Hyperliquid's daily trading volume exceeds 5.2 billion! Precious metals dominate, with silver perpetual contracts surging

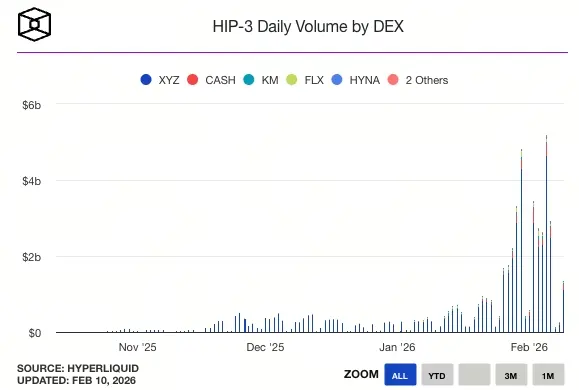

Hyperliquid’s HIP-3 set a daily trading volume record of $5.2 billion on February 5, with silver perpetual contracts reaching $4.09 billion. TradeXYZ dominates, with precious metals contracts accounting for 90% of trading volume. Previously, gold broke $5,000 and silver plunged after surpassing $100. The platform’s metal trading volume has reached 1% of COMEX, transforming into a full-asset trading layer.

$5.2 Billion Record: Silver Perpetual Contracts Take Center Stage

Hyperliquid’s permissionless perpetual markets under HIP-3 hit a daily trading volume of $5.2 billion on February 5, the highest since the protocol launched in October 2025. This figure is rare in the decentralized derivatives exchange (DEX) space, even surpassing many centralized exchanges’ daily spot volumes. The $5.2 billion scale signifies Hyperliquid’s evolution from an experimental DeFi protocol to a significant trading infrastructure with real market impact.

TradeXYZ is the main trader on the HIP-3 platform, consistently accounting for nearly 90% of the volume in precious metals, stock indices, and individual stocks perpetual contracts. This concentration indicates Hyperliquid’s success heavily relies on a single market maker, which is both an advantage and a risk. TradeXYZ’s active participation provides deep liquidity and tight spreads, but if the market maker withdraws for any reason, trading volume could sharply decline.

Just on February 5, TradeXYZ’s silver perpetual contract volume reached $4.09 billion, about 68% of the total HIP-3 daily volume. This phenomenon of a single product dominating nearly 70% of trading is extremely rare, showing that silver’s volatility attracts traders seeking crypto alternatives. The $4.09 billion daily volume for silver is astonishing for a traditional commodity; for context, the world’s largest metal derivatives exchange, COMEX, typically sees daily silver trading volumes of $40–50 billion. Hyperliquid’s $4.09 billion already accounts for roughly 8–10% of COMEX’s daily volume.

From a product design perspective, Hyperliquid’s metal perpetual contracts use mechanisms similar to crypto perpetuals, including funding rates, leverage, and 24/7 trading. This offers traditional commodity traders a new experience: no need to wait for market open, no intermediaries like futures brokers, and the ability to use cryptocurrencies as collateral. For traders accustomed to 24/7 crypto markets, trading silver and gold on the same platform is highly attractive.

Three Main Drivers Behind the Silver Perpetual Surge

Extreme Price Volatility: Silver plunged 30% from $100, creating arbitrage and speculative opportunities.

Crypto Substitution Demand: When Bitcoin crashes, traders seek new volatility assets.

24/7 Trading Advantage: While traditional commodity exchanges are closed, Hyperliquid remains open to capture opportunities.

This explosive growth demonstrates the potential for decentralized platforms to penetrate traditional finance. As crypto protocols begin offering trading services for traditional assets, their permissionless, global, 24/7 nature could attract many conventional traders.

Metal Rollercoaster: From Record Highs to Epic Crashes

(Source: The Block)

The surge in HIP-3 trading volume initially occurred in late January, when gold first broke $5,000 per ounce and silver surpassed $100 per ounce. These milestones are rare in precious metals history. Gold was around $3,700 at the start of 2025; surpassing $5,000 represented over 35% short-term gains. Silver’s rally was even more dramatic, soaring from about $30 to $100, a gain of over 230%.

The drivers included geopolitical tensions, rising inflation fears, and large inflows into safe-haven assets. Market panic triggered by Trump’s announcement of 100% tariffs on China led investors to sell stocks and crypto, shifting into gold and silver. However, such rapid surges often trigger technical corrections.

Fate was cruel—just days later, both metals experienced historic sharp declines, with single-day drops of about 20% for gold and 30% for silver. Gold fell from $5,000 to $4,000, silver from $100 to $70. Causes likely included profit-taking, leverage liquidations, and market realization that prices had become overly inflated. Additionally, China’s retaliatory tariffs, which had been announced but not yet implemented, eased geopolitical tensions temporarily, reducing safe-haven demand.

This extreme volatility created excellent trading opportunities for Hyperliquid. High volatility is favored by derivatives traders, as it generates arbitrage, speculation, and hedging opportunities. When traditional exchanges hit circuit breakers or trading halts due to extreme moves, Hyperliquid’s permissionless, 24/7 markets remained open, attracting funds unable to trade elsewhere.

Before the crash, HIP-3 open interest (OI) hit a record $1.06 billion, with TradeXYZ accounting for 87%. OI reflects market participation and potential volatility. The peak of $1.06 billion indicates large leveraged positions concentrated in metal perpetuals, which could trigger cascades of liquidations during sharp declines. Currently, HIP-3’s open interest is about $665 million, up 88% from last quarter, still strong despite the pullback.

From Native Crypto to Full-Asset Trading Layer: Strategic Shift

Despite the correction, the metal frenzy has transformed Hyperliquid’s image—from a crypto-native perpetual platform to a “full-asset trading layer,” with silver and gold now among the top five traded instruments. This shift has strategic significance beyond volume figures.

Traditionally, decentralized derivatives exchanges mainly offered crypto perpetuals like BTC/USD, ETH/USD, limiting their user base to crypto-native traders. But after Hyperliquid enabled permissionless creation of new markets via HIP-3 proposals, anyone can create trading pairs for traditional assets like precious metals, stocks, and forex. This openness unlocks the platform’s potential to serve a broader trader community.

TradeXYZ capitalized on this, launching precious metals, stock indices, and individual stocks perpetuals on Hyperliquid. These products fill gaps: traditional commodities require futures brokers, have limited trading hours, and often high entry barriers. Hyperliquid’s offerings provide 24/7 trading, low entry thresholds (using stablecoins as collateral), and no KYC, enabling anonymous trading.

Further evidence is the trading volume of HIP-3’s gold and silver markets, which has reached about 1% of COMEX’s daily volume. COMEX, part of CME Group, is the world’s leading gold and silver derivatives exchange, with daily volumes exceeding $500 billion. Achieving 1% of COMEX’s volume in just months indicates rapid growth and market acceptance.

This transformation is crucial for Hyperliquid’s long-term value proposition. Pure crypto derivatives markets are limited by crypto market size; full-asset layers tap into a global universe of tradable assets—stocks, bonds, commodities, FX—worth hundreds of trillions of dollars. Successfully attracting traditional asset traders could unlock enormous growth potential.

However, this shift also introduces regulatory challenges. Offering stocks and commodities derivatives typically requires strict licenses and compliance. Hyperliquid’s permissionless model may attract regulatory scrutiny, especially as volumes grow large enough to influence real-world prices. Balancing decentralization with compliance will be a key challenge moving forward.

Permissionless Markets: Double-Edged Sword

The core innovation of HIP-3 is the permissionless creation of perpetual markets. Any user can propose new trading pairs, which, after community voting, go live. This openness contrasts sharply with traditional exchanges’ approval processes. For example, launching new derivatives on COMEX or CME involves regulatory approval, market demand assessment, and technical preparations, often taking months or years.

The advantage of permissionless markets is rapid responsiveness. When an asset becomes popular, Hyperliquid can launch related perpetuals within days, capturing trading demand. The recent metal boom exemplifies this: as gold and silver prices surged, TradeXYZ quickly listed corresponding contracts, attracting traders who couldn’t access traditional channels fast enough.

But permissionless also entails risks. Lack of strict vetting can lead to listing low-quality or manipulative trading pairs. Illiquid markets may experience slippage and price manipulation. Hyperliquid attempts to mitigate this via community voting, but the effectiveness of decentralized governance remains to be proven.

Market maturity-wise, Hyperliquid has moved beyond early-stage tech validation into product-market fit, evidenced by the $5.2 billion daily volume. This shows genuine demand, not just hype. To become a true “full-asset trading layer,” it must improve liquidity depth, price stability, and regulatory compliance.

Related Articles

Bitcoin Sees $2.3B in Realized Losses As Capitulation Intensifies

Sui Joins Ethereum and Solana as Coinbase-Supported Token Standard

Into The Cryptoverse Founder Takes a Dig at Meme Coins as Segment Shows Decline

Cardano Developers Welcome Rosetta Java v2.0.0 Improving Sync Speed and ADA Market Dynamics