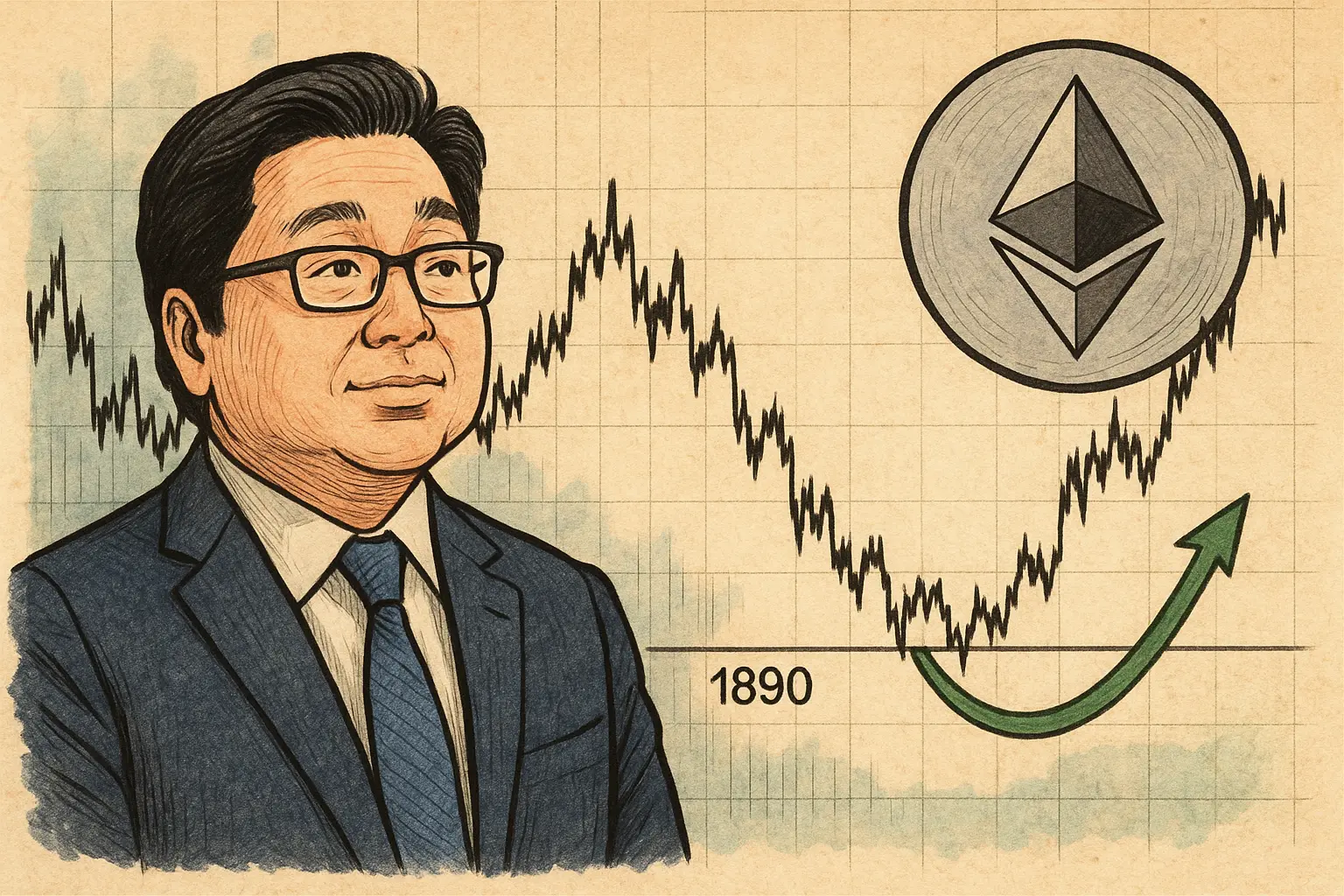

Tom Lee: If Ethereum reaches $1890 again, it will form a perfect bottom.

BitMine Chairman Tom Lee stated at Consensus 2026 that Ethereum will form a perfect bottom if it hits $1,890 again. He pointed out that since 2018, Ethereum has experienced 8 declines exceeding 52%, with all previous 8 rebounds resulting in V-shaped reversals. Last year, from January to March, Ethereum fell 64% and recovered at a similar speed.

The Perfect Bottom Theory at $1,890: Tom Lee’s Historical Validation

Tom Lee said at Consensus 2026 that if Ethereum reaches $1,890 again, it will mark a perfect bottom. He believes Ethereum is now very close to its bottom, and investors should look for opportunities rather than sell off. This specific price of $1,890 is not a random guess but based on a comprehensive analysis of historical price patterns and technical indicators.

Lee pointed out that since 2018, Ethereum has experienced 8 declines of over 52%, with all previous 8 rebounds showing V-shaped reversals. A V-shaped rebound refers to a rapid and sharp price recovery after a bottom, forming a V pattern rather than a slow U-shaped consolidation. This characteristic indicates that Ethereum historically does not stay in prolonged sideways movement at the bottom; once the bottom is confirmed, it tends to rebound quickly.

From January to March last year, Ethereum dropped 64%, but then recovered almost at the same speed. During that period, Ethereum fell from about $4,900 to around $1,760, a 64% decline. However, within a few weeks after hitting the bottom, Ethereum rebounded to over $3,000, nearly recovering all losses within three months. This rapid recovery capability is one of the core reasons Tom Lee remains optimistic about Ethereum.

Why is $1,890 a key level? From a technical analysis perspective, this price may correspond to the intersection of multiple support factors: a critical previous low, a significant Fibonacci retracement level, and a psychological barrier with high buy orders. More importantly, $1,890 may be close to the average cost basis of long-term Ethereum holders. When the price reaches this level, long-term investors may see it as severely oversold and start accumulating heavily.

Historical Pattern of 8 V-Shaped Reversals After Ethereum’s Declines

2018-2019 Bear Market: from $1,400 down to $85, a 94% drop, then V-rebound to $350

March 2020 Black Swan: single-day 60% crash, fully recovered within weeks

May 2021 Correction: 60% decline, new highs within 3 months

January-March 2025 Adjustment: down 64%, then quickly recovered to the high

The reliability of this historical pattern lies in Ethereum’s structural demand. As the largest smart contract platform, Ethereum supports a vast DeFi ecosystem, NFT markets, and enterprise applications. After each major price drop, the demand generated by these real-world applications quickly absorbs selling pressure and drives rebounds. As long as these fundamental drivers remain unchanged, the V-shaped rebound pattern may continue to be effective.

However, investors must recognize that “8 times V-shaped rebounds” does not guarantee the 9th. Market conditions change, macro environments evolve, and past patterns may fail in the future. Tom Lee’s forecasts are based on historical similarities, but history does not simply repeat itself. Cautious investors should consider deploying in tranches around the $1,890 level rather than betting everything at once.

Weakening Gold as a Precondition for Bitcoin Reversal: Tom Lee’s Macro Logic

Tom Lee said that the crypto market needs to wait for Bitcoin to reverse, and that Bitcoin’s reversal depends on gold weakening. He believes this shift will happen this year. This view reveals Tom Lee’s macro framework for understanding the crypto market. Currently, gold hovers near $5,000, at a historical high. This strength is driven by global safe-haven demand, geopolitical tensions, and distrust in traditional financial systems.

Lee’s logic is that although gold and Bitcoin are both considered “alternative assets,” they compete for capital in the current environment. When investors flock to gold for safety, capital inflows into Bitcoin decrease. Only when gold’s safe-haven demand cools and its price begins to decline will some funds reallocate into Bitcoin and crypto markets.

This “gold weakening → Bitcoin reversal → Ethereum rally” transmission chain has some rational basis. Historically, gold and Bitcoin’s correlation is unstable—sometimes they rise and fall together, other times they move inversely. During risk-off events, gold usually performs better, as its safe-haven properties are validated over thousands of years. But during economic recovery and liquidity easing, Bitcoin’s gains often surpass gold’s.

Lee’s belief that gold will weaken this year may be based on several factors: market absorption of Trump’s tariff policies’ negative impacts, easing geopolitical tensions, Fed rate cuts in the second half lowering real interest rates, and global economic recovery boosting risk assets. If these conditions materialize, gold could fall from $5,000 to $4,000 or lower, creating favorable conditions for Bitcoin and Ethereum rebounds.

BitMine Buys 40,000 ETH Daily: $7 Billion Loss but Steady Accumulation

In a recent press release, BitMine disclosed that last week it purchased 40,613 ETH. As of 3 p.m. ET on February 8, 2026, the company held a total of 4.325 million ETH. The news seemed to boost investor sentiment, with BitMine’s stock (BMNR) closing at $21.45 on February 9, up 4.79% for the day.

BitMine’s accumulation did not stop there. On-chain analytics platform Lookonchain reported that after the disclosure, the company added more ETH. Data shows that the company first acquired 20,000 ETH via FalconX, then another 20,000 ETH through BitGo, worth approximately $42.3 million. Lookonchain wrote: “Today alone, it bought 40,000 ETH ($83.4 million).”

The continuous buying indicates that even amid increasing market uncertainty and unrealized losses exceeding $7 billion, BitMine remains committed to expanding its Ethereum holdings. According to BeInCrypto Markets, Ethereum’s price has fallen 13.2% over the past week. At press time, the second-largest cryptocurrency by market cap was trading at $2,012, down 3.28% from the previous day.

Tom Lee sees the price dip as a strategic buying opportunity, citing improving network fundamentals. He also pointed out that despite the decline, the Ethereum network remains strong. Official data shows daily ETH transaction volume has reached 2.5 million, with active addresses expected to hit 1 million by 2026. These figures suggest that regardless of market volatility, Ethereum’s adoption continues to grow.

“We believe that the price of ETH does not reflect its high utility and its role in future finance,” said Tom Lee. This is the core logic behind BitMine’s continued accumulation. If Ethereum’s intrinsic value is much higher than current market prices, then the losses are only paper losses temporarily, and a long-term recovery is inevitable.

Wall Street, AI Agents, and Creator Economy: Three Future Drivers for Ethereum

Tom Lee emphasized that Ethereum’s future drivers include Wall Street rebuilding financial systems on blockchain, AI agent applications, and the creator economy. He stated that while Wall Street still has internal disagreements, their willingness to use public blockchains is clear. These three drivers represent different dimensions of Ethereum’s value proposition.

Rebuilding financial infrastructure on Ethereum is the most important long-term driver. DTCC, ICE, CME, and other traditional financial institutions are exploring blockchain applications in securities clearing, derivatives settlement, and tokenized assets. If these explorations turn into actual deployments, Ethereum’s value as a foundational layer will grow exponentially. Asset managers like BlackRock and Franklin D. D. have launched tokenized funds on Ethereum, managing billions of dollars.

AI agent applications are emerging as the fastest-growing sector. As repeatedly mentioned in this series, the ERC-8004 standard positions Ethereum as the trust and payment infrastructure for the AI agent economy. When hundreds of millions or billions of AI agents interact on-chain and perform micro-payments, Ethereum’s transaction volume and fee income will surge.

The creator economy is an application scenario targeting end users. Web3 creator tools like NFTs, social tokens, and content subscriptions are mostly built on Ethereum. As creators realize the unfair platform commissions (YouTube takes 45%, TikTok even more), more are turning to blockchain for fairer revenue sharing. Ethereum, as the most mature infrastructure for creators, will benefit from this trend.

Tom Lee said, “The best investment opportunities in cryptocurrencies often appear after prices decline. Think back to 2025—the best entry point was right after the market plunged due to tariff concerns.” BitMine is actively betting on Ethereum’s success, but the outcome remains uncertain. If a V-shaped recovery occurs, BitMine could gain significant advantage. However, continued price declines or prolonged market downturns could further challenge BitMine’s strategy.

Related Articles

Whale "0x6C8" Deposits $1.99M USDC to HyperLiquid, Increases ETH Long Position to $87.8M

Tom Lee tells investors: Stop obsessing over finding the "bottom," now is the "buying opportunity"

Ethereum Plans Major Architecture Change With L1-zkEVM Roadmap for 2026

Hong Kong plans to open up "perpetual contract" trading and allow Bitcoin and Ethereum collateralized financing