# USIranNuclearTalksTurmoil

20.69K

HighAmbition

#USIranNuclearTalksTurmoil

🧠 What’s Happening: US‑Iran Nuclear Talks & Geopolitical Tension

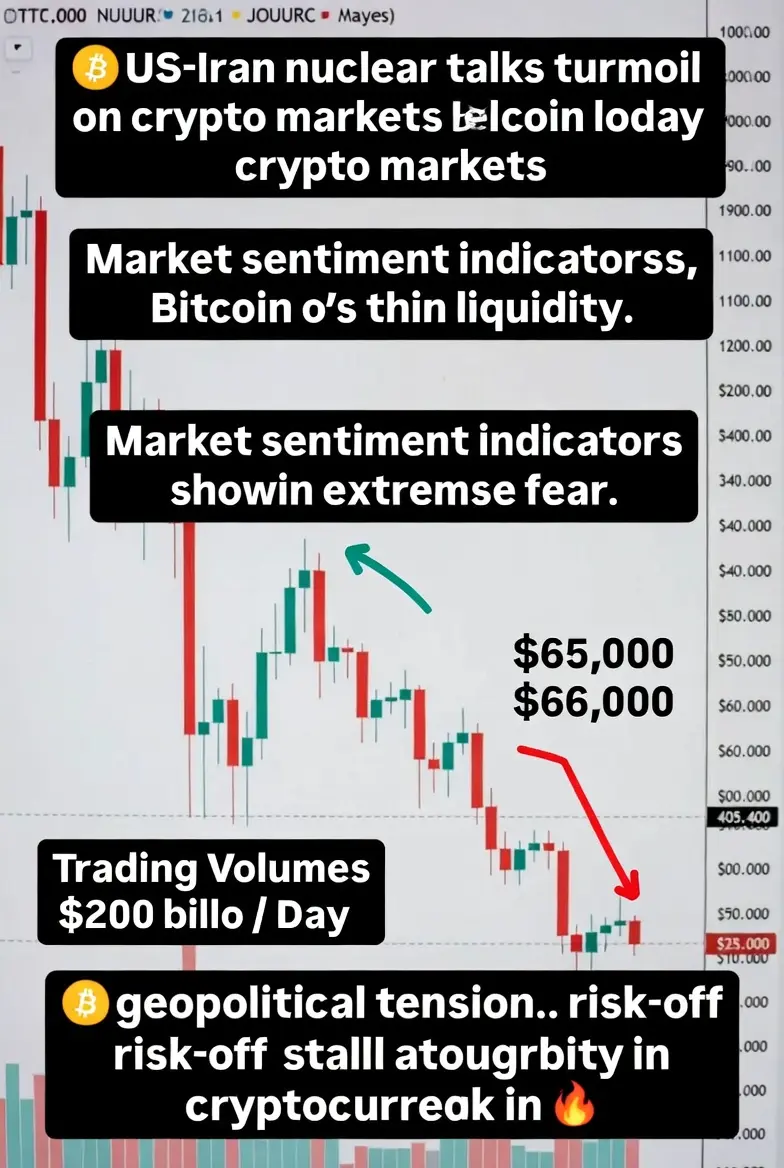

Recently, renewed tensions between the United States and Iran — tied to stalled nuclear negotiations, military incidents, and diplomatic uncertainty — have created a high‑risk, volatile global environment. Markets now are reacting not just to the talks themselves but to fears that negotiations could fail and escalate into conflict or instability. This risk‑off mood has rippled into financial and crypto markets.

📊 Current Bitcoin Price & Crypto Market Status

✅ Bitcoin Price:

Recently, Bitcoin dropped

🧠 What’s Happening: US‑Iran Nuclear Talks & Geopolitical Tension

Recently, renewed tensions between the United States and Iran — tied to stalled nuclear negotiations, military incidents, and diplomatic uncertainty — have created a high‑risk, volatile global environment. Markets now are reacting not just to the talks themselves but to fears that negotiations could fail and escalate into conflict or instability. This risk‑off mood has rippled into financial and crypto markets.

📊 Current Bitcoin Price & Crypto Market Status

✅ Bitcoin Price:

Recently, Bitcoin dropped

BTC-0,85%

- Reward

- 21

- 15

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#USIranNuclearTalksTurmoil

Geopolitics Shaping Global Markets and Risk Sentiment

The ongoing US-Iran nuclear negotiations have entered a phase of heightened uncertainty, as conflicting positions, geopolitical tensions, and domestic political pressures create a turbulent backdrop for diplomacy. What may appear as routine negotiation developments carry far-reaching implications for global energy markets, geopolitical stability, and investor risk appetite, making this turmoil a critical factor for financial and crypto markets alike.

Geopolitical Context and Strategic Stakes

The nuclear talks be

Geopolitics Shaping Global Markets and Risk Sentiment

The ongoing US-Iran nuclear negotiations have entered a phase of heightened uncertainty, as conflicting positions, geopolitical tensions, and domestic political pressures create a turbulent backdrop for diplomacy. What may appear as routine negotiation developments carry far-reaching implications for global energy markets, geopolitical stability, and investor risk appetite, making this turmoil a critical factor for financial and crypto markets alike.

Geopolitical Context and Strategic Stakes

The nuclear talks be

BTC-0,85%

- Reward

- 8

- 12

- Repost

- Share

ybaser :

:

Watching Closely 🔍️View More

#USIranNuclearTalksTurmoil Markets on Edge

Geopolitical tension is back as uncertainty surrounds the latest U.S.–Iran nuclear negotiations. When talks stall or headlines turn negative, markets react immediately.

📉 Why this matters for crypto & global assets:

• Oil volatility spikes

• Safe-haven flows into Gold & USD

• Stocks & crypto face pressure

• Investor sentiment shifts toward “risk-off”

We’ve already seen synchronized weakness across BTC, equities, and commodities during geopolitical stress.

Bitcoin is still behaving as a high-beta risk asset, not “digital gold,” in moments like this.

�

Geopolitical tension is back as uncertainty surrounds the latest U.S.–Iran nuclear negotiations. When talks stall or headlines turn negative, markets react immediately.

📉 Why this matters for crypto & global assets:

• Oil volatility spikes

• Safe-haven flows into Gold & USD

• Stocks & crypto face pressure

• Investor sentiment shifts toward “risk-off”

We’ve already seen synchronized weakness across BTC, equities, and commodities during geopolitical stress.

Bitcoin is still behaving as a high-beta risk asset, not “digital gold,” in moments like this.

�

BTC-0,85%

- Reward

- 9

- 18

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

#USIranNuclearTalksTurmoil

Renewed turmoil surrounding U.S.–Iran nuclear talks has once again injected uncertainty into global markets, reminding investors how deeply geopolitics can influence risk sentiment. As negotiations face renewed tension, markets are reacting not just to headlines, but to the broader implications for energy supply, regional stability, and global risk appetite. In moments like these, uncertainty itself becomes the catalyst, pushing investors to reassess exposure across assets.

From a macro perspective, stalled or strained nuclear talks elevate concerns around oil suppl

Renewed turmoil surrounding U.S.–Iran nuclear talks has once again injected uncertainty into global markets, reminding investors how deeply geopolitics can influence risk sentiment. As negotiations face renewed tension, markets are reacting not just to headlines, but to the broader implications for energy supply, regional stability, and global risk appetite. In moments like these, uncertainty itself becomes the catalyst, pushing investors to reassess exposure across assets.

From a macro perspective, stalled or strained nuclear talks elevate concerns around oil suppl

BTC-0,85%

- Reward

- 6

- 11

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#USIranNuclearTalksTurmoil Markets on Edge

Geopolitical tensions are back in focus as uncertainty surrounds the latest U.S.–Iran nuclear negotiations. Whenever talks stall or negative headlines emerge, financial markets respond quickly, reflecting the broader sensitivity to macro and geopolitical shocks.

These developments have meaningful implications for crypto and global assets. Oil prices often spike during heightened tensions, creating volatility that ripples across commodity markets. Safe-haven assets such as gold and the U.S. dollar attract inflows, while risk-on assets, including equiti

Geopolitical tensions are back in focus as uncertainty surrounds the latest U.S.–Iran nuclear negotiations. Whenever talks stall or negative headlines emerge, financial markets respond quickly, reflecting the broader sensitivity to macro and geopolitical shocks.

These developments have meaningful implications for crypto and global assets. Oil prices often spike during heightened tensions, creating volatility that ripples across commodity markets. Safe-haven assets such as gold and the U.S. dollar attract inflows, while risk-on assets, including equiti

BTC-0,85%

- Reward

- 3

- 9

- Repost

- Share

YingYue :

:

1000x VIbes 🤑View More

#USIranNuclearTalksTurmoil Markets on Edge

Geopolitical tensions are back in focus as uncertainty surrounds the latest U.S.–Iran nuclear negotiations. Whenever talks stall or negative headlines emerge, financial markets respond quickly, reflecting the broader sensitivity to macro and geopolitical shocks.

These developments have meaningful implications for crypto and global assets. Oil prices often spike during heightened tensions, creating volatility that ripples across commodity markets. Safe-haven assets such as gold and the U.S. dollar attract inflows, while risk-on assets, including equiti

Geopolitical tensions are back in focus as uncertainty surrounds the latest U.S.–Iran nuclear negotiations. Whenever talks stall or negative headlines emerge, financial markets respond quickly, reflecting the broader sensitivity to macro and geopolitical shocks.

These developments have meaningful implications for crypto and global assets. Oil prices often spike during heightened tensions, creating volatility that ripples across commodity markets. Safe-haven assets such as gold and the U.S. dollar attract inflows, while risk-on assets, including equiti

BTC-0,85%

- Reward

- 16

- 31

- Repost

- Share

YingYue :

:

2026 GOGOGO 👊View More

#USIranNuclearTalksTurmoil 🌍⚠️ | Markets on Edge

Geopolitical tension is back in focus as uncertainty surrounds the latest U.S.–Iran nuclear negotiations.

Whenever talks stall or headlines turn negative, markets react fast.

📉 Why it matters for crypto & global assets:

• Oil price volatility increases

• Safe-haven flows move into Gold & USD

• Risk assets (Stocks & Crypto) face pressure

• Investor sentiment shifts toward “risk-off”

We’ve already seen synchronized weakness across BTC, equities, and commodities during periods of geopolitical stress.

Bitcoin is still trading more like a high-bet

Geopolitical tension is back in focus as uncertainty surrounds the latest U.S.–Iran nuclear negotiations.

Whenever talks stall or headlines turn negative, markets react fast.

📉 Why it matters for crypto & global assets:

• Oil price volatility increases

• Safe-haven flows move into Gold & USD

• Risk assets (Stocks & Crypto) face pressure

• Investor sentiment shifts toward “risk-off”

We’ve already seen synchronized weakness across BTC, equities, and commodities during periods of geopolitical stress.

Bitcoin is still trading more like a high-bet

BTC-0,85%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

New Year Wealth Explosion 🤑#USIranNuclearTalksTurmoil

Tensions surrounding the U.S.-Iran nuclear talks are creating a complex backdrop for global markets, and Dragon Fly Official views this as a situation that can influence crypto and risk assets in subtle but meaningful ways. Geopolitical uncertainty often drives short-term liquidity swings, and traders are now weighing both headline risk and macro fundamentals in positioning decisions.

From a crypto perspective, periods of geopolitical turmoil historically increase volatility. Bitcoin and Ethereum, often seen as high-beta risk assets, can experience rapid swings as c

Tensions surrounding the U.S.-Iran nuclear talks are creating a complex backdrop for global markets, and Dragon Fly Official views this as a situation that can influence crypto and risk assets in subtle but meaningful ways. Geopolitical uncertainty often drives short-term liquidity swings, and traders are now weighing both headline risk and macro fundamentals in positioning decisions.

From a crypto perspective, periods of geopolitical turmoil historically increase volatility. Bitcoin and Ethereum, often seen as high-beta risk assets, can experience rapid swings as c

- Reward

- 7

- 5

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#USIranNuclearTalksTurmoil 🌍⚠️ | Markets on Edge

Geopolitical tension is back in focus as uncertainty surrounds the latest U.S.–Iran nuclear negotiations.

Whenever talks stall or headlines turn negative, markets react fast.

📉 Why it matters for crypto & global assets:

• Oil price volatility increases

• Safe-haven flows move into Gold & USD

• Risk assets (Stocks & Crypto) face pressure

• Investor sentiment shifts toward “risk-off”

We’ve already seen synchronized weakness across BTC, equities, and commodities during periods of geopolitical stress.

Bitcoin is still trading more like a high-bet

Geopolitical tension is back in focus as uncertainty surrounds the latest U.S.–Iran nuclear negotiations.

Whenever talks stall or headlines turn negative, markets react fast.

📉 Why it matters for crypto & global assets:

• Oil price volatility increases

• Safe-haven flows move into Gold & USD

• Risk assets (Stocks & Crypto) face pressure

• Investor sentiment shifts toward “risk-off”

We’ve already seen synchronized weakness across BTC, equities, and commodities during periods of geopolitical stress.

Bitcoin is still trading more like a high-bet

BTC-0,85%

- Reward

- 12

- 15

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#USIranNuclearTalksTurmoil

Global markets are reacting to renewed tensions surrounding US-Iran nuclear talks, creating uncertainty that extends across equities, commodities, and cryptocurrencies. Political and geopolitical turmoil often drives risk-off sentiment, leading investors to reassess positions in both traditional and digital assets.

Market Context

Bitcoin (BTC): ~$67,000 – $68,000, experiencing volatility amid risk-off flows

Gold and precious metals: Prices have risen slightly as investors seek safe havens, but gold stocks are under pressure due to equity correlations

Equities: Globa

Global markets are reacting to renewed tensions surrounding US-Iran nuclear talks, creating uncertainty that extends across equities, commodities, and cryptocurrencies. Political and geopolitical turmoil often drives risk-off sentiment, leading investors to reassess positions in both traditional and digital assets.

Market Context

Bitcoin (BTC): ~$67,000 – $68,000, experiencing volatility amid risk-off flows

Gold and precious metals: Prices have risen slightly as investors seek safe havens, but gold stocks are under pressure due to equity correlations

Equities: Globa

- Reward

- 12

- 13

- Repost

- Share

ShainingMoon :

:

thanks the outstanding information your share with us thanks for your hardwork View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

231.35K Popularity

53.09K Popularity

22.46K Popularity

17.58K Popularity

16.95K Popularity

94.84K Popularity

6.2K Popularity

11.5K Popularity

6.77K Popularity

4.25K Popularity

5.52K Popularity

15.23K Popularity

4.04K Popularity

22.29K Popularity

13.99K Popularity

News

View MoreBlackRock is discussing with the U.S. SEC the tokenization of iShares ETFs

2 m

AINFT Challenge Season 1 begins, with triple prize pools waiting to be claimed

5 m

Birch Hill Holdings completes $2.5 million pre-seed funding round, led by ParaFi Capital and others

6 m

User Pays $125.7K in Gas Fees for Single Ethereum Transaction

12 m

ETH Breaks Through 2000 USDT

14 m

Pin