# BTCMarketAnalysis

65.24K

Berserker_09

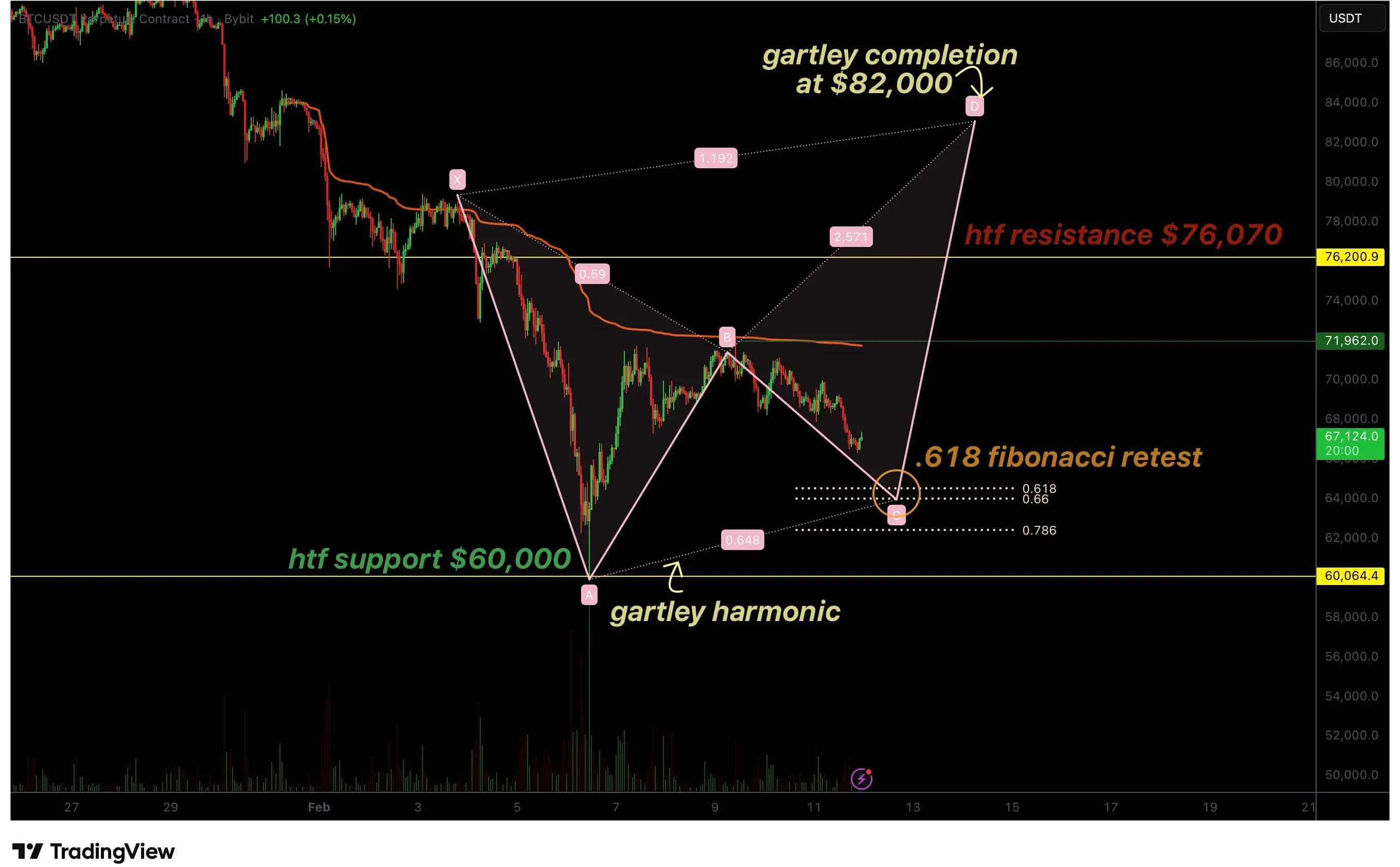

Why Bitcoin price gartley pattern signals potential move toward $80,000

Bitcoin price action is beginning to resemble a developing Gartley harmonic pattern, raising the probability of a technical reversal toward the $80,000–$82,000 region if key Fibonacci support holds.

Bitcoin ( $BTC ) has spent recent sessions consolidating after a sharp corrective move, with price behavior on the intraday timeframe beginning to form a recognizable harmonic structure. While broader market sentiment remains cautious, technical conditions suggest that Bitcoin may be entering a potential reversal zone.

The deve

Bitcoin price action is beginning to resemble a developing Gartley harmonic pattern, raising the probability of a technical reversal toward the $80,000–$82,000 region if key Fibonacci support holds.

Bitcoin ( $BTC ) has spent recent sessions consolidating after a sharp corrective move, with price behavior on the intraday timeframe beginning to form a recognizable harmonic structure. While broader market sentiment remains cautious, technical conditions suggest that Bitcoin may be entering a potential reversal zone.

The deve

BTC-1,68%

- Reward

- 1

- Comment

- Repost

- Share

#BTCMarketAnalysis

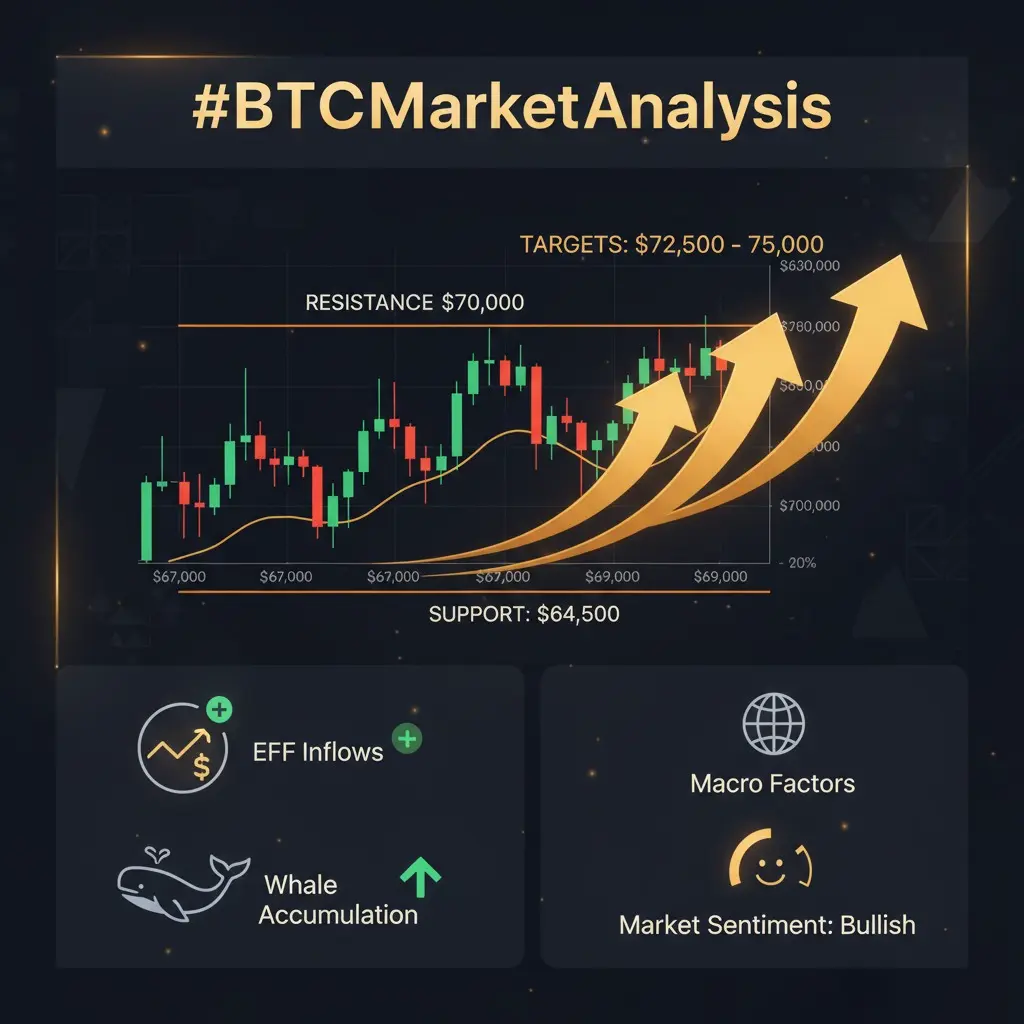

Bitcoin (BTC) continues to dominate the crypto market as the flagship digital asset, setting the tone for overall sentiment and liquidity flows. As of now, BTC is trading around the $67,000–$69,000 range, showing resilience despite short-term volatility. The market structure remains bullish on the higher time frames, although intraday swings reflect profit-taking and macro uncertainty.

Current Market Structure

Bitcoin recently rebounded from a key support zone near $64,500, which acted as a strong demand area backed by institutional buying and ETF inflows. The immediate re

Bitcoin (BTC) continues to dominate the crypto market as the flagship digital asset, setting the tone for overall sentiment and liquidity flows. As of now, BTC is trading around the $67,000–$69,000 range, showing resilience despite short-term volatility. The market structure remains bullish on the higher time frames, although intraday swings reflect profit-taking and macro uncertainty.

Current Market Structure

Bitcoin recently rebounded from a key support zone near $64,500, which acted as a strong demand area backed by institutional buying and ETF inflows. The immediate re

BTC-1,68%

- Reward

- 9

- 17

- Repost

- Share

User_any :

:

2026 GOGOGO 👊View More

#BTCMarketAnalysis Bitcoin’s Current State, Key Levels & What Traders Need to Know

Bitcoin’s market structure in early 2026 reflects a phase of heightened volatility, cautious sentiment, and growing sensitivity to macroeconomic signals. After strong performance in previous cycles, BTC has recently faced renewed selling pressure, pushing price action below the $70,000 level and toward critical short-term support zones. This movement highlights growing uncertainty among traders as global markets wait for clearer direction from economic data and policy expectations.

📉 Current Price Action and Vo

Bitcoin’s market structure in early 2026 reflects a phase of heightened volatility, cautious sentiment, and growing sensitivity to macroeconomic signals. After strong performance in previous cycles, BTC has recently faced renewed selling pressure, pushing price action below the $70,000 level and toward critical short-term support zones. This movement highlights growing uncertainty among traders as global markets wait for clearer direction from economic data and policy expectations.

📉 Current Price Action and Vo

BTC-1,68%

- Reward

- 5

- 4

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#BTCMarketAnalysis Bitcoin’s Current State, Key Levels & What Traders Need to Know

Bitcoin’s market structure in early 2026 reflects a phase of heightened volatility, cautious sentiment, and growing sensitivity to macroeconomic signals. After strong performance in previous cycles, BTC has recently faced renewed selling pressure, pushing price action below the $70,000 level and toward critical short-term support zones. This movement highlights growing uncertainty among traders as global markets wait for clearer direction from economic data and policy expectations.

📉 Current Price Action and Vo

Bitcoin’s market structure in early 2026 reflects a phase of heightened volatility, cautious sentiment, and growing sensitivity to macroeconomic signals. After strong performance in previous cycles, BTC has recently faced renewed selling pressure, pushing price action below the $70,000 level and toward critical short-term support zones. This movement highlights growing uncertainty among traders as global markets wait for clearer direction from economic data and policy expectations.

📉 Current Price Action and Vo

BTC-1,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 8

- 12

- Repost

- Share

AylaShinex :

:

Happy New Year! 🤑View More

#BTCMarketAnalysis Bitcoin’s Market Outlook, Critical Levels & What Traders Should Watch

Bitcoin’s market structure in early 2026 is entering a phase marked by higher volatility, cautious investor sentiment, and strong sensitivity to macroeconomic developments. After delivering strong performance in previous cycles, BTC is now facing renewed selling pressure, pushing prices below the $70,000 mark and toward key short-term support zones. This shift reflects growing uncertainty as global markets await clearer signals from economic data and policy direction.

📉 Price Action & Market Volatility

Bi

Bitcoin’s market structure in early 2026 is entering a phase marked by higher volatility, cautious investor sentiment, and strong sensitivity to macroeconomic developments. After delivering strong performance in previous cycles, BTC is now facing renewed selling pressure, pushing prices below the $70,000 mark and toward key short-term support zones. This shift reflects growing uncertainty as global markets await clearer signals from economic data and policy direction.

📉 Price Action & Market Volatility

Bi

BTC-1,68%

- Reward

- 3

- 3

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#BTCMarketAnalysis |The Bitcoin market has been showing significant dynamism recently. Recent price action gives a clear insight into the ongoing battle between buyers and sellers, with market sentiment leaning slightly cautious. A close look at the charts shows that Bitcoin has tested multiple support levels and has bounced back each time, signaling that demand remains strong.

For top positioning, it’s essential to understand that despite short-term volatility, the long-term trend continues to favor bullish momentum.

Currently, Bitcoin has challenged the near-term resistance around $28,500 b

For top positioning, it’s essential to understand that despite short-term volatility, the long-term trend continues to favor bullish momentum.

Currently, Bitcoin has challenged the near-term resistance around $28,500 b

BTC-1,68%

- Reward

- 3

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Thank you for sharing the information; it was very inspiring to me💪💪💪View More

Market Volatility Is Rising — Has the BTC Playbook Changed?

Bitcoin volatility is picking up again, and that usually signals transition, not randomness. After a period of compression, price is reacting faster to macro headlines, liquidity shifts, and derivatives positioning.

🔍 What’s different now

Shorter swings: BTC is respecting intraday levels more tightly, making patience and timing more important than prediction.

Liquidity-driven moves: Wicks are sharper as leverage builds on both sides — fake breakouts are more common.

Macro sensitivity: Yields, USD moves, and risk sentiment are having

Bitcoin volatility is picking up again, and that usually signals transition, not randomness. After a period of compression, price is reacting faster to macro headlines, liquidity shifts, and derivatives positioning.

🔍 What’s different now

Shorter swings: BTC is respecting intraday levels more tightly, making patience and timing more important than prediction.

Liquidity-driven moves: Wicks are sharper as leverage builds on both sides — fake breakouts are more common.

Macro sensitivity: Yields, USD moves, and risk sentiment are having

BTC-1,68%

- Reward

- 19

- 15

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#BTCMarketAnalysis

✅ Viral Style Post (Gate.io)

🚀 #BTCMarketAnalysis

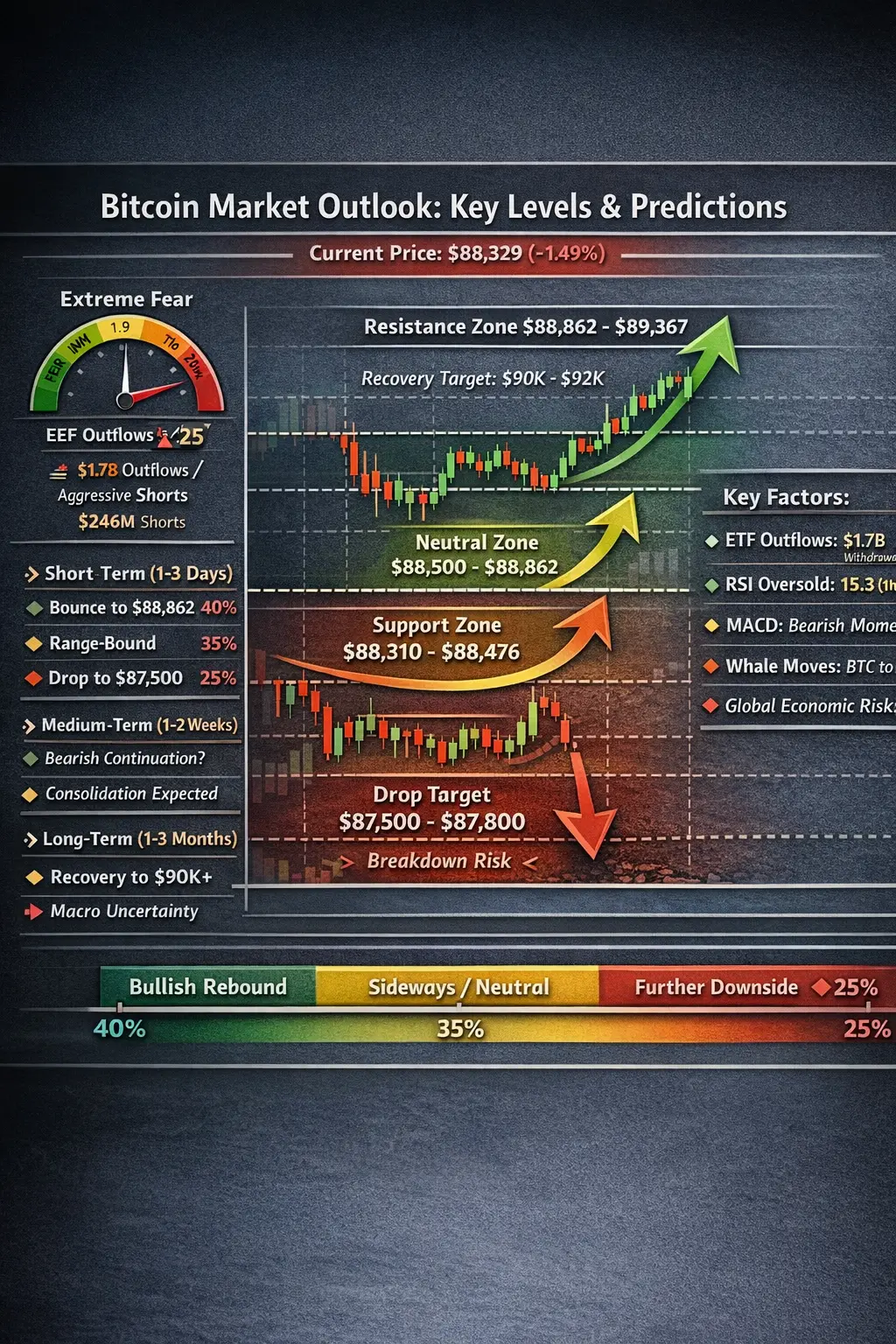

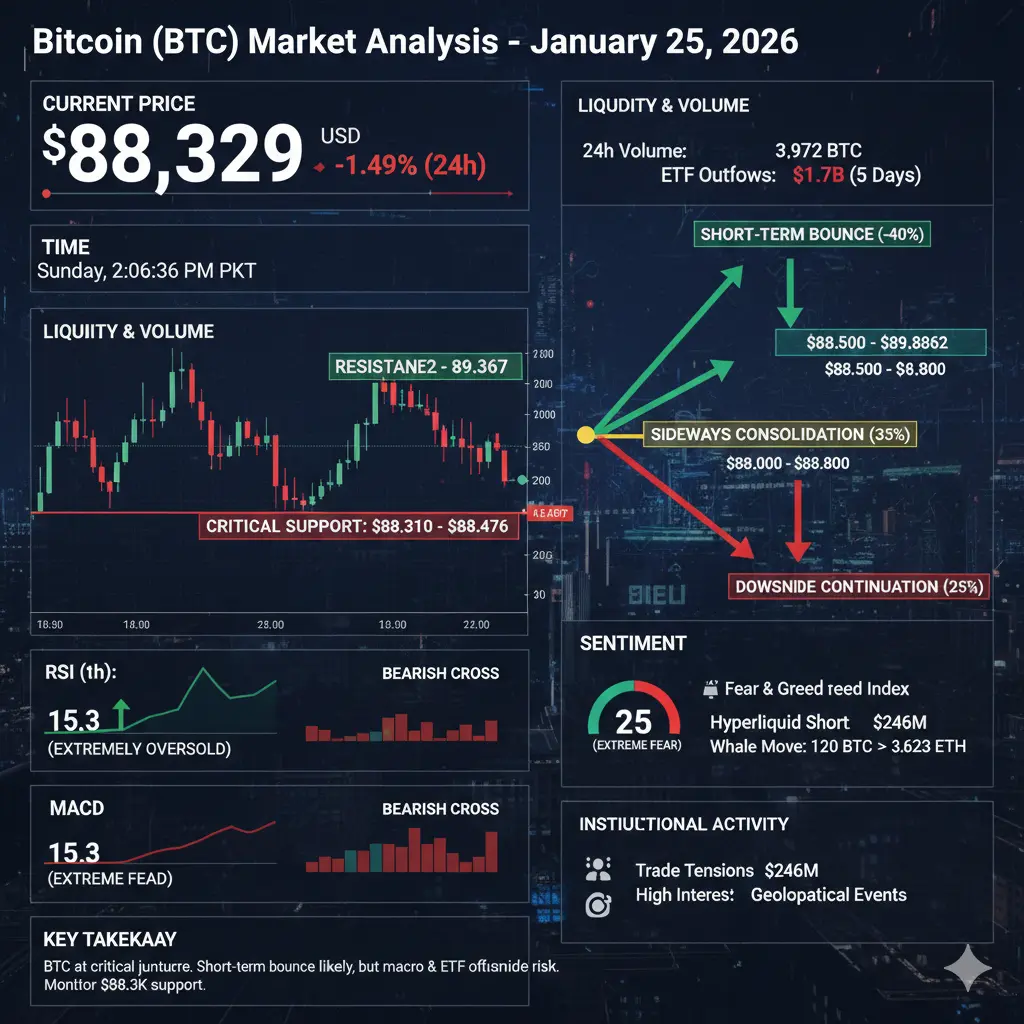

Bitcoin is in extreme fear mode, trading at $88,329 and down 1.49% in 24h.

The market is flooded with ETF outflows ($1.7B in 5 days) and heavy institutional shorts, making short-term downside likely.

📌 Key Support: $88,310 – $88,476

📌 Key Resistance: $88,862 – $89,367

🔥 My Take:

BTC is oversold (RSI 15.3) — so a small bounce (0.5–1.5%) is possible if support holds.

But if it breaks $88,310, we may drop further toward $87,500–$87,800.

💡 The real signal:

Fear & Greed Index at 25 (Extreme Fear) → possible local bottom, but

✅ Viral Style Post (Gate.io)

🚀 #BTCMarketAnalysis

Bitcoin is in extreme fear mode, trading at $88,329 and down 1.49% in 24h.

The market is flooded with ETF outflows ($1.7B in 5 days) and heavy institutional shorts, making short-term downside likely.

📌 Key Support: $88,310 – $88,476

📌 Key Resistance: $88,862 – $89,367

🔥 My Take:

BTC is oversold (RSI 15.3) — so a small bounce (0.5–1.5%) is possible if support holds.

But if it breaks $88,310, we may drop further toward $87,500–$87,800.

💡 The real signal:

Fear & Greed Index at 25 (Extreme Fear) → possible local bottom, but

BTC-1,68%

- Reward

- 1

- Comment

- Repost

- Share

#BTCMarketAnalysis

Bitcoin (BTC) continues to show high volatility, currently trading at $88,329, down 1.49% in the last 24 hours. Market sentiment is dominated by extreme fear, fueled by institutional outflows, aggressive short positions, and macroeconomic uncertainties. This analysis will break down price action, liquidity, volume, sentiment, technical structure, and future predictions to provide a clear market picture.

🔹 Price Action and Percentage Movements

Current Price: $88,329

24h High/Low: $89,673.50 / $88,128.40 → a $1,545 intra-day range (~1.75% movement).

Recent Drop: From $89,657

Bitcoin (BTC) continues to show high volatility, currently trading at $88,329, down 1.49% in the last 24 hours. Market sentiment is dominated by extreme fear, fueled by institutional outflows, aggressive short positions, and macroeconomic uncertainties. This analysis will break down price action, liquidity, volume, sentiment, technical structure, and future predictions to provide a clear market picture.

🔹 Price Action and Percentage Movements

Current Price: $88,329

24h High/Low: $89,673.50 / $88,128.40 → a $1,545 intra-day range (~1.75% movement).

Recent Drop: From $89,657

- Reward

- 36

- 22

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

#BTCMarketAnalysis

✅ Viral Style Post (Gate.io)

🚀 #BTCMarketAnalysis

Bitcoin is in extreme fear mode, trading at $88,329 and down 1.49% in 24h.

The market is flooded with ETF outflows ($1.7B in 5 days) and heavy institutional shorts, making short-term downside likely.

📌 Key Support: $88,310 – $88,476

📌 Key Resistance: $88,862 – $89,367

🔥 My Take:

BTC is oversold (RSI 15.3) — so a small bounce (0.5–1.5%) is possible if support holds.

But if it breaks $88,310, we may drop further toward $87,500–$87,800.

💡 The real signal:

Fear & Greed Index at 25 (Extreme Fear) → possible local bottom, but

✅ Viral Style Post (Gate.io)

🚀 #BTCMarketAnalysis

Bitcoin is in extreme fear mode, trading at $88,329 and down 1.49% in 24h.

The market is flooded with ETF outflows ($1.7B in 5 days) and heavy institutional shorts, making short-term downside likely.

📌 Key Support: $88,310 – $88,476

📌 Key Resistance: $88,862 – $89,367

🔥 My Take:

BTC is oversold (RSI 15.3) — so a small bounce (0.5–1.5%) is possible if support holds.

But if it breaks $88,310, we may drop further toward $87,500–$87,800.

💡 The real signal:

Fear & Greed Index at 25 (Extreme Fear) → possible local bottom, but

BTC-1,68%

- Reward

- 6

- 1

- Repost

- Share

LeoStar :

:

2026 GOGOGO 👊Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

242.34K Popularity

55.79K Popularity

29.07K Popularity

22.57K Popularity

19.98K Popularity

121.5K Popularity

7.72K Popularity

13.2K Popularity

6.77K Popularity

5.79K Popularity

6.94K Popularity

17.68K Popularity

4.21K Popularity

23.5K Popularity

15.61K Popularity

News

View MoreAlameda Research bankruptcy liquidation address exchanges 129 million STG for ZRO, worth $24.29 million

1 m

Offshore RMB against the US dollar breaks through the 6.9 level, continuing to hit a new high in 2023

5 m

"Maqi" is no longer bearish and has closed all limit ETH short positions.

7 m

Ripple CEO: Not ruling out the possibility of restarting mergers and acquisitions in the second half of the year

9 m

S (Sonic) has increased by 20.82% in the past 24 hours, with a market capitalization of approximately $141 million.

10 m

Pin