M USDC to HyperLiquid, Increases ETH Long Position to $87.8M

Stripe launches beta version of machine and AI agent payments, supporting USDC and X.402 standards

USDC Treasury has added a new minting of 250 million USDC on the Solana blockchain.

Decentralized trading platform edgeX receives investment from Circle Ventures

Visa enables on-chain settlement of Ethereum stablecoins, with USDC annual trading volume exceeding $3.5 billion

An address with a loss of over $1.3 million USD deposited $3.85 million USD in USDC into Hyperliquid and placed an order to short 3000 ETH.