# InstitutionalCrypto

3.94K

zubairr90

- Reward

- like

- Comment

- Repost

- Share

#BitMineBuys40KETH 💎 #BitMineBuys40KETH | Institutional Confidence Rising

While retail sentiment stayed cautious, major players were quietly accumulating. BitMine Immersion Technologies ($BMNR) has now officially disclosed the purchase of 40,613 ETH this week — a move that’s turning heads across the crypto space.

Why this matters:

🔹 Supply Concentration: With this acquisition, BitMine commands around 3.6% of Ethereum’s total supply, positioning itself as a key force within the ETH ecosystem rather than a passive holder.

🔹 Leadership Outlook: Chairman Tom Lee sees this phase as a high-convic

While retail sentiment stayed cautious, major players were quietly accumulating. BitMine Immersion Technologies ($BMNR) has now officially disclosed the purchase of 40,613 ETH this week — a move that’s turning heads across the crypto space.

Why this matters:

🔹 Supply Concentration: With this acquisition, BitMine commands around 3.6% of Ethereum’s total supply, positioning itself as a key force within the ETH ecosystem rather than a passive holder.

🔹 Leadership Outlook: Chairman Tom Lee sees this phase as a high-convic

ETH-2,79%

- Reward

- 4

- 9

- Repost

- Share

AYATTAC :

:

thanks for information sent every day dearView More

🚀 #BitMineBuys40KETH — Institutional Accumulation Highlight

BitMine Immersion Technologies — the Nasdaq-listed crypto treasury firm chaired by Tom Lee — has just made a big move in the Ethereum market. According to on-chain and company reports, the firm acquired approximately 40,613 ETH (~$83–$86 million) during last week’s market pullback, raising its total holdings to over 4.3 million ETH (~3.58% of circulating supply).

🔹 Strategic Accumulation: Despite the ETH price slump and large unrealized losses on its existing holdings, BitMine doubled down on accumulation — signaling continued conf

BitMine Immersion Technologies — the Nasdaq-listed crypto treasury firm chaired by Tom Lee — has just made a big move in the Ethereum market. According to on-chain and company reports, the firm acquired approximately 40,613 ETH (~$83–$86 million) during last week’s market pullback, raising its total holdings to over 4.3 million ETH (~3.58% of circulating supply).

🔹 Strategic Accumulation: Despite the ETH price slump and large unrealized losses on its existing holdings, BitMine doubled down on accumulation — signaling continued conf

ETH-2,79%

- Reward

- 1

- Comment

- Repost

- Share

#StrategyBuys1,142BTC

As of today, Strategy’s purchase of 1,142 BTC underscores a renewed institutional focus on Bitcoin accumulation, even amidst periods of market uncertainty. Moves of this scale signal conviction rather than speculation, suggesting that long-term confidence in Bitcoin’s narrative remains strong, despite short-term volatility and macroeconomic pressures.

What stands out is timing. Large accumulations like this often occur when markets are in a consolidation phase rather than during euphoric rallies. This approach indicates that institutions are strategically positioning the

As of today, Strategy’s purchase of 1,142 BTC underscores a renewed institutional focus on Bitcoin accumulation, even amidst periods of market uncertainty. Moves of this scale signal conviction rather than speculation, suggesting that long-term confidence in Bitcoin’s narrative remains strong, despite short-term volatility and macroeconomic pressures.

What stands out is timing. Large accumulations like this often occur when markets are in a consolidation phase rather than during euphoric rallies. This approach indicates that institutions are strategically positioning the

BTC-1,57%

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️View More

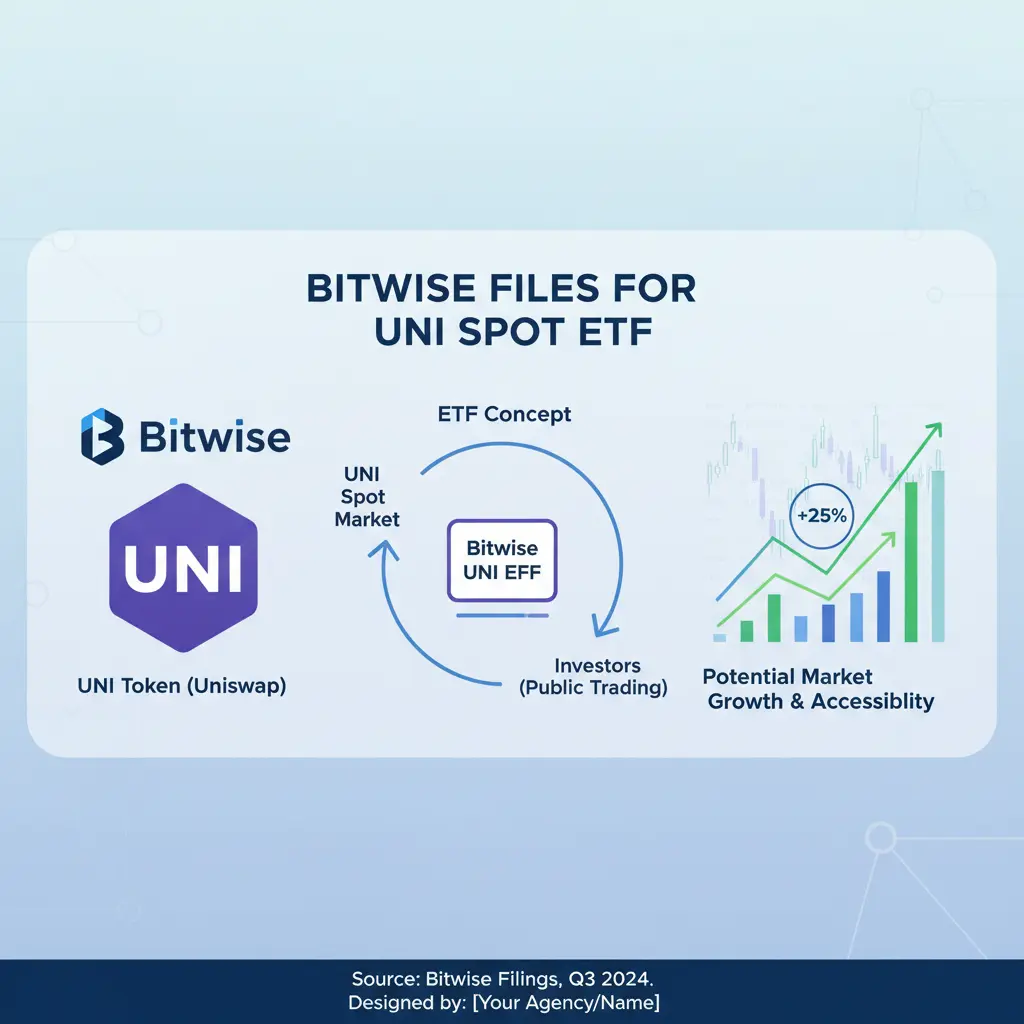

Bitwise Files for a UNI Spot ETF — A Signal of DeFi’s Next Phase

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 represents far more than another regulatory application. It marks a broader shift in how Decentralized Finance (DeFi) is being evaluated by regulators, institutions, and market architects.

This filing arrives at a moment when the regulatory environment has evolved from hesitation to structured engagement. Policymakers are increasingly focused on transparency, liquidity standards, custody frameworks, and investor protection—creating conditions whe

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 represents far more than another regulatory application. It marks a broader shift in how Decentralized Finance (DeFi) is being evaluated by regulators, institutions, and market architects.

This filing arrives at a moment when the regulatory environment has evolved from hesitation to structured engagement. Policymakers are increasingly focused on transparency, liquidity standards, custody frameworks, and investor protection—creating conditions whe

- Reward

- like

- Comment

- Repost

- Share

#CMEGroupPlansCMEToken 💥 | Institutional Crypto Update

CME Group, one of the world’s largest derivatives exchanges, is planning to launch its own CME Token.

This move could:

• Bridge traditional finance with crypto

• Offer new trading and hedging opportunities

• Attract institutional investors to tokenized markets

A big step showing how legacy finance is increasingly entering the crypto space.

#CryptoNews #InstitutionalCrypto #CME #BTC 🚀

CME Group, one of the world’s largest derivatives exchanges, is planning to launch its own CME Token.

This move could:

• Bridge traditional finance with crypto

• Offer new trading and hedging opportunities

• Attract institutional investors to tokenized markets

A big step showing how legacy finance is increasingly entering the crypto space.

#CryptoNews #InstitutionalCrypto #CME #BTC 🚀

BTC-1,57%

- Reward

- 12

- 14

- Repost

- Share

Peacefulheart :

:

Happy New Year! 🤑View More

Bitwise Files for a UNI Spot ETF — A Signal of DeFi’s Next Phase

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 is more than a regulatory milestone — it reflects a structural shift in how DeFi is being evaluated by institutions and regulators.

This move comes as regulatory frameworks mature, with greater emphasis on transparency, liquidity standards, custody, and investor protection. At the same time, institutional-grade infrastructure now exists to support DeFi assets at scale — making regulated exposure increasingly viable.

Why UNI matters:

Uniswap is no

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 is more than a regulatory milestone — it reflects a structural shift in how DeFi is being evaluated by institutions and regulators.

This move comes as regulatory frameworks mature, with greater emphasis on transparency, liquidity standards, custody, and investor protection. At the same time, institutional-grade infrastructure now exists to support DeFi assets at scale — making regulated exposure increasingly viable.

Why UNI matters:

Uniswap is no

UNI4,04%

- Reward

- 5

- 5

- Repost

- Share

Crypto_Teacher :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

Bitwise Files for a UNI Spot ETF — A Signal of DeFi’s Next Phase

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 represents far more than another regulatory application. It marks a broader shift in how Decentralized Finance (DeFi) is being evaluated by regulators, institutions, and market architects.

This filing arrives at a moment when the regulatory environment has evolved from hesitation to structured engagement. Policymakers are increasingly focused on transparency, liquidity standards, custody frameworks, and investor protection—creating conditions whe

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 represents far more than another regulatory application. It marks a broader shift in how Decentralized Finance (DeFi) is being evaluated by regulators, institutions, and market architects.

This filing arrives at a moment when the regulatory environment has evolved from hesitation to structured engagement. Policymakers are increasingly focused on transparency, liquidity standards, custody frameworks, and investor protection—creating conditions whe

- Reward

- 4

- 8

- Repost

- Share

NovaCryptoGirl :

:

DYOR 🤓View More

Bitwise Files for a UNI Spot ETF — A Signal of DeFi’s Next Phase

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 represents far more than another regulatory application. It marks a broader shift in how Decentralized Finance (DeFi) is being evaluated by regulators, institutions, and market architects.

This filing arrives at a moment when the regulatory environment has evolved from hesitation to structured engagement. Policymakers are increasingly focused on transparency, liquidity standards, custody frameworks, and investor protection—creating conditions whe

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 represents far more than another regulatory application. It marks a broader shift in how Decentralized Finance (DeFi) is being evaluated by regulators, institutions, and market architects.

This filing arrives at a moment when the regulatory environment has evolved from hesitation to structured engagement. Policymakers are increasingly focused on transparency, liquidity standards, custody frameworks, and investor protection—creating conditions whe

- Reward

- 8

- 13

- Repost

- Share

CryptoFiler :

:

Ape In 🚀View More

# CMEGroupPlansCMEToken

🏦 Power Move: CME Group Plans to Launch "CME Token"

The traditional finance giant, CME

Group (Chicago Mercantile Exchange), is making a massive leap into the digital

asset space. Reports confirm that they are planning to launch their own token,

the "CME Token."

This is not just another meme coin;

this is Wall Street doubling down on blockchain infrastructure. Here is why

this is a watershed moment for crypto:

1. Institutional Validation CME is the biggest. They already dominate the Bitcoin and

Ethereum futures markets. If they are launching a token, it means they

🏦 Power Move: CME Group Plans to Launch "CME Token"

The traditional finance giant, CME

Group (Chicago Mercantile Exchange), is making a massive leap into the digital

asset space. Reports confirm that they are planning to launch their own token,

the "CME Token."

This is not just another meme coin;

this is Wall Street doubling down on blockchain infrastructure. Here is why

this is a watershed moment for crypto:

1. Institutional Validation CME is the biggest. They already dominate the Bitcoin and

Ethereum futures markets. If they are launching a token, it means they

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Happy New Year! 🤑Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

240.56K Popularity

54.7K Popularity

26.94K Popularity

21.14K Popularity

18.5K Popularity

108.29K Popularity

7.61K Popularity

12.73K Popularity

6.77K Popularity

5.17K Popularity

6.56K Popularity

17.46K Popularity

4.21K Popularity

23.12K Popularity

15.25K Popularity

News

View MoreData: 30.26 WBTC transferred from an anonymous address, worth approximately 2,037,300 USD.

12 m

BlackRock Executive: If Asian asset allocation allocates only 1% to cryptocurrencies, it could bring in nearly $2 trillion in capital inflows

15 m

DCG Founder Barry Silbert: In the future, 5%–10% of Bitcoin may flow into privacy-focused cryptocurrencies

16 m

Upexi's revenue doubled but recorded a $179 million loss, with SOL's decline dragging down the digital asset treasury performance

18 m

Paxful fined $4 million for anti-money laundering violations, with the U.S. Department of Justice stating it profited from the flow of criminal funds

22 m

Pin