# Buythedip

4.42K

CryptoTrader775

💥📉 #BTCDipOrHoldDecision

Bitcoin is hovering around $67,271, slipping below the $68K zone and testing a key support area.

The big question:

Is this the right moment to buy the dip, or should we wait for lower levels?

🔎 Crucial Levels to Track:

🟢 Immediate Support: $66,500 – $67,000

🟢 Stronger Support: $65,000

🔴 Resistance Zone: $68,500 – $69,000

If BTC pushes back above $68K with strong volume, we could see a short-term relief rally.

But continued selling might target the $65K liquidity area.

💡 Trader’s Tip:

Focus on confirmation over emotions.

Liquidity sweeps often happen before trend

Bitcoin is hovering around $67,271, slipping below the $68K zone and testing a key support area.

The big question:

Is this the right moment to buy the dip, or should we wait for lower levels?

🔎 Crucial Levels to Track:

🟢 Immediate Support: $66,500 – $67,000

🟢 Stronger Support: $65,000

🔴 Resistance Zone: $68,500 – $69,000

If BTC pushes back above $68K with strong volume, we could see a short-term relief rally.

But continued selling might target the $65K liquidity area.

💡 Trader’s Tip:

Focus on confirmation over emotions.

Liquidity sweeps often happen before trend

BTC1,08%

- Reward

- 1

- Comment

- Repost

- Share

💥📉 #BTCDipOrHoldDecision

Bitcoin is hovering around $67,271, slipping below the $68K zone and testing a key support area.

The big question:

Is this the right moment to buy the dip, or should we wait for lower levels?

🔎 Crucial Levels to Track:

🟢 Immediate Support: $66,500 – $67,000

🟢 Stronger Support: $65,000

🔴 Resistance Zone: $68,500 – $69,000

If BTC pushes back above $68K with strong volume, we could see a short-term relief rally.

But continued selling might target the $65K liquidity area.

💡 Trader’s Tip:

Focus on confirmation over emotions.

Liquidity sweeps often happen before trend

Bitcoin is hovering around $67,271, slipping below the $68K zone and testing a key support area.

The big question:

Is this the right moment to buy the dip, or should we wait for lower levels?

🔎 Crucial Levels to Track:

🟢 Immediate Support: $66,500 – $67,000

🟢 Stronger Support: $65,000

🔴 Resistance Zone: $68,500 – $69,000

If BTC pushes back above $68K with strong volume, we could see a short-term relief rally.

But continued selling might target the $65K liquidity area.

💡 Trader’s Tip:

Focus on confirmation over emotions.

Liquidity sweeps often happen before trend

BTC1,08%

- Reward

- 7

- 14

- Repost

- Share

AYATTAC :

:

Ape In 🚀View More

#BuyTheDipOrWaitNow? 🤔

Markets are giving mixed signals right now. Volatility is high, emotions are louder than data, and patience is becoming a real edge.

Buying the dip only works when the dip is backed by strong fundamentals, capital inflows, and market structure support — not just hope. At the same time, waiting blindly can mean missing key accumulation zones institutions are quietly building.

The smart approach?

📌 Scale entries instead of going all-in

📌 Follow spot market flows, not just price

📌 Let confirmation guide you, not FOMO

In uncertain markets, risk management is the real pro

Markets are giving mixed signals right now. Volatility is high, emotions are louder than data, and patience is becoming a real edge.

Buying the dip only works when the dip is backed by strong fundamentals, capital inflows, and market structure support — not just hope. At the same time, waiting blindly can mean missing key accumulation zones institutions are quietly building.

The smart approach?

📌 Scale entries instead of going all-in

📌 Follow spot market flows, not just price

📌 Let confirmation guide you, not FOMO

In uncertain markets, risk management is the real pro

BTC1,08%

- Reward

- 3

- 7

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#BuyTheDipOrWaitNow? 😅

This is the question every trader is asking right now. Price drops look tempting, but let’s be honest — not every dip is a gift, and not every wait is safe.

Real opportunity comes when fear meets strong demand, not when panic controls decisions. Instead of guessing the bottom, focus on what smart money is doing: spot buying, volume expansion, and key support holding.

Sometimes the best move isn’t buying or selling — it’s waiting with a plan.

Trade smart. Stay patient. Protect your capital.

#CryptoTraders

#BuyTheDip

#BitcoinTrading

This is the question every trader is asking right now. Price drops look tempting, but let’s be honest — not every dip is a gift, and not every wait is safe.

Real opportunity comes when fear meets strong demand, not when panic controls decisions. Instead of guessing the bottom, focus on what smart money is doing: spot buying, volume expansion, and key support holding.

Sometimes the best move isn’t buying or selling — it’s waiting with a plan.

Trade smart. Stay patient. Protect your capital.

#CryptoTraders

#BuyTheDip

#BitcoinTrading

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? 😅

This is the question every trader is asking right now. Price drops look tempting, but let’s be honest — not every dip is a gift, and not every wait is safe.

Real opportunity comes when fear meets strong demand, not when panic controls decisions. Instead of guessing the bottom, focus on what smart money is doing: spot buying, volume expansion, and key support holding.

Sometimes the best move isn’t buying or selling — it’s waiting with a plan.

Trade smart. Stay patient. Protect your capital.

#CryptoTraders

#BuyTheDip

#BitcoinTrading

This is the question every trader is asking right now. Price drops look tempting, but let’s be honest — not every dip is a gift, and not every wait is safe.

Real opportunity comes when fear meets strong demand, not when panic controls decisions. Instead of guessing the bottom, focus on what smart money is doing: spot buying, volume expansion, and key support holding.

Sometimes the best move isn’t buying or selling — it’s waiting with a plan.

Trade smart. Stay patient. Protect your capital.

#CryptoTraders

#BuyTheDip

#BitcoinTrading

- Reward

- 3

- 5

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#BuyTheDipOrWaitNow?

As of today, the crypto market is once again testing investors’ patience. After weeks of choppy price action, rising macro uncertainty, and fading short-term momentum, traders are stuck between two classic emotions: fear of further downside and fear of missing the next rally. This is the phase where impulsive decisions usually hurt the most, and disciplined strategy matters more than prediction.

From a market structure perspective, Bitcoin and major altcoins are still moving inside a broader consolidation range rather than a confirmed trend reversal. Volume has thinned co

As of today, the crypto market is once again testing investors’ patience. After weeks of choppy price action, rising macro uncertainty, and fading short-term momentum, traders are stuck between two classic emotions: fear of further downside and fear of missing the next rally. This is the phase where impulsive decisions usually hurt the most, and disciplined strategy matters more than prediction.

From a market structure perspective, Bitcoin and major altcoins are still moving inside a broader consolidation range rather than a confirmed trend reversal. Volume has thinned co

BTC1,08%

- Reward

- 4

- 5

- Repost

- Share

HighAmbition :

:

1000x VIbes 🤑View More

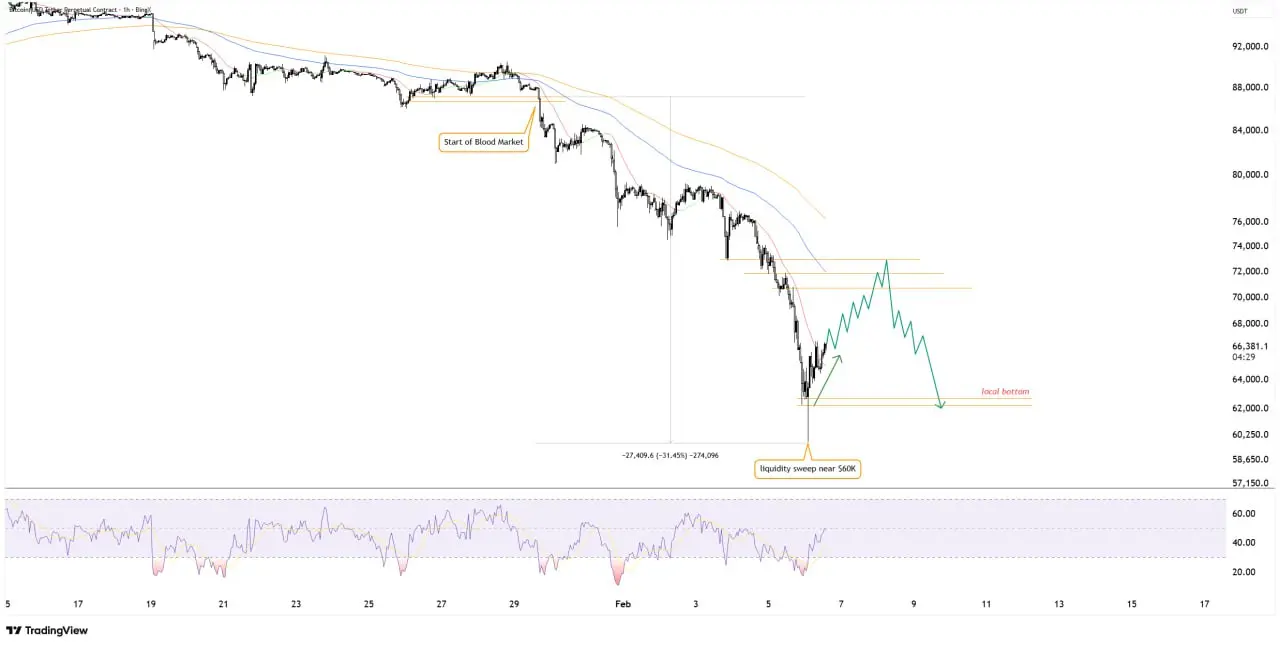

Headline: Buying Blood: Is the BTC Bottom In? 🩸

Market sentiment is at a 16-month low, but seasoned @Gate_io traders know that "capitulation" is often a synonym for "opportunity." $BTC has retraced nearly 50% from its October peak of $126k, testing the resolve of even the strongest HODLers. 🌊

Key Indicators to Watch:

1️⃣ Supply in Loss: Nearly 10M BTC are currently in a "loss" position—historically, this convergence of profit/loss supply has signaled major market bottoms. 📊

2️⃣ ETF Outflows: We are seeing institutional cooling, but whale accumulation at the $60k-$65k range remains a "last l

Market sentiment is at a 16-month low, but seasoned @Gate_io traders know that "capitulation" is often a synonym for "opportunity." $BTC has retraced nearly 50% from its October peak of $126k, testing the resolve of even the strongest HODLers. 🌊

Key Indicators to Watch:

1️⃣ Supply in Loss: Nearly 10M BTC are currently in a "loss" position—historically, this convergence of profit/loss supply has signaled major market bottoms. 📊

2️⃣ ETF Outflows: We are seeing institutional cooling, but whale accumulation at the $60k-$65k range remains a "last l

BTC1,08%

- Reward

- 3

- 2

- Repost

- Share

Crypto_iqra :

:

2026 GOGOGO 👊View More

#BuyTheDipOrWaitNow?

Markets are once again at a critical decision point. After sharp volatility and a partial rebound, investors are facing the classic dilemma: is this pullback a strategic buying opportunity, or a temporary bounce before another leg down?

In times like these, discipline matters more than emotions. Buying the dip only makes sense when aligned with strong fundamentals, clear risk management, and a defined time horizon. For long-term investors, gradual accumulation during fear-driven corrections can reduce average entry costs. For short-term traders, patience is often the edge—

Markets are once again at a critical decision point. After sharp volatility and a partial rebound, investors are facing the classic dilemma: is this pullback a strategic buying opportunity, or a temporary bounce before another leg down?

In times like these, discipline matters more than emotions. Buying the dip only makes sense when aligned with strong fundamentals, clear risk management, and a defined time horizon. For long-term investors, gradual accumulation during fear-driven corrections can reduce average entry costs. For short-term traders, patience is often the edge—

- Reward

- 6

- 10

- Repost

- Share

CryptoFiler :

:

hold tightly 💪View More

#BuyTheDipOrWaitNow?

Bitcoin remains volatile, and current price action suggests the market has unfinished business on the downside. While short-term bounces are possible, the broader structure still leaves room for a deeper test.

My view: BTC may move toward the 75,000 USDT zone before the next meaningful reaction.

📉 Short-Term Outlook (Derivatives Traders)

The 75K area stands out as a major liquidity and reaction zone

If price reaches this level, I expect strong volatility and a tradable rejection

Strategy:

Wait patiently

Look for rejection signals near 75K

Consider short positions only af

Bitcoin remains volatile, and current price action suggests the market has unfinished business on the downside. While short-term bounces are possible, the broader structure still leaves room for a deeper test.

My view: BTC may move toward the 75,000 USDT zone before the next meaningful reaction.

📉 Short-Term Outlook (Derivatives Traders)

The 75K area stands out as a major liquidity and reaction zone

If price reaches this level, I expect strong volatility and a tradable rejection

Strategy:

Wait patiently

Look for rejection signals near 75K

Consider short positions only af

BTC1,08%

- Reward

- 5

- 1

- Repost

- Share

ybaser :

:

Thanks for sharing#CryptoMarketPullback 📉⚠️

The market is bleeding — but panic is not a strategy.

Bitcoin is testing major support.

Ethereum is under pressure.

Altcoins are correcting harder than expected.

This isn’t chaos. This is a liquidity reset.

When leverage builds too fast, the market corrects aggressively. Weak hands exit. Overexposed positions get liquidated. Structure gets cleaned.

Now the real game begins.

🔎 What matters here: • Is BTC holding key higher-timeframe demand?

• Are liquidations slowing down?

• Is volume showing absorption or continued selling?

Extreme fear often appears near turning po

The market is bleeding — but panic is not a strategy.

Bitcoin is testing major support.

Ethereum is under pressure.

Altcoins are correcting harder than expected.

This isn’t chaos. This is a liquidity reset.

When leverage builds too fast, the market corrects aggressively. Weak hands exit. Overexposed positions get liquidated. Structure gets cleaned.

Now the real game begins.

🔎 What matters here: • Is BTC holding key higher-timeframe demand?

• Are liquidations slowing down?

• Is volume showing absorption or continued selling?

Extreme fear often appears near turning po

- Reward

- 13

- 25

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

17.28K Popularity

7.43K Popularity

3.14K Popularity

34.99K Popularity

249.76K Popularity

147.04K Popularity

3.12K Popularity

3.3K Popularity

2.04K Popularity

3.08K Popularity

121.06K Popularity

25.53K Popularity

21.89K Popularity

16.23K Popularity

1.58K Popularity

News

View MoreData: 4,791,000 TON transferred from anonymous addresses, and after routing, flowed into TON

1 m

Whale 3NVeXmB Deposits 7,900 BTC Worth $539M to Exchanges in Two Days

1 m

Strong non-farm payrolls fail to prevent the dollar from weakening; bearish sentiment remains deeply rooted

5 m

Bank of America: Potential Agreement Between U.S. Treasury and Federal Reserve Won't Shake the Market

6 m

Coincheck Q3 revenue up 17% year-over-year, CEO to hand over to 3iQ leader at the end of the fiscal year

13 m

Pin