Analysis: The crypto market correction may be influenced by traditional financial factors, not an industry crisis.

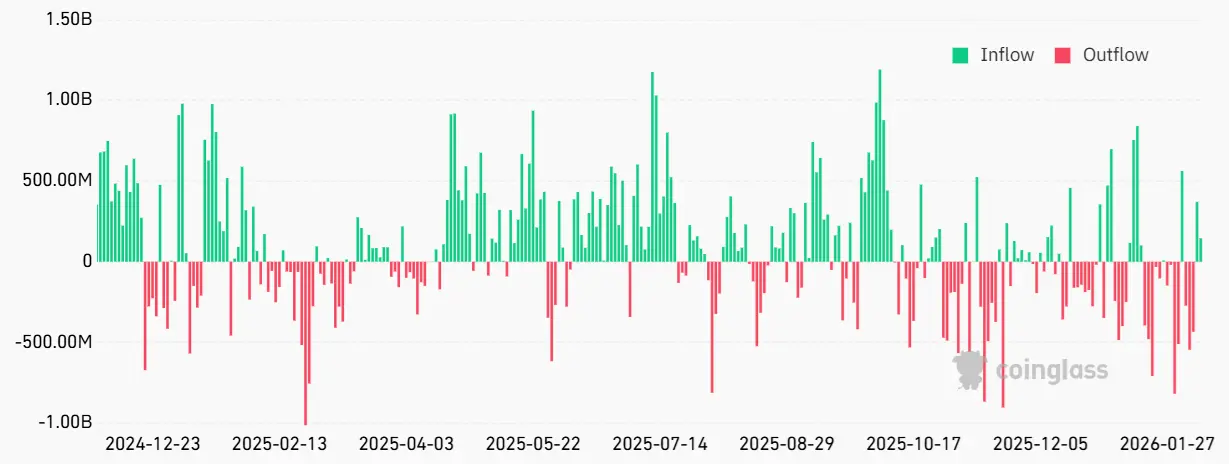

The recent decline in the cryptocurrency market is viewed as a "traditional financial event," caused by rising Japanese yen interest rates and increased borrowing costs leading traders to liquidate positions. Despite increased market volatility and active Bitcoin ETF trading, industry insiders believe that institutions have not fully withdrawn. It is expected that by 2026, traditional finance and crypto infrastructure will become further integrated.

BTC-2,45%

GateNewsBot·13m ago