Pi Network Falls Victim to Pyramid Scam! Analyst: Promised Years Ago but Still No Mainnet

Pi Network has fallen from a high of $3 to around $0.14. X users accuse the team of years of promises without a mainnet, merely performing mobile mining demonstrations, labeling it as the longest-running scam disguising itself as Web3. The project is about to unlock 250 million tokens, with an average of 8.3 million per day, releasing 23.6 million on February 13. The RSI is at 35, approaching oversold levels, hinting at a possible rebound.

Years of Promises of No Mainnet as a Hollow Check

According to X user pinetworkmembers, this decline is not a “healthy correction,” but rather the market pricing in the biggest issue behind this controversial project: “This is not a healthy correction but the market ultimately reflecting the obvious truth: after years of promises, there is still no usable mainnet, aside from ‘keeping the app open,’ with no real utility, and a large-scale mobile mining show.”

This criticism directly targets Pi Network’s core problem: the huge gap between promises and reality. Since its launch in 2019, Pi Network has promised to launch a fully functional mainnet allowing users to freely trade and use PI tokens. Yet, nearly 7 years later, the mainnet remains “closed” or “semi-open,” with most features unusable. Users can only tap the app daily to “mine,” but these tokens cannot be converted or used for actual transactions over the long term.

The critique that it “has no real utility besides keeping the app open” is extremely sharp. It implies Pi Network’s only function is to have users log in daily and click to maintain the illusion of “active users,” but behind the scenes, there are no substantial blockchain applications or economic activities. This model is very similar to Ponzi or pyramid schemes: attracting new users to sustain the system, but not creating real value.

The “large-scale mobile mining show” is even more telling. The so-called “mining” requires no computational power or electricity; it’s simply clicking daily to prove account activity. This “mining” is not true proof-of-work or proof-of-stake; it’s more like a points distribution mechanism. Packaging it as “mining” borrows the concept from Bitcoin mining, but is fundamentally different. This misleading promotion is what critics find most objectionable.

Three Major Evidence of Pi Network Being Accused of a Scam

Broken Promises: Mainnet features promised for 7 years have never been truly realized

No Real Utility: Aside from daily “mining” clicks, no substantial applications

Development Features: Requires inviting others to increase mining efficiency, similar to referral schemes

They claim that PI was initially promoted as “revolutionary,” but ultimately turned into “the longest scam disguised as Web3, targeting hopeful retirees and late-night browsers.” This characterization is very harsh, directly classifying Pi Network as a scam rather than a failed innovation attempt. The description “targeting retirees and late-night browsers” suggests the project’s target audience is those unfamiliar with crypto, easily attracted by “free mining.”

Unlocking 250 Million and the February 13 Selling Peak

(Source: PiScan)

(Source: PiScan)

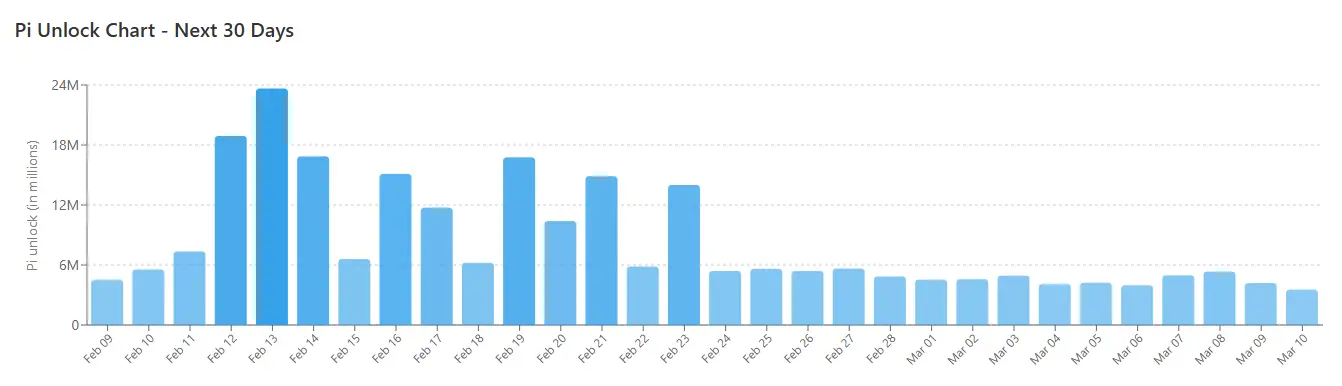

What lies ahead for Pi Network? Several concerning factors, including upcoming token unlocks, suggest PI’s price could further decline in the short term. Data shows nearly 250 million tokens will be released in the next 30 days, averaging over 8.3 million per day. February 13 is expected to be the highest trading volume day, with 23.6 million PI released. While this development doesn’t necessarily cause a sharp drop in price, it increases selling pressure and is considered bearish.

The 250 million tokens unlocked over 30 days represent an extreme level in Pi Network’s history. Compared to the current circulating supply of about 2.8 billion, this is an 8.9% increase in supply in one month. Without corresponding demand growth, this supply shock will likely continue to depress the price. Even more concerning, on February 13 alone, 23.6 million tokens will be released. If these tokens flood the market in a short period, it could trigger a 10-20% single-day crash.

Historical data confirms these concerns. Past large unlocks have led to significant price drops. Pre-unlock speculative selling, concentrated liquidation on the unlock day, and continued selling afterward created three downward waves. February 13 may repeat this pattern, with PI testing or even breaking below the $0.13 low.

The daily unlock rate of 8.3 million is also startling. If sustained through 2026, it could add over 3 billion tokens annually—doubling the current circulating supply. Such a flood of supply is almost impossible for the market to absorb, and PI’s price could continue to decline or even crash under this pressure.

RSI at 35 Oversold and Moderator Appreciation Day Controversy

On the other hand, Pi Network’s Relative Strength Index (RSI) also indicates a potential rebound. This technical indicator measures recent price change speed and magnitude, helping traders identify potential reversals. RSI values range from 0 to 100; below 30 suggests PI is oversold and may rebound soon. According to RSI Hunter data, the current RSI is about 35, approaching but not yet in oversold territory.

An RSI of 35 shows PI is nearing conditions for a technical rebound but has not reached extreme oversold levels. Historically, when PI’s RSI drops below 30, short-term rebounds often occur, though these are usually brief and limited in scope during strong downtrends. If RSI continues downward to 25 or below, the rebound could be stronger. However, with the upcoming large unlock on February 13, any bounce could be interrupted by new selling pressure.

This project has faced criticism before. Earlier this month, Pi Network’s core team held a so-called “Moderator Appreciation Day.” The event aimed to recognize moderators and praise their contributions to community building and support. However, the announcement sparked strong backlash, with many members feeling the project should focus on more urgent issues like accelerating verification and related tasks.

This backlash reveals the community’s anger and disappointment. As users wait years without usable tokens, with prices down 95%, and massive unlocks imminent, the team spends time and resources on a PR event honoring moderators. This misplaced priority is seen as “unprofessional” or even “diverting attention.” The community wants tangible progress on mainnet features, faster KYC processes, and tokenomics improvements, not superficial gratitude activities.

They believe Pi Network users (called pioneers) should admit the experiment has failed and shift focus to more valuable pursuits. “May those still stuck where they are rest in peace. Honestly, go touch some grass.” This extreme pessimism reflects some community members’ deep disappointment, feeling that continuing to invest time and energy is pointless and that it’s better to give up early.

Related Articles

PI (Pi Coin) has decreased by 4.02% in the past 24 hours, now trading at $0.13

Pi Network Releases Key KYC and Mainnet Migration Updates: What Pioneers Need to Know

Pi Network Testnet Expands Ecosystem! Starpath and Pitogo Social Improve User Experience

PaiCoin Weekly Price Prediction: $0.13 Critical Support Level, Major Holders Rush to Exit

Pi Network Testnet Expands With Starpath and Pitogo Apps