Crypto_Xincheng

No content yet

Crypto_Xincheng

Tonight's Non-Farm Payrolls Expectations and Their Impact on Cryptocurrency

Tonight (February 11) at 21:30, the US January Non-Farm Payrolls report will be released, and the market is in a "wait-and-see" mode. The key is not whether the data is strong or weak, but whether an "unexpected" event occurs that can change the rate cut expectations.

① Conventional Data: Expected 70,000 new jobs (previously 50,000), Unemployment Rate 4.4%. Goldman Sachs is more pessimistic (45,000), Citibank expects 135,000, and the divergence could trigger intense volatility.

② Impact Logic: Using the "Dollar" as a t

Tonight (February 11) at 21:30, the US January Non-Farm Payrolls report will be released, and the market is in a "wait-and-see" mode. The key is not whether the data is strong or weak, but whether an "unexpected" event occurs that can change the rate cut expectations.

① Conventional Data: Expected 70,000 new jobs (previously 50,000), Unemployment Rate 4.4%. Goldman Sachs is more pessimistic (45,000), Citibank expects 135,000, and the divergence could trigger intense volatility.

② Impact Logic: Using the "Dollar" as a t

BTC-4,47%

- Reward

- like

- Comment

- Repost

- Share

Here is the AI's response:

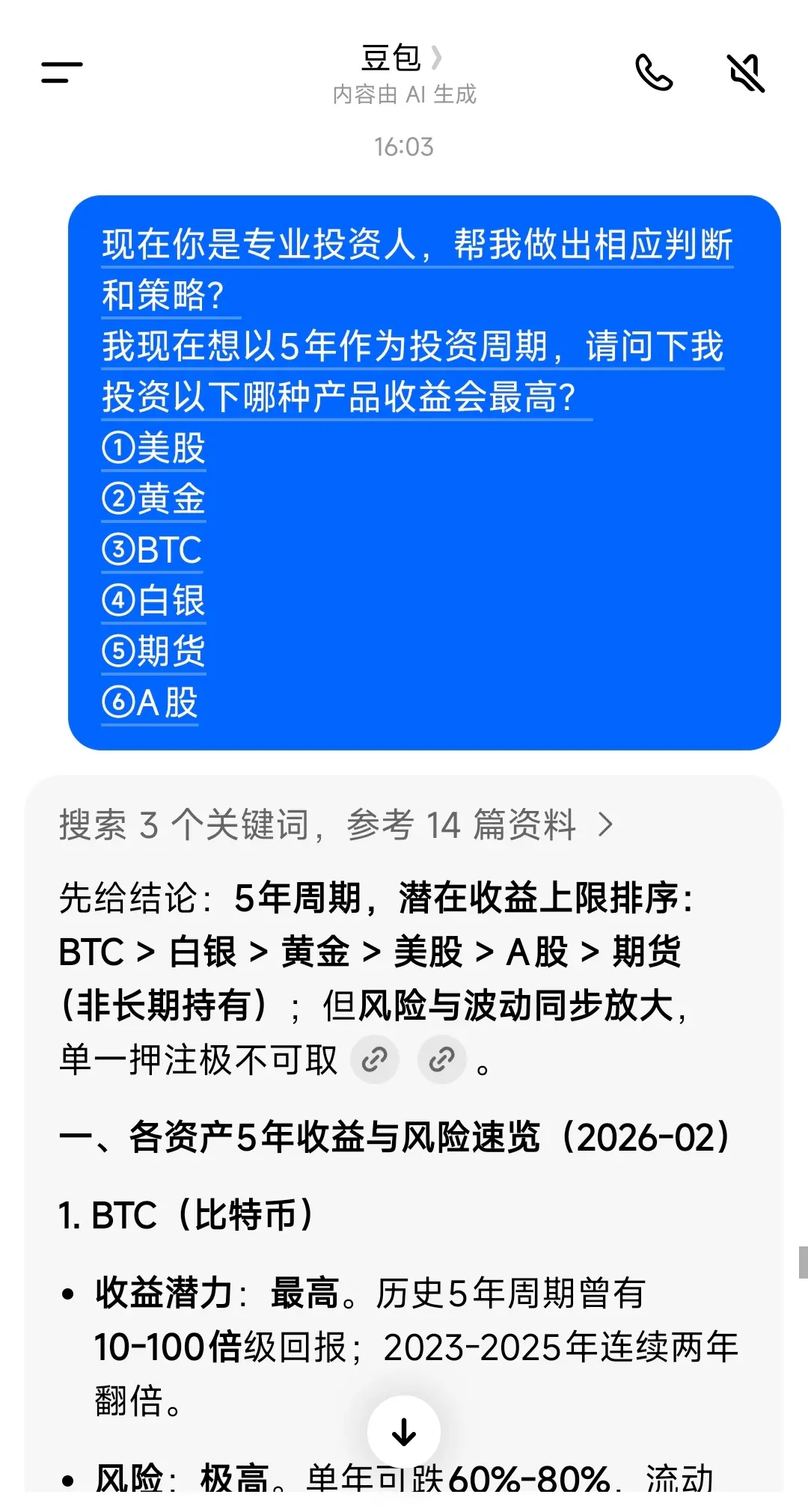

I am now considering a 5-year investment horizon. Which of the following products would yield the highest returns?

① U.S. stocks

② Gold

③ BTC

④ Silver

⑤ Futures

⑥ A-shares

As expected, BTC remains the most worthwhile investment target.

I am now considering a 5-year investment horizon. Which of the following products would yield the highest returns?

① U.S. stocks

② Gold

③ BTC

④ Silver

⑤ Futures

⑥ A-shares

As expected, BTC remains the most worthwhile investment target.

BTC-4,47%

- Reward

- like

- Comment

- Repost

- Share

2.10

BTC

The current market is mainly focused on repairing sentiment, and the overall daily outlook remains unchanged. At this position, the price will still fluctuate around 67,800 to 71,600. The daily chart indicates that the rebound has not yet ended; its purpose is to repair indicators. Meanwhile, attention should be paid to whether the four-hour level can break above 71,600, and only if the MACD crosses above the zero line can the trend continue. Otherwise, it will continue to move within the range, and after completing this move, another downward move may follow. Support is at 67,900-63,

View OriginalBTC

The current market is mainly focused on repairing sentiment, and the overall daily outlook remains unchanged. At this position, the price will still fluctuate around 67,800 to 71,600. The daily chart indicates that the rebound has not yet ended; its purpose is to repair indicators. Meanwhile, attention should be paid to whether the four-hour level can break above 71,600, and only if the MACD crosses above the zero line can the trend continue. Otherwise, it will continue to move within the range, and after completing this move, another downward move may follow. Support is at 67,900-63,

- Reward

- 1

- Comment

- Repost

- Share

2.9

Key Events This Week:

February 10th: The White House will hold a stablecoin yield discussion meeting again next Tuesday;

February 11th: The US will release January non-farm payroll data at 21:30; market expects 70,000 new jobs and an unemployment rate of 4.4%

February 13th: At 21:30, January CPI data will be released; core CPI growth is expected to drop to the lowest since early 2021

BTC

The market pressure remains high, liquidity has not recovered. The recent decline was significant but did not show obvious bearish signals. This situation is the most concerning because, without a clear re

View OriginalKey Events This Week:

February 10th: The White House will hold a stablecoin yield discussion meeting again next Tuesday;

February 11th: The US will release January non-farm payroll data at 21:30; market expects 70,000 new jobs and an unemployment rate of 4.4%

February 13th: At 21:30, January CPI data will be released; core CPI growth is expected to drop to the lowest since early 2021

BTC

The market pressure remains high, liquidity has not recovered. The recent decline was significant but did not show obvious bearish signals. This situation is the most concerning because, without a clear re

- Reward

- like

- Comment

- Repost

- Share

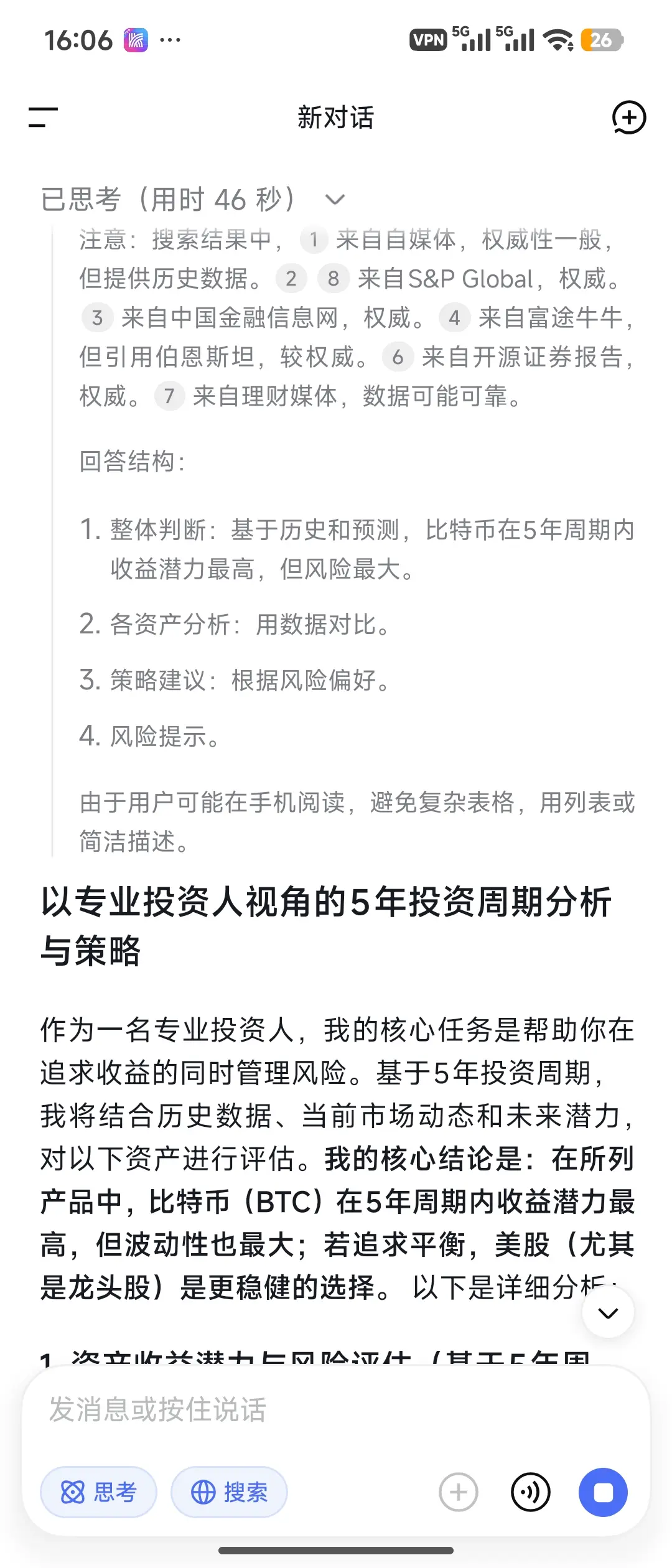

Key Events This Week:

February 10

The White House will hold another stablecoin yield discussion meeting next Tuesday;

February 11

The United States will release January non-farm payroll data at 21:30 on February 11; market expectations are for 70,000 new jobs and an unemployment rate of 4.4%

February 13

The United States will release January CPI data at 21:30 on February 13; core CPI growth is expected to drop to the lowest since early 2021

#当前行情抄底还是观望?

View OriginalFebruary 10

The White House will hold another stablecoin yield discussion meeting next Tuesday;

February 11

The United States will release January non-farm payroll data at 21:30 on February 11; market expectations are for 70,000 new jobs and an unemployment rate of 4.4%

February 13

The United States will release January CPI data at 21:30 on February 13; core CPI growth is expected to drop to the lowest since early 2021

#当前行情抄底还是观望?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

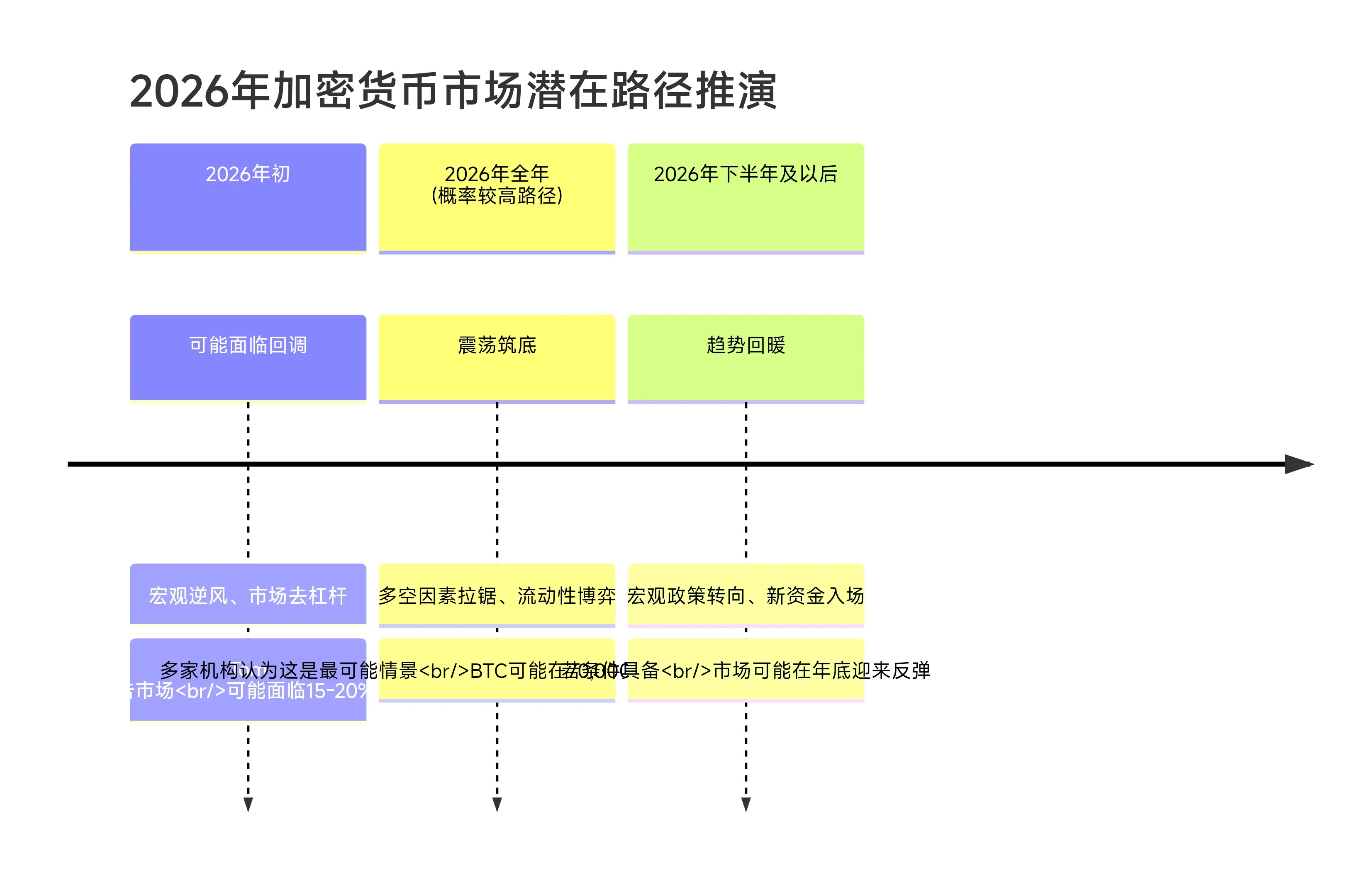

The current volatility and downward trend may continue until the first half of 2026. The key to a rebound lies in improving macro liquidity and easing internal market pressures.

Key Factors for Market Continuation:

① Macro Pressure: Federal Reserve policies, geopolitical tensions, and potential AI bubble risks may keep risk assets like Bitcoin under pressure.

② Internal Market Pressure: Ongoing selling by long-term holders and intermittent inflows of institutional funds have led to a "slow bleeding" spot selling pressure.

Potential Rebound Signals and Timing:

Most analyses suggest that the mar

Key Factors for Market Continuation:

① Macro Pressure: Federal Reserve policies, geopolitical tensions, and potential AI bubble risks may keep risk assets like Bitcoin under pressure.

② Internal Market Pressure: Ongoing selling by long-term holders and intermittent inflows of institutional funds have led to a "slow bleeding" spot selling pressure.

Potential Rebound Signals and Timing:

Most analyses suggest that the mar

BTC-4,47%

- Reward

- 1

- 1

- Repost

- Share

Lock_433 :

:

Buy To Earn 💎Is BTC reaching 60,000 a temporary bottom or a consolidation decline?

Bitcoin has already experienced a volume-driven decline on the daily chart at this level, returning to 60,000. Currently, the strong support below is in the 55,000 to 60,000 range. The recent decline in this wave has seen increased volume, which indicates active trading activity below. Do you think more people are buying or selling at this level? Ethereum's daily chart also shows volume accumulation, and we should pay attention to the turnover at this level.

Summary: Not all bullish signals are necessarily positive, and not

View OriginalBitcoin has already experienced a volume-driven decline on the daily chart at this level, returning to 60,000. Currently, the strong support below is in the 55,000 to 60,000 range. The recent decline in this wave has seen increased volume, which indicates active trading activity below. Do you think more people are buying or selling at this level? Ethereum's daily chart also shows volume accumulation, and we should pay attention to the turnover at this level.

Summary: Not all bullish signals are necessarily positive, and not

- Reward

- like

- Comment

- Repost

- Share

The Fear & Greed Index has hit a three-year low. Do you dare to buy the dip?

Currently, the Fear & Greed Index has dropped to 9, with the all-time low at 5. Historically, every time it falls below 10, it marks a stage bottom. The current market sentiment is extremely fearful, which could also be a buying opportunity. So at this point, do you dare to buy?#当前行情抄底还是观望?

Currently, the Fear & Greed Index has dropped to 9, with the all-time low at 5. Historically, every time it falls below 10, it marks a stage bottom. The current market sentiment is extremely fearful, which could also be a buying opportunity. So at this point, do you dare to buy?#当前行情抄底还是观望?

BTC-4,47%

- Reward

- like

- 1

- Repost

- Share

Blablablablaa :

:

Buy To Earn 💎After this round of cleansing, the key area to focus on is the payments sector, because in the entire crypto market, only payments can be practically implemented; the others cannot take off.

The entire crypto market is declining, but HYPE remains resilient because HYPE is becoming the underlying infrastructure for all transactions. It is no longer just an exchange—ranging from perpetual contracts to prediction markets, AI trading, and payments, HYPE might be the first native infrastructure of the AI era.

The entire crypto market is declining, but HYPE remains resilient because HYPE is becoming the underlying infrastructure for all transactions. It is no longer just an exchange—ranging from perpetual contracts to prediction markets, AI trading, and payments, HYPE might be the first native infrastructure of the AI era.

HYPE-2,83%

- Reward

- like

- Comment

- Repost

- Share

2.4 Beginning of Spring Market Analysis, Wishing Everyone a Happy New Year

View Original- Reward

- like

- Comment

- Repost

- Share

2.4

BTC

The House has passed the funding bill, which is now on Trump’s desk for signing. The government shutdown has ended. The market, as we expected, did not last long around the shutdown period. Now, the focus is on when the price will stop falling. Currently, Bitcoin is approaching the 71,300 level, which is also the upper boundary of a previous consolidation zone. We have observed that in the past few days, the price has been oscillating around 76,000. Since MicroStrategy’s cost basis is near 76,000, there are no clear signs of a reversal at this level yet. However, given the previous acc

View OriginalBTC

The House has passed the funding bill, which is now on Trump’s desk for signing. The government shutdown has ended. The market, as we expected, did not last long around the shutdown period. Now, the focus is on when the price will stop falling. Currently, Bitcoin is approaching the 71,300 level, which is also the upper boundary of a previous consolidation zone. We have observed that in the past few days, the price has been oscillating around 76,000. Since MicroStrategy’s cost basis is near 76,000, there are no clear signs of a reversal at this level yet. However, given the previous acc

- Reward

- like

- Comment

- Repost

- Share

2.3

Yesterday, CME futures opened with a significant decline, but started to recover during the European session. The expectation that the government shutdown would end by Monday seems to be delayed by a few more days. This shutdown has once again delayed the release of labor data, but the January data is no longer very important. Everyone is more focused on the trend after the transition. Therefore, in the short term, there are no major fundamental bearish signals.

BTC

The idea shared yesterday was that as long as 76,400 is not broken, there would be a small rebound. Yesterday, after a false

View OriginalYesterday, CME futures opened with a significant decline, but started to recover during the European session. The expectation that the government shutdown would end by Monday seems to be delayed by a few more days. This shutdown has once again delayed the release of labor data, but the January data is no longer very important. Everyone is more focused on the trend after the transition. Therefore, in the short term, there are no major fundamental bearish signals.

BTC

The idea shared yesterday was that as long as 76,400 is not broken, there would be a small rebound. Yesterday, after a false

- Reward

- like

- Comment

- Repost

- Share

Precious Metals Experience Major Shakeup: What Does It Mean for the Market?

First, the conclusion: this wave of intense volatility is a “bubble squeeze + leverage washout” in a bull market, similar to multiple historical major corrections (such as after 2011). In the short term, there is downward pressure (increased volatility and potential overshoot), but the medium- to long-term bullish pattern remains intact. Investors should enhance risk awareness: avoid chasing highs and selling lows, control leverage, and monitor Federal Reserve/US dollar developments. Physical gold and silver or ETFs ar

View OriginalFirst, the conclusion: this wave of intense volatility is a “bubble squeeze + leverage washout” in a bull market, similar to multiple historical major corrections (such as after 2011). In the short term, there is downward pressure (increased volatility and potential overshoot), but the medium- to long-term bullish pattern remains intact. Investors should enhance risk awareness: avoid chasing highs and selling lows, control leverage, and monitor Federal Reserve/US dollar developments. Physical gold and silver or ETFs ar

- Reward

- like

- Comment

- Repost

- Share

When will BTC rebound?

First, the conclusion: in the short term (2–6 weeks), a rebound is very likely, but it is probably just a technical correction rather than a trend reversal. Truly sustainable growth requires macroeconomic warming, institutional return, and retail adoption of new narratives, which could be delayed until the second half of 2026 or even later. At this stage, it is recommended to remain cautious and watchful; $74,000–$76,000 is the critical threshold—holding above it is the key to hope, while breaking below suggests patiently waiting for lower levels.

First, the conclusion: in the short term (2–6 weeks), a rebound is very likely, but it is probably just a technical correction rather than a trend reversal. Truly sustainable growth requires macroeconomic warming, institutional return, and retail adoption of new narratives, which could be delayed until the second half of 2026 or even later. At this stage, it is recommended to remain cautious and watchful; $74,000–$76,000 is the critical threshold—holding above it is the key to hope, while breaking below suggests patiently waiting for lower levels.

BTC-4,47%

- Reward

- like

- Comment

- Repost

- Share

The Epstein case ignites discussions in the crypto community. What are the impacts on the crypto world?

①Reputation and Trust Crisis: The crypto industry originally emphasizes "decentralization" and "anti-establishment," but the Epstein case reveals that early funds may have come from suspicious sources, damaging the industry's image. Critics argue this proves cryptocurrencies are "elite tools" rather than empowering the masses. This has led some investors to shift to more "clean" projects or simply exit.

②Market Volatility and Price Shock: The release of Epstein documents directly intensified

①Reputation and Trust Crisis: The crypto industry originally emphasizes "decentralization" and "anti-establishment," but the Epstein case reveals that early funds may have come from suspicious sources, damaging the industry's image. Critics argue this proves cryptocurrencies are "elite tools" rather than empowering the masses. This has led some investors to shift to more "clean" projects or simply exit.

②Market Volatility and Price Shock: The release of Epstein documents directly intensified

BTC-4,47%

- Reward

- like

- Comment

- Repost

- Share

ETH just needs to pay attention to these key levels, which will be enough to help you turn around in the next wave

The monthly chart for ETH is consolidating at high levels, and at the same time, the MACD is showing ongoing divergence, so the risk for Ethereum in the upcoming period is greater than that of Bitcoin, but Ethereum has a corresponding ecosystem to support it

From a technical perspective, neither the monthly nor the weekly chart has fully corrected. The levels to watch next are:

① $1755

② $1125

③ $700

The monthly chart for ETH is consolidating at high levels, and at the same time, the MACD is showing ongoing divergence, so the risk for Ethereum in the upcoming period is greater than that of Bitcoin, but Ethereum has a corresponding ecosystem to support it

From a technical perspective, neither the monthly nor the weekly chart has fully corrected. The levels to watch next are:

① $1755

② $1125

③ $700

ETH-5,17%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin should now focus on these four levels; do not look at other levels. Once reached, they will definitely make you money.

After the peak in 2013, it retraced 86%.

After the peak in 2017, it retraced 84%.

After the peak in 2017, it retraced 77%.

After the peak in 2025, it retraced ( ? )

The magnitude of each major bear market retracement is gradually weakening, and this time the expected retracement is around 60% to 70%.

So the key support levels to watch next are:

① $65,400

② $55,400

③ $46,600

④ $38,200

After the peak in 2013, it retraced 86%.

After the peak in 2017, it retraced 84%.

After the peak in 2017, it retraced 77%.

After the peak in 2025, it retraced ( ? )

The magnitude of each major bear market retracement is gradually weakening, and this time the expected retracement is around 60% to 70%.

So the key support levels to watch next are:

① $65,400

② $55,400

③ $46,600

④ $38,200

BTC-4,47%

- Reward

- 1

- 1

- Repost

- Share

OP :

:

Are you shorting?- Reward

- like

- Comment

- Repost

- Share