# BuyTheDipOrWaitNow?

232.37K

repanzal

#BuyTheDipOrWaitNow?

Every time the market pulls back, the same debate starts:

Is this a golden buying opportunity… or the beginning of a deeper correction?

The truth is — there’s no one-size-fits-all answer. The right move depends on market structure, liquidity conditions, macro factors, and most importantly, your personal strategy.

Let’s break it down properly:

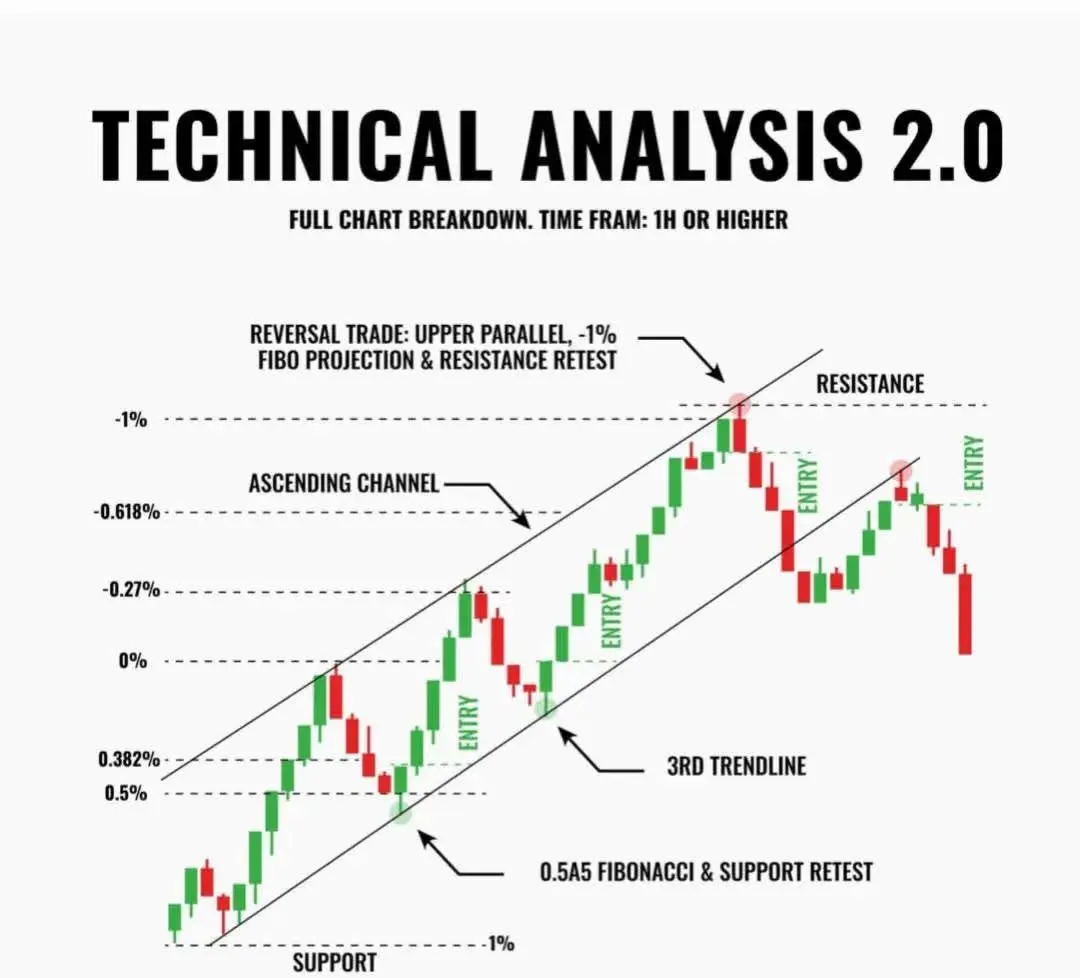

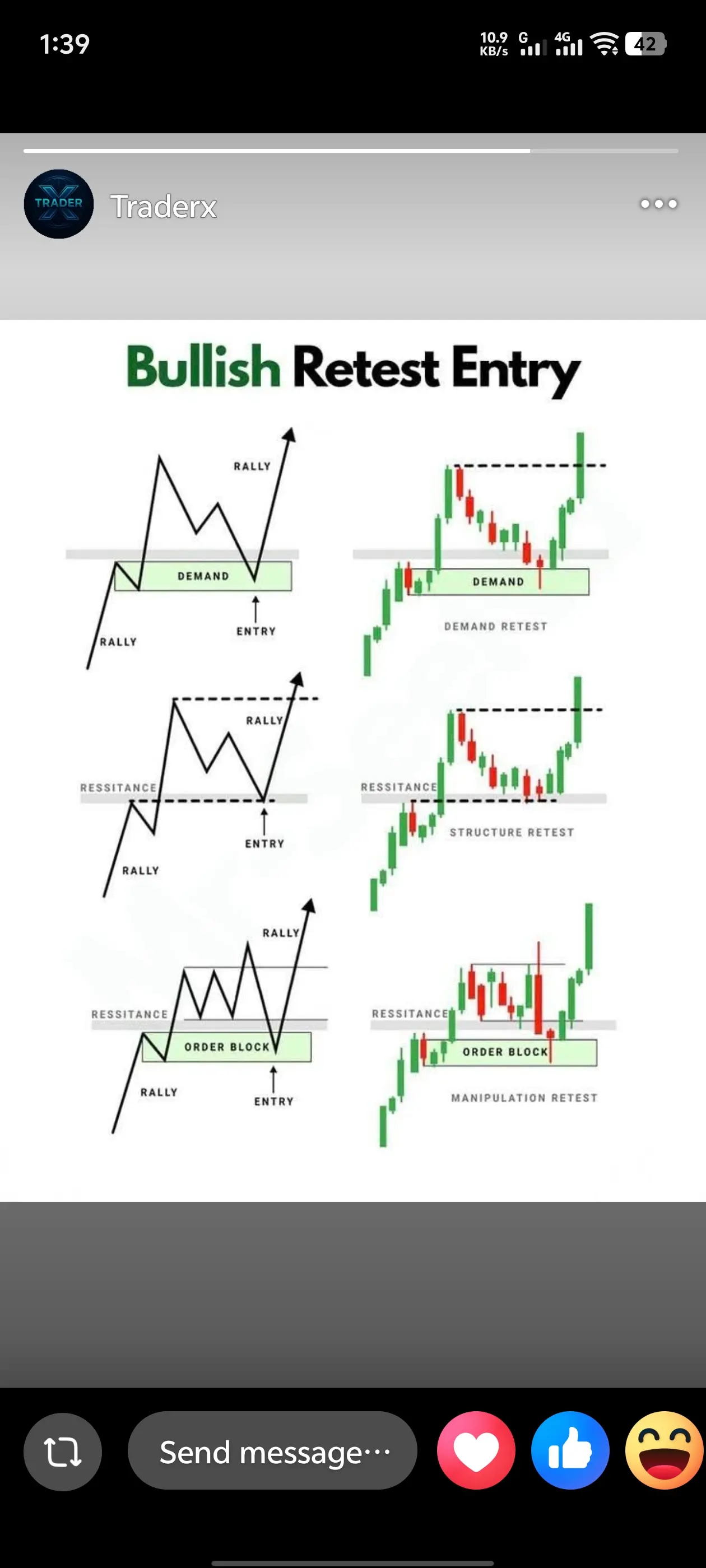

1️⃣ Understanding the Current Market Structure

Before buying any dip, zoom out to the higher timeframes (Daily & Weekly charts).

Are we still making higher highs and higher lows?

→ If yes, the dip could simply be a healthy correction

Every time the market pulls back, the same debate starts:

Is this a golden buying opportunity… or the beginning of a deeper correction?

The truth is — there’s no one-size-fits-all answer. The right move depends on market structure, liquidity conditions, macro factors, and most importantly, your personal strategy.

Let’s break it down properly:

1️⃣ Understanding the Current Market Structure

Before buying any dip, zoom out to the higher timeframes (Daily & Weekly charts).

Are we still making higher highs and higher lows?

→ If yes, the dip could simply be a healthy correction

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

$XRP (XRP_USDT) is showing clear downside momentum after being rejected from recent highs. Sellers are in control, with the structure making consistent lower highs and lower lows.

Entry Zone: 1.365 – 1.385

Targets: TP1: 1.340 | TP2: 1.310 | TP3: 1.280

Stop Loss: 1.425

Liquidity got swept below 1.358, causing a small bounce, but the overall picture remains bearish. Any pullback into the entry zone could give another chance for continuation toward lower liquidity pockets if selling pressure stays strong.

The market is clearly favoring the bears—watch your zones and plan accordingly.

#BuyTheDipO

Entry Zone: 1.365 – 1.385

Targets: TP1: 1.340 | TP2: 1.310 | TP3: 1.280

Stop Loss: 1.425

Liquidity got swept below 1.358, causing a small bounce, but the overall picture remains bearish. Any pullback into the entry zone could give another chance for continuation toward lower liquidity pockets if selling pressure stays strong.

The market is clearly favoring the bears—watch your zones and plan accordingly.

#BuyTheDipO

XRP-2,71%

- Reward

- like

- Comment

- Repost

- Share

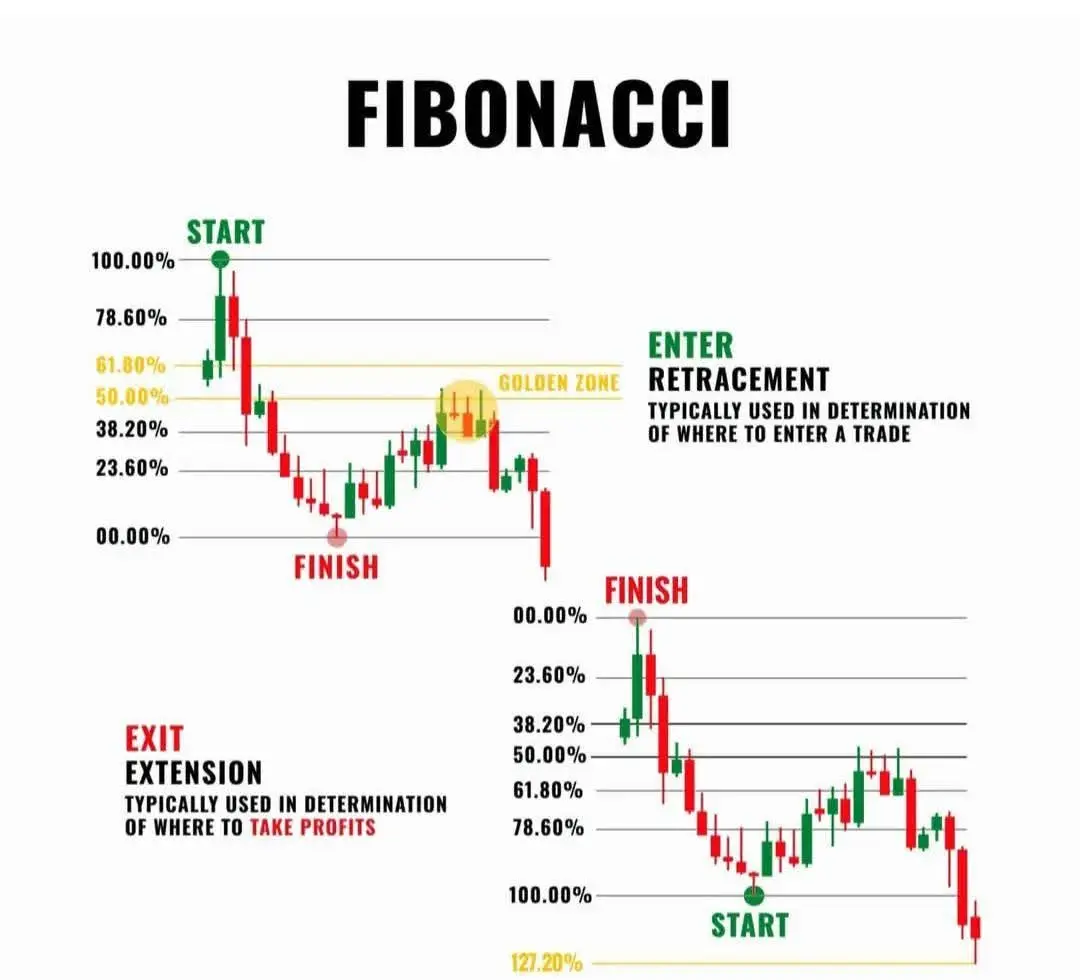

In the world of trading, Fibonacci Retracement is a powerhouse tool used to identify hidden levels of support and resistance. It’s based on the idea that markets don't move in a straight line; they "breathe"—pulling back before continuing a trend.

1. How the Tool Works

Traders take two extreme points on a chart (a major high and a major low) and divide the vertical distance by the key Fibonacci ratios: 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

The "Golden Pocket": The area between the 61.8% and 65% levels is often considered the most significant zone where a price reversal is likely to happen.

50%

1. How the Tool Works

Traders take two extreme points on a chart (a major high and a major low) and divide the vertical distance by the key Fibonacci ratios: 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

The "Golden Pocket": The area between the 61.8% and 65% levels is often considered the most significant zone where a price reversal is likely to happen.

50%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

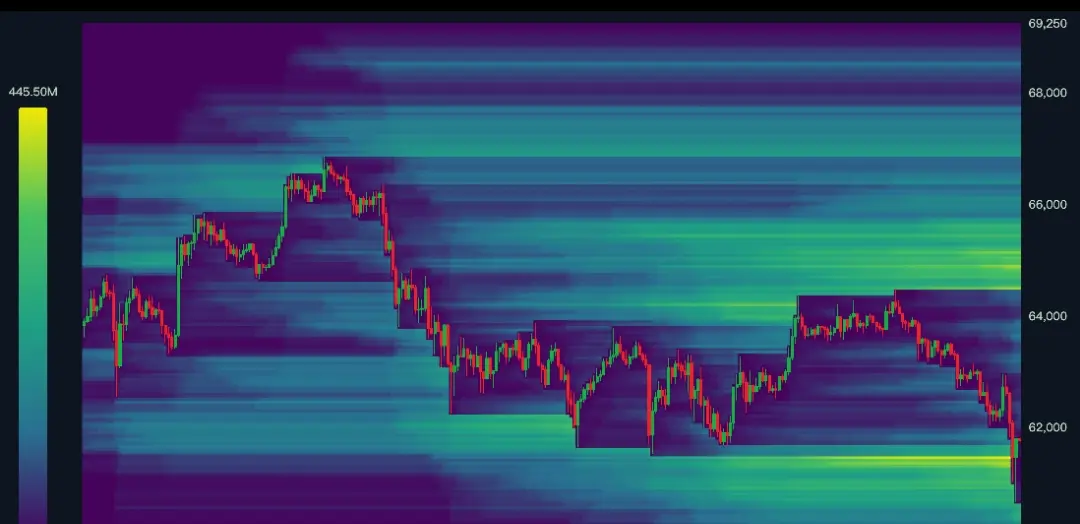

2026 GOGOGO 👊"Bitcoin is trading at roughly $67,100 right now. Where do you see us by the end of the week?

A) Back above $70,000 🚀

B) Consolidating at $65,000 🦀

C) A deeper dive to $58,000 📉

Drop your vote below! $BTC #BuyTheDipOrWaitNow?

A) Back above $70,000 🚀

B) Consolidating at $65,000 🦀

C) A deeper dive to $58,000 📉

Drop your vote below! $BTC #BuyTheDipOrWaitNow?

BTC-3,1%

- Reward

- like

- 1

- Repost

- Share

GateUser-4fa8d8be :

:

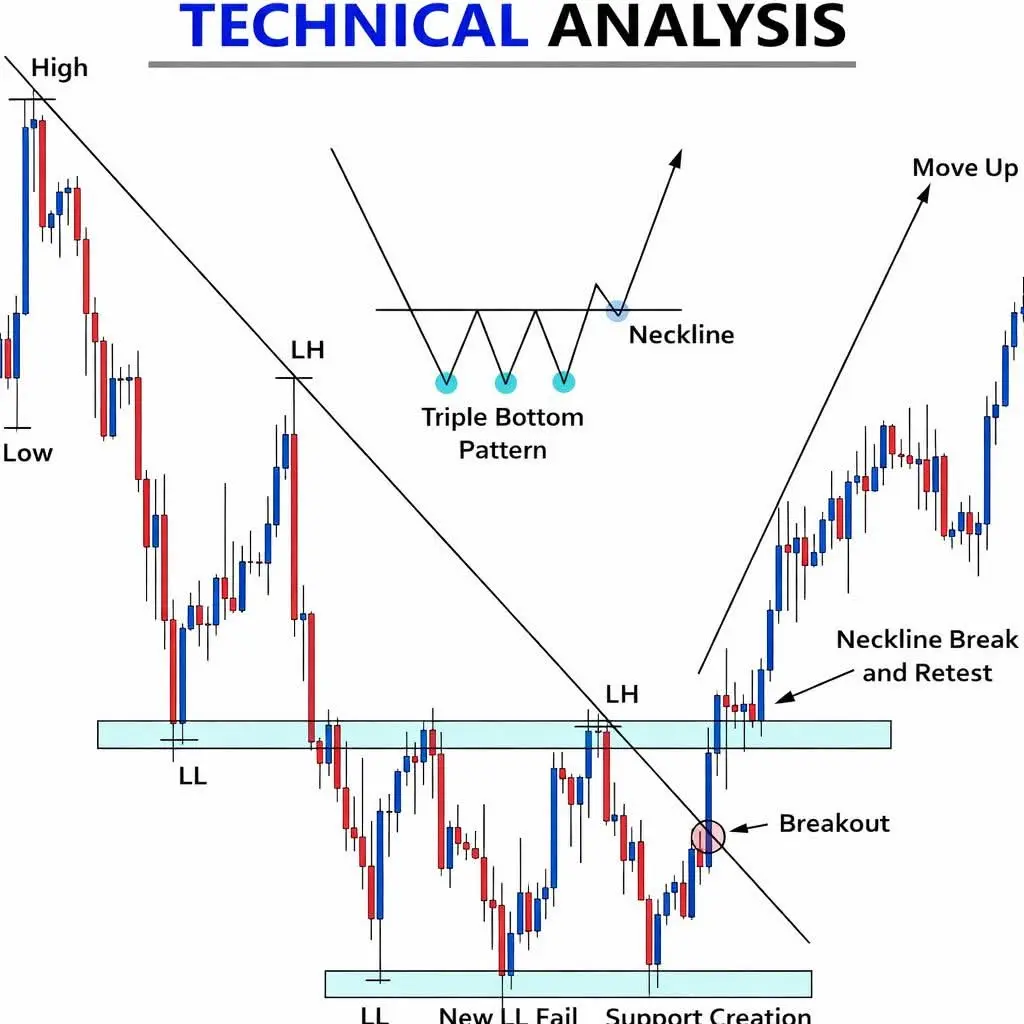

c#BuyTheDipOrWaitNow? 📉🔥 Bitcoin is currently trading around $67,271, breaking below the $68K zone and testing a critical support area.

Now the real question —

Is this the dip to accumulate… or should we wait for deeper levels?

🔎 Key Levels to Watch:

🟢 Support: $66,500 – $67,000

🟢 Major Support: $65,000

🔴 Resistance: $68,500 – $69,000

If BTC reclaims $68K with strong volume, we could see a relief bounce.

But if selling pressure continues, a move toward $65K liquidity zone is possible.

💡 Smart traders focus on confirmation, not emotions.

Liquidity grabs are common before reversals.

At $67

Now the real question —

Is this the dip to accumulate… or should we wait for deeper levels?

🔎 Key Levels to Watch:

🟢 Support: $66,500 – $67,000

🟢 Major Support: $65,000

🔴 Resistance: $68,500 – $69,000

If BTC reclaims $68K with strong volume, we could see a relief bounce.

But if selling pressure continues, a move toward $65K liquidity zone is possible.

💡 Smart traders focus on confirmation, not emotions.

Liquidity grabs are common before reversals.

At $67

BTC-3,1%

- Reward

- 4

- 6

- Repost

- Share

xxx40xxx :

:

Happy New Year! 🤑View More

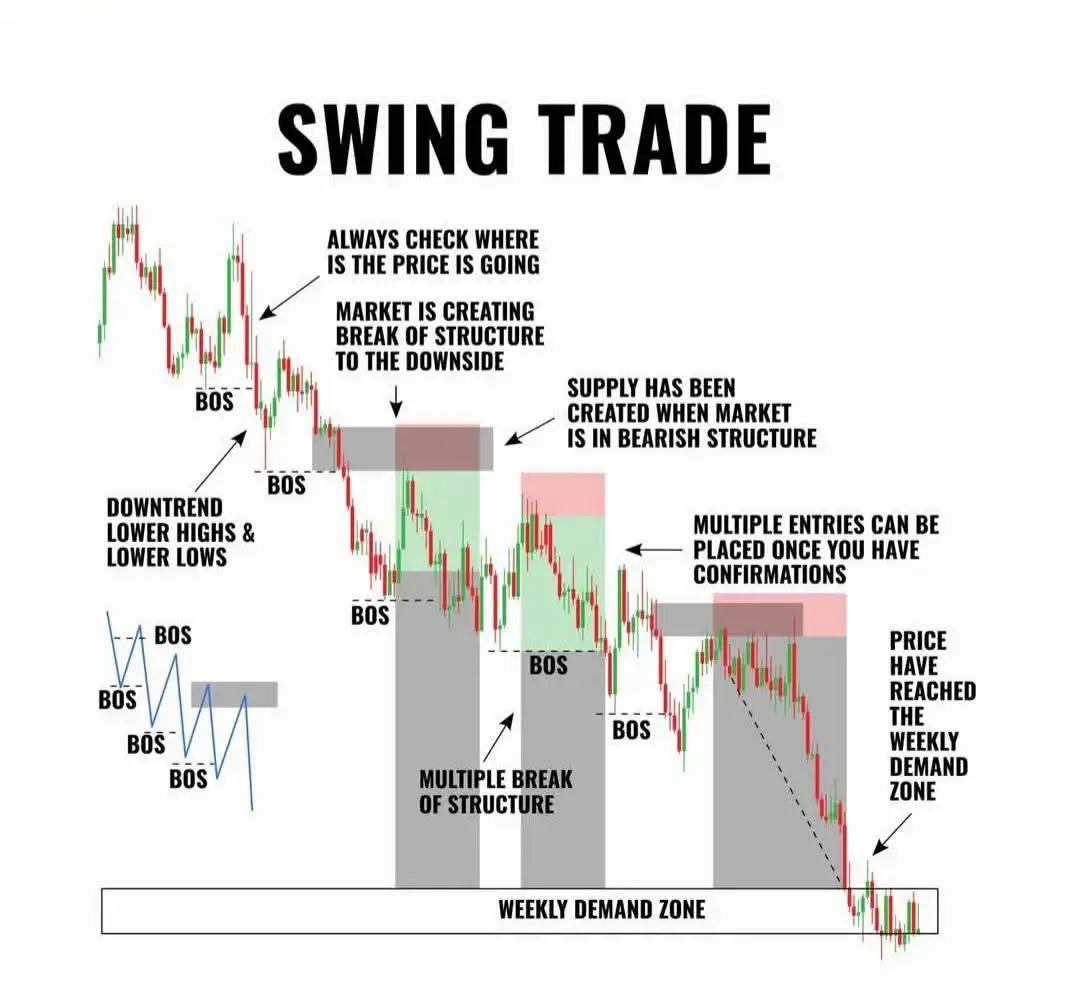

#BuyTheDipOrWaitNow?

The market is testing patience again.

Prices drop… fear rises… and everyone starts asking — “Is this the bottom?”

But here’s the truth:

Not every dip is a discount. Some dips are warnings.

A real opportunity shows signs: ✔️ Price reacts at a key support zone

✔️ Sellers lose momentum

✔️ Volume increases on bullish candles

✔️ Structure starts shifting

If the chart is still making lower lows with strong selling pressure, buying blindly is not confidence — it’s hope. And hope is not a trading strategy.

Professional traders don’t chase bottoms.

They wait for confirmation or bui

The market is testing patience again.

Prices drop… fear rises… and everyone starts asking — “Is this the bottom?”

But here’s the truth:

Not every dip is a discount. Some dips are warnings.

A real opportunity shows signs: ✔️ Price reacts at a key support zone

✔️ Sellers lose momentum

✔️ Volume increases on bullish candles

✔️ Structure starts shifting

If the chart is still making lower lows with strong selling pressure, buying blindly is not confidence — it’s hope. And hope is not a trading strategy.

Professional traders don’t chase bottoms.

They wait for confirmation or bui

- Reward

- 4

- 4

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

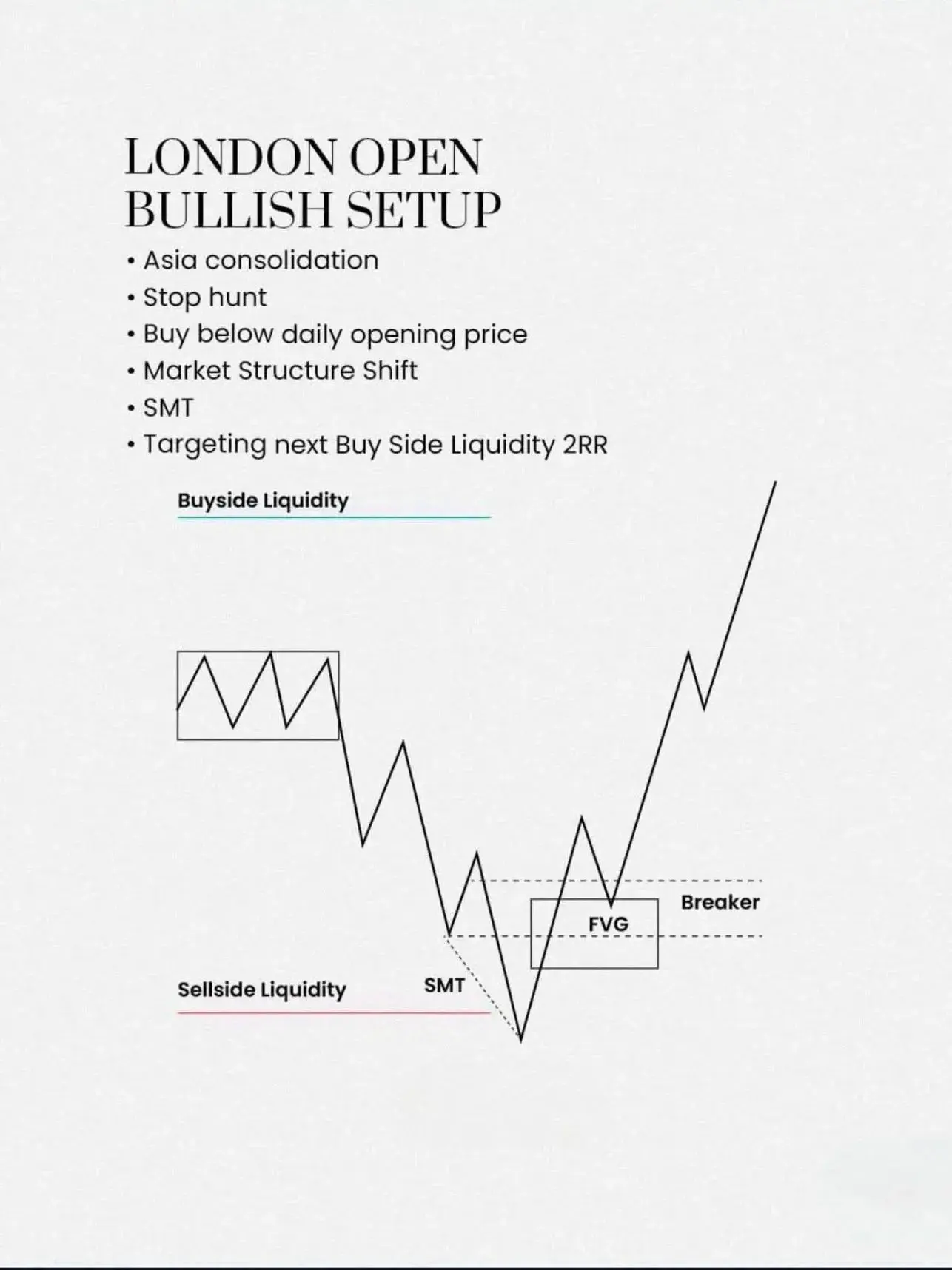

How Whales Actually Move the Market (It’s Not What You Think)

Every time the market drops suddenly, the same sentence appears:

“Whales are manipulating.”

But very few people understand how large players really operate.

Because whales don’t move markets with random market buys and sells.

They move markets with liquidity engineering.

---

First: What Is a Whale?

In crypto, a whale is: • A large holder

• A fund

• An institution

• An exchange

• Early adopters with size

But size alone doesn’t give control.

Liquidity does.

---

The Real Weapon: Liquidity

Price doesn’t move because someone sells.

Price

Every time the market drops suddenly, the same sentence appears:

“Whales are manipulating.”

But very few people understand how large players really operate.

Because whales don’t move markets with random market buys and sells.

They move markets with liquidity engineering.

---

First: What Is a Whale?

In crypto, a whale is: • A large holder

• A fund

• An institution

• An exchange

• Early adopters with size

But size alone doesn’t give control.

Liquidity does.

---

The Real Weapon: Liquidity

Price doesn’t move because someone sells.

Price

BTC-3,1%

- Reward

- 2

- 6

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

【$NIL Signal】No Position. After short squeeze, extreme overbought condition, waiting for healthy correction.

$NIL on the 4-hour timeframe, a massive bullish surge of 34% with a violent long candle. Price has broken above previous resistance, but RSI is at 80.35, entering the extremely overbought zone.

Key data reveals the nature of the short squeeze: funding rate is -0.2342% (negative), but open interest remains stable, and buy order depth is significantly thicker than sell orders (Bid/Ask Ratio 0.68), indicating shorts are being squeezed and buying strength is strong. However, the last 4H c

$NIL on the 4-hour timeframe, a massive bullish surge of 34% with a violent long candle. Price has broken above previous resistance, but RSI is at 80.35, entering the extremely overbought zone.

Key data reveals the nature of the short squeeze: funding rate is -0.2342% (negative), but open interest remains stable, and buy order depth is significantly thicker than sell orders (Bid/Ask Ratio 0.68), indicating shorts are being squeezed and buying strength is strong. However, the last 4H c

- Reward

- 1

- Comment

- Repost

- Share

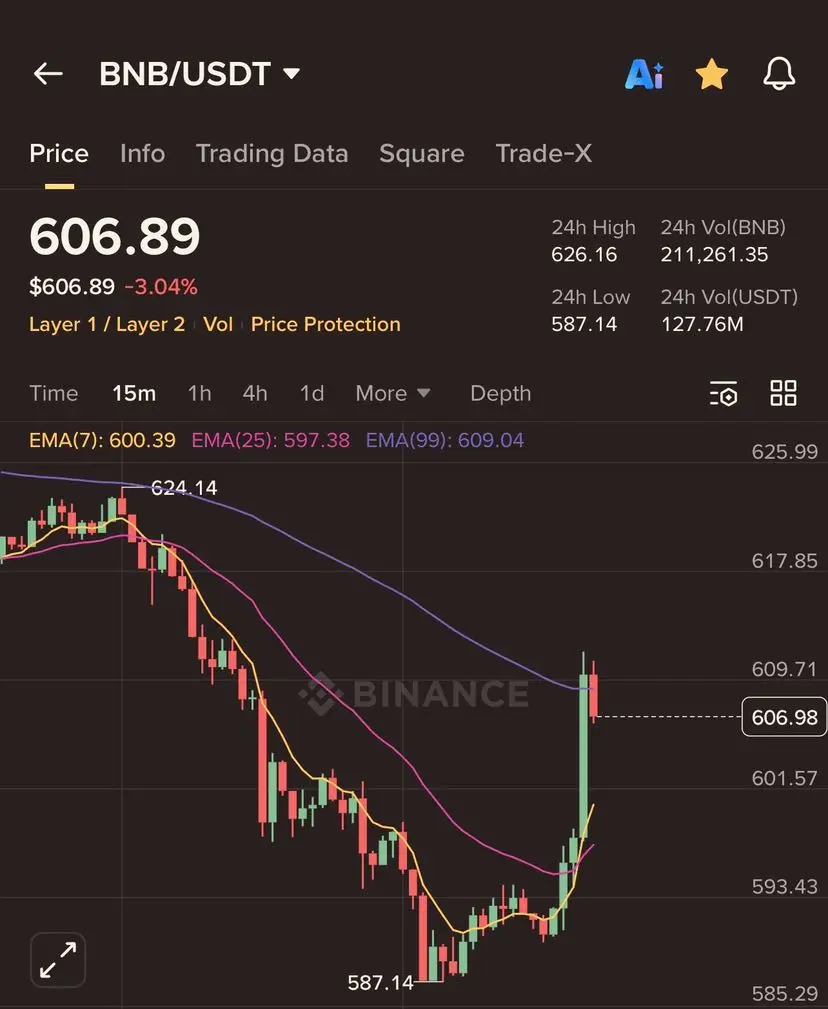

$BNB /USDT

$BNB Pullback Continuation Setup

BNB bounced strongly from the 587 support and pushed into resistance near 610. The move was clean and bullish, but price is now reacting at supply. Holding above 605 on a pullback keeps the continuation scenario intact, while rejection could lead to a quick dip.

Trade Setup:

• Entry: 604 – 608

• Targets: 615 / 620

• Stop Loss: 598

Wait for confirmation on the pullback and avoid chasing green candles.

$BNB #BuyTheDipOrWaitNow?

#CryptoSurvivalGuide

#GateSpringFestivalHorseRacingEvent

$BNB Pullback Continuation Setup

BNB bounced strongly from the 587 support and pushed into resistance near 610. The move was clean and bullish, but price is now reacting at supply. Holding above 605 on a pullback keeps the continuation scenario intact, while rejection could lead to a quick dip.

Trade Setup:

• Entry: 604 – 608

• Targets: 615 / 620

• Stop Loss: 598

Wait for confirmation on the pullback and avoid chasing green candles.

$BNB #BuyTheDipOrWaitNow?

#CryptoSurvivalGuide

#GateSpringFestivalHorseRacingEvent

BNB-3,08%

- Reward

- like

- Comment

- Repost

- Share

$ETH /USDT

Ethereum is trading around $1,933, down roughly -4% in the last 24H. After a sharp sell-off from the $2,030 area, price is now consolidating near intraday lows, forming a tight range. This zone often decides the next impulsive move.

On lower timeframes, selling pressure is slowing and candles are compressing — a classic pause before expansion. A reclaim of key levels could trigger a fast relief move, while failure keeps the downside in play.

Trade Setup (Short-term)

• Entry Zone: $1,920 – $1,940

• Target 1 🎯: $1,975

• Target 2 🎯: $2,020

• Target 3 🎯: $2,080

• Stop Loss: $1,895

I

Ethereum is trading around $1,933, down roughly -4% in the last 24H. After a sharp sell-off from the $2,030 area, price is now consolidating near intraday lows, forming a tight range. This zone often decides the next impulsive move.

On lower timeframes, selling pressure is slowing and candles are compressing — a classic pause before expansion. A reclaim of key levels could trigger a fast relief move, while failure keeps the downside in play.

Trade Setup (Short-term)

• Entry Zone: $1,920 – $1,940

• Target 1 🎯: $1,975

• Target 2 🎯: $2,020

• Target 3 🎯: $2,080

• Stop Loss: $1,895

I

ETH-3,26%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

232.37K Popularity

52.12K Popularity

23.18K Popularity

17.89K Popularity

17.12K Popularity

96.4K Popularity

6.36K Popularity

11.54K Popularity

6.77K Popularity

4.44K Popularity

5.62K Popularity

15.74K Popularity

4.04K Popularity

22.57K Popularity

14.08K Popularity

News

View MoreCryptocurrency lending platform BlockFills suspends customer withdrawals

3 m

Intercontinental Exchange launches Polymarket signals and sentiment tools, exclusively providing institutional clients with prediction market data

4 m

The Congressional Budget Office projects a deficit of $1.9 trillion in 2026.

5 m

Traditional Finance Alert: XTIUSD rises over 2%

7 m

Whale 3NVeXm Deposits 2,500 BTC Worth $170M to Centralized Exchange

13 m

Pin