State Street Bank warns: If the Federal Reserve aggressively cuts interest rates, the US dollar could depreciate by 10% this year

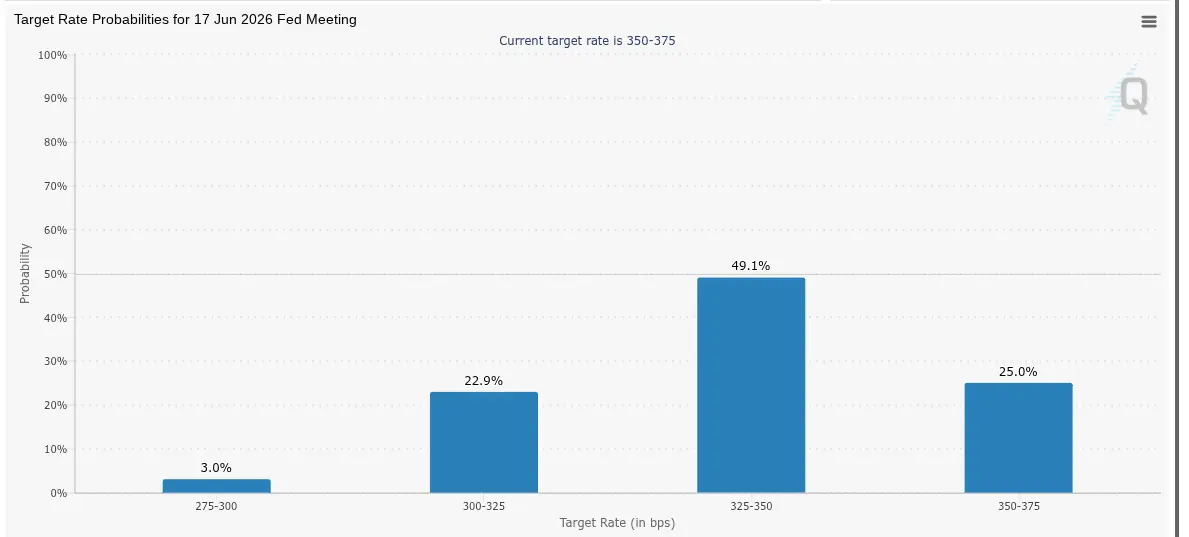

Goldman Sachs strategists warn that if the Federal Reserve adopts more aggressive easing, the dollar could depreciate by 10% this year, marking the worst performance in a decade. Two rate cuts are the baseline, with three also possible, as narrowing interest rate differentials prompt overseas investors to sell dollars. Trump has nominated Kevin Warsh to succeed Jerome Powell as Fed Chair, with expectations of more aggressive rate cuts. Currently, interest rates are at 3.50%-3.75%, and CME indicates the first of two cuts could occur as early as June.

Goldman Sachs Warns of the Worst Dollar Decline in a Decade

One of the world’s largest asset managers, Goldman Sachs, warns that if the Fed pursues more aggressive easing than market expectations, the dollar could face its worst decline in nearly ten years, especially if leadership changes at the Fed occur. At a conference in Miami, Goldman Sachs strategist Lee Ferridge said that if financial conditions ease further, the dollar could depreciate by as much as 10% this year.

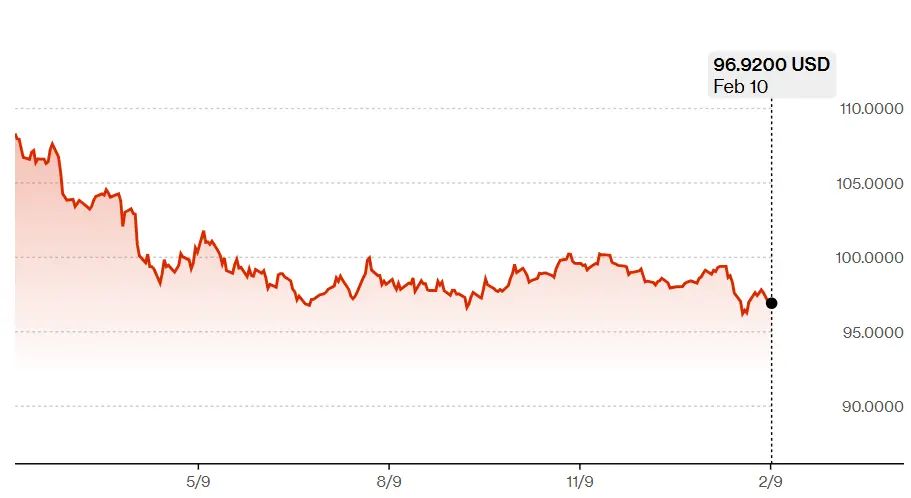

A 10% dollar decline is extremely rare in recent history. Over the past decade, the dollar index has typically fluctuated between 90 and 105, with annual drops exceeding 10% only in 2017 (from 103 down to 92). A 10% decline from the current level of about 97 would bring the index to around 87, the lowest since the 2008 financial crisis. Such an extreme depreciation would have profound impacts on global financial markets.

Ferridge believes two rate cuts are a “reasonable baseline scenario,” but warns that the risk leans toward more cuts. “Three cuts are also possible,” he said. With the current Fed target range at 3.50%-3.75%, two cuts (each 25 basis points) would lower rates to 3.00%-3.25%, and three cuts would bring it to 2.75%-3.00%. This level of easing is aggressive given the current economic environment.

Analysis of Fed Rate Cut Scenarios

Baseline (two cuts): Rates fall to 3.00%-3.25%, dollar declines about 5-7%

Aggressive (three cuts): Rates fall to 2.75%-3.00%, dollar could fall up to 10%

Extreme (more than four cuts): If recession occurs, more cuts could lead to a dollar crash

Lower U.S. interest rates tend to reduce the attractiveness of dollar-denominated assets, especially for foreign investors. As the interest rate differential narrows, overseas investors are more likely to hedge currency risk by selling dollars to protect returns. This increased hedging demand can further pressure the dollar downward. Currently, the U.S. 10-year Treasury yield is about 4.2%, compared to Japan’s 0.5% and the Eurozone’s 2.5%, maintaining a significant yield advantage. However, if the Fed cuts rates three times, U.S. yields could fall below 3.5%, substantially shrinking the yield gap.

Kevin Warsh Nomination and Dovish Policy Expectations

(Source: CME Fed Watch)

A weaker dollar may also be linked to President Trump’s nomination of Kevin Warsh to lead the Fed, replacing Jerome Powell. If Warsh’s nomination is confirmed, markets widely expect him to favor more aggressive rate cuts. This expectation seems contradictory to Warsh’s past hawkish reputation but may reflect alignment with Trump’s policy stance.

Trump has publicly criticized Powell for not cutting rates fast enough, urging lower rates to stimulate the economy and stock markets. As Trump’s nominee, Warsh might be more inclined to follow the president’s preferences. Although Warsh was a hawk during the 2008 financial crisis when he served as a Fed governor, the current economic environment is very different. Facing potential slowdown and weak employment, he might shift toward more accommodative policies.

Given the current Fed target range of 3.50%-3.75%, market sentiment and cautious expectations align. According to CME Group’s FedWatch tool, investors expect two rate cuts this year, with the first possibly in June. Before that, the Fed has scheduled meetings in March and May. The timing in June is delicate; if Warsh’s nomination is confirmed, June would be his first policy meeting as Chair.

Market expectations of a dovish Warsh are partly based on his past emphasis on productivity growth and technological innovation. He has suggested that AI and other tech could significantly boost productivity, allowing the economy to grow at lower interest rates without triggering inflation. If this “productivity optimism” becomes part of the Fed’s framework, it could justify more aggressive easing.

Dollar Depreciation and Bitcoin: A Double-Edged Sword

(Source: Bloomberg)

A weakening dollar is often seen as a catalyst for Bitcoin. When the dollar weakens, demand for risk assets, including Bitcoin, tends to increase. Analysts frequently point to an inverse relationship between the dollar index and Bitcoin, with periods of dollar weakness often creating a more favorable environment for crypto prices. Recently, the dollar index hit a four-year low around 97; a further 10% decline would push it to about 87, the lowest since 2008.

Dollar depreciation can ease financial conditions, boost global liquidity, and encourage investors to turn to assets seen as alternatives to fiat currencies. Historically, during past dollar declines, Bitcoin has benefited. In 2017, as the dollar depreciated, Bitcoin surged from $1,000 to $20,000. During the 2020 dollar weakness, Bitcoin rose from $10,000 to $60,000. These cases support the logic that a weaker dollar favors Bitcoin.

However, this relationship is not guaranteed. Recent analysis shows Bitcoin’s short-term performance does not always align with dollar weakness; in some periods, Bitcoin has fallen alongside the dollar. The 2022 example is instructive: despite a strong dollar rally, Bitcoin also plunged. This decoupling indicates Bitcoin is influenced by multiple factors, with the dollar only one.

Profit-taking, investor positioning, overall risk sentiment, and monetary policy uncertainty can all diminish the impact of exchange rate movements. During times of extreme panic, even a falling dollar may lead capital into safe-haven assets like U.S. Treasuries rather than Bitcoin. Concerns over crypto regulation or technological issues (like quantum threats) can also offset the benefits of dollar weakness. Therefore, while Goldman Sachs’ warning offers a potential bullish signal for Bitcoin, whether it translates into price gains depends on other factors.

For Bitcoin investors, how should Goldman Sachs’ warning be interpreted? An optimistic scenario is that if the Fed indeed begins consecutive rate cuts in June, dollar depreciation could trigger global liquidity easing, attracting funds into risk assets like Bitcoin and sparking a new bull run. A pessimistic scenario is that rate cuts are driven by rising recession risks; in a recession environment, even with a weaker dollar, Bitcoin—being a high-risk asset—may be sold off. The key distinction is between “growth-oriented rate cuts” (where the economy remains healthy but rate cuts are preemptive) and “recession-driven rate cuts” (necessitated by economic collapse). The former is bullish for Bitcoin, the latter less so.

Related Articles

The probability of the Federal Reserve maintaining interest rates in March before the non-farm payrolls announcement is 78.3%.

The Federal Reserve may cut interest rates by 25 basis points to a range of 3.25%-3.5% before the end of June

Bank Negara Malaysia Launches 3 Major Initiatives: Testing "Ringgit Stablecoin" and "Tokenized Deposits" Use Cases

Hong Kong Securities and Futures Commission's latest guidelines: opening virtual asset collateralized financing, first-ever perpetual contract framework, allowing affiliated companies to provide market-making

White House Stablecoin Negotiations Break Down? Profit Dispute Stalls U.S. Cryptocurrency Legislation, Digital Dollar's Future in Jeopardy

Pre-NFP Shock in the US: Bitcoin Drops to $66,000, Market Bets on Employment Data Influencing BTC Movement