# WhiteHouseTalksStablecoinYields

17.21K

SheenCrypto

#WhiteHouseTalksStablecoinYields 🇺🇸💵

The conversation around stablecoin yields has officially reached the White House — and the implications for crypto markets are massive. As regulators sharpen their focus, the core question is no longer if stablecoins will be integrated into the financial system… but how far their influence will go.

🔎 What’s Being Discussed?

Policy leaders are examining how yield-bearing stablecoins intersect with:

• Banking regulations

• Treasury market stability

• Consumer protection frameworks

• Dollar dominance in digital finance

This signals a shift from viewing sta

The conversation around stablecoin yields has officially reached the White House — and the implications for crypto markets are massive. As regulators sharpen their focus, the core question is no longer if stablecoins will be integrated into the financial system… but how far their influence will go.

🔎 What’s Being Discussed?

Policy leaders are examining how yield-bearing stablecoins intersect with:

• Banking regulations

• Treasury market stability

• Consumer protection frameworks

• Dollar dominance in digital finance

This signals a shift from viewing sta

DEFI-12,04%

- Reward

- 2

- 4

- Repost

- Share

SheenCrypto :

:

Buy To Earn 💎View More

#CelebratingNewYearOnGateSquare

#WhiteHouseTalksStablecoinYields 🇺🇸💵

🚀 When Policy Meets Blockchain: The Next Phase of Digital Finance

The global conversation around stablecoins has entered a new and powerful phase. In 2026, discussions about stablecoin yields are no longer limited to crypto forums and DeFi communities — they have officially reached the White House. This marks a historic moment for the digital asset industry, signaling that stablecoins are now being recognized as a core component of the modern financial system rather than a niche innovation.

As policymakers, regulators, a

#WhiteHouseTalksStablecoinYields 🇺🇸💵

🚀 When Policy Meets Blockchain: The Next Phase of Digital Finance

The global conversation around stablecoins has entered a new and powerful phase. In 2026, discussions about stablecoin yields are no longer limited to crypto forums and DeFi communities — they have officially reached the White House. This marks a historic moment for the digital asset industry, signaling that stablecoins are now being recognized as a core component of the modern financial system rather than a niche innovation.

As policymakers, regulators, a

- Reward

- 6

- 7

- Repost

- Share

MrFlower_ :

:

Happy New Year! 🤑View More

#WhiteHouseTalksStablecoinYields 🏛️💵

The conversation around stablecoins is heating up as reports suggest the White House is actively discussing stablecoin yields. This development could mark a major turning point for the digital asset ecosystem.

Stablecoins have long been viewed as the bridge between traditional finance and crypto, but yield-bearing stablecoins introduce a new dynamic. If regulators move toward clearer frameworks, we could see increased institutional participation, improved investor confidence, and broader adoption of tokenized financial products.

However, the key question

The conversation around stablecoins is heating up as reports suggest the White House is actively discussing stablecoin yields. This development could mark a major turning point for the digital asset ecosystem.

Stablecoins have long been viewed as the bridge between traditional finance and crypto, but yield-bearing stablecoins introduce a new dynamic. If regulators move toward clearer frameworks, we could see increased institutional participation, improved investor confidence, and broader adoption of tokenized financial products.

However, the key question

- Reward

- 6

- 9

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#WhiteHouseTalksStablecoinYields

Date: 11 February 2026

The White House is currently holding discussions around stablecoin yield regulations, and this debate could significantly impact the future of crypto in the United States. Here’s the breakdown

━━━━━━━━━━━━━━━━━━

🔹 1️⃣ What’s Being Debated?

Lawmakers, banking representatives, and crypto industry leaders are discussing whether stablecoin issuers should be allowed to offer yields or rewards to holders.

This has become one of the most controversial points in upcoming U.S. crypto legislation.

━━━━━━━━━━━━━━━━━━

🔹 2️⃣ Why Is This Important

Date: 11 February 2026

The White House is currently holding discussions around stablecoin yield regulations, and this debate could significantly impact the future of crypto in the United States. Here’s the breakdown

━━━━━━━━━━━━━━━━━━

🔹 1️⃣ What’s Being Debated?

Lawmakers, banking representatives, and crypto industry leaders are discussing whether stablecoin issuers should be allowed to offer yields or rewards to holders.

This has become one of the most controversial points in upcoming U.S. crypto legislation.

━━━━━━━━━━━━━━━━━━

🔹 2️⃣ Why Is This Important

- Reward

- 3

- 3

- Repost

- Share

HighAmbition :

:

thnxx for sharing information about cryptoView More

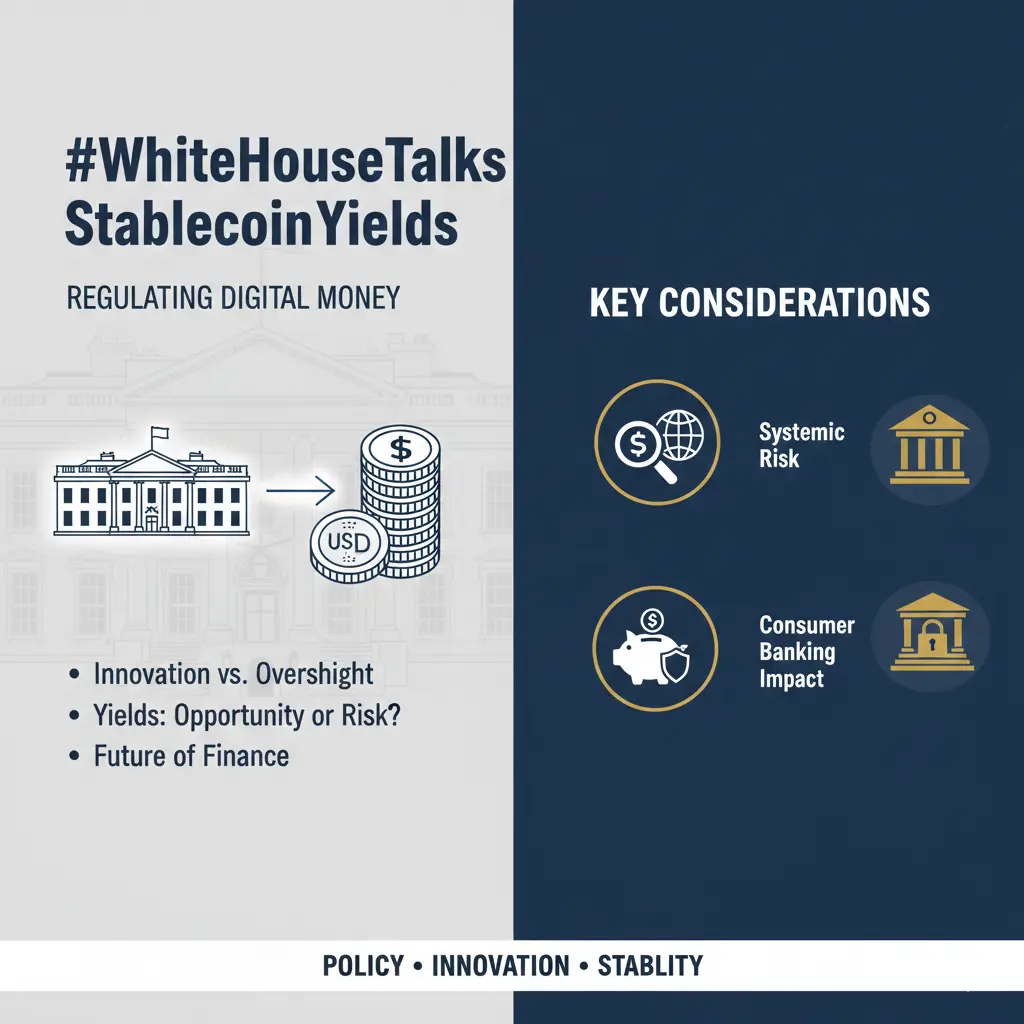

#WhiteHouseTalksStablecoinYields 🏛️ The Great "Yield" Stalemate

The core of the issue is whether stablecoins should be simple payment tools (like a digital $20 bill) or investment vehicles (like a high-yield savings account).📈 What This Actually Means for You

The "Activity-Based" Compromise: Recent discussions suggest a middle ground where you can’t earn interest just for holding a stablecoin (idle balance), but you can earn rewards for activity—like providing liquidity, staking, or using them in DeFi protocols.

Institutional FOMO: Clearer rules are the "green light" for big pensions and hed

The core of the issue is whether stablecoins should be simple payment tools (like a digital $20 bill) or investment vehicles (like a high-yield savings account).📈 What This Actually Means for You

The "Activity-Based" Compromise: Recent discussions suggest a middle ground where you can’t earn interest just for holding a stablecoin (idle balance), but you can earn rewards for activity—like providing liquidity, staking, or using them in DeFi protocols.

Institutional FOMO: Clearer rules are the "green light" for big pensions and hed

- Reward

- 12

- 14

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

#WhiteHouseTalksStablecoinYields

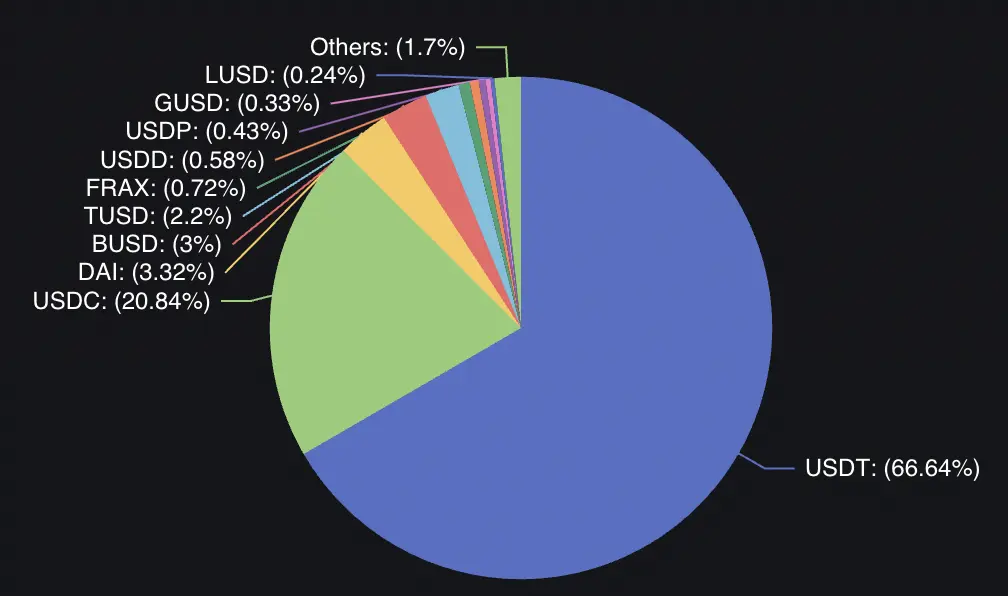

The White House has recently held high-level discussions regarding stablecoin yields, signaling a growing interest in the regulation and oversight of digital assets. Stablecoins cryptocurrencies pegged to traditional fiat currencies have become integral to the crypto ecosystem, providing stability in a market known for its volatility. As their adoption rises, regulators are focusing on how yield-bearing stablecoins could affect financial stability, consumer protection, and innovation.

Stablecoins such as USDT, USDC, and BUSD offer the promise of a 1:1 peg to t

The White House has recently held high-level discussions regarding stablecoin yields, signaling a growing interest in the regulation and oversight of digital assets. Stablecoins cryptocurrencies pegged to traditional fiat currencies have become integral to the crypto ecosystem, providing stability in a market known for its volatility. As their adoption rises, regulators are focusing on how yield-bearing stablecoins could affect financial stability, consumer protection, and innovation.

Stablecoins such as USDT, USDC, and BUSD offer the promise of a 1:1 peg to t

- Reward

- 3

- 7

- Repost

- Share

MissCrypto :

:

Watching Closely 🔍️View More

#WhiteHouseTalksStablecoinYields

The White House’s recent discussions around stablecoin yields have reignited an important debate at the intersection of crypto innovation, financial stability, and regulatory oversight.

As stablecoins continue to play a central role in digital asset markets, policymakers are paying closer attention to how yield-generating mechanisms attached to these assets could impact consumers and the broader financial system.

Stablecoins were originally designed to provide price stability by being pegged to fiat currencies like the US dollar. Over time, however, many issue

The White House’s recent discussions around stablecoin yields have reignited an important debate at the intersection of crypto innovation, financial stability, and regulatory oversight.

As stablecoins continue to play a central role in digital asset markets, policymakers are paying closer attention to how yield-generating mechanisms attached to these assets could impact consumers and the broader financial system.

Stablecoins were originally designed to provide price stability by being pegged to fiat currencies like the US dollar. Over time, however, many issue

- Reward

- 2

- 2

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

#WhiteHouseTalksStablecoinYields

The discussions at the White House regarding stablecoin yields represent a critical intersection between financial innovation, regulatory oversight, and systemic risk management. At the core of these talks is the question of whether digital dollar-pegged tokens, such as USDC, USDT, and other regulated stablecoins, should be allowed to offer interest or yield-like incentives to users. This debate goes far beyond technicalities: it challenges traditional banking models, tests regulatory frameworks, and sets the stage for how crypto and traditional finance will c

The discussions at the White House regarding stablecoin yields represent a critical intersection between financial innovation, regulatory oversight, and systemic risk management. At the core of these talks is the question of whether digital dollar-pegged tokens, such as USDC, USDT, and other regulated stablecoins, should be allowed to offer interest or yield-like incentives to users. This debate goes far beyond technicalities: it challenges traditional banking models, tests regulatory frameworks, and sets the stage for how crypto and traditional finance will c

USDC-0,02%

- Reward

- 7

- 14

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#WhiteHouseTalksStablecoinYields 🚀GateSquare Vision 2026: The Future of Finance, Technology, and Society

In 2030, the world stands at a crossroads where technology, finance, and human ambition converge in unprecedented ways. Digital assets have become a universal language, enabling anyone, anywhere, to transact in seconds without intermediaries. Blockchain infrastructures now underpin global trade, not just cryptocurrencies, but smart contracts, identity verification, and supply chains. Stablecoins with algorithmic yield have revolutionized savings, making traditional banking optional for mi

In 2030, the world stands at a crossroads where technology, finance, and human ambition converge in unprecedented ways. Digital assets have become a universal language, enabling anyone, anywhere, to transact in seconds without intermediaries. Blockchain infrastructures now underpin global trade, not just cryptocurrencies, but smart contracts, identity verification, and supply chains. Stablecoins with algorithmic yield have revolutionized savings, making traditional banking optional for mi

- Reward

- 3

- 9

- Repost

- Share

YingYue :

:

DYOR 🤓View More

#WhiteHouseTalksStablecoinYields

The summits recently organized by the White House on stablecoin yields, one of the most pressing topics in the crypto world, represent a historic turning point for the future of digital assets. These new and powerful players in the financial ecosystem possess the potential to go beyond being mere payment instruments and transform traditional banking models entirely.

As of February 2026, these winds of change blowing through Washington are redefining the balance between the crypto industry and Wall Street. In discussions led by White House advisors, the legal f

The summits recently organized by the White House on stablecoin yields, one of the most pressing topics in the crypto world, represent a historic turning point for the future of digital assets. These new and powerful players in the financial ecosystem possess the potential to go beyond being mere payment instruments and transform traditional banking models entirely.

As of February 2026, these winds of change blowing through Washington are redefining the balance between the crypto industry and Wall Street. In discussions led by White House advisors, the legal f

- Reward

- 4

- 3

- Repost

- Share

Yunna :

:

1000x VIbes 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

230.78K Popularity

52.73K Popularity

22.01K Popularity

17.21K Popularity

16.67K Popularity

93.67K Popularity

6.17K Popularity

11.41K Popularity

6.77K Popularity

4.17K Popularity

5.54K Popularity

15.11K Popularity

4.04K Popularity

22.2K Popularity

13.88K Popularity

News

View MoreU.S. non-farm payrolls for November and December revised downward by 17,000.

2 m

Data: 170 BTC transferred from an anonymous address to Cumberland DRW, worth approximately 11.36 million US dollars

2 m

Spot gold plunges nearly $40 in the short term, while the US dollar index DXY surges 50 points in the short term

3 m

The U.S. unemployment rate in January was 4.3%, slightly below market expectations.

4 m

U.S. Non-Farm Employment Change Final (Unadjusted) for 2025 -862,000, previous value -911,000

4 m

Pin