Coin distribution in February shifted 300 million tokens, the most aggressive ever! The key defense line has been breached, risking a collapse to $0.128.

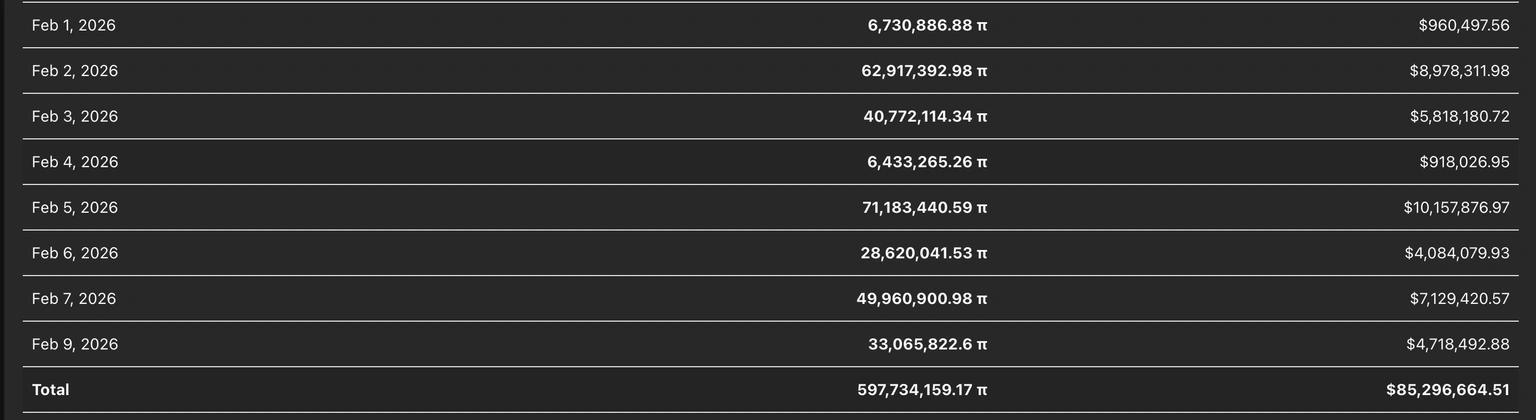

The Pi token has been declining for three consecutive trading days, with the downward trend aligning with the stable mainnet migration, potentially intensifying selling pressure. On Monday, 33.06 million Pi tokens were transferred to the mainnet, bringing the total transfer for February to approximately 300 million tokens. The CEX supporting Pi recorded 324,152 tokens outflow in the past 24 hours. While withdrawals from CEXs usually indicate easing selling pressure, this suggests that supply pressure mainly comes from OTC and other off-exchange channels.

Selling Pressure from 33.06 Million Pi Mainnet Migration in a Single Day

(Source: PiScan)

PiScan data shows that the mainnet migration is progressing smoothly, providing holders with an opportunity to sell Pi tokens and increasing selling pressure. On Monday, 33.06 million PI tokens were transferred to the mainnet, pushing the total transfer for February to about 300 million tokens. This figure is extremely significant in Pi’s history, equivalent to about 30 million tokens migrated daily. If this pace continues throughout the month, the total migration could reach 900 million tokens, far exceeding any previous month.

Mainnet migration means these tokens are shifting from their locked testnet state to a freely tradable circulating state. For early miners who have held Pi for years, this is their first chance to convert “mining rewards” into real fiat currency. This cash-out impulse is very strong, especially after Pi’s price has plummeted over 94% from its peak. Many fear that if they don’t sell quickly, the price could fall even further, missing the last opportunity to cash out.

A monthly migration of 300 million tokens against a circulating supply of about 2.8 billion represents roughly a 10.7% increase in supply within a single month. Such a supply shock is almost impossible among mainstream crypto assets. Bitcoin’s annual inflation rate is only about 1.8%, and Ethereum is even deflationary after transitioning to PoS. Pi’s rapid supply expansion, without corresponding demand growth, will inevitably continue to depress the price.

Even more concerning is that this migration speed may accelerate. As more users complete KYC verification and fingerprint recognition, the number of eligible users continues to grow. If migration speed increases from 30 million to 50 million or more per day, supply pressure will grow exponentially. Under this flood of supply, Pi’s price could continue to decline for months or even quarters.

Three Stages of Pi Mainnet Migration

January: Released about 134 million tokens, price dropped from 0.19 to 0.146

February: Estimated release of about 300 million tokens (migration progress), price continues to hit bottom

In the coming months: If the pace does not slow, monthly releases could reach 300-500 million tokens, creating ongoing pressure

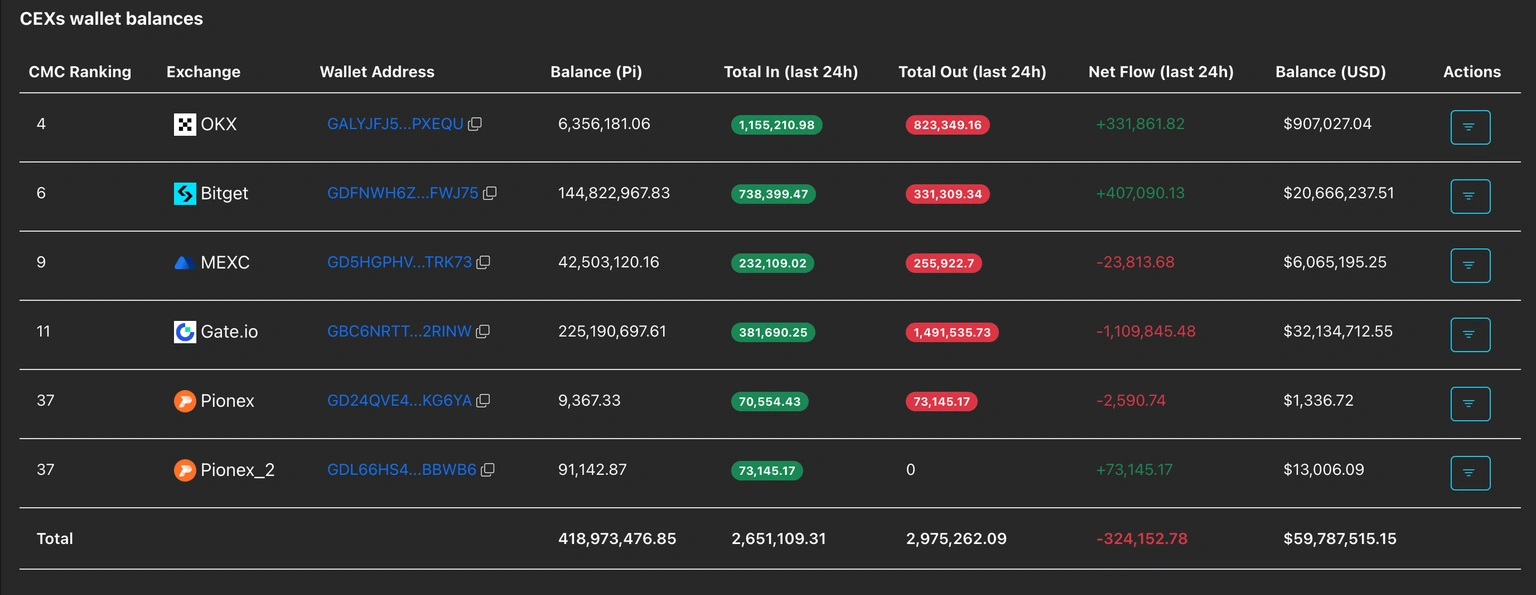

OTC Selling Hidden Behind CEX Outflows

(Source: PiScan)

Meanwhile, centralized exchanges (CEXs) supporting Pi recorded an outflow of 324,152 PI tokens in the past 24 hours. Usually, withdrawals from CEXs suggest reduced selling pressure, indicating that supply pressure may mainly come from OTC and other off-exchange channels. This is a critical insight, as it reveals that the true source of Pi selling may be masked by CEX data.

When Pi flows out of CEXs, it often appears as users transferring tokens to long-term personal wallets, which is typically a bullish signal. However, in Pi’s case, a more likely explanation is that users are withdrawing large amounts from exchanges and selling them via OTC channels to buyers. OTC trades do not show up on public order books, so they don’t directly impact market prices, but they still represent actual selling.

Why use OTC instead of selling directly on exchanges? Mainly due to scale. Early miners holding hundreds of thousands or even millions of Pi cannot sell large amounts on exchanges without crashing the price and getting poor prices. OTC channels allow private negotiations with buyers (often at a discount), enabling large transactions without market impact. This “hidden” selling, while not directly reflected in prices, continuously erodes buying support, making rebounds unsustainable.

The daily outflow of 324,152 tokens on CEXs may seem small, but if this continues and most flow into OTC sales, the cumulative effect will be significant. Assuming similar daily outflows, in a month, about 9.7 million tokens could enter the market via OTC, absorbing potential buying support that could stabilize prices.

Key Support at $0.1400, Next Target at $0.1283

(Source: TradingView)

As of Tuesday’s writing, Pi is approaching the critical psychological level of $0.1400. If the 4-hour chart shows the price breaking below $0.1400, it could test the S1 pivot point at $0.1283. The $0.1400 level is a short-term key level and a psychological barrier. From a previous low of $0.146, only a rebound to around $0.15 has occurred, indicating very weak buying support. If $0.14 cannot hold, market confidence will further collapse.

The 4-hour momentum indicators show that sellers dominate. The MACD is approaching the signal line, with the green histogram shrinking, increasing the risk of a death cross. Meanwhile, the RSI has fallen to 32, nearing oversold territory. If the MACD forms a death cross and RSI enters oversold, Pi could experience a larger correction.

The S1 pivot at $0.1283 is a critical support level in technical analysis. Pivot points are calculated based on the previous day’s high, low, and close prices and are widely used for intraday trading. S1 is the first support level; if broken, the next target is usually S2. A drop from $0.14 to $0.1283 represents about an 8.4% decline. For a token already at a historic low, such a drop could trigger a final capitulation sell-off.

On the upside, if the closing price stays above $0.1450, it could ease downward pressure and push Pi toward the $0.1500 level. However, considering the current mainnet migration pressure, OTC selling hidden flows, and overall bearish technical signals, such a rebound seems unlikely. The more probable scenario is that Pi will oscillate between $0.14 and $0.15 for several days before breaking below $0.14 to seek a bottom.

For Pi holders, the current situation is extremely tough. The price has fallen to historic lows, but supply pressure is not easing; it’s increasing. Rational strategy might be to acknowledge losses and liquidate while liquidity remains. Those who choose to hold should be prepared for further sharp declines or worse.

Related Articles

PI (Pi Coin) has decreased by 4.02% in the past 24 hours, now trading at $0.13

Pi Network Releases Key KYC and Mainnet Migration Updates: What Pioneers Need to Know

Pi Network Testnet Expands Ecosystem! Starpath and Pitogo Social Improve User Experience

PaiCoin Weekly Price Prediction: $0.13 Critical Support Level, Major Holders Rush to Exit

Pi Network Falls Victim to Pyramid Scam! Analyst: Promised Years Ago but Still No Mainnet