The tokenized commodities market surpasses $6 billion as gold prices surge to unprecedented levels

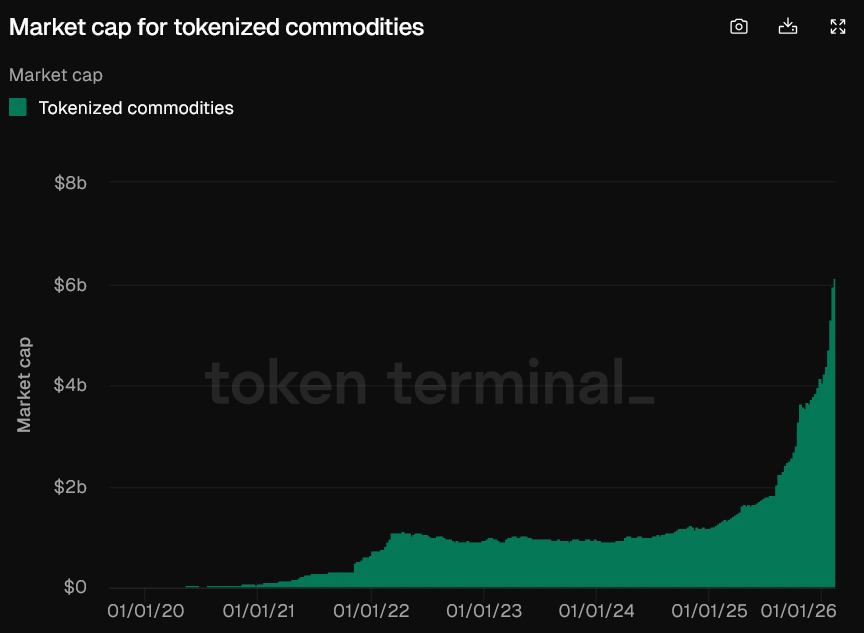

The digitized commodities market has recorded impressive growth, increasing by 53% in less than six weeks, reaching a value of over $6.1 billion. This is currently the fastest-growing sector in the real asset tokenization market, as more gold is being brought onto the blockchain.

According to data from the cryptocurrency analytics platform Token Terminal, the tokenized commodities market was valued at just over $4 billion at the beginning of this year. This means approximately $2 billion has been added to the market value since January 1, 2026.

Market capitalization volatility of tokenized commodities since 2018 | Source: Token Terminal## Gold Dominates the Tokenized Commodities Market

Market capitalization volatility of tokenized commodities since 2018 | Source: Token Terminal## Gold Dominates the Tokenized Commodities Market

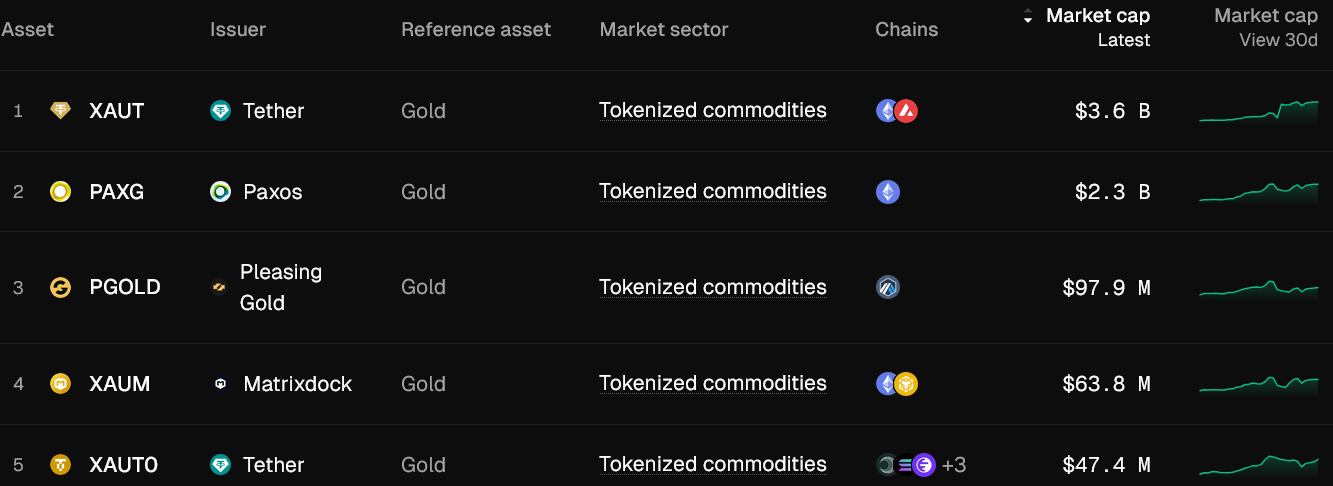

Data shows that gold products are leading in the tokenized commodities market. Notably, the Tether-backed gold token, Tether Gold (XAUt), is the largest contributor to this growth. The market cap of XAUt has increased by 51.6% in the past month, reaching $3.6 billion. Meanwhile, PAX Gold (PAXG), a gold token issued by Paxos, also grew by 33.2%, reaching $2.3 billion during the same period.

Top five tokenized commodities by market cap | Source: Token TerminalSince the beginning of 2026, the tokenized commodities market has grown by 360% compared to the same period last year, far outpacing the growth rates of the tokenized stock market (42%) and tokenized funds (3.6%). Currently, the tokenized commodities market is worth more than one-third of the $17.2 billion tokenized fund market and is much larger than the tokenized stock market, which is valued at only $538 million.

Top five tokenized commodities by market cap | Source: Token TerminalSince the beginning of 2026, the tokenized commodities market has grown by 360% compared to the same period last year, far outpacing the growth rates of the tokenized stock market (42%) and tokenized funds (3.6%). Currently, the tokenized commodities market is worth more than one-third of the $17.2 billion tokenized fund market and is much larger than the tokenized stock market, which is valued at only $538 million.

Tether Expands Strategy with Tokenized Gold

Tether continues to strengthen its leading position in the tokenized commodities sector by investing $150 million to acquire a stake in the precious metals trading platform Gold.com. This move aims to expand access to tokenized gold for users worldwide.

Tether announced that they will integrate the XAUt token into the Gold.com platform and are exploring solutions to allow customers to purchase physical gold using the stablecoin USDT.

Gold Accelerates, Bitcoin Stalls Below $70,000

The growth of tokenized gold has occurred amid a strong increase in spot gold prices, which surged over 80% in the past year and hit a record high of $5,600 on January 29. After a slight correction, gold prices fell to $4,700 in early February but quickly recovered to $5,050 at present.

In contrast, Bitcoin (BTC) and the broader cryptocurrency market have been in a downturn since October 10, when a crypto market crash led to $19 billion in liquidations. From an all-time high of $126,080 in early October, Bitcoin has fallen 52.4% to around $60,000 by February 9. However, the cryptocurrency has recovered slightly, reaching $67,700.

The decline of Bitcoin, while traditional safe-haven assets like gold are rising, has sparked mixed opinions. Strike CEO Jack Mallers stated that Bitcoin is still viewed as a tech stock rather than being properly recognized as a “hard money” asset.

Similarly, asset management firm Grayscale believes the “digital gold” narrative for Bitcoin is being challenged. They note that Bitcoin’s recent price volatility resembles that of a high-risk growth asset rather than a traditional safe haven.