Goldman Sachs reveals $2.3 billion in cryptocurrency investments! From skepticism to embracing BTC and XRP assets

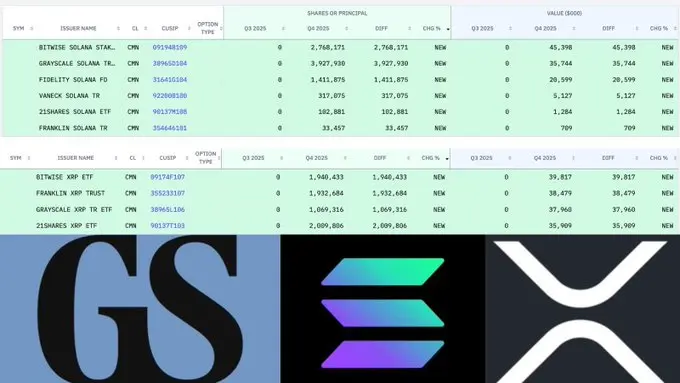

Goldman Sachs disclosed a $2.36 billion cryptocurrency exposure in its Q4 2025 13F filing, including holdings of $1.1 billion in Bitcoin, $1 billion in Ethereum, $153 million in XRP, and $108 million in Solana. These are held through regulated instruments like XRP ETFs rather than direct coin holdings. Goldman manages $3.6 trillion in assets, and this move marks a shift from skepticism to cautious adoption of cryptocurrencies.

Analysis of the $2.36 Billion Holdings: Goldman’s Crypto Allocation Logic

(Source: SEC)

Goldman Sachs revealed a substantial crypto exposure in its Q4 2025 13F filing, showing holdings of over $2.36 billion in digital assets. The 13F filing is a quarterly report that U.S. institutional investors managing over $100 million are required to submit, providing insight into top-tier institutional investment strategies. Goldman’s crypto investments appearing at this scale for the first time in a 13F signals a historic turning point in Wall Street’s attitude toward digital assets.

The filing shows the firm holds $1.1 billion in Bitcoin, $1 billion in Ethereum, $153 million in XRP, and $108 million in Solana, representing approximately 0.33% of its reported investment portfolio. This allocation reveals several key features of Goldman’s crypto strategy. First, Bitcoin and Ethereum together account for 89% of the crypto holdings, indicating a focus on the most mainstream and liquid assets. Second, the presence of XRP and Solana suggests Goldman is not entirely conservative, willing to tactically allocate to selected altcoins.

A closer look shows Goldman’s XRP exposure primarily comes via XRP exchange-traded funds (ETFs), totaling about $152 million. This detail is crucial because it reveals how Goldman participates in the crypto market: through regulated ETFs rather than direct token purchases and custody. The advantage of this approach lies in compliance, liquidity, and risk management. ETFs are managed by professional institutions responsible for custody and security, sparing Goldman from building complex crypto asset infrastructure.

The U.S. spot XRP ETF currently holds over $1.04 billion in net assets. The ETF has been trading for 56 days, with only four days of outflows. This strong capital inflow trend indicates growing institutional demand for XRP, and Goldman’s $152 million stake makes it one of the largest institutional holders of the ETF. Based on the total $1.04 billion in assets, Goldman’s share accounts for 14.6%, demonstrating that its confidence in XRP is not tentative but a well-considered strategic decision.

Distribution of Goldman’s $2.36 Billion Crypto Holdings

Bitcoin (BTC): $1 billion — 46.6% of crypto holdings

Ethereum (ETH): $1 billion — 42.4%

XRP: $153 million — 6.5%

Solana (SOL): $108 million — 4.6%

This allocation aligns with the classic “core-satellite” approach for institutional investors: anchoring on the safest, most mainstream assets (BTC and ETH) as core holdings, with emerging high-growth potential assets (XRP and SOL) as satellites, aiming for optimal risk-adjusted returns.

By early 2026, Goldman’s managed assets for institutional and private clients total approximately $3.6 trillion. It also operates extensive trading, asset management, and wealth management businesses. As a market bellwether, its portfolio disclosures often reflect broader institutional sentiment. Although the $2.36 billion only accounts for 0.066% of total assets under management, this absolute scale surpasses many dedicated crypto funds’ entire assets.

From “Scam” to $2.3 Billion: Goldman’s Dramatic Reversal

Historically, Goldman’s public stance on Bitcoin was skeptical. Before 2020, executives and research teams described Bitcoin as a speculative asset with limited use as currency and no intrinsic cash flow. The firm consistently viewed cryptocurrencies as unsuitable for conservative portfolios, emphasizing volatility and regulatory risks. In 2018, Goldman analysts even published reports explicitly stating “cryptocurrencies are not an asset class.”

Post-2020, as institutional demand grew, Goldman’s stance softened. It relaunched its crypto trading desk, expanded derivatives trading channels, and published research acknowledging Bitcoin’s potential as an inflation hedge, though it still did not see it as a core asset class. In 2021, Goldman began offering Bitcoin-related investment products to private wealth clients, limited to futures and structured notes, not direct coin holdings.

After the 2022 crypto winter, the firm emphasized infrastructure and counterparty risks again. Failures of FTX, Celsius, Voyager, and others validated Goldman’s early concerns, allowing it to avoid direct involvement and escape unscathed. However, this crisis also underscored the value of regulated investment tools, paving the way for the launch of spot ETFs in 2024 and Goldman’s large-scale entry.

Recently, Goldman’s crypto investment approach has shifted toward cautious participation. It engages via ETFs, structured products, and tokenized projects, while maintaining a view that cryptocurrencies remain speculative. This “participate but with caution” stance is reflected in its 0.33% allocation. For a $3.6 trillion institution, this small percentage indicates recognition of the asset class’s potential while preserving overall portfolio stability. If the crypto market crashes, Goldman’s losses would be limited to less than 0.33% of total assets, making risk fully manageable.

This filing marks a shift in Goldman’s attitude from past skepticism. The firm is now cautiously expanding its crypto exposure through compliant investment vehicles. This evolution was not sudden but the result of years of observation, testing, and risk assessment. From outright rejection to tentative participation, and now to a substantial $2.36 billion allocation, Goldman’s crypto journey reflects the broader traditional financial industry’s evolving understanding of digital assets.

Why Did Goldman Favor XRP? The Logic Behind $152 Million

(Source: SoSoValue)

Goldman’s decision to allocate $153 million to XRP is relatively rare among Wall Street institutions. For a long time, XRP was viewed as high-risk due to its ongoing lawsuit with the SEC. However, in 2023, Ripple achieved partial legal victories, and the launch of a spot XRP ETF in 2025 cleared major hurdles for institutional participation.

The XRP holdings via ETF total about $152 million, indicating Goldman’s approach is exposure through regulated, market-based instruments rather than direct token ownership. The advantage is regulatory compliance. Directly holding XRP involves complex legal issues—whether the token is a security, how to handle accounting, and custody responsibilities. Through ETFs, these issues are managed by the ETF issuer and custodian, with Goldman only exposed to market risk.

The investment logic for XRP likely stems from its practical application in cross-border payments. Ripple’s RippleNet has established partnerships with hundreds of financial institutions worldwide, with transaction volumes steadily increasing. For a global finance player like Goldman, XRP as a bridge currency offers strategic value. If XRP becomes a mainstream tool for cross-border payments, early investors could realize significant returns.

Additionally, XRP’s relatively lower volatility (compared to Bitcoin) may appeal to Goldman. While still a high-risk asset, XRP’s price swings are generally smaller than Bitcoin and small-cap altcoins. For institutions needing to explain investment decisions to clients and regulators, this more controlled volatility reduces portfolio management complexity.

The $108 million in Solana (SOL) holdings also warrants attention. As a newer blockchain platform that gained prominence after 2021, Solana’s high-performance infrastructure and expanding DeFi, NFT, and tokenized securities applications suggest Goldman sees long-term potential in high-speed blockchain ecosystems.

Wall Street’s FOMO: The Chain Reaction of Goldman’s Example

Goldman Sachs is one of the world’s most influential investment banks, advising on mergers and acquisitions, capital markets, and restructuring. As a market bellwether, its portfolio disclosures often reflect broader institutional sentiment and can trigger herd behavior. When a top-tier firm like Goldman discloses $2.3 billion in crypto holdings, it sends a strong signal: crypto assets are now an acceptable institutional asset class.

This demonstration can spark a chain reaction. JPMorgan, Bank of America, Wells Fargo, and other major Wall Street players may disclose similar crypto holdings in upcoming 13F filings. Pension funds, sovereign wealth funds, family offices, and more conservative investors might consider small allocations after seeing Goldman’s example. This institutional acceleration could inject hundreds of billions or even trillions of dollars into the crypto market.

Timing-wise, Goldman’s disclosure during a market correction is notable. The $2.36 billion investment was likely accumulated at higher Bitcoin prices, meaning Goldman may currently be sitting on paper losses. Yet, its willingness to disclose transparently signals confidence in the long-term prospects of digital assets. This “contrarian disclosure” also communicates: Goldman is not a short-term speculator but a long-term holder.

Related Articles

Ethereum Co-Founder Drops Bitcoin Doomsday Warning

Bitcoin Moves With Tech Stocks, Not Gold, Grayscale Research Shows

Bitcoin Sees $2.3B in Realized Losses As Capitulation Intensifies

Dead Cat Bounce or Bottoming Out? Bitcoin Bulls Face Harsh Reality Check

Analysis: The crypto market correction may be influenced by traditional financial factors, not an industry crisis.