Gate Daily (February 11): Federal Reserve warns of cooling crypto craze; former SafeMoon CEO sentenced to 8 years in prison

Bitcoin (BTC) remains in a sluggish trend, currently around $69,160 as of February 11. Federal Reserve Board member Waller warned that the cryptocurrency boom is waning because it is closely linked to traditional finance (TradFi). Former SafeMoon CEO was sentenced to 8 years in prison for a crypto scam, with orders to forfeit approximately $7.5 million and two residential properties.

Macro Events & Crypto Highlights

-

Federal Reserve Board member Christopher Waller stated on Monday that, with President Trump winning the election, the crypto craze is beginning to fade as the market becomes increasingly connected to the traditionally risk-averse financial system. Waller said at a conference, “I think, with the current administration in power, there has been some enthusiasm in the crypto space, but that enthusiasm is gradually diminishing.” He also added that many cryptocurrencies “have already been integrated into the mainstream financial system.” “And, you know, there’s always something happening, so I believe the large sell-offs are just companies entering the space from mainstream finance having to adjust their risk profiles,” he said.

-

Braden John Karony, former CEO of SafeMoon US LLC, was sentenced to over eight years in prison. Prosecutors said he lied to investors to fund his lavish lifestyle, including “mansions, sports cars, and customized trucks.” A statement from the U.S. Attorney’s Office in the Eastern District of New York on Tuesday said the 29-year-old from Utah was also ordered to forfeit about $7.5 million and two residential properties. “Braden John Karony not only abused his position as CEO but also betrayed investors’ trust by stealing over $9 million in digital assets from the company to sustain his extravagant lifestyle,” said FBI Assistant Director James Barnacle.

News & Market Updates

-

Crypto journalist: White House’s second round of stablecoin yield meetings was “productive” but no agreement was reached.

-

Hyperliquid’s HIP-3 daily trading volume surpasses $5 billion, driven by the precious metals boom increasing activity.

-

Bitmine re-staked over 140,000 ETH about 4 hours ago, worth approximately $282 million.

-

Robinhood’s stock fell after earnings release, with Q4 crypto revenue down 38%.

-

Former SafeMoon CEO sentenced to 8 years for fraud; funds used to buy mansions and sports cars.

-

LayerZero to launch a new blockchain “Zero” targeting traditional finance, with Citadel, ICE, and Cathie Wood involved.

-

Goldman Sachs reveals it holds $2.361 billion in crypto indirectly through ETFs.

-

A Hyperunit whale, previously holding over $10 billion in BTC, lost $250 million on a long ETH position on Hyperliquid.

-

YZi Labs responds to CEA Industries’ board statement and demands clarification of misleading information.

-

State Street: Rate cuts by 2026 may exceed market expectations, with the dollar potentially declining 10% throughout the year.

Market Trends

-

Latest Bitcoin news: BTC remains in a sluggish trend, around $69,160, with $82.42 million in liquidation over the past 24 hours, mostly long positions.

-

S&P 500 and NASDAQ closed lower on February 10, ending two consecutive days of gains. The Dow slightly rose, marking its third consecutive record close. Investors are digesting disappointing retail sales data while awaiting key labor market reports. The Dow Jones Industrial Average rose 52.27 points, or 0.1%, to close at 50,188.14, hitting a new all-time high during the session. The S&P 500 fell 23.01 points, or 0.33%, to 6,941.81. The NASDAQ declined 136.19 points, or 0.59%, to 23,102.48.

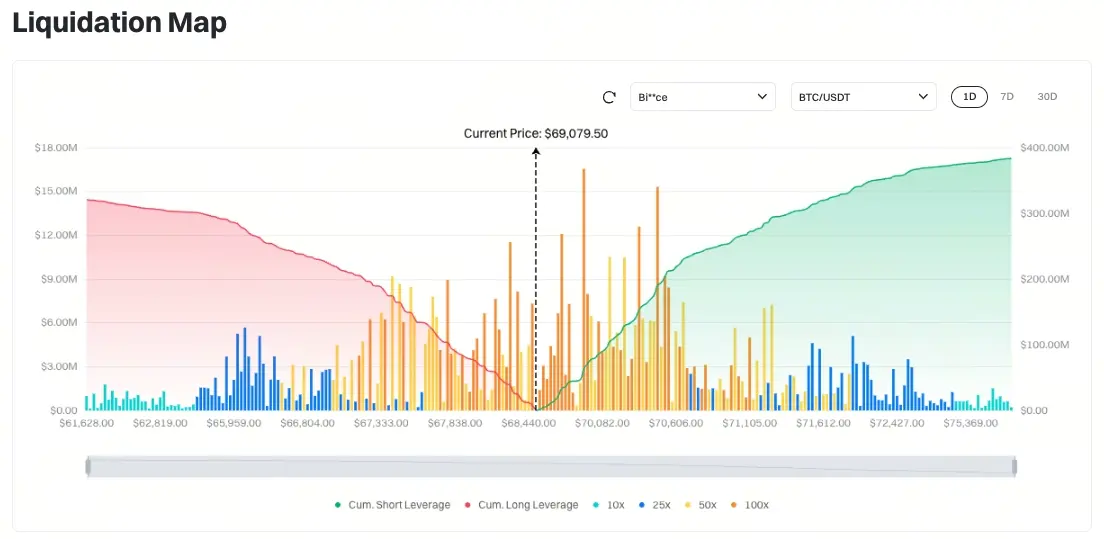

(Source: Gate)

- According to Gate’s BTC/USDT liquidation map, with the current price at $69,079.50, if the price drops to around $68,304, total long liquidations exceed $37.81 million; if it rises to about $69,967, total short liquidations exceed $63.21 million. Short liquidations are significantly higher than longs, so it’s advisable to control leverage wisely to avoid large-scale liquidations during market fluctuations.

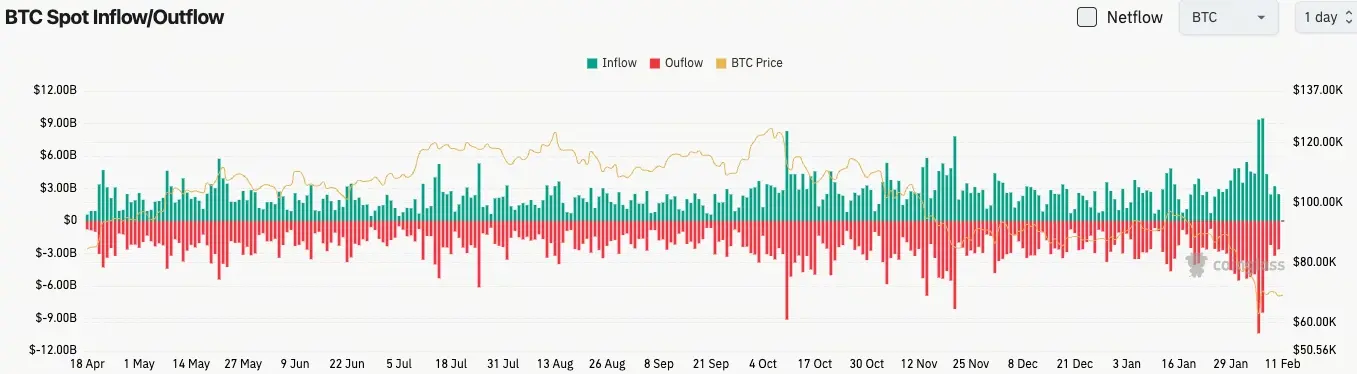

(Source: Coinglass)

- In the past 24 hours, spot inflows totaled $2.48 billion, outflows $2.62 billion, net outflow $140 million.

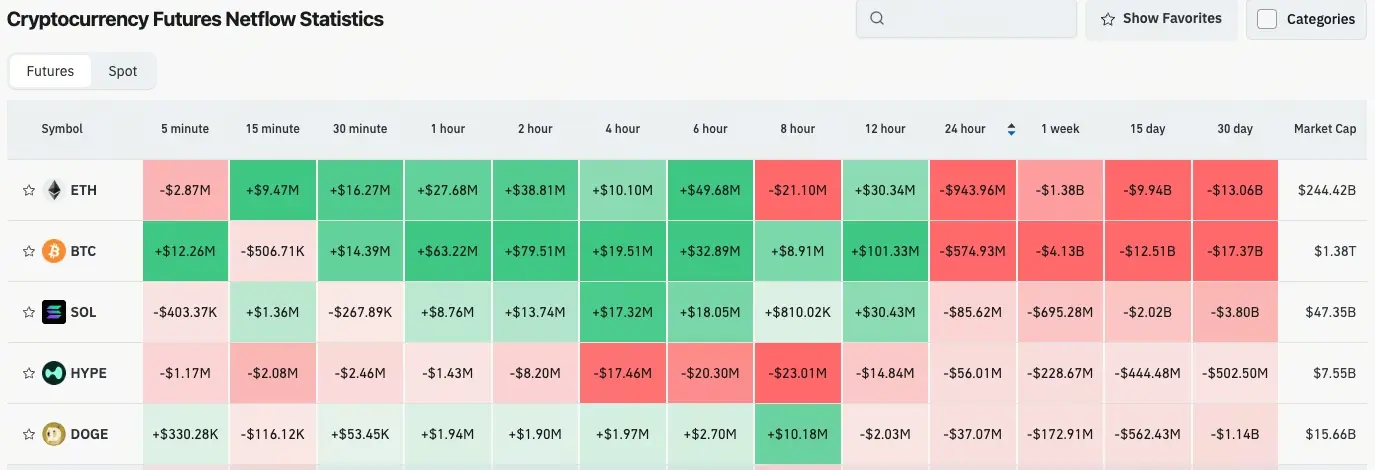

(Source: Coinglass)

- In the past 24 hours, net outflows led in contracts trading for ETH, BTC, SOL, HYPE, DOGE, indicating trading opportunities.

X Key Opinion Leader Insights

Phyrex Ni (@Phyrex_Ni): “Today’s work is relatively straightforward, and the market still feels calm. Recently, I haven’t been very interested in macro data because all the current data probably won’t influence the Federal Reserve’s monetary policy after June. If Waller is Trump’s spokesperson, then no matter if the data is good or bad, it won’t change the rate cut direction. If Waller becomes the second Powell after taking office, there could be some risks in the US by 2026.”

“So I personally think that all current data isn’t the most important. What matters most is whether Trump can embed some ‘nails’ within the Fed and how much influence the Fed chair has. The most interesting scenario I can imagine is Waller and Waller, along with a few other board members, calling for easing, while most members insist on looking at the data. Some folks say the Fed chair is waiting for the interest rate to be set.”

“The market in the first half of the year might not be easy. Before the Fed chair takes office, Trump’s tariffs are likely to be a predictable factor affecting the market, but we might have to wait until after the new year.”

“Looking at Bitcoin data, although it appears heavily reduced holdings, the actual turnover isn’t high—it’s quite normal. The main players are short-term investors, many of whom expect BTC’s price to rise in the future. So, those in loss are less willing to sell, while everyone is waiting for lower prices, leading to liquidity shortages.”

“From the chip structure, it’s clear that the chips on both sides of URPD haven’t changed much; most investors are still on the sidelines. But panic has increased short-term selling. The market mainly lacks confidence right now.”

Today’s Outlook

-

China’s M2 money supply at the end of January (annual rate), previous: 8.5%

-

US API weekly crude oil inventory change (10,000 barrels) (as of 02/06), previous: -1107.9

-

China’s January Consumer Price Index (annual rate), previous: 0.8%

-

China’s January Producer Price Index (annual rate), previous: -1.9%

-

US January unemployment rate, previous: 4.4%

-

US January non-farm payroll change (thousands), previous: 50

-

US EIA weekly crude oil inventory change (10,000 barrels) (as of 02/06), previous: -345.5

-

OPEC monthly oil market report release

-

Federal Reserve Board member Bowman participates in a “Regulation and Oversight” panel

Related Articles

This New XRP ETF Pays Monthly Income — But It Doesn’t Actually Hold XRP

Sui Joins Ethereum and Solana as Coinbase-Supported Token Standard

Analysis: Bitcoin has fallen for three consecutive days after dropping below $70,000, but the timing for medium- to long-term positioning may have already appeared.

LayerZero Launches ‘Zero’ Layer 1 as Citadel, ARK Buy ZRO - Unchained

Pre-NFP Shock in the US: Bitcoin Drops to $66,000, Market Bets on Employment Data Influencing BTC Movement

USDT Market Cap Experiences Negative Growth for the First Time in Two Years: Does the Fluctuation in Stablecoins Signal a Mid-term Shift for Bitcoin?