#FedLeadershipImpact

FedLeadershipImpact

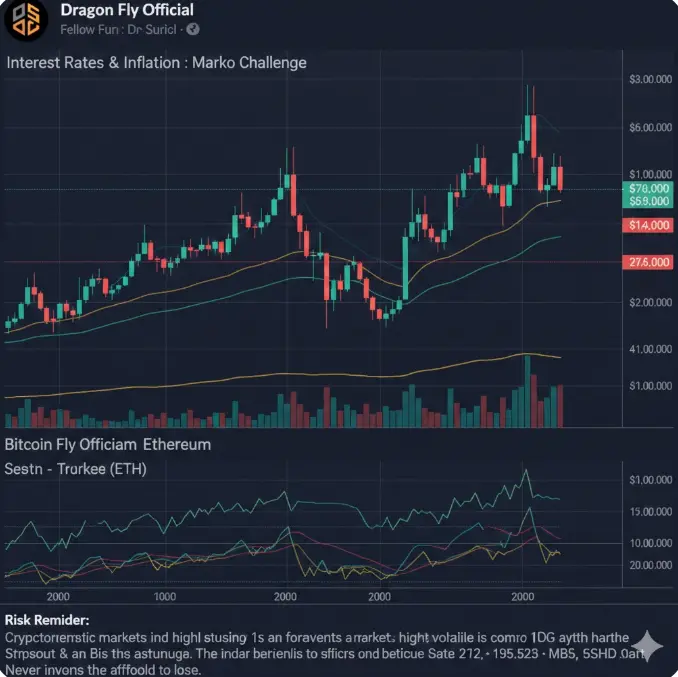

The Federal Reserve's leadership changes are impacting monetary policy and markets. New appointments signal a hawkish stance on inflation, with rate hikes possible.

Chair transitions influence crypto via liquidity effects; tighter policy pressures prices.

Analysts assess how leadership shapes economic recovery post-pandemic.

Understanding this helps in forecasting trends. The Fed's decisions remain pivotal for global finance.

FedLeadershipImpact

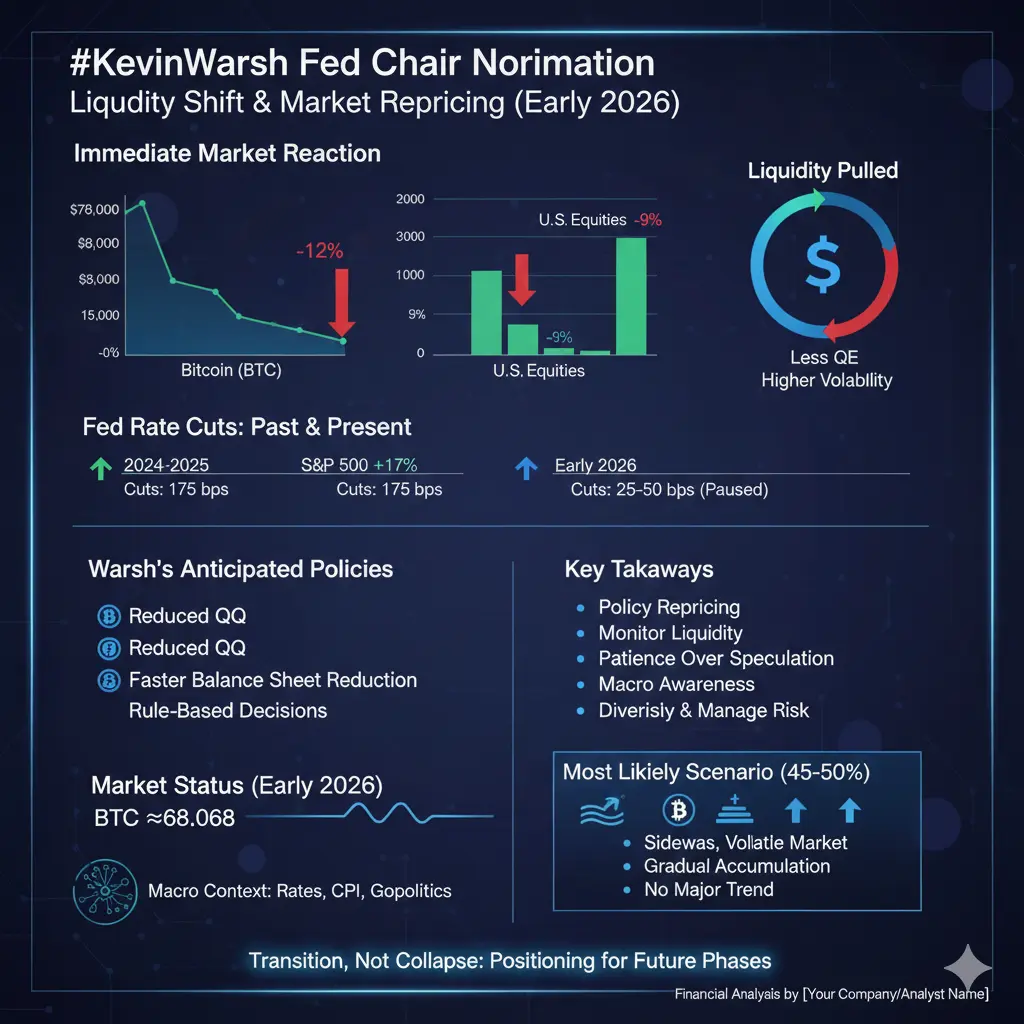

The Federal Reserve's leadership changes are impacting monetary policy and markets. New appointments signal a hawkish stance on inflation, with rate hikes possible.

Chair transitions influence crypto via liquidity effects; tighter policy pressures prices.

Analysts assess how leadership shapes economic recovery post-pandemic.

Understanding this helps in forecasting trends. The Fed's decisions remain pivotal for global finance.