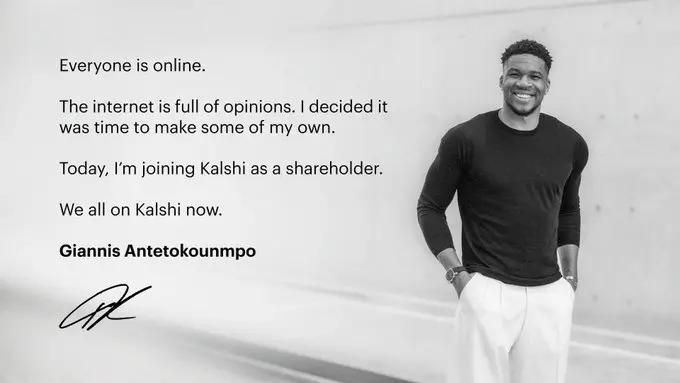

"Greek Freak" Giannis Antetokounmpo becomes a Kalshi shareholder! Predictive markets welcome the NBA's top player

Milwaukee Bucks forward Giannis Antetokounmpo has invested in the prediction market platform Kalshi, becoming the first active NBA player to directly invest in a federally regulated event contract exchange. The two-time MVP announced the partnership on Friday, stating he will participate as a shareholder and collaborate on live events. Kalshi confirmed the agreement but emphasized that internal rules prohibit Giannis Antetokounmpo from trading in any NBA-related markets.

Giannis Antetokounmpo Becomes NBA’s First Player Investor in Prediction Markets

(Source: X)

Giannis Antetokounmpo officially announced the partnership via social media on Friday, marking the first direct investment case of an active NBA player in a prediction market platform. “I like winning. In my view, Kalshi will definitely win, and I’m excited to be involved,” the Greek star said on Twitter, sharing a photo with the Kalshi team.

Kalshi confirmed the deal in a statement, specifying the particular restrictions of the collaboration. Due to internal rules against insider trading and manipulation, Giannis Antetokounmpo will not be allowed to trade in any markets related to the NBA. This restriction aims to prevent conflicts of interest and potential ethical issues, given that as an active player, he has direct influence and inside information on game outcomes.

This restriction is not unfounded. Earlier this week, Kalshi even listed a betting market on whether Giannis Antetokounmpo himself would be traded before the NBA trade deadline. Such cases clearly illustrate why players cannot trade in markets related to themselves—any inside knowledge of trading activity could constitute an unfair advantage.

The NBA’s collective bargaining agreement allows players to promote betting companies under certain conditions, provided they do not promote betting on NBA, WNBA, or G League games. Players can also hold passive equity stakes of up to 1% in such companies. Giannis Antetokounmpo’s investment falls within this scope, meaning his stake is no more than 1% and is a passive investment rather than an active management role.

Giannis Antetokounmpo is not the first basketball figure associated with Kalshi. Reports indicate that Phoenix Suns star Kevin Durant indirectly invested through his co-founded venture fund 35V, alongside his agent Rich Kleiman. However, Giannis’s investment is the first case of an active player directly holding shares in a personal capacity, making it more symbolic and newsworthy.

How Kalshi’s Prediction Markets Work: Not Gambling, But Financial Trading

Kalshi operates a marketplace where users can trade “Yes or No” contracts tied to real-world outcomes. The platform lists markets covering politics, entertainment, and sports, allowing traders to bet on events such as winners, election results, or championship outcomes. This model appears similar to traditional sports betting but has a key legal distinction.

While there is capital flow, Kalshi is considered a financial exchange rather than a sports betting platform. This classification is crucial because it determines the regulatory framework. Kalshi is authorized to operate under federal regulation across the U.S., avoiding the complex state-by-state gambling laws that traditional operators face. Each state has different laws on sports betting, requiring operators to obtain individual licenses, but as a federally regulated financial exchange, Kalshi can operate nationwide uniformly.

Key Differences Between Kalshi and Traditional Sports Betting

Regulatory System: Federal financial regulation vs. State gaming commissions

Product Definition: Event contracts vs. Wagers

Trading Mechanism: Two-sided markets (buy and sell) vs. One-sided bets

Pricing Method: Market-driven dynamic pricing vs. Bookmaker-set odds

Legal Scope: Federal license for nationwide operation vs. State-by-state licensing

This legal distinction allows Kalshi to collaborate with active athletes, whereas traditional betting companies face more restrictions. Although the NBA’s collective bargaining agreement permits players to hold stakes, it strictly limits promotional content, which is why Giannis’s statement emphasizes “live events and marketing activities,” rather than directly promoting NBA betting.

Blurring Lines Between Sports Betting and Prediction Markets Sparks Controversy

This move comes amid increased scrutiny of sports betting. U.S. authorities have recently filed gambling-related charges against several basketball figures, and regulators are investigating the growing overlap between trading platforms and betting markets. This scrutiny does not target Kalshi specifically but reflects regulatory uncertainty across the industry.

Previously, NCAA asked Kalshi to modify language on its website that implied an official relationship with the organization. This incident highlights that even if Kalshi is legally classified as a financial exchange, its operational similarities to sports betting have raised concerns among sports organizations. NCAA worries that such associations could harm the image of college sports or encourage improper conduct among student-athletes.

The NBA’s attitude toward betting is also evolving. The league has signed official partnership deals with multiple betting companies, allowing them to use NBA trademarks and data, while also strictly monitoring betting activities among players, coaches, and referees. This balancing act reflects the league’s attempt to develop new revenue streams while maintaining competitive integrity.

Giannis Antetokounmpo’s investment case provides a test of this balance. If such collaborations prove successful and controversy-free, more players may follow suit. Conversely, any disputes involving conflicts of interest or insider trading could lead the NBA to tighten regulations.

Kalshi’s Expansion Strategy: From NHL to Golf, Full-Scale Sports Entry

Despite the attention, Kalshi continues to expand its influence in sports. In October, the company announced a partnership with the NHL, becoming the league’s official prediction market partner. This collaboration allows Kalshi to use NHL trademarks and team logos, listing hockey-related event contracts on its platform.

In January, Kalshi signed professional golfer Bryson DeChambeau as its first athlete ambassador. DeChambeau, a well-known PGA Tour player, is famous for his scientific approach to training and powerful drives. His endorsement includes attending events and participating in promotional activities related to tournaments he plays in. Unlike Giannis, DeChambeau is not restricted by the NBA’s collective bargaining agreement, so his endorsement scope may be broader.

Kalshi has also made significant strides in media. After partnering with CNN, it became the network’s official prediction market partner. This collaboration allows Kalshi’s market data and forecasts to be cited in CNN’s election coverage and other news programs, greatly increasing brand exposure and credibility.

On the financial front, Kalshi completed a $1 billion funding round, valuing the company at $11 billion. This valuation places Kalshi among unicorns, reflecting investor optimism about the future of prediction markets. The funds will be used for platform expansion, technology upgrades, and marketing, including collaborations with high-profile athletes like Giannis Antetokounmpo.

Prediction Market Boom: Web3 Platforms Surpass $13 Billion in Trading Volume

Giannis Antetokounmpo’s investment occurs amid a broader prediction market boom. The total trading volume of Web3 prediction markets has exceeded $13 billion, reaching a record high even as the overall crypto market cools. This surge has attracted major players from tech and finance, including Fanatics, Coinbase, and MetaMask, which have recently launched or expanded event trading platforms.

Part of this growth is attributed to the accuracy of prediction markets during the 2024 U.S. presidential election cycle. Many prediction markets have outperformed traditional polls in forecasting election results, boosting public trust in these tools. Investors are increasingly viewing prediction markets not just as entertainment but as effective means of harnessing collective intelligence and signals.

Kalshi leads this wave, partly because its federal regulation provides greater confidence for institutional investors. Compared to decentralized crypto-based prediction markets, Kalshi’s fiat settlement and regulatory compliance make it more accessible to mainstream financial institutions and retail investors.

Giannis Antetokounmpo’s involvement and endorsement bring significant brand value to Kalshi. As one of the most influential NBA stars with millions of fans worldwide, his high-profile backing could attract more young users to try prediction markets and signals to regulators and sports organizations that prediction markets are becoming mainstream financial products.

Related Articles

Backpack's valuation surpasses $1 billion, becoming a unicorn! Former FTX employee turns their fortunes around through tokenization

IP Creation and Distribution Platform Xross Road Completes $1.5 Million Pre-Seed Funding

Stripe's valuation soars to $140 billion! Acquisition offers continue to surge, yet they still refuse to go public

466 million subscribers, MrBeast ventures into finance! Acquiring Step Bank hints at a crypto setup

Chiliz Targets the 2026 FIFA World Cup! Fan Token Three-Stage Roadmap Revealed

After investing $200 million in BitMine, MrBeast acquired the banking app Step targeting young people.