BTCFREE

No content yet

BTCFREE

It's almost the New Year~

The market is so quiet~

It's time to take a break for yourself~

Trading is for a better life, not to make life revolve around trading~

You don't have to watch the charts, you can turn off the K-line first, and prioritize returning to real life~

The market is always there, missing a day or two of operation won't make a difference; but family reunions, meeting friends, and rare moments of relaxation—once missed, it's not so easy to make up for. The money earned is ultimately to improve your quality of life, not to create more anxiety~

People who know how to rest often g

View OriginalThe market is so quiet~

It's time to take a break for yourself~

Trading is for a better life, not to make life revolve around trading~

You don't have to watch the charts, you can turn off the K-line first, and prioritize returning to real life~

The market is always there, missing a day or two of operation won't make a difference; but family reunions, meeting friends, and rare moments of relaxation—once missed, it's not so easy to make up for. The money earned is ultimately to improve your quality of life, not to create more anxiety~

People who know how to rest often g

- Reward

- like

- Comment

- Repost

- Share

The secret to trading, if there is one, probably boils down to two words: patience.

Be patient and wait for the structure to form~

Be patient and wait for the emotions to settle~

Be patient and wait for the price to reach the level where you should make a move~

Most losses are not because of wrong market direction judgment, but because of rushing into the market too quickly, too eager to prove you're right. When the market isn't ready, if you act prematurely, the result is often a "lesson" from the market~

True experts don't necessarily spend a lot of time watching the charts, and they don't t

Be patient and wait for the structure to form~

Be patient and wait for the emotions to settle~

Be patient and wait for the price to reach the level where you should make a move~

Most losses are not because of wrong market direction judgment, but because of rushing into the market too quickly, too eager to prove you're right. When the market isn't ready, if you act prematurely, the result is often a "lesson" from the market~

True experts don't necessarily spend a lot of time watching the charts, and they don't t

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

Life depends on fate, luck, and feng shui; accumulating virtue and reading books;

Six names, seven appearances, eight reverence for gods; nine connections with noble people, ten nurturing health.

Spiritual matters should not be neglected. It is not superstition, but a form of reverence and self-discipline.

View OriginalSix names, seven appearances, eight reverence for gods; nine connections with noble people, ten nurturing health.

Spiritual matters should not be neglected. It is not superstition, but a form of reverence and self-discipline.

- Reward

- like

- Comment

- Repost

- Share

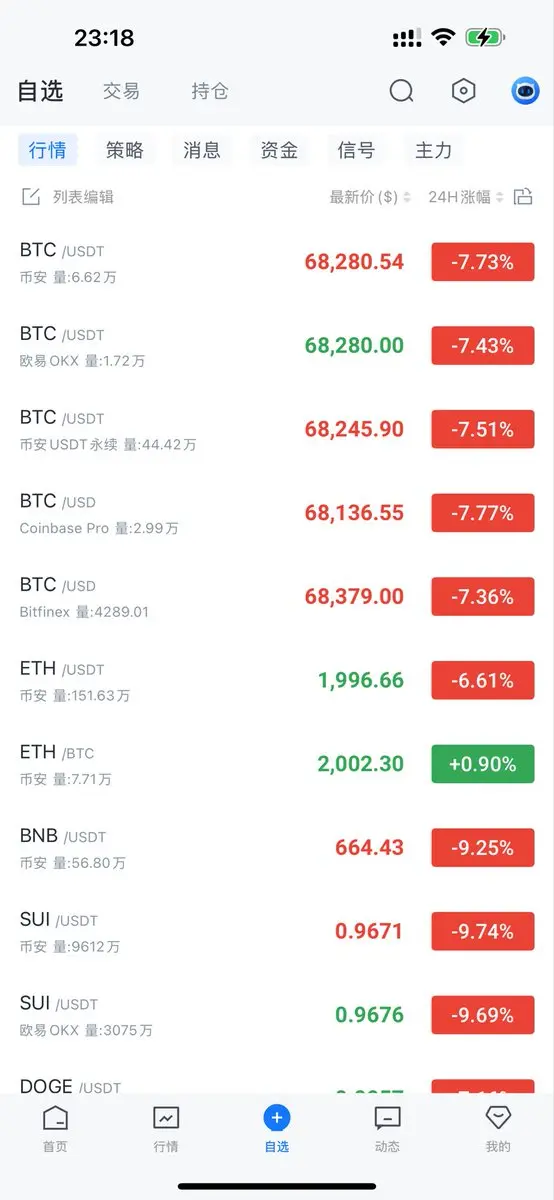

Today’s #Bitcoin market really feels somewhat “indescribable”—

The rhythm is sluggish, and the direction is unclear—

No matter how you look at it, it doesn’t seem to be delivering a certain market trend for retail investors—

At this stage, blindly being bearish often only results in early misses—

Turning bullish, more likely, will only be late rather than wrong—

From Dow Theory, the trend has not yet become clear again; prices are still oscillating within a range, repeatedly testing support and resistance, with bulls and bears in a tug-of-war—

From wave structure analysis, it looks more like a

The rhythm is sluggish, and the direction is unclear—

No matter how you look at it, it doesn’t seem to be delivering a certain market trend for retail investors—

At this stage, blindly being bearish often only results in early misses—

Turning bullish, more likely, will only be late rather than wrong—

From Dow Theory, the trend has not yet become clear again; prices are still oscillating within a range, repeatedly testing support and resistance, with bulls and bears in a tug-of-war—

From wave structure analysis, it looks more like a

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

Right now, the market feels like #Bitcoin has already entered a "pretend to be dead until US stocks open" mode~\nWith Europe and the US closed, prices are basically staying put, and the candlesticks look like they're taking a nap; once US stocks open, volatility kicks in, and sentiment, liquidity, and stories all come into play~\nFrom a structural perspective, short-term fluctuations are compressed, but essentially, it's still funds on the sidelines, with US stock expectations and macro outlooks setting the rhythm for the crypto market. A stagnant market doesn't mean the end of the trend; it's

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

I'm going to withdraw some cash later, and I'm a bit curious—can I conveniently get a few consecutive new bills? The probability is probably a bit higher than catching the lowest point. If I really manage to get consecutive new bills, I'll consider it a good luck buff for myself, a good omen. If not, that's normal too; after all, good luck doesn't appear all the time. The market is like this, life is like this. It's a surprise if you encounter it, and if not, don't take it too seriously. Staying calm is more important than whether the numbers are consecutive or not. Hahaha~

View Original- Reward

- like

- Comment

- Repost

- Share

The 60,000 level is most likely not the true bottom of #Bitcoin in the real sense. A more realistic scenario is: first a rebound that gives you some hope, then sideways consolidation to test your patience, and finally a decisive move to "seal the deal," teaching both the hesitant and stubborn holders a lesson. Only then will the market gradually stabilize. According to Dow Theory, the true bottom often takes time to build, with repeated tests and volume contraction to form an effective demand zone. From wave structure analysis, this looks more like the end of an adjustment wave, which usually

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

In a short period of time, #Bitcoin's market performance has been strong, just as we expected~ Previously, sentiment hit rock bottom and chips were washed out. Now the price is starting to rebound and showing strength~ No doubt about it, it won't be long before someone can't hold back and starts shouting "The bull market is back"~ That's how the market works: doubting life when it falls, recharging faith when it rises~ The real challenge isn't in judging the direction, but in whether you can maintain your rhythm when emotions swing back and forth~

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

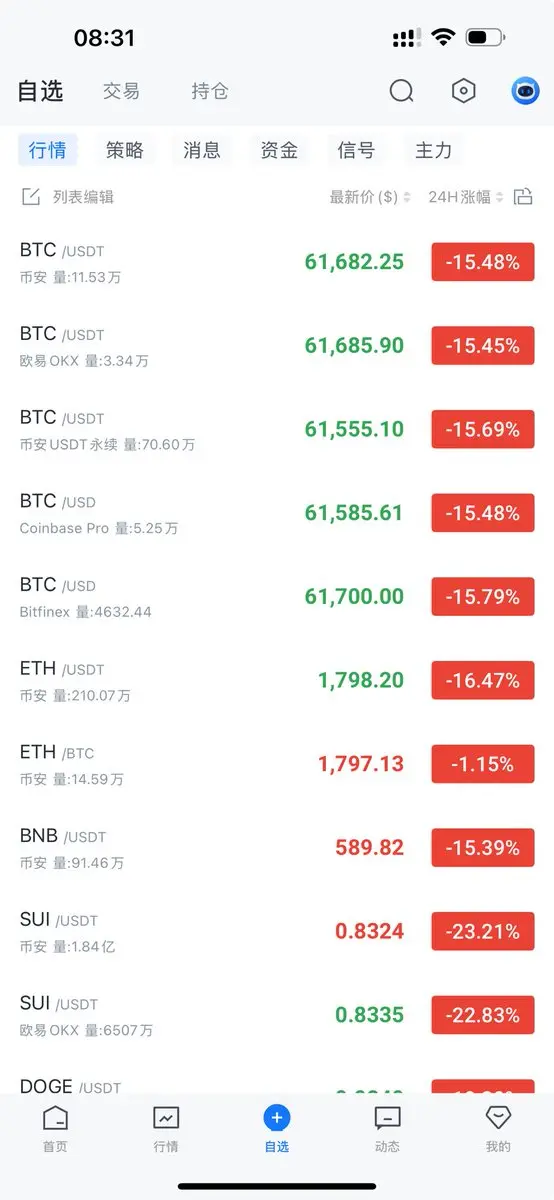

The crisis came suddenly—cryptocurrency once again makes history—this is the sound of a scam echoing in the air—

View Original

- Reward

- like

- Comment

- Repost

- Share

True courage is never about being bearish after a decline or bullish only after a rise; at best, it's what you might call a "front-running player." What is even more scarce in trading is the ability to see structural changes during a downtrend, to smell opportunity when panic is spreading. According to Dow Theory, trend reversals often occur after emotional collapse; from wave structure analysis, real opportunities usually appear at the end of corrective waves, not when everyone’s emotions are warming up and prices are soaring. By the time the market seems "safe," the risk-reward ratio has oft

View Original- Reward

- like

- Comment

- Repost

- Share

When things reach an extreme, they tend to reverse; when adversity reaches its peak, prosperity follows. #Bitcoin This recent decline can basically be understood as a temporary pause in the cycle. When market sentiment collectively turns extremely pessimistic and everyone is bearish, it is often the night before a trend quietly begins to reverse. Bottoms are never announced with loud drums; they usually develop slowly when "everyone doesn't want to look at the charts."

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

$73,000 ← #BTC current price $76,000 ← Saylor's holding cost Bitcoin drops below MSTR's average cost, this cut directly hits Saylor's "faith moat." In the short term, the emotional pressure is definitely significant, and the market loves to use these key levels to make a fuss~

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

The Rise and Fall: After the "Great Heat" in all assets, how cold will the winter be? Everyone, stop dreaming of a "super cycle" anymore. Dow Theory tells us: trends are always destroyed in madness. This round of bear market may be colder than anyone imagines. Why? Because this time, it's not just Bitcoin heating up, but global assets collectively "running naked." #BTC :三年8倍,涨幅不可谓不大~• 纳指:从1万点杀到2.6万点,那是靠货币超发堆出来的虚火~• # NVDA: Market cap breaks 5 trillion, although AI is the future, Elliott Wave reminds us that no matter how fierce the fifth wave surge, the ABC wave phase clearing is never absent.

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

Brothers, stop just staring at the candlestick charts. This bear market, according to Dow Theory's "primary trend," may be experiencing a systemic deviation~ Previously, #Bitcoin caught a cold, and altcoins took medicine; this time, global assets are collectively "running a high fever." The AI surge in the US stock market, the myth of gold as a safe haven, and even commodities that have been silent for years have all exhausted the scripts for the coming years. According to Elliott Wave Theory, this might not just be a simple C-wave correction but a complete industry-wide "reset." When all asse

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

After a round of scanning, many people are starting to think that #Bitcoin has entered a major bear market, but it has already dropped by $50,000... Let's be optimistic. Over time, the scales are slowly tipping in favor of the bulls~ When the price falls to a certain level, the bulls will gain the advantage~ At that point, most people will be extremely bearish, proclaiming what they call a deep bear market~ By then, you'll see a flood of apocalyptic narratives and voices predicting Bitcoin's demise one after another~ History has repeatedly shown that real opportunities are often hidden in thes

BTC1,03%

- Reward

- like

- Comment

- Repost

- Share

Who understands? Is it more difficult to increase the win rate in trading, or to improve the risk-reward ratio?

View Original- Reward

- like

- Comment

- Repost

- Share

Last night, #Bitcoin once again hit a new low for this phase. Many people started to panic again, but for me, this is just another realization of the bear market logic. It's actually strange when prices don't hit new lows in a bear market. The real discomfort isn't the market falling, but the fact that you're in a bear market yet still using bullish thinking to hold your positions. Some say I’ve been like a “fortune teller” recently, and honestly, I can understand why. If you don’t know a person’s past track record, you’ll naturally focus only on the current ups and downs. But if you look back

BTC1,03%

- Reward

- 1

- Comment

- Repost

- Share

The US stock market index has plummeted—#IXIC

View Original- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More15.94K Popularity

6.97K Popularity

2.83K Popularity

34.68K Popularity

249.31K Popularity

Pin