Kaff

No content yet

Kaff

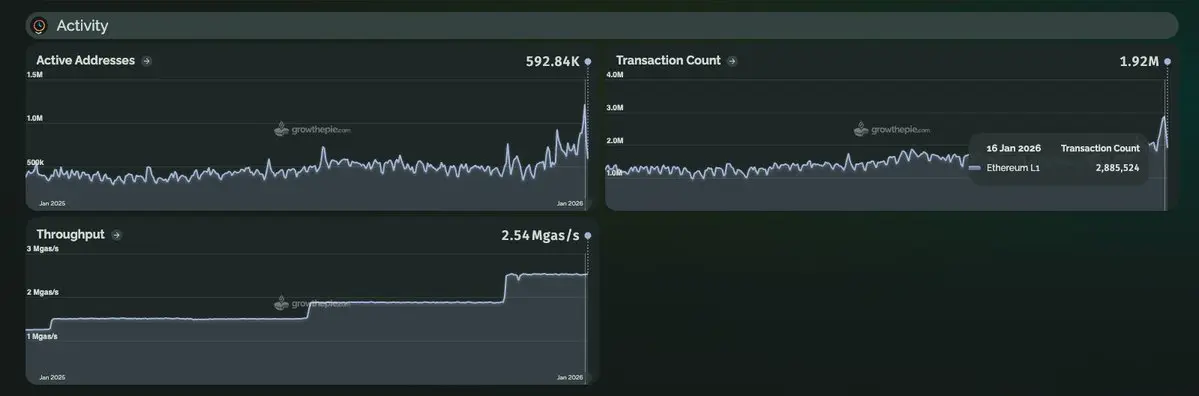

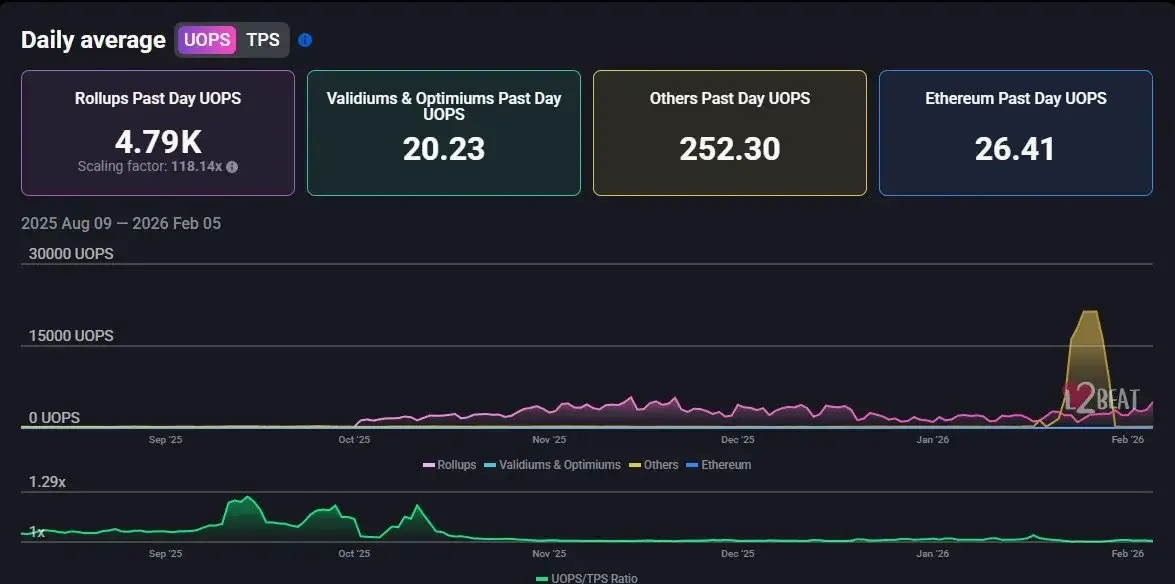

Vitalik just re-priced the whole L2 trade in public. The easy era of cheaper Ethereum is over.

Two numbers explain the shift:

→ L2 user activity is down about 50% from peak, while mainnet activity snapped back hard once fees got cheap again

→ blobs made rollup data so cheap it’s not the bottleneck anymore, around $0.04 per MB

So what happens when the only edge is low fees, and the base chain starts handing out low fees too?

A lot of quiet deaths. Major L2 token market cap is down to ~$6.8B, with $ARB, $OP and friends down ~90% from highs.

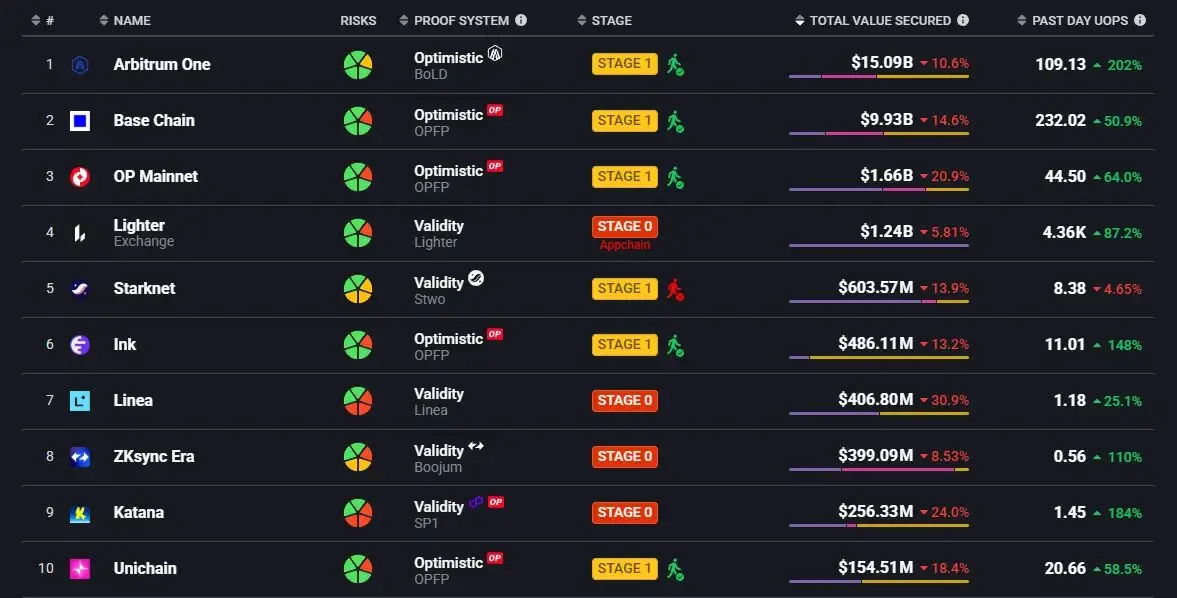

Look at who’s still alive on pure activity:

▫️ Base is

Two numbers explain the shift:

→ L2 user activity is down about 50% from peak, while mainnet activity snapped back hard once fees got cheap again

→ blobs made rollup data so cheap it’s not the bottleneck anymore, around $0.04 per MB

So what happens when the only edge is low fees, and the base chain starts handing out low fees too?

A lot of quiet deaths. Major L2 token market cap is down to ~$6.8B, with $ARB, $OP and friends down ~90% from highs.

Look at who’s still alive on pure activity:

▫️ Base is

- Reward

- like

- Comment

- Repost

- Share

Paradex just announced their $DIME token with the airdrop plan, so I’m looking at the top 5 perpetual DEXes by 7-day volume:1/ Hyperliquid | $74B volume | $25.15m fees2/ Aster | $34.88B volume | $6.83m fees3/ Lighter | $30.7B volume | $1.7m fees4/ EdgeX | $30.2B volume | $8.46m fees5/ Extended | $$16.2B volume | $1.8m feesDespite the top 3 having already launched tokens, EdgeX and Extended currently have the most potential for farming rn.

- Reward

- like

- Comment

- Repost

- Share

Gold and silver have been the talk of the town for the last few weeks. If you don’t know where to trade these types of commodities, HL is a good platform.HIP 3 OI has grown sharply since the trend started. In the past month, HIP 3 generated $18.4B in volume alone.– ~1B in volume for silver perps– $100M+ in revenue addedSo with this strong momentum, will the $HYPE return to the meta?

HYPE10,53%

- Reward

- like

- Comment

- Repost

- Share

Been reading a lot about vibe coding today.\n\nMy gut says this might be one of the most valuable pro skills for the next decade. Wdyt?\n\nI’m starting to dig deeper into it now and saving a few good reads. Will share once I’m done!

- Reward

- like

- Comment

- Repost

- Share

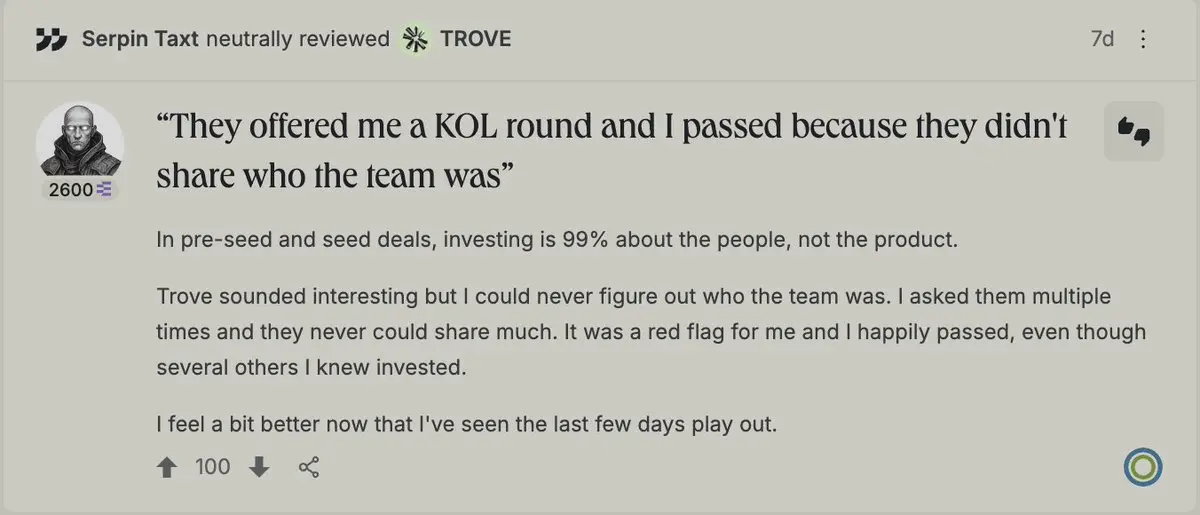

About $TROVE dumped > 95% within the 1st hour listing 👇🏻

I’m adding one more step before jump in any presale: “Read some reviews on @ethos_network !”

I’m adding one more step before jump in any presale: “Read some reviews on @ethos_network !”

- Reward

- like

- Comment

- Repost

- Share

Privacy narrative gonna be everywhere this year.

If $ZEC and $XMR are your only bookmarks, you’re probably looking in the wrong place for the multiple.

the real move is privacy that markets can actually trade on. @Aptos | $APT is playing that lane.

but not slow privacy. #Aptos is trying to build performant privacy for a simple thesis:

→ if institutions are going onchain in size, they cannot operate in a world where every balance, intent, and order leaks in real time.

privacy primitives are designed to run sub-second and live inside the core execution model, which ends up with:

– encrypted bal

If $ZEC and $XMR are your only bookmarks, you’re probably looking in the wrong place for the multiple.

the real move is privacy that markets can actually trade on. @Aptos | $APT is playing that lane.

but not slow privacy. #Aptos is trying to build performant privacy for a simple thesis:

→ if institutions are going onchain in size, they cannot operate in a world where every balance, intent, and order leaks in real time.

privacy primitives are designed to run sub-second and live inside the core execution model, which ends up with:

– encrypted bal

- Reward

- like

- Comment

- Repost

- Share

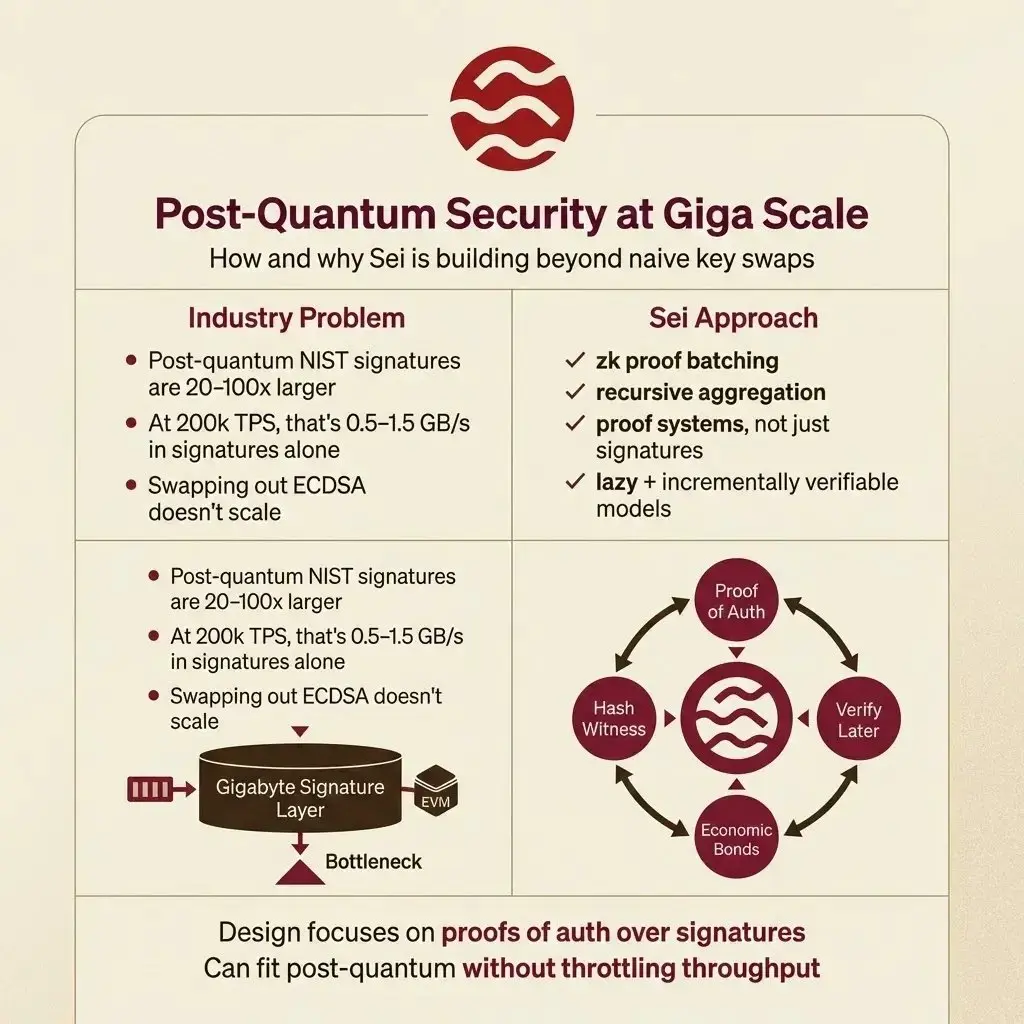

#Sei Giga and the problem most chains aren’t designing for yet

I don’t think about quantum risk in crypto as a future key swap where it’s just new signatures and libraries.

That framing completely breaks once you look at high-performance chains.

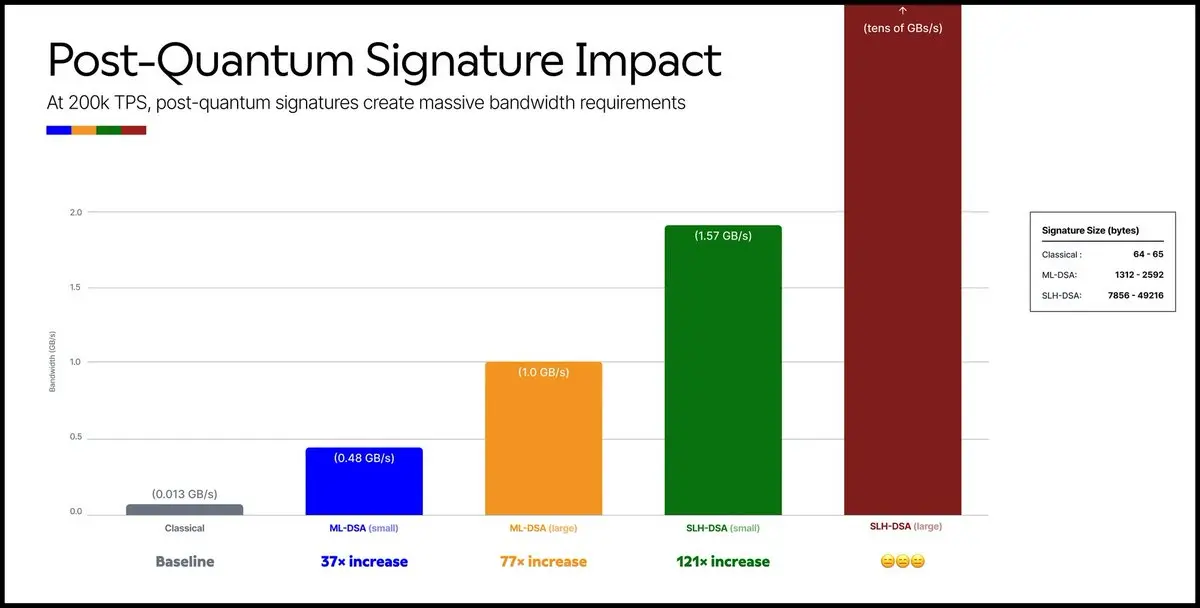

At Giga scale, post-quantum security is a systems problem:

– Current ECDSA signatures are ~64 bytes

– Post-quantum NIST signatures jump to 1.3KB–8KB+

– At 200k TPS, that’s ~0.5 to 1.5 GB per second in signature data alone

– The chain turns into a signature DA layer with an EVM attached

But @SeiNetwork's design naturally leans toward:

– zk proof batchi

I don’t think about quantum risk in crypto as a future key swap where it’s just new signatures and libraries.

That framing completely breaks once you look at high-performance chains.

At Giga scale, post-quantum security is a systems problem:

– Current ECDSA signatures are ~64 bytes

– Post-quantum NIST signatures jump to 1.3KB–8KB+

– At 200k TPS, that’s ~0.5 to 1.5 GB per second in signature data alone

– The chain turns into a signature DA layer with an EVM attached

But @SeiNetwork's design naturally leans toward:

– zk proof batchi

- Reward

- like

- Comment

- Repost

- Share

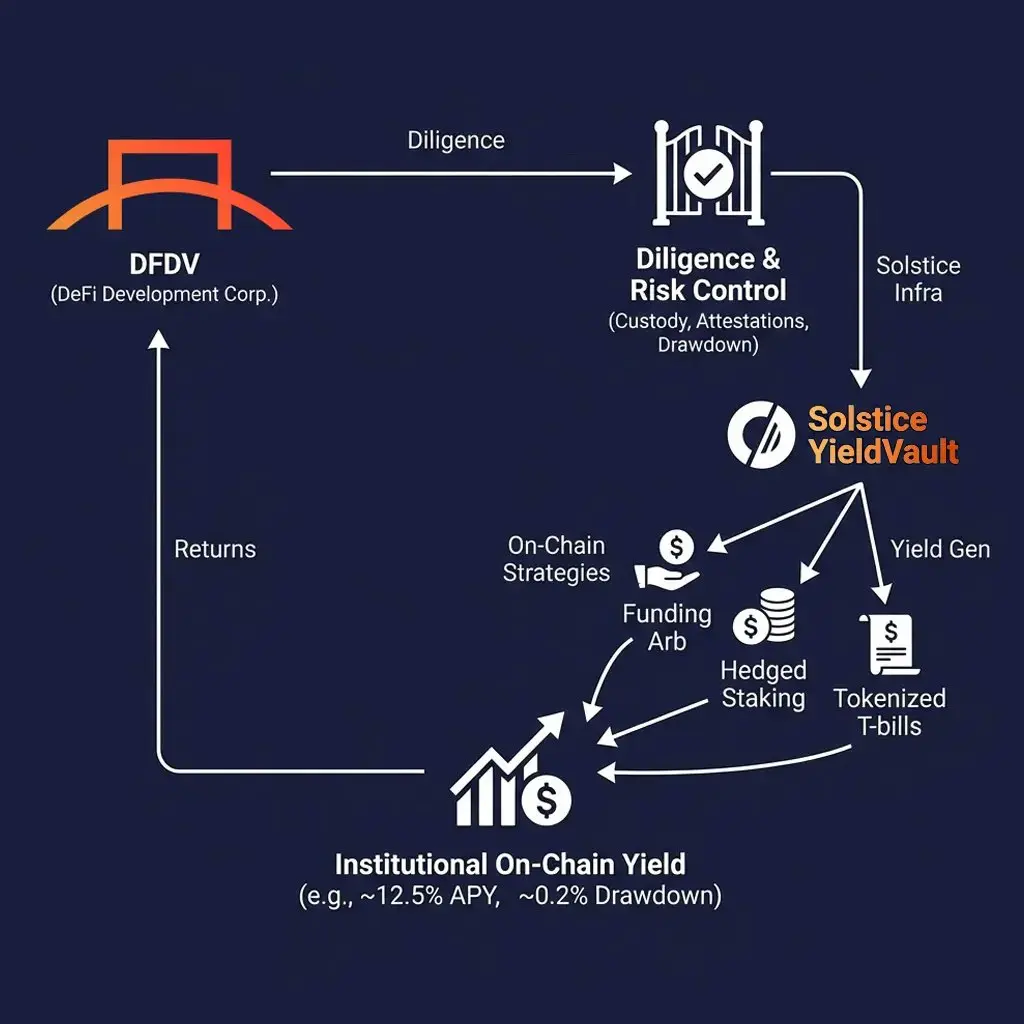

a Nasdaq-listed company only deploys treasury capital on-chain after stress-testing custody, attestations, drawdown control, and operational survivability.

@defidevcorp running capital through @solsticefi | $SLX is a vote on infrastructure quality.

a few details worth paying attention to:

– the diligence stack is TradFi-native: off-exchange custody (Copper, Ceffu) + recurring overcollateralization attestations

– the risk profile matches treasury logic: 100% positive months since Jan 2023, ~6.8 Sharpe, ~-0.2% max daily drawdown, ~12.5% trailing APY

– the yield engine is intentionally boring: fu

@defidevcorp running capital through @solsticefi | $SLX is a vote on infrastructure quality.

a few details worth paying attention to:

– the diligence stack is TradFi-native: off-exchange custody (Copper, Ceffu) + recurring overcollateralization attestations

– the risk profile matches treasury logic: 100% positive months since Jan 2023, ~6.8 Sharpe, ~-0.2% max daily drawdown, ~12.5% trailing APY

– the yield engine is intentionally boring: fu

DEFI0,81%

- Reward

- like

- Comment

- Repost

- Share