Why Some Traders Say Bitcoin’s 21 Million Cap Is Being Diluted Off-Chain

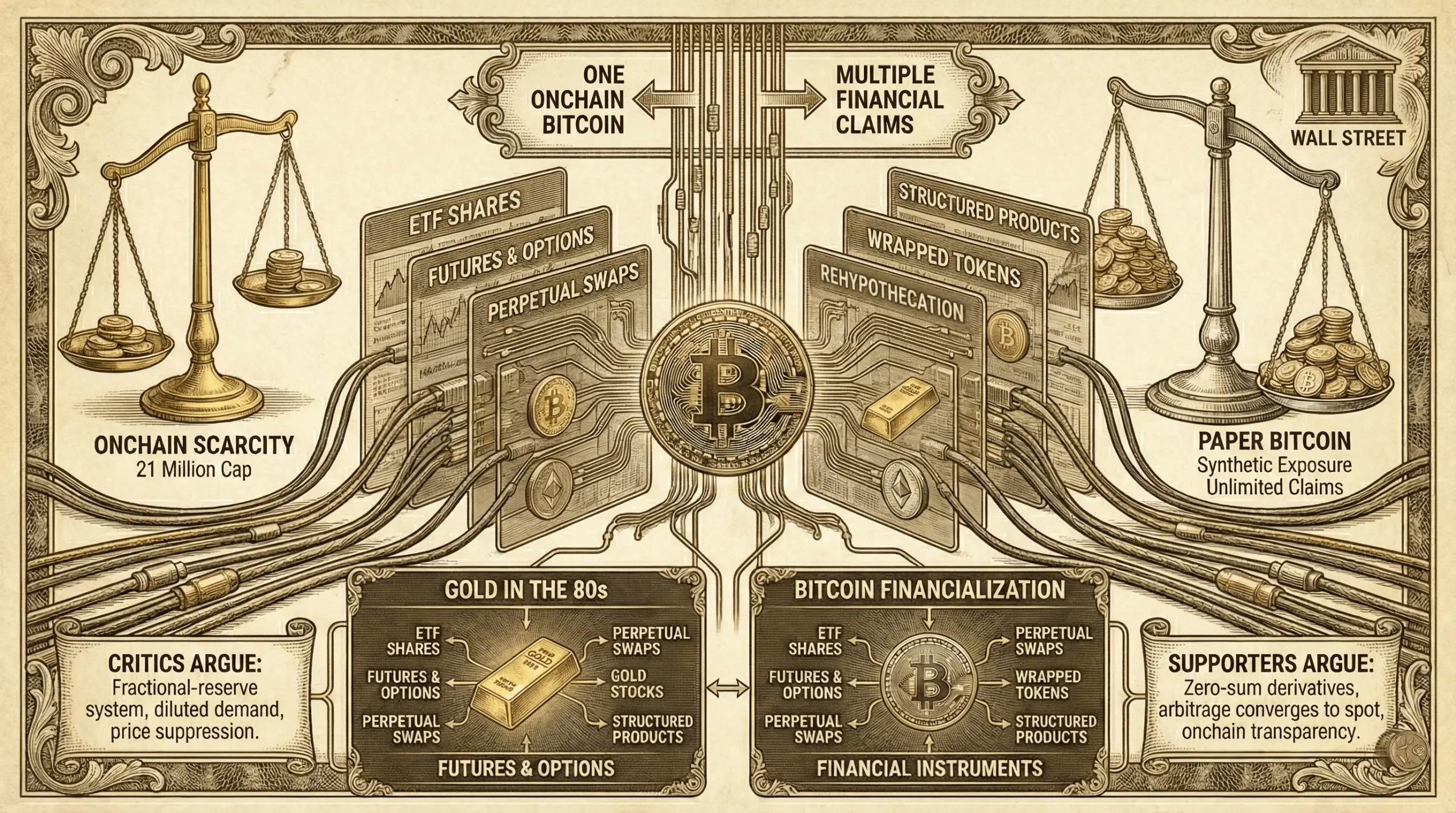

Several X accounts have reignited a long-running debate in bitcoin circles, arguing that a single onchain bitcoin now underpins multiple financial claims across exchange-traded funds (ETFs), futures, perpetual swaps, wrapped tokens, and structured products. The argument, often labeled the “paper bitcoin” theory, draws direct comparisons to gold’s financialization in the 1980s, when derivatives came to dominate price discovery.

Paper Bitcoin vs. Onchain Scarcity

The discussion has gained traction as bitcoin’s price action dropped massively despite rising institutional participation, ETFs, and expanding derivatives markets. Critics argue that bitcoin’s fixed onchain supply still exists in theory, but that price discovery has migrated off-chain into layers of synthetic exposure that behave more like a fractional-reserve system than a scarce digital asset.

“Maxis won’t tell you this, but bitcoin has been fractionalized,” the X account dubbed Nolimit stated. “Wall Street didn’t buy bitcoin to pump your bags and make you rich lol. They bought it to turn it into a fee-generating instrument, just like they did with gold in the 80s,” the account added. The Nolimit post quickly gained traction on X, drawing thousands of likes and racking up hundreds of reposts as the argument spread virally.

At the center of the debate is a simple claim: one real bitcoin can simultaneously support several paper claims. An ETF share may be backed by custodial bitcoin, while futures and options hedge that exposure, perpetual swaps amplify leverage, wrapped bitcoin creates tokenized versions elsewhere, and banks issue structured notes tied to price or volatility. None of these instruments requires new bitcoin to be mined, yet all influence market pricing.

Supporters of the theory argue that this structure allows synthetic supply to expand far beyond the 21 million coin cap in practice, even if not onchain. As derivatives volume grows, they say, demand for physical bitcoin becomes diluted, with buying pressure absorbed by cash-settled products rather than spot markets.

At the same time, multiple X accounts began circulating nearly identical claims, a repetition that struck some observers as unusual. “The 21 million cap doesn’t matter anymore. Why? Because the market isn’t trading real bitcoin, it’s trading ‘Paper BTC,’” the X account Nonzee wrote. It was almost as if the posts followed the same cadence and structure, striking a chord with X’s algorithm in the process. Nevertheless, the approach worked and pulled widespread engagement into the so-called theory.

This framework mirrors what critics describe as “paper gold,” where futures contracts and unallocated accounts came to dominate price discovery decades ago. By the 1980s, gold markets were heavily influenced by derivatives trading on exchanges like COMEX, with physical delivery becoming the exception rather than the rule. The result, according to skeptics, was muted volatility and persistent price containment despite rising demand.

Applied to bitcoin, the paper bitcoin theory suggests that derivatives-heavy markets enable large players to short rallies, trigger liquidations, and cover at lower prices without sourcing actual bitcoin. In this view, leverage and positioning—not onchain scarcity—drive short-term price movements.

Some analysts quantify this effect using metrics that compare derivatives’ open interest to liquid onchain supply, arguing that synthetic exposure can inflate effective float by double-digit percentages. This, they say, explains why major ETF inflows do not always translate into immediate price appreciation. A similar argument has been applied to bitcoin treasury firms and industry heavyweights such as Michael Saylor’s Strategy. Saylor’s purchases, data shows, barely move the needle in today’s market.

The theory has also revived concerns around rehypothecation. When bitcoin sits with custodians, exchanges, lending desks, and so on, it may be used as collateral for multiple obligations at once. If claims exceed reserves, the system functions less like direct ownership and more like layered credit.

Critics of the paper bitcoin thesis push back hard. They argue that derivatives are inherently zero-sum, with every long matched by a short, preventing unlimited directional pressure. Futures and perpetual swaps, they note, converge toward spot prices through funding rates, arbitrage, and expiration mechanics.

Others emphasize bitcoin’s transparency as a key distinction from gold. Onchain supply is publicly verifiable, custodians are audited, and large-scale shortages would quickly surface if claims materially exceeded reserves. You can’t audit gold with a blockchain explorer. In this view, derivatives may amplify volatility but cannot permanently suppress price without triggering market stress.

There is also a structural argument that institutional adoption naturally shifts price discovery toward deeper, more liquid venues. As markets mature, leverage and hedging increase, smoothing price swings rather than destroying scarcity.

Still, the debate persists because it strikes at bitcoin’s core narrative. Bitcoin was designed as a bearer asset, where ownership and supply were inseparable from private keys. The more exposure shifts to paper instruments, critics argue, the further price behavior drifts from that original model.

Read more: ‘I’ll Keep Buying’: Dave Portnoy Doubles Down on XRP as Price Falls

Whether the paper bitcoin theory reflects structural manipulation or simply market evolution remains unsettled. What is clear is that bitcoin’s growing role in traditional finance has introduced layers of abstraction that did not exist in its early years, reshaping how scarcity, ownership, and price discovery interact.

For now, the argument continues to circulate across X and crypto circles, fueled by choppy markets and an uneasy sense that bitcoin’s exchange plumbing matters just as much as its code.

FAQ ❓

- **What is the paper bitcoin theory?**It argues that derivatives and financial products create synthetic bitcoin exposure that dilutes real scarcity.

- **Does paper bitcoin mean more BTC exists on-chain?**No, the onchain supply remains capped, but multiple financial claims can reference the same bitcoin.

- Why is gold often used as a comparison? Gold’s price became dominated by derivatives in the 1980s, reducing the role of physical delivery.

- **Can derivatives permanently suppress bitcoin’s price?**Critics say no, citing arbitrage and transparency, while supporters argue they distort short-term price discovery.

Related Articles

New Bitcoin Core Version Released: Fixes for Wallet Migration and P2P Stability - U.Today

Over the past hour, the entire network has experienced liquidations exceeding $84 million, with BTC liquidations reaching $41.71 million.