AfnovaAvian

No content yet

AfnovaAvian

Ethereum at a Crossroads Is This a Relief Bounce or the Beginning of a Deeper Crash

Bitcoin is still struggling to stand strong, and because of that, the whole crypto market feels shaky. Ethereum is trying to recover after a sudden and painful drop. The price fell hard, cut through an important support level, and then slowed down. But there is a problem the level that once supported ETH is now acting like a wall above it. This is a classic sign of fear after panic selling, and it often kills excitement very quickly.

Right now, Ethereum does have a small chance to bounce. In the short term, the

Bitcoin is still struggling to stand strong, and because of that, the whole crypto market feels shaky. Ethereum is trying to recover after a sudden and painful drop. The price fell hard, cut through an important support level, and then slowed down. But there is a problem the level that once supported ETH is now acting like a wall above it. This is a classic sign of fear after panic selling, and it often kills excitement very quickly.

Right now, Ethereum does have a small chance to bounce. In the short term, the

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short positions get unwound around $0.10068, and price stayed composed instead of dipping after that event. The reaction looks controlled, suggesting sell pressure was absorbed while buyers held the area.

EP (Entry Price): $0.1024

TP1: $0.1071

TP2: $0.1146

TP3: $0.1262

SL (Stop Loss): $0.0959

Price is sustaining acceptance above the $0.100 reaction zone, preserving a healthy structure.

Upside progression is strengthening as liquidation flow removes downward resistance from the move.

Liquidity is positioned above $0.110 and $0.120, which often draws price higher if participation rema

EP (Entry Price): $0.1024

TP1: $0.1071

TP2: $0.1146

TP3: $0.1262

SL (Stop Loss): $0.0959

Price is sustaining acceptance above the $0.100 reaction zone, preserving a healthy structure.

Upside progression is strengthening as liquidation flow removes downward resistance from the move.

Liquidity is positioned above $0.110 and $0.120, which often draws price higher if participation rema

SIREN1,86%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing a noticeable short clear-out near $0.01301, and price stayed firm instead of slipping back after that sweep. The response looks orderly, suggesting supply was absorbed as participation rotated higher.

EP (Entry Price): $0.01325

TP1: $0.01395

TP2: $0.01510

TP3: $0.01685

SL (Stop Loss): $0.01235

Price is sustaining acceptance above the $0.013 reaction zone, keeping the structure supportive rather than stressed.

Upward continuation is gaining pace as liquidation activity removes downside weight from the move.

Liquidity is stacked above $0.0144 and $0.0159, which often pulls price highe

EP (Entry Price): $0.01325

TP1: $0.01395

TP2: $0.01510

TP3: $0.01685

SL (Stop Loss): $0.01235

Price is sustaining acceptance above the $0.013 reaction zone, keeping the structure supportive rather than stressed.

Upward continuation is gaining pace as liquidation activity removes downside weight from the move.

Liquidity is stacked above $0.0144 and $0.0159, which often pulls price highe

YALA-19,33%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short positions get taken out near $81.86, and price stayed firm instead of easing lower after that event. The response feels decisive, suggesting supply was absorbed while buyers maintained control.

EP (Entry Price): $82.40

TP1: $84.10

TP2: $86.95

TP3: $91.20

SL (Stop Loss): $79.80

Price is sustaining value above the $81.8 reaction zone, keeping the structure constructive and supported.

Upside expansion is improving as liquidation flow removes downward pressure from the move.

Liquidity is concentrated above $85.00 and $89.50, which often attracts price higher if participation remai

EP (Entry Price): $82.40

TP1: $84.10

TP2: $86.95

TP3: $91.20

SL (Stop Loss): $79.80

Price is sustaining value above the $81.8 reaction zone, keeping the structure constructive and supported.

Upside expansion is improving as liquidation flow removes downward pressure from the move.

Liquidity is concentrated above $85.00 and $89.50, which often attracts price higher if participation remai

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short positions get cleared near $0.64655, and price stayed elevated instead of retracing after that removal. The response looks confident, showing selling effort was taken in while demand stayed present.

EP (Entry Price): $0.6528

TP1: $0.6745

TP2: $0.7080

TP3: $0.7605

SL (Stop Loss): $0.6209

Price is holding above the $0.646 reaction area, keeping the structure clean and supported.

Upside continuation is strengthening as liquidation flow reduces downward pressure from the move.

Liquidity is positioned above $0.685 and $0.730, which often pulls price higher if participation remains

EP (Entry Price): $0.6528

TP1: $0.6745

TP2: $0.7080

TP3: $0.7605

SL (Stop Loss): $0.6209

Price is holding above the $0.646 reaction area, keeping the structure clean and supported.

Upside continuation is strengthening as liquidation flow reduces downward pressure from the move.

Liquidity is positioned above $0.685 and $0.730, which often pulls price higher if participation remains

ASTER0,55%

- Reward

- 2

- Comment

- Repost

- Share

I’m seeing short positions get removed around $0.28196, and price stayed resilient rather than dipping afterward. The reaction looks constructive, suggesting sell pressure was absorbed as buyers defended the area.

EP (Entry Price): $0.2854

TP1: $0.2978

TP2: $0.3165

TP3: $0.3440

SL (Stop Loss): $0.2706

Price is holding above the $0.282 reaction zone, preserving a supportive structure.

Upside continuation is strengthening as liquidation activity clears downside weight from the move.

Liquidity is clustered above $0.305 and $0.330, which often attracts price higher if participation remains active.

EP (Entry Price): $0.2854

TP1: $0.2978

TP2: $0.3165

TP3: $0.3440

SL (Stop Loss): $0.2706

Price is holding above the $0.282 reaction zone, preserving a supportive structure.

Upside continuation is strengthening as liquidation activity clears downside weight from the move.

Liquidity is clustered above $0.305 and $0.330, which often attracts price higher if participation remains active.

POWER13,03%

- Reward

- like

- Comment

- Repost

- Share

I’m noticing short positions getting flushed near $0.02174, and price remained steady rather than sliding afterward. The reaction feels controlled, showing supply was taken in while buyers defended the area.

EP (Entry Price): $0.02205

TP1: $0.02310

TP2: $0.02485

TP3: $0.02740

SL (Stop Loss): $0.02095

Price is maintaining value above the $0.0217 reaction zone, keeping the structure balanced and intact.

Upward continuation is developing as liquidation activity removes downward pressure from the range.

Liquidity is stacked above $0.0238 and $0.0262, which often attracts price higher if participat

EP (Entry Price): $0.02205

TP1: $0.02310

TP2: $0.02485

TP3: $0.02740

SL (Stop Loss): $0.02095

Price is maintaining value above the $0.0217 reaction zone, keeping the structure balanced and intact.

Upward continuation is developing as liquidation activity removes downward pressure from the range.

Liquidity is stacked above $0.0238 and $0.0262, which often attracts price higher if participat

STABLE-6,9%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short positions get swept near $0.00466, and price stayed composed rather than slipping afterward. The reaction looks firm, indicating sell pressure was absorbed while buyers kept the area defended.

EP (Entry Price): $0.00472

TP1: $0.00498

TP2: $0.00542

TP3: $0.00605

SL (Stop Loss): $0.00434

Price is sustaining acceptance above the $0.00466 reaction zone, preserving a clean structure.

Upside progression is building as liquidation activity removes downward friction from the move.

Liquidity sits above $0.00510 and $0.00575, which often attracts price higher if participation stays acti

EP (Entry Price): $0.00472

TP1: $0.00498

TP2: $0.00542

TP3: $0.00605

SL (Stop Loss): $0.00434

Price is sustaining acceptance above the $0.00466 reaction zone, preserving a clean structure.

Upside progression is building as liquidation activity removes downward friction from the move.

Liquidity sits above $0.00510 and $0.00575, which often attracts price higher if participation stays acti

BANANAS31-1,21%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short exposure get cleared around $5052.25, and price stayed elevated rather than fading after that sweep. The reaction looks firm, suggesting sell pressure was absorbed as demand stayed active.

EP (Entry Price): $5075

TP1: $5150

TP2: $5280

TP3: $5450

SL (Stop Loss): $4955

Price is holding above the $5050 reaction zone, keeping the structure constructive and supported.

Upside continuation is strengthening as liquidation flow removes downside weight from the move.

Liquidity is positioned above $5200 and $5350, which often draws price higher if participation remains active.

$XAU

EP (Entry Price): $5075

TP1: $5150

TP2: $5280

TP3: $5450

SL (Stop Loss): $4955

Price is holding above the $5050 reaction zone, keeping the structure constructive and supported.

Upside continuation is strengthening as liquidation flow removes downside weight from the move.

Liquidity is positioned above $5200 and $5350, which often draws price higher if participation remains active.

$XAU

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short positions get cleared near $17.11677, and price remained supported instead of drifting lower afterward. The reaction appears orderly, showing supply was absorbed as buyers maintained control.

EP (Entry Price): $17.32

TP1: $18.05

TP2: $19.18

TP3: $20.85

SL (Stop Loss): $16.45

Price is holding above the $17.10 reaction zone, preserving a constructive structure.

Upside progression is improving as liquidation activity removes downward pressure from the move.

Liquidity is positioned above $18.60 and $20.00, which often attracts price higher if participation remains active.

$RIVER

EP (Entry Price): $17.32

TP1: $18.05

TP2: $19.18

TP3: $20.85

SL (Stop Loss): $16.45

Price is holding above the $17.10 reaction zone, preserving a constructive structure.

Upside progression is improving as liquidation activity removes downward pressure from the move.

Liquidity is positioned above $18.60 and $20.00, which often attracts price higher if participation remains active.

$RIVER

- Reward

- like

- Comment

- Repost

- Share

I’m seeing a heavy short flush around $82.3531, and price stayed firm instead of slipping back afterward. The reaction looks decisive, showing sell-side pressure was absorbed while buyers kept control.

EP (Entry Price): $83.10

TP1: $85.40

TP2: $88.90

TP3: $94.80

SL (Stop Loss): $79.60

Price is sustaining above the $82.3 reaction zone, keeping the structure constructive rather than fragile.

Upside momentum is strengthening as liquidation flow removes downward pressure from the move.

Liquidity is positioned above $86.50 and $91.20, which often attracts price higher if participation remains activ

EP (Entry Price): $83.10

TP1: $85.40

TP2: $88.90

TP3: $94.80

SL (Stop Loss): $79.60

Price is sustaining above the $82.3 reaction zone, keeping the structure constructive rather than fragile.

Upside momentum is strengthening as liquidation flow removes downward pressure from the move.

Liquidity is positioned above $86.50 and $91.20, which often attracts price higher if participation remains activ

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short sellers get forced out around $0.02729, and price stayed firm rather than slipping after that clearance. The response looks stable, suggesting selling pressure was absorbed as buyers defended the zone.

EP (Entry Price): $0.02775

TP1: $0.02910

TP2: $0.03140

TP3: $0.03490

SL (Stop Loss): $0.02595

Price is holding above the $0.0272 reaction area, keeping the structure organized and supported.

Upside continuation is strengthening as liquidation activity removes downward weight from the range.

Liquidity is positioned above $0.0300 and $0.0330, which often draws price higher if part

EP (Entry Price): $0.02775

TP1: $0.02910

TP2: $0.03140

TP3: $0.03490

SL (Stop Loss): $0.02595

Price is holding above the $0.0272 reaction area, keeping the structure organized and supported.

Upside continuation is strengthening as liquidation activity removes downward weight from the range.

Liquidity is positioned above $0.0300 and $0.0330, which often draws price higher if part

ZAMA-26,86%

- Reward

- like

- 1

- Repost

- Share

liby :

:

In the crypto world, don't be fooled by candle patterns, bro🤣🤣🤣 Up and down, the one who determines it is the coin owner, not the candle movement🤣🤣

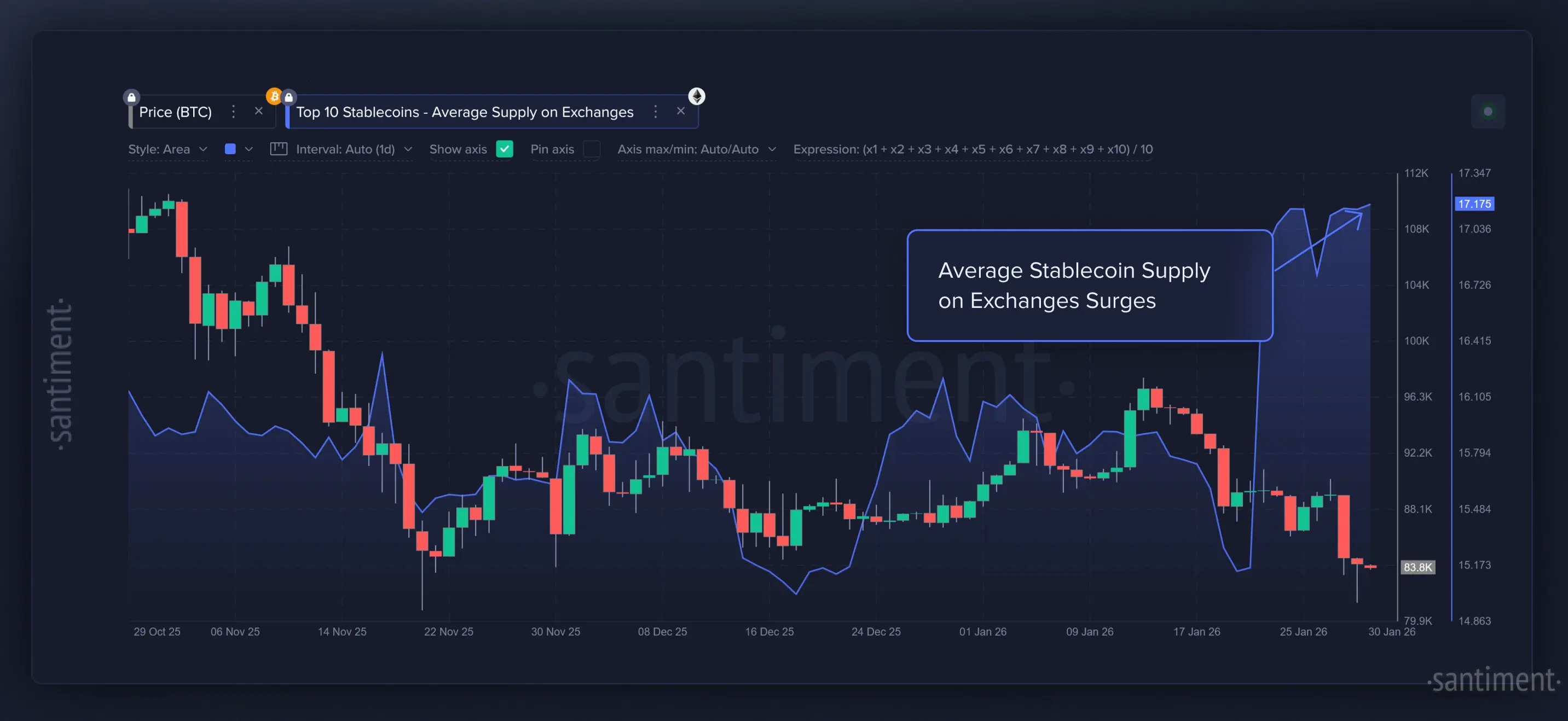

Everyone Is Watching Price, Almost No One Is Watching This Bitcoin Setup

Something unusual is happening beneath the surface of Bitcoin.

On the outside, price action looks tired. Excitement feels loud. Social media is full of confident calls and bold predictions. But underneath that noise, the market is quietly shifting in a way that usually comes before big and sudden moves.

This is not a normal moment.

Bitcoin has just entered a rare setup where emotions, value, and money flow are all telling different stories. And when that happens, the market rarely stays calm for long.

Crowd Excitement Is

Something unusual is happening beneath the surface of Bitcoin.

On the outside, price action looks tired. Excitement feels loud. Social media is full of confident calls and bold predictions. But underneath that noise, the market is quietly shifting in a way that usually comes before big and sudden moves.

This is not a normal moment.

Bitcoin has just entered a rare setup where emotions, value, and money flow are all telling different stories. And when that happens, the market rarely stays calm for long.

Crowd Excitement Is

BTC-2,25%

- Reward

- like

- Comment

- Repost

- Share

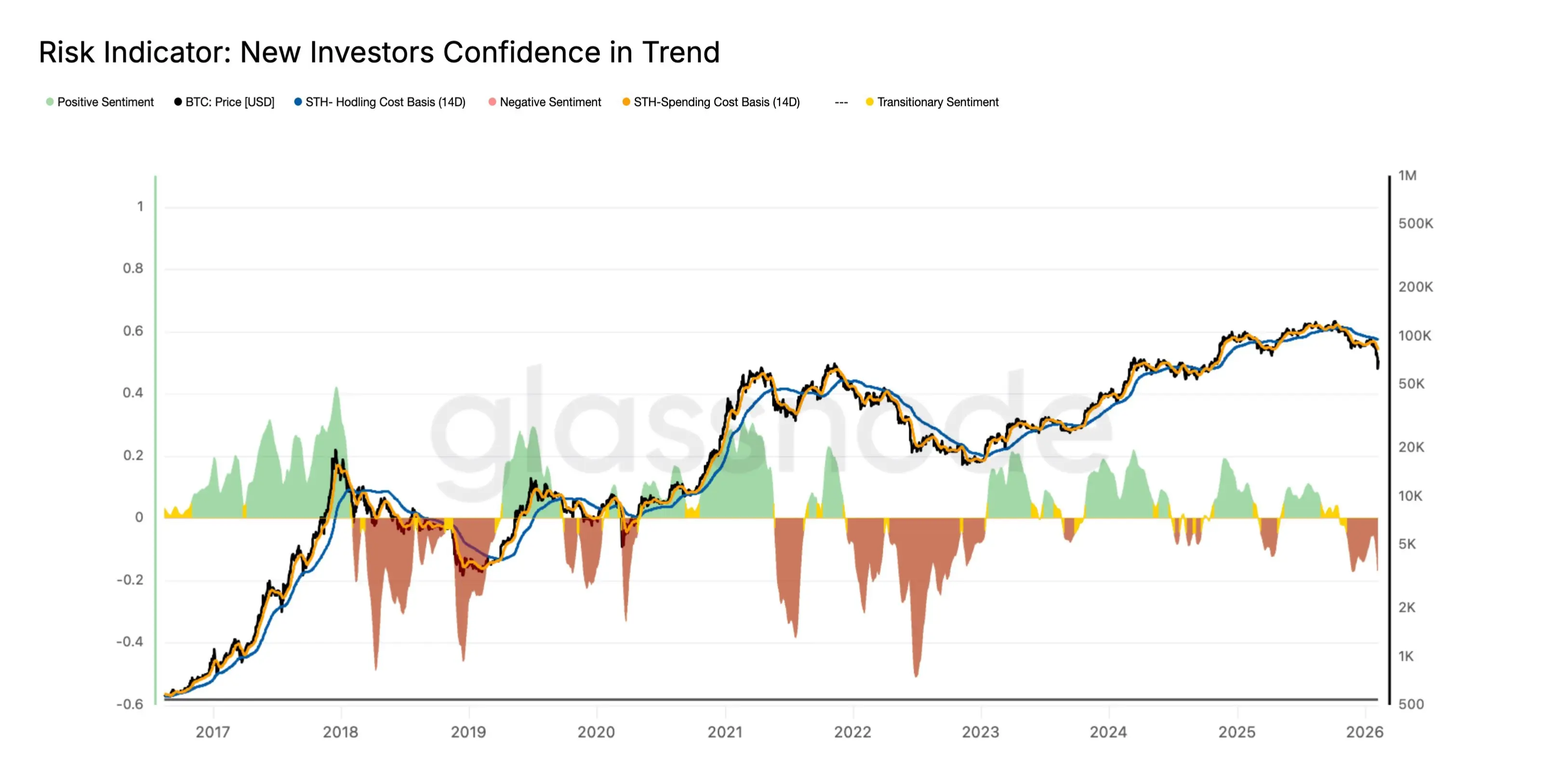

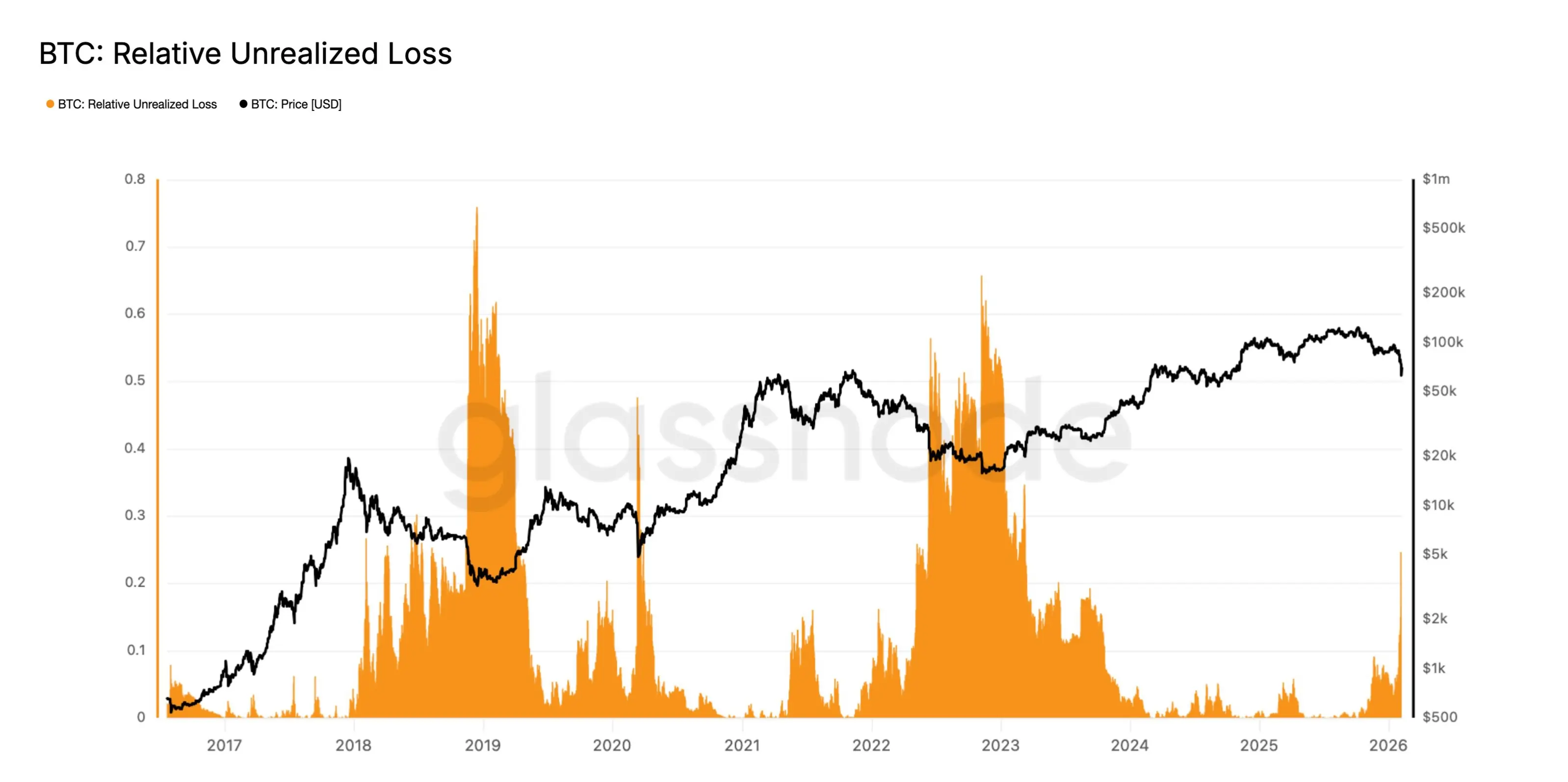

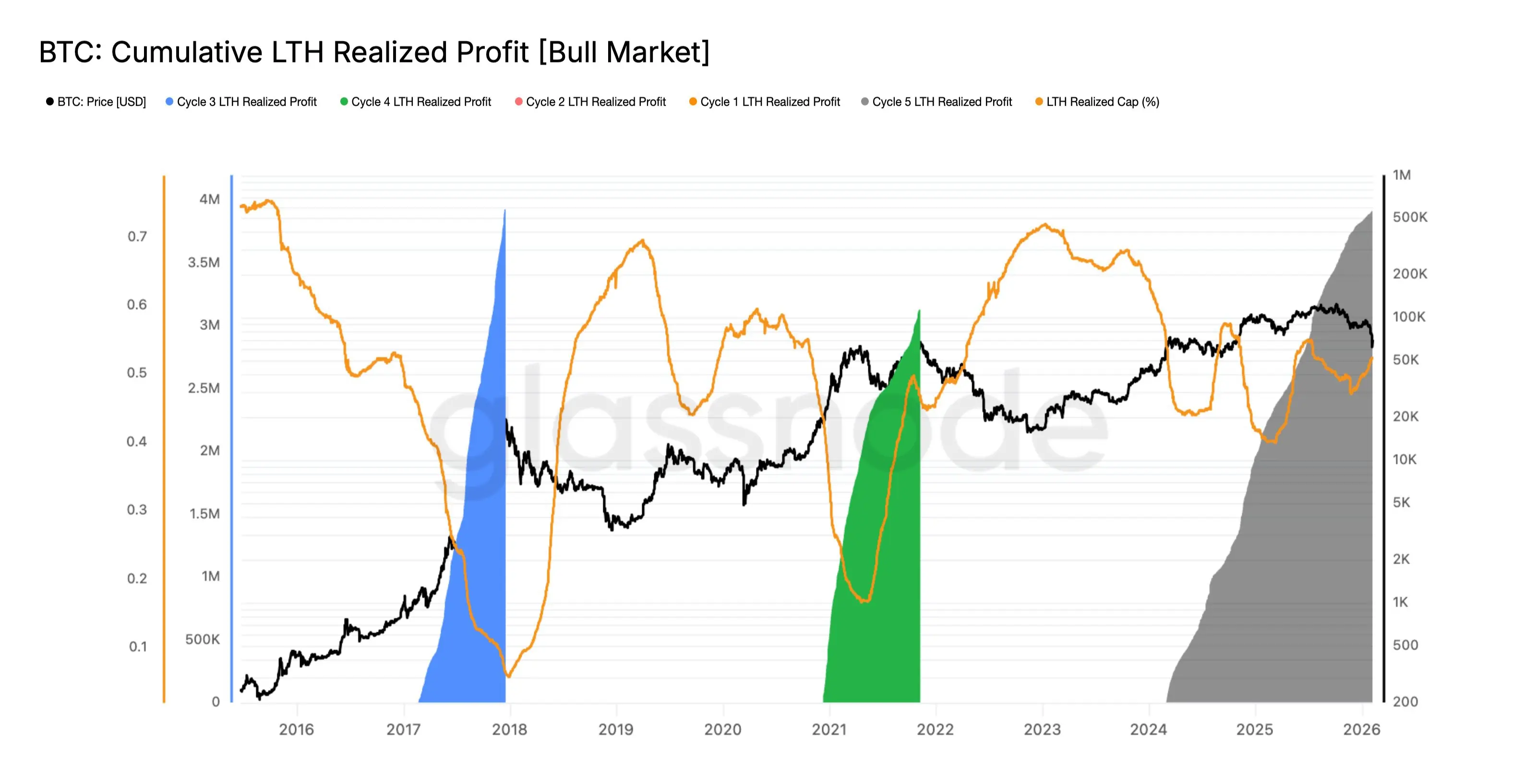

Has Bitcoin’s Explosive Momentum Ended or Is This the Calm Before the Next Big Move?

Bitcoin is not crashing.

It is not exploding either.

What we are seeing now is something more interesting a shift in behavior.

Recent on-chain data shows that Bitcoin is moving into a transition stage. This is the phase where strong upward momentum begins to slow, and long-term holders quietly start locking in profits. The market structure itself is changing, not breaking.

Bitcoin’s price is currently trading close to levels where late-cycle buyers usually enter. Historically, this is the zone where many new

Bitcoin is not crashing.

It is not exploding either.

What we are seeing now is something more interesting a shift in behavior.

Recent on-chain data shows that Bitcoin is moving into a transition stage. This is the phase where strong upward momentum begins to slow, and long-term holders quietly start locking in profits. The market structure itself is changing, not breaking.

Bitcoin’s price is currently trading close to levels where late-cycle buyers usually enter. Historically, this is the zone where many new

BTC-2,25%

- Reward

- like

- Comment

- Repost

- Share

I’m noticing a solid short cleanout around $0.259, and price remained steady instead of pulling back after that event. The reaction looks controlled, showing sell pressure was absorbed as demand held the zone.

EP (Entry Price): $0.262

TP1: $0.273

TP2: $0.290

TP3: $0.315

SL (Stop Loss): $0.247

Price is maintaining acceptance above the $0.259 reaction area, keeping the structure organized.

Upside continuation is gaining traction as liquidation flow removes downward weight from the range.

Liquidity is layered above $0.278 and $0.302, which often draws price higher if participation remains active.

EP (Entry Price): $0.262

TP1: $0.273

TP2: $0.290

TP3: $0.315

SL (Stop Loss): $0.247

Price is maintaining acceptance above the $0.259 reaction area, keeping the structure organized.

Upside continuation is gaining traction as liquidation flow removes downward weight from the range.

Liquidity is layered above $0.278 and $0.302, which often draws price higher if participation remains active.

CRV-2,22%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short positions get unwound near $0.0618, and price held firm instead of slipping after the sweep. The reaction looks balanced, suggesting supply was taken in while demand stayed active.

EP (Entry Price): $0.0626

TP1: $0.0654

TP2: $0.0699

TP3: $0.0768

SL (Stop Loss): $0.0589

Price is sustaining acceptance above the $0.0618 reaction zone, keeping the structure orderly and supported.

Upside progress is improving as liquidation flow reduces downward constraint from the move.

Liquidity is stacked above $0.067 and $0.073, which often draws price higher if participation remains steady.

$W

EP (Entry Price): $0.0626

TP1: $0.0654

TP2: $0.0699

TP3: $0.0768

SL (Stop Loss): $0.0589

Price is sustaining acceptance above the $0.0618 reaction zone, keeping the structure orderly and supported.

Upside progress is improving as liquidation flow reduces downward constraint from the move.

Liquidity is stacked above $0.067 and $0.073, which often draws price higher if participation remains steady.

$W

WCT5,18%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short contracts get cleared around $0.1646, and price stayed composed instead of rolling over afterward. The reaction suggests selling effort was absorbed while participation leaned higher.

EP (Entry Price): $0.1671

TP1: $0.1738

TP2: $0.1846

TP3: $0.2019

SL (Stop Loss): $0.1582

Price is holding above the $0.164 reaction area, preserving a stable market layout.

Upward acceleration is forming as forced exits remove downward pressure from the range.

Liquidity sits overhead near $0.178 and $0.192, which often attracts price if activity remains strong.

$IMX

EP (Entry Price): $0.1671

TP1: $0.1738

TP2: $0.1846

TP3: $0.2019

SL (Stop Loss): $0.1582

Price is holding above the $0.164 reaction area, preserving a stable market layout.

Upward acceleration is forming as forced exits remove downward pressure from the range.

Liquidity sits overhead near $0.178 and $0.192, which often attracts price if activity remains strong.

$IMX

IMX-2,28%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short exposure get removed around $0.54981, and price stayed supported rather than fading after the sweep. The response looks firm, suggesting supply was absorbed while buyers kept control.

EP (Entry Price): $0.556

TP1: $0.579

TP2: $0.615

TP3: $0.668

SL (Stop Loss): $0.523

Price is sustaining above the $0.55 reaction zone, preserving a constructive structure.

Upside follow through is strengthening as liquidation activity clears downward pressure.

Liquidity is aligned above $0.590 and $0.640, which often draws price higher if participation remains active.

$0G

EP (Entry Price): $0.556

TP1: $0.579

TP2: $0.615

TP3: $0.668

SL (Stop Loss): $0.523

Price is sustaining above the $0.55 reaction zone, preserving a constructive structure.

Upside follow through is strengthening as liquidation activity clears downward pressure.

Liquidity is aligned above $0.590 and $0.640, which often draws price higher if participation remains active.

$0G

0G-2,15%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short positions get taken out near $0.22607, and price stayed firm instead of sliding back after the sweep. The response looks steady, indicating supply was absorbed while buyers held the ground.

EP (Entry Price): $0.2296

TP1: $0.2384

TP2: $0.2529

TP3: $0.2758

SL (Stop Loss): $0.2179

Price is maintaining strength above the $0.226 reaction zone, keeping the structure organized.

Upward continuation is building as liquidation flow reduces selling pressure.

Liquidity is resting above $0.245 and $0.265, which often draws price higher if activity remains present.

$FORM

EP (Entry Price): $0.2296

TP1: $0.2384

TP2: $0.2529

TP3: $0.2758

SL (Stop Loss): $0.2179

Price is maintaining strength above the $0.226 reaction zone, keeping the structure organized.

Upward continuation is building as liquidation flow reduces selling pressure.

Liquidity is resting above $0.245 and $0.265, which often draws price higher if activity remains present.

$FORM

FORM-1,01%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing a strong wave of short positions get cleared near $0.02625, and price stayed resilient instead of slipping lower afterward. The reaction suggests sellers lost control while demand absorbed the move.

EP (Entry Price): $0.02680

TP1: $0.02810

TP2: $0.03025

TP3: $0.03360

SL (Stop Loss): $0.02490

Price is holding above the $0.026 reaction area, keeping the structure constructive and defended.

Upside continuation is developing as liquidation activity removes downside pressure.

Liquidity is aligned above $0.029 and $0.032, which often pulls price higher if participation remains active.

$BU

EP (Entry Price): $0.02680

TP1: $0.02810

TP2: $0.03025

TP3: $0.03360

SL (Stop Loss): $0.02490

Price is holding above the $0.026 reaction area, keeping the structure constructive and defended.

Upside continuation is developing as liquidation activity removes downside pressure.

Liquidity is aligned above $0.029 and $0.032, which often pulls price higher if participation remains active.

$BU

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More231.68K Popularity

53.11K Popularity

22.66K Popularity

17.6K Popularity

16.95K Popularity

Pin