Aster (ASTER) To Soar Higher? This Key Breakout Hints at Potential Upside Move

Key Takeaways

-

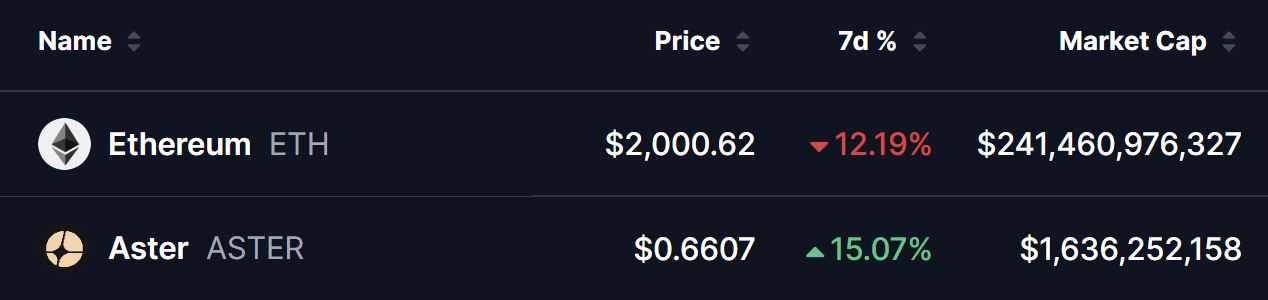

ASTER has outperformed the broader market, gaining ~15% while ETH dropped over 12%

-

Price has broken out of a multi-month descending broadening wedge

-

Strong support formed near $0.4032 before the breakout

-

Measured target points toward $0.89 if momentum holds

ASTER, the native token of the Aster DEX, has quietly been showing relative strength while much of the altcoin market remains under pressure.

Over the past seven days, Ethereum (ETH) has slid more than 12%, dragging most major altcoins lower. Meanwhile, ASTER has moved in the opposite direction — climbing over 15% in the same period. More importantly, the latest chart structure suggests this move may just be getting started.

Source: Coinmarketcap

Descending Broadening Wedge Breakout Signals Trend Shift

As shown on the daily chart, ASTER spent the last few weeks consolidating inside a descending broadening wedge — a classic bullish reversal pattern that often forms near the end of extended downtrends.

Price found strong demand around the lower boundary of the wedge near $0.4032, where buyers stepped in aggressively. That defense sparked a steady recovery, eventually leading to a decisive breakout this week above the wedge’s descending resistance around $0.6461.

Aster (ASTER) Daily Chart/Coinsprobe (Source: Tradingview)

This marks ASTER’s first meaningful bullish breakout since late November.

Following the move, ASTER pushed above $0.66, showing early signs of a trend reversal as momentum begins to shift back in favor of buyers.

What’s Next for ASTER?

From a technical perspective, the structure remains constructive.

If bulls can maintain control, ASTER may first look to retest the breakout zone near $0.64–$0.65 and confirm it as new support — a common and healthy behavior after wedge breakouts.

The next major level overhead sits near the 200-day moving average around $0.8389. A clean daily close above this area would significantly strengthen bullish sentiment and could open the door toward the $0.89 region, which aligns with the measured-move target of the descending broadening wedge.

That would imply roughly 30–35% upside from current levels, assuming broader market conditions remain supportive.

Key Risk to Watch

While the breakout is encouraging, it still needs confirmation.

If ASTER fails to hold above the former wedge resistance and slips back below $0.64, price could re-enter consolidation, delaying the next leg higher. A sustained move back inside the pattern would weaken the bullish thesis in the near term.

For now, however, buyers appear firmly in control, defending the breakout and keeping momentum tilted to the upside.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.