# CryptoMarketStructureUpdate

20.37K

BeautifulDay

#CryptoMarketStructureUpdate

February 2026: How the Crypto Market is Structuring Itself

The crypto market in early 2026 is showing clear structural trends that indicate both risk management and opportunity for strategic participants. Here’s the deep dive:

🔹 1. Market Cycles Are Becoming Layered

Unlike previous cycles dominated by speculation:

Top-tier Layer 1s show strong support zones

Altcoins follow structural consolidation before any breakout

BTC remains the market anchor, with movements guiding the rest

This layered structure shows the market is maturing, separating strong protocols from

February 2026: How the Crypto Market is Structuring Itself

The crypto market in early 2026 is showing clear structural trends that indicate both risk management and opportunity for strategic participants. Here’s the deep dive:

🔹 1. Market Cycles Are Becoming Layered

Unlike previous cycles dominated by speculation:

Top-tier Layer 1s show strong support zones

Altcoins follow structural consolidation before any breakout

BTC remains the market anchor, with movements guiding the rest

This layered structure shows the market is maturing, separating strong protocols from

- Reward

- 5

- 7

- Repost

- Share

HighAmbition :

:

hop on boardView More

#CryptoMarketStructureUpdate

#CryptoMarketStructureUpdate

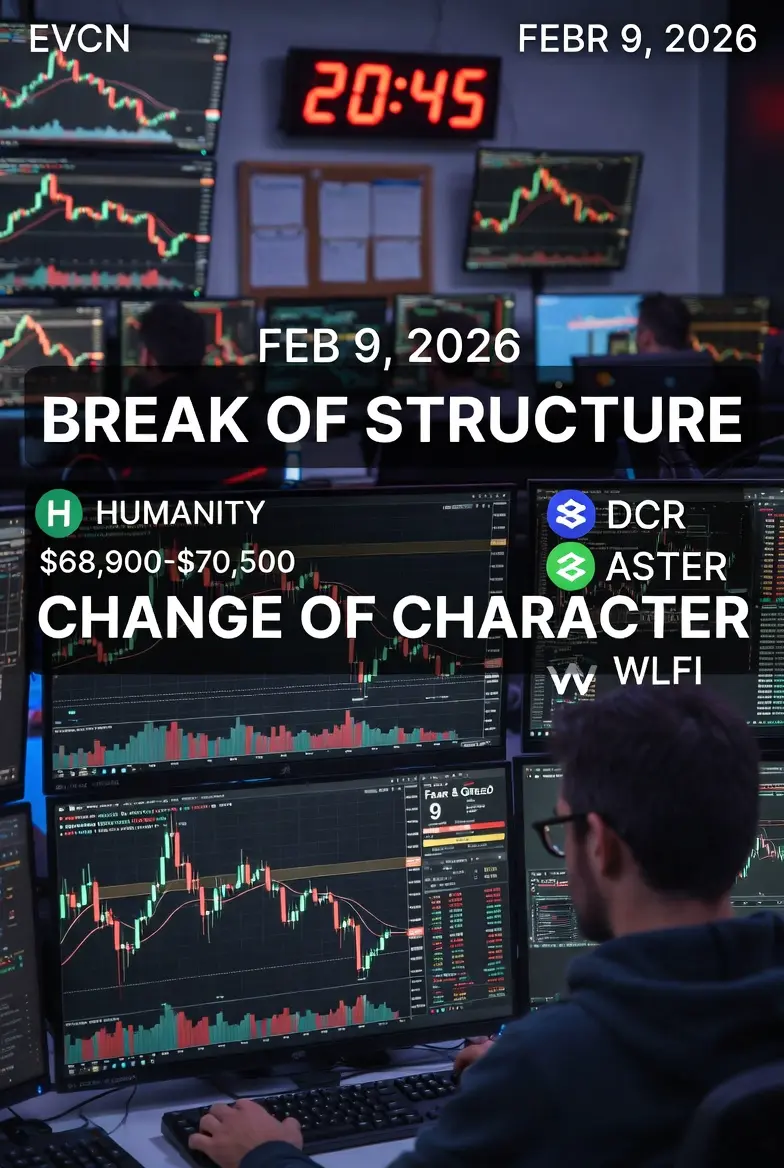

1. Current Overall Market Snapshot (Real-Time Data – Feb 9, 2026 Evening)

Total Crypto Market Cap: ~$2.32T – $2.45T (down 2-3% in 24h, reflecting broad selling pressure and partial stabilization attempts).

24h Trading Volume: ~$47B – $107B (elevated due to liquidations and defensive flows, but spot volume defensive).

Bitcoin Dominance: ~58-59% (rising as BTC acts as the "safe haven" in crypto during fear phases).

Ethereum Dominance: ~10-10.5% (underperforming, signaling weak altcoin rotation).

Fear & Greed Index: 9 (Extreme Fear) — ne

#CryptoMarketStructureUpdate

1. Current Overall Market Snapshot (Real-Time Data – Feb 9, 2026 Evening)

Total Crypto Market Cap: ~$2.32T – $2.45T (down 2-3% in 24h, reflecting broad selling pressure and partial stabilization attempts).

24h Trading Volume: ~$47B – $107B (elevated due to liquidations and defensive flows, but spot volume defensive).

Bitcoin Dominance: ~58-59% (rising as BTC acts as the "safe haven" in crypto during fear phases).

Ethereum Dominance: ~10-10.5% (underperforming, signaling weak altcoin rotation).

Fear & Greed Index: 9 (Extreme Fear) — ne

- Reward

- 22

- 18

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#CryptoMarketStructureUpdate

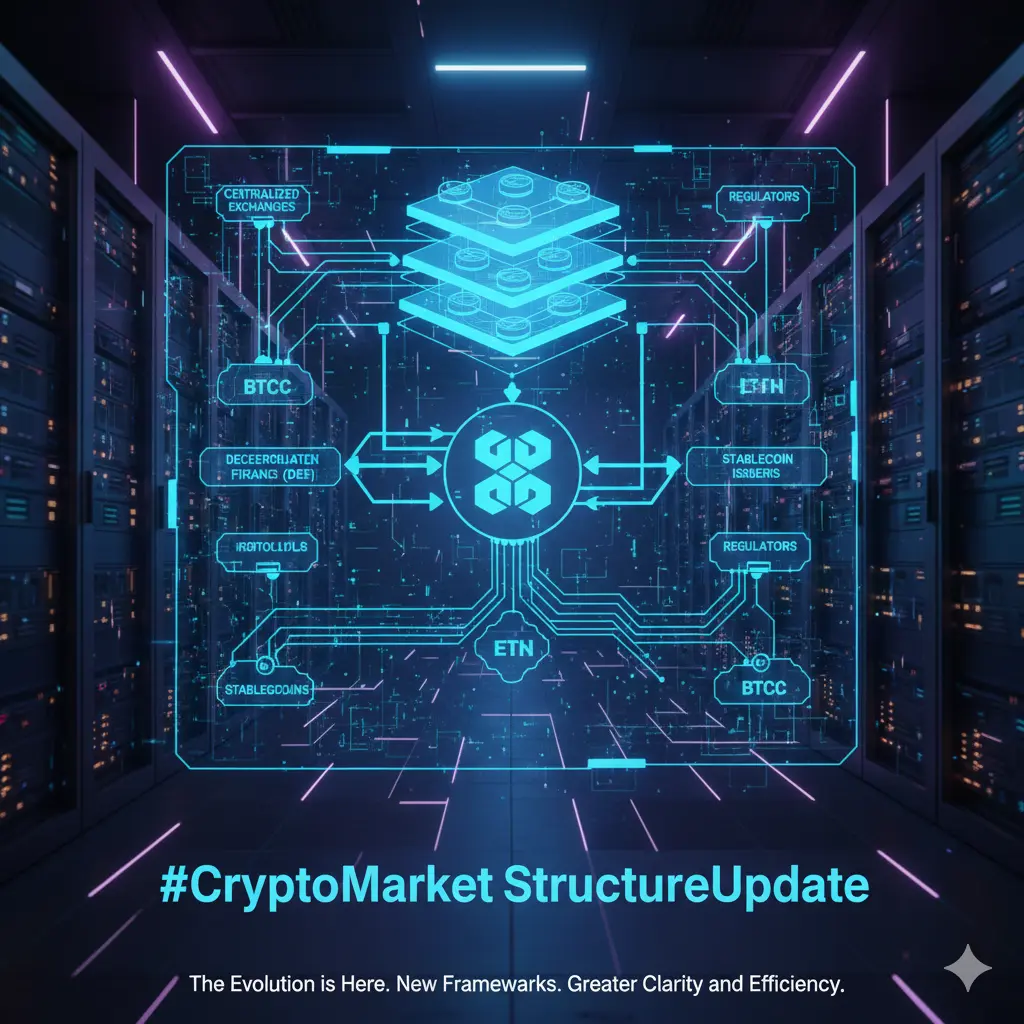

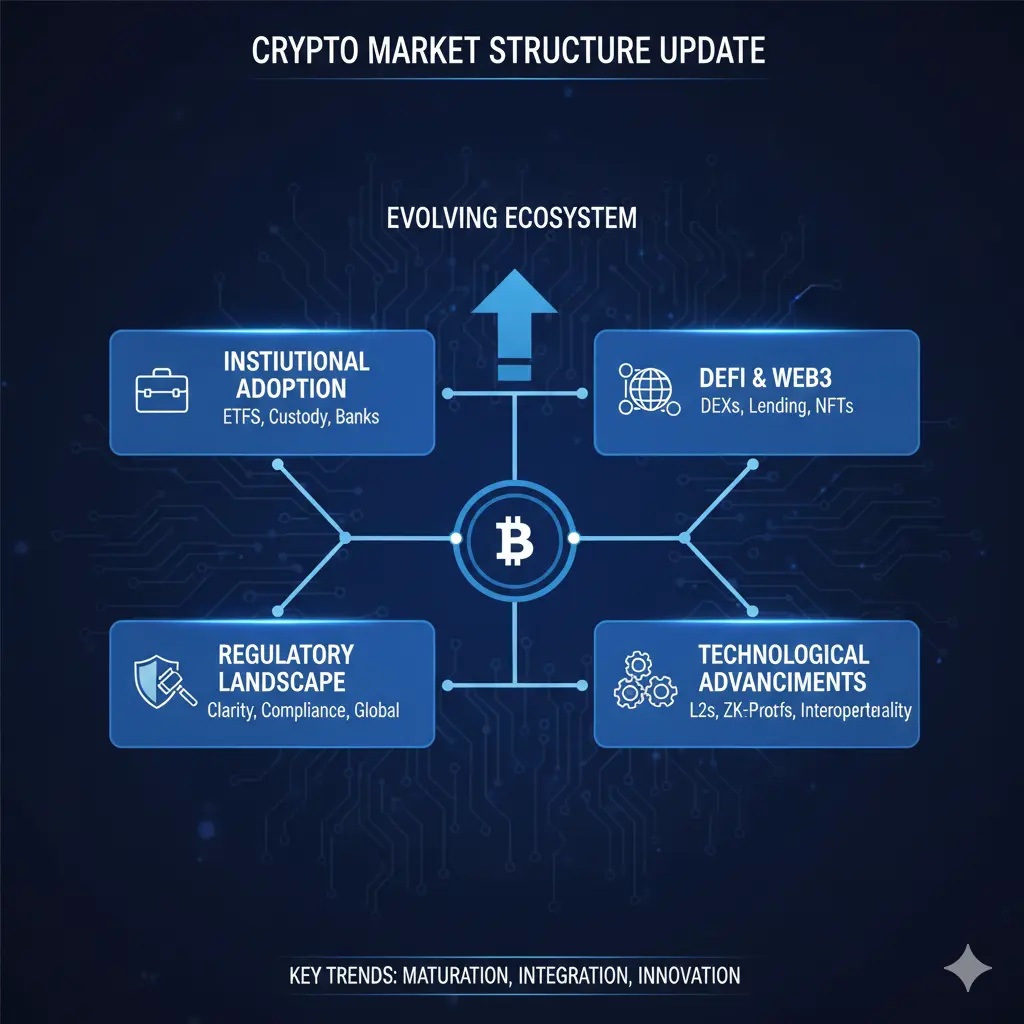

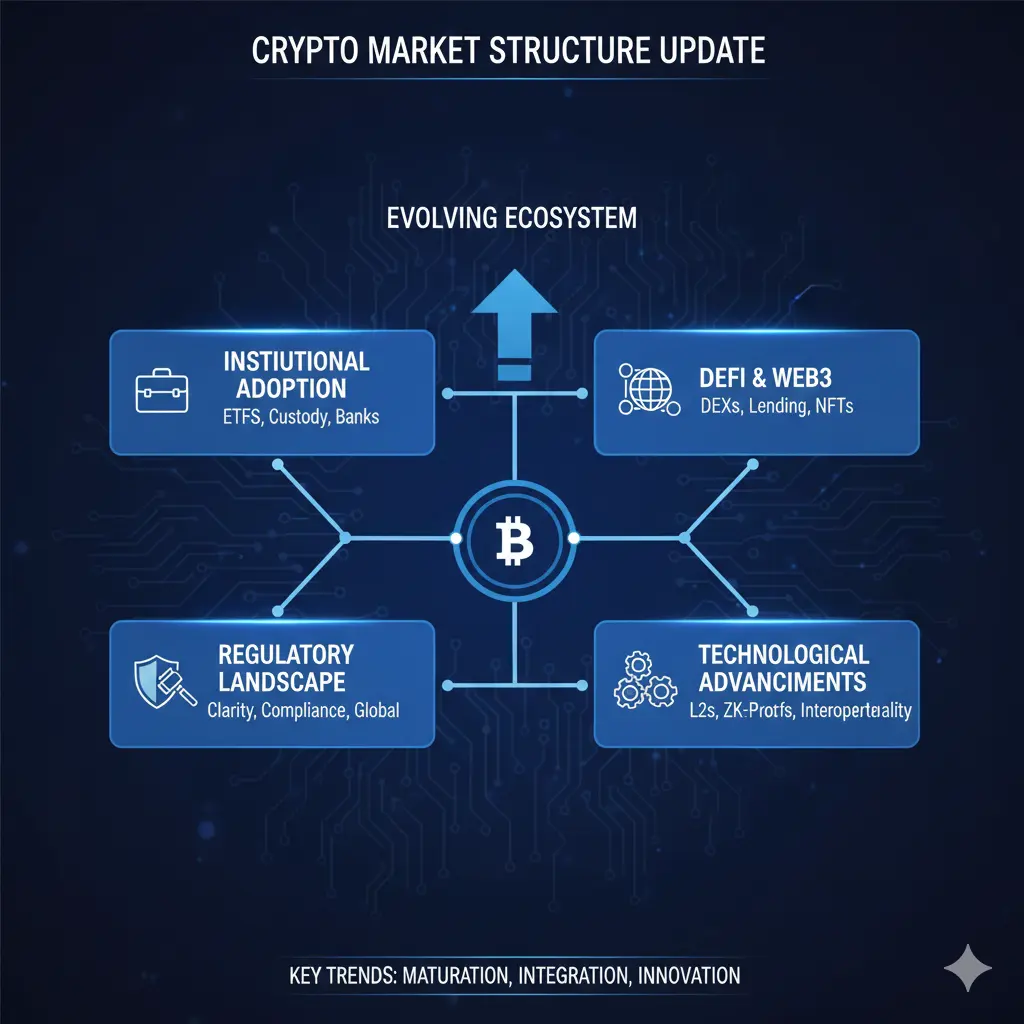

The cryptocurrency market has been witnessing a remarkable evolution over the past few months, as shifts in liquidity, trading behavior, and market structure redefine the landscape for both retail and institutional participants. Understanding these structural changes is crucial for anyone looking to navigate crypto markets effectively and capitalize on emerging opportunities.

One of the most noticeable trends is the increasing presence of institutional investors. Hedge funds, asset managers, and even traditional financial institutions are now actively participati

The cryptocurrency market has been witnessing a remarkable evolution over the past few months, as shifts in liquidity, trading behavior, and market structure redefine the landscape for both retail and institutional participants. Understanding these structural changes is crucial for anyone looking to navigate crypto markets effectively and capitalize on emerging opportunities.

One of the most noticeable trends is the increasing presence of institutional investors. Hedge funds, asset managers, and even traditional financial institutions are now actively participati

- Reward

- 7

- 14

- Repost

- Share

CryptoDaisy :

:

1000x VIbes 🤑View More

#CryptoMarketStructureUpdate

The crypto market continues to evolve at a rapid pace, and today’s structural update highlights both the resilience and fragility within the ecosystem. Price swings, liquidity shifts, and changing participant behavior are reshaping the way traders and investors approach risk. Understanding market structure isn’t just about charts it’s about flows, sentiment, network activity, and regulatory signals all converging to influence asset performance.

From a macro perspective, the market has entered a phase of selective rotation. High-cap coins, certain DeFi protocols,

The crypto market continues to evolve at a rapid pace, and today’s structural update highlights both the resilience and fragility within the ecosystem. Price swings, liquidity shifts, and changing participant behavior are reshaping the way traders and investors approach risk. Understanding market structure isn’t just about charts it’s about flows, sentiment, network activity, and regulatory signals all converging to influence asset performance.

From a macro perspective, the market has entered a phase of selective rotation. High-cap coins, certain DeFi protocols,

DEFI-11,94%

- Reward

- 5

- 9

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#CryptoMarketStructureUpdate

Crypto Market Structure Update

The crypto market structure is going through a critical transition phase. After years of extreme volatility driven by leverage hype cycles and sudden liquidity injections the market is slowly maturing. This update focuses on how structure liquidity and behavior are evolving and what it means for traders investors and long term participants.

Current Market Structure Overview

At present the crypto market is moving within a broad consolidation range. Bitcoin continues to act as the structural anchor for the entire market while altcoins

Crypto Market Structure Update

The crypto market structure is going through a critical transition phase. After years of extreme volatility driven by leverage hype cycles and sudden liquidity injections the market is slowly maturing. This update focuses on how structure liquidity and behavior are evolving and what it means for traders investors and long term participants.

Current Market Structure Overview

At present the crypto market is moving within a broad consolidation range. Bitcoin continues to act as the structural anchor for the entire market while altcoins

BTC-2,22%

- Reward

- 7

- 12

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

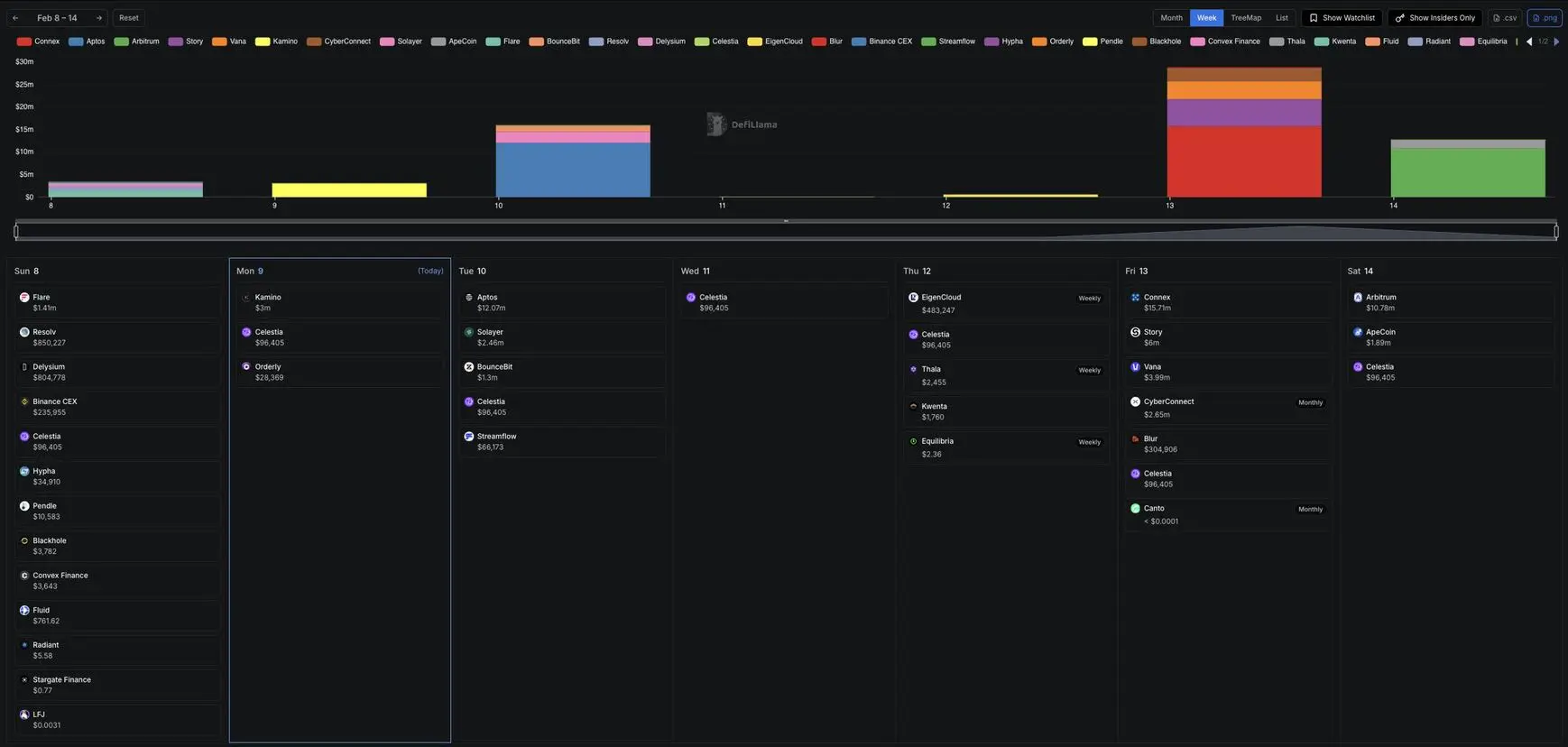

🚨 UPDATE: Over $64M worth of tokens will be unlocked this week, per DefiLlama.

The largest will be $15.71M unlocked by $CONX on February 13.

#BuyTheDipOrWaitNow?

#BitcoinBouncesBack

#BTCMiningDifficultyDrops

#TopCoinsRisingAgainsttheTrend

#CryptoMarketStructureUpdate $BTC

The largest will be $15.71M unlocked by $CONX on February 13.

#BuyTheDipOrWaitNow?

#BitcoinBouncesBack

#BTCMiningDifficultyDrops

#TopCoinsRisingAgainsttheTrend

#CryptoMarketStructureUpdate $BTC

BTC-2,22%

- Reward

- 2

- Comment

- Repost

- Share

#CryptoMarketStructureUpdate

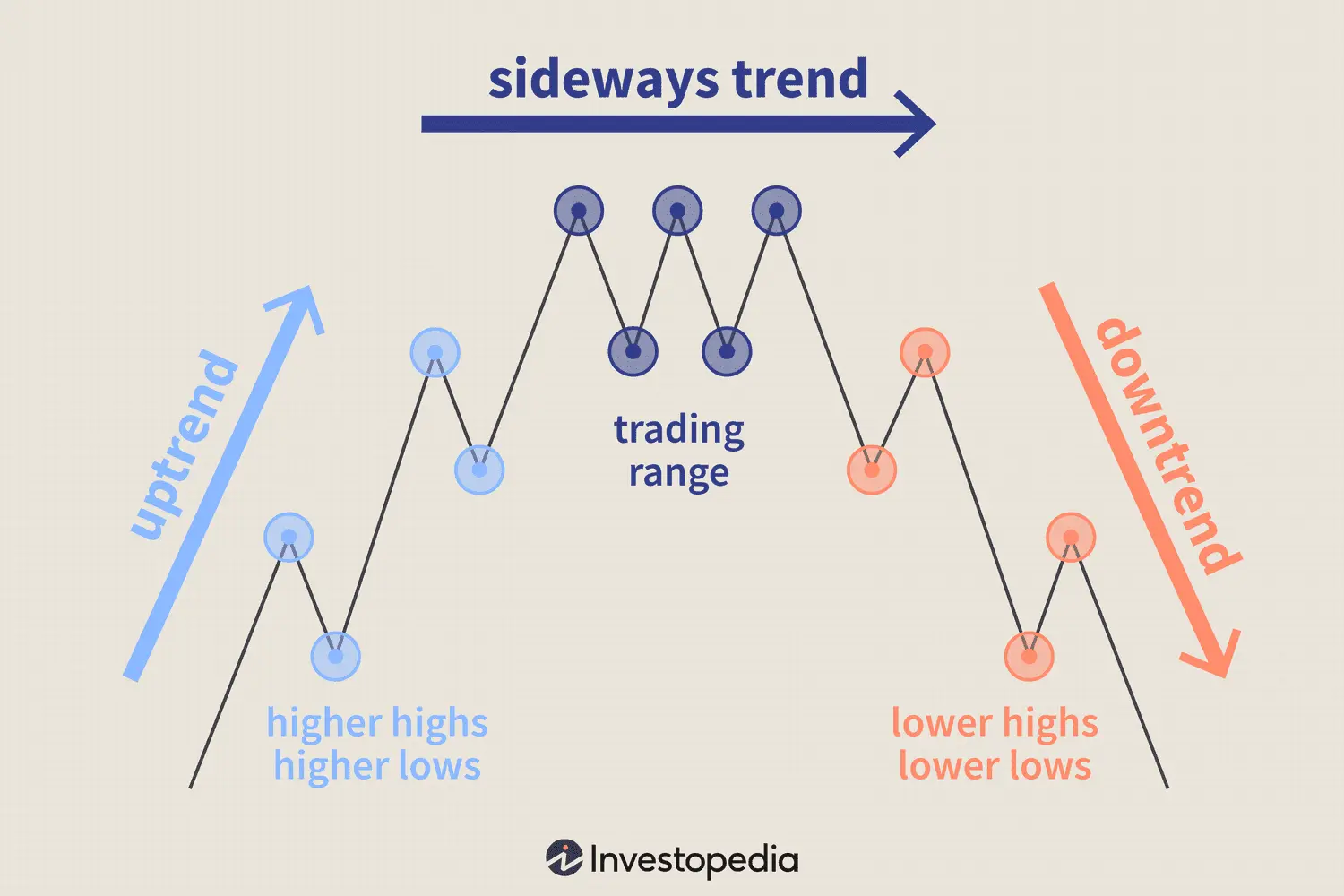

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

1000x VIbes 🤑#Bitcoin Sunday Analysis 📉

$BTC is still trading below 72k, with only a few hours left before the weekly candle closes. If we close below this level, Bitcoin officially enters the accumulation zone between 54k and 72k. The daily candle has already closed inside this range. As I mentioned earlier, I expect price to trade within this box for weeks, possibly months.

The 72k level was critical, which is why I opened a long there. My expectation was a bounce leading to a move toward 80k to 85k. That plan failed, and I accept that I was wrong. For any meaningful recovery, Bitcoin must reclaim 72k a

$BTC is still trading below 72k, with only a few hours left before the weekly candle closes. If we close below this level, Bitcoin officially enters the accumulation zone between 54k and 72k. The daily candle has already closed inside this range. As I mentioned earlier, I expect price to trade within this box for weeks, possibly months.

The 72k level was critical, which is why I opened a long there. My expectation was a bounce leading to a move toward 80k to 85k. That plan failed, and I accept that I was wrong. For any meaningful recovery, Bitcoin must reclaim 72k a

BTC-2,22%

- Reward

- 11

- 17

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#CryptoMarketStructureUpdate

Updates to crypto market structure are reshaping trading landscapes. Regulatory frameworks in the EU and US emphasize transparency, with MiCA enforcing stablecoin rules.

Exchanges adopt advanced surveillance to combat manipulation. Decentralized order books gain traction, reducing centralization risks.

Institutional inflows via ETFs alter liquidity dynamics. This evolution promotes maturity, attracting more capital.

Stay updated on compliance changes; they define the market's next phase.

Updates to crypto market structure are reshaping trading landscapes. Regulatory frameworks in the EU and US emphasize transparency, with MiCA enforcing stablecoin rules.

Exchanges adopt advanced surveillance to combat manipulation. Decentralized order books gain traction, reducing centralization risks.

Institutional inflows via ETFs alter liquidity dynamics. This evolution promotes maturity, attracting more capital.

Stay updated on compliance changes; they define the market's next phase.

- Reward

- 46

- 39

- Repost

- Share

Kai_Zen :

:

Happy New Year! 🤑View More

#CryptoMarketStructureUpdate

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

- Reward

- 10

- 11

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

229.67K Popularity

52.77K Popularity

21.3K Popularity

17.11K Popularity

16.78K Popularity

92.37K Popularity

6.14K Popularity

11.35K Popularity

6.77K Popularity

4.21K Popularity

5.47K Popularity

15.09K Popularity

4.03K Popularity

22.2K Popularity

13.78K Popularity

News

View MoreNon-Farm Payrolls Preview: US January Non-Farm Data May Show Modest Growth, but the Job Market is "Hot on Paper, Rigid in Reality"

5 m

The four main core products of the LX ecosystem will be launched successively starting from February 11.

8 m

OpenAI seeks an $830 billion valuation, with an expected net loss of $14 billion in 2026

9 m

Bitcoin's 200-Day Moving Average Shows Fastest Deterioration Since 2022

10 m

Denmark's largest bank, Danske Bank, offers Bitcoin and Ethereum ETPs to investors, ending an eight-year cryptocurrency ban

12 m

Pin