LacolaCrypto

No content yet

LacolaCrypto

JPMorgan: Bitcoin More Attractive Than Gold in the Long Term

In a recent report, JPMorgan noted that gold has outperformed Bitcoin since October, with gold also experiencing greater price volatility. As negative sentiment shifts, JPMorgan believes Bitcoin has the potential to be reevaluated as a hedge comparable to gold in risk scenarios.

Two reasons JPMorgan remains bullish amid a declining market:

1. Bitcoin has fallen below the breakeven point for miners, with the estimated cost to mine one BTC around $77,000. Many weaker miners are forced to shut down, but this is seen as a natural cleansi

In a recent report, JPMorgan noted that gold has outperformed Bitcoin since October, with gold also experiencing greater price volatility. As negative sentiment shifts, JPMorgan believes Bitcoin has the potential to be reevaluated as a hedge comparable to gold in risk scenarios.

Two reasons JPMorgan remains bullish amid a declining market:

1. Bitcoin has fallen below the breakeven point for miners, with the estimated cost to mine one BTC around $77,000. Many weaker miners are forced to shut down, but this is seen as a natural cleansi

BTC-0,86%

- Reward

- 1

- 1

- Repost

- Share

Unoshi :

:

Thanks for informationJPMorgan: Bitcoin More Attractive Than Gold in the Long Term

In a recent report, JPMorgan noted that gold has outperformed Bitcoin since October, with gold also experiencing greater price volatility. As negative sentiment shifts, JPMorgan believes Bitcoin has the potential to be reevaluated as a hedge comparable to gold in risk scenarios.

Two reasons JPMorgan remains bullish amid a declining market:

1. Bitcoin has fallen below the breakeven point for miners, with the estimated cost to mine one BTC around $77,000. Many weaker miners are forced to shut down, but this is seen as a natural cleansi

In a recent report, JPMorgan noted that gold has outperformed Bitcoin since October, with gold also experiencing greater price volatility. As negative sentiment shifts, JPMorgan believes Bitcoin has the potential to be reevaluated as a hedge comparable to gold in risk scenarios.

Two reasons JPMorgan remains bullish amid a declining market:

1. Bitcoin has fallen below the breakeven point for miners, with the estimated cost to mine one BTC around $77,000. Many weaker miners are forced to shut down, but this is seen as a natural cleansi

BTC-0,86%

- Reward

- like

- Comment

- Repost

- Share

Market Update - Wednesday, February 11

- Bitcoin is trading between $68K and $69K, while altcoins are mostly in the red. The market sentiment index remains at 11, indicating "extreme fear."

- At 8:30 PM EST, the U.S. will release January Nonfarm Payroll data. The forecast for new jobs is 70K, up from 50K previously. The unemployment rate is expected to remain at 4.4%.

ETF Spot Update as of February 10:

- Bitcoin shows a gain of $140 million; BlackRock has not provided data.

- Ethereum shows a gain of $13.8 million; BlackRock has not provided data.

- Solana shows a gain of $7.7 million.

- The E

- Bitcoin is trading between $68K and $69K, while altcoins are mostly in the red. The market sentiment index remains at 11, indicating "extreme fear."

- At 8:30 PM EST, the U.S. will release January Nonfarm Payroll data. The forecast for new jobs is 70K, up from 50K previously. The unemployment rate is expected to remain at 4.4%.

ETF Spot Update as of February 10:

- Bitcoin shows a gain of $140 million; BlackRock has not provided data.

- Ethereum shows a gain of $13.8 million; BlackRock has not provided data.

- Solana shows a gain of $7.7 million.

- The E

- Reward

- like

- Comment

- Repost

- Share

U.S. stocks showed mixed results, with the Dow Jones reaching a new high, while the S&P 500 and Nasdaq both declined. Bitcoin remains range-bound below $70,000, and most altcoins are in the red.

In economic data, December retail sales disappointed, showing no growth at 0.0% compared to November, falling short of the expected 0.4% increase. This weak data slightly raised expectations for a Federal Reserve rate cut in March from 17.2% to around 20%.

Regarding tensions in Iran, former President Trump is considering deploying a second aircraft carrier if Iran does not cooperate in upcoming negotia

In economic data, December retail sales disappointed, showing no growth at 0.0% compared to November, falling short of the expected 0.4% increase. This weak data slightly raised expectations for a Federal Reserve rate cut in March from 17.2% to around 20%.

Regarding tensions in Iran, former President Trump is considering deploying a second aircraft carrier if Iran does not cooperate in upcoming negotia

BTC-0,86%

- Reward

- 1

- Comment

- Repost

- Share

Market Update - Monday, February 9

- Bitcoin remains steady around $70,000, with altcoins showing similar trends. Market sentiment index has increased from 7 to 14.

- The White House will hold a second meeting with crypto and major banking representatives tomorrow to address issues related to the CLARITY Act.

- The CFTC is expanding regulations to allow national trust banks to issue USD stablecoins under the GENIUS Act framework.

- Illinois has proposed a community Bitcoin bill managed by the state, which will be stored in a multi-signature cold wallet.

- Michael Saylor revealed plans to acqui

- Bitcoin remains steady around $70,000, with altcoins showing similar trends. Market sentiment index has increased from 7 to 14.

- The White House will hold a second meeting with crypto and major banking representatives tomorrow to address issues related to the CLARITY Act.

- The CFTC is expanding regulations to allow national trust banks to issue USD stablecoins under the GENIUS Act framework.

- Illinois has proposed a community Bitcoin bill managed by the state, which will be stored in a multi-signature cold wallet.

- Michael Saylor revealed plans to acqui

- Reward

- like

- Comment

- Repost

- Share

Market Update - Thursday, February 5

- Gold fluctuates around $5,000, while Bitcoin continues to decline, trading between $72,000 and $73,000. Market sentiment index hits a low of 12, indicating "extreme fear."

- U.S. and Iran nuclear negotiations have been revived and are scheduled to take place tomorrow morning, February 6, in Oman.

- Former President Trump spoke with President Xi, discussing trade and geopolitical issues, with a visit to China planned for April.

ETF Spot Update as of February 4:

- Bitcoin shows a negative balance of $171.5 million, with Fidelity selling $86.4 million. Black

- Gold fluctuates around $5,000, while Bitcoin continues to decline, trading between $72,000 and $73,000. Market sentiment index hits a low of 12, indicating "extreme fear."

- U.S. and Iran nuclear negotiations have been revived and are scheduled to take place tomorrow morning, February 6, in Oman.

- Former President Trump spoke with President Xi, discussing trade and geopolitical issues, with a visit to China planned for April.

ETF Spot Update as of February 4:

- Bitcoin shows a negative balance of $171.5 million, with Fidelity selling $86.4 million. Black

- Reward

- like

- Comment

- Repost

- Share

Bitcoin dropped to $72,900, its lowest point since November 2024, when Trump was elected, before rebounding over 5% to $76,800. Ethereum fell to $2,110 and then recovered to $2,340.

This sharp V-shaped decline resulted in over $740 million in liquidations within the last 24 hours, primarily affecting long positions.

US-Iran Tensions Escalate

- The US military confirmed it shot down an Iranian Shahed-139 drone for aggressively approaching the USS Abraham Lincoln aircraft carrier in the Arabian Sea. This incident occurred while both sides were attempting to arrange nuclear negotiations.

- Accord

This sharp V-shaped decline resulted in over $740 million in liquidations within the last 24 hours, primarily affecting long positions.

US-Iran Tensions Escalate

- The US military confirmed it shot down an Iranian Shahed-139 drone for aggressively approaching the USS Abraham Lincoln aircraft carrier in the Arabian Sea. This incident occurred while both sides were attempting to arrange nuclear negotiations.

- Accord

- Reward

- 1

- Comment

- Repost

- Share

Market Update for Tuesday, February 3

- Gold has regained the $4,800 mark, while Bitcoin is trading between $78,000 and $79,000. Altcoins are showing slight movement as Bitcoin dominance surpasses 60%.

- The Trump administration has reduced tariffs on India from 25% to 18% due to India's halt on oil purchases from Russia and a commitment to buy American goods.

- The U.S. Nonfarm Payroll report for January, scheduled for February 6, has been postponed due to the partial government shutdown, as the House has not yet passed the necessary legislation.

ETF Spot Update from February 2

- Bitcoin is u

- Gold has regained the $4,800 mark, while Bitcoin is trading between $78,000 and $79,000. Altcoins are showing slight movement as Bitcoin dominance surpasses 60%.

- The Trump administration has reduced tariffs on India from 25% to 18% due to India's halt on oil purchases from Russia and a commitment to buy American goods.

- The U.S. Nonfarm Payroll report for January, scheduled for February 6, has been postponed due to the partial government shutdown, as the House has not yet passed the necessary legislation.

ETF Spot Update from February 2

- Bitcoin is u

- Reward

- like

- Comment

- Repost

- Share

Latest Update on the CLARITY Bill Following White House Meeting

A two-hour meeting led by White House crypto advisor Patrick Witt focused on a key issue: whether stablecoins can pay interest to users and if third parties like Coinbase can facilitate this.

No consensus was reached:

- The crypto representatives argue that banks are stalling and have not proposed any compromise.

- The banking representatives stated they are acting on behalf of their association and need to consult member banks before negotiations.

The White House has urged both sides to narrow the negotiating group and return to

A two-hour meeting led by White House crypto advisor Patrick Witt focused on a key issue: whether stablecoins can pay interest to users and if third parties like Coinbase can facilitate this.

No consensus was reached:

- The crypto representatives argue that banks are stalling and have not proposed any compromise.

- The banking representatives stated they are acting on behalf of their association and need to consult member banks before negotiations.

The White House has urged both sides to narrow the negotiating group and return to

- Reward

- like

- Comment

- Repost

- Share

Market Update - Saturday, January 31

- Gold and silver prices are cooling down, while Bitcoin has risen to $84,000. Altcoins remain stagnant as Bitcoin dominance increases to 59.7%.

- The U.S. Congress has reached a budget agreement to reopen the government, but partial shutdown will continue until February 2 for a House vote.

- U.S. Producer Price Index (PPI) for December increased by 3%, exceeding the forecast of 2.7%. Inflation is expected to decrease to 3% in 2025, down from 3.5% in 2024.

ETF Spot Update as of January 30:

- Bitcoin is up by $15.6 million; BlackRock has not provided data.

-

- Gold and silver prices are cooling down, while Bitcoin has risen to $84,000. Altcoins remain stagnant as Bitcoin dominance increases to 59.7%.

- The U.S. Congress has reached a budget agreement to reopen the government, but partial shutdown will continue until February 2 for a House vote.

- U.S. Producer Price Index (PPI) for December increased by 3%, exceeding the forecast of 2.7%. Inflation is expected to decrease to 3% in 2025, down from 3.5% in 2024.

ETF Spot Update as of January 30:

- Bitcoin is up by $15.6 million; BlackRock has not provided data.

-

- Reward

- like

- Comment

- Repost

- Share

1. Who is Kevin Warsh?

- Leading candidate for the FED Chair: As of January 2026, he has a 95% chance of becoming the next FED Chair and has reportedly met with President Trump at the White House.

- Extensive experience: He was the youngest person to serve as a FED Governor at age 35, has worked at Morgan Stanley, and served as an economic advisor to President Bush.

- Powerful connections: He is the son-in-law of the Estée Lauder family. His father-in-law is a close friend and major donor to Trump, giving him an advantage in accessing power.

2. Economic Views & Monetary Policy (If in power)

-

- Leading candidate for the FED Chair: As of January 2026, he has a 95% chance of becoming the next FED Chair and has reportedly met with President Trump at the White House.

- Extensive experience: He was the youngest person to serve as a FED Governor at age 35, has worked at Morgan Stanley, and served as an economic advisor to President Bush.

- Powerful connections: He is the son-in-law of the Estée Lauder family. His father-in-law is a close friend and major donor to Trump, giving him an advantage in accessing power.

2. Economic Views & Monetary Policy (If in power)

-

BTC-0,86%

- Reward

- 1

- Comment

- Repost

- Share

Market Update - Friday, January 30

- Bitcoin continues to decline, now at $81,000, with over $1.75 billion liquidated in the past 24 hours.

- Former President Trump will announce the new Fed Chair, with Kevin Warsh's odds rising to 94%.

- The U.S. will release December PPI inflation data at 8:30 PM tonight:

- Year-over-year PPI inflation (Forecast = 2.9%, Previous = 3%)

- Year-over-year Core PPI inflation (Forecast = 3%, Previous = 3%)

ETF Spot Update as of January 29:

- Bitcoin is down $500 million, with Fidelity selling $168 million; BlackRock has no data available.

- Ethereum is down $100.8

- Bitcoin continues to decline, now at $81,000, with over $1.75 billion liquidated in the past 24 hours.

- Former President Trump will announce the new Fed Chair, with Kevin Warsh's odds rising to 94%.

- The U.S. will release December PPI inflation data at 8:30 PM tonight:

- Year-over-year PPI inflation (Forecast = 2.9%, Previous = 3%)

- Year-over-year Core PPI inflation (Forecast = 3%, Previous = 3%)

ETF Spot Update as of January 29:

- Bitcoin is down $500 million, with Fidelity selling $168 million; BlackRock has no data available.

- Ethereum is down $100.8

- Reward

- like

- Comment

- Repost

- Share

Breaking: Trump has just confirmed he will announce Jerome Powell's replacement tomorrow morning.

The race has narrowed to two candidates: Kevin Warsh and Rick Rieder (CEO of BlackRock). Sources indicate that Warsh is currently favored.

Today, Trump met with both candidates at the White House before making his final decision.

The race has narrowed to two candidates: Kevin Warsh and Rick Rieder (CEO of BlackRock). Sources indicate that Warsh is currently favored.

Today, Trump met with both candidates at the White House before making his final decision.

- Reward

- like

- Comment

- Repost

- Share

Market Update for Wednesday, January 28

- Gold and silver are seeking new highs. Bitcoin has increased slightly from $87,000 to $89,000, and altcoins are showing some improvement.

- The US dollar index has dropped to its lowest level in nearly four years following a surprising announcement from former President Trump.

- The Federal Reserve will announce its January interest rate decision at 2:00 AM tomorrow, with a 97.2% expectation that rates will remain unchanged.

ETF Spot Update as of January 27

- Bitcoin is down $44.6 million, with no data from BlackRock.

- Ethereum is down $4.6 million, w

- Gold and silver are seeking new highs. Bitcoin has increased slightly from $87,000 to $89,000, and altcoins are showing some improvement.

- The US dollar index has dropped to its lowest level in nearly four years following a surprising announcement from former President Trump.

- The Federal Reserve will announce its January interest rate decision at 2:00 AM tomorrow, with a 97.2% expectation that rates will remain unchanged.

ETF Spot Update as of January 27

- Bitcoin is down $44.6 million, with no data from BlackRock.

- Ethereum is down $4.6 million, w

- Reward

- like

- Comment

- Repost

- Share

Tether has officially launched USAT, a stablecoin regulated under U.S. federal law and designed specifically for the American market in accordance with the new GENIUS Act.

Key Compliance and Operational Structure:

- USAT is pegged 1:1 to the USD and issued by Anchorage Digital Bank, a federally licensed bank, with Cantor Fitzgerald overseeing the reserves.

- Tether aims to fully comply with the latest U.S. legal requirements, including transparency and mandated audits.

Expansion Strategy and Expected Benefits:

- USAT represents a significant step in attracting traditional financial institution

Key Compliance and Operational Structure:

- USAT is pegged 1:1 to the USD and issued by Anchorage Digital Bank, a federally licensed bank, with Cantor Fitzgerald overseeing the reserves.

- Tether aims to fully comply with the latest U.S. legal requirements, including transparency and mandated audits.

Expansion Strategy and Expected Benefits:

- USAT represents a significant step in attracting traditional financial institution

- Reward

- like

- Comment

- Repost

- Share

Former President Trump made a surprising statement regarding the U.S. dollar, suggesting it may continue to lose value. When asked if he was concerned about the dollar's decline, Trump replied, "No, I think the dollar is doing very well."

This comment has intensified the dollar's recent downturn, which is experiencing its most significant sell-off since last weekend. The DXY index has fallen to its lowest level in nearly four years.

Reasons for the dollar's sharp decline include:

- Last week, the New York Fed unexpectedly conducted a currency swap operation involving the USD/JPY pair, fueling

This comment has intensified the dollar's recent downturn, which is experiencing its most significant sell-off since last weekend. The DXY index has fallen to its lowest level in nearly four years.

Reasons for the dollar's sharp decline include:

- Last week, the New York Fed unexpectedly conducted a currency swap operation involving the USD/JPY pair, fueling

- Reward

- like

- Comment

- Repost

- Share

**Market Brief Tuesday - Jan 27**

+ Gold and silver diverge, US stocks rebound, BTC remains stuck at $88K - $89K, while altcoins show little momentum

+ President Trump raises tariffs on South Korea from 15% to 25% as the country has not ratified the previously signed trade agreement

**📝 Spot ETF Session Jan 26**

+ BTC is down -$6.2M, BlackRock data pending

+ ETH is up +$137.2M, BlackRock data pending

+ SOL is up +$2.5M

+ The US 🇺🇸 Senate crypto bill vote and the CFTC-SEC meeting are postponed for 2 days due to a winter storm in the US

+ Russia 🇷🇺 bans crypto exchange WhiteBIT (Ukrainian r

+ Gold and silver diverge, US stocks rebound, BTC remains stuck at $88K - $89K, while altcoins show little momentum

+ President Trump raises tariffs on South Korea from 15% to 25% as the country has not ratified the previously signed trade agreement

**📝 Spot ETF Session Jan 26**

+ BTC is down -$6.2M, BlackRock data pending

+ ETH is up +$137.2M, BlackRock data pending

+ SOL is up +$2.5M

+ The US 🇺🇸 Senate crypto bill vote and the CFTC-SEC meeting are postponed for 2 days due to a winter storm in the US

+ Russia 🇷🇺 bans crypto exchange WhiteBIT (Ukrainian r

- Reward

- like

- Comment

- Repost

- Share

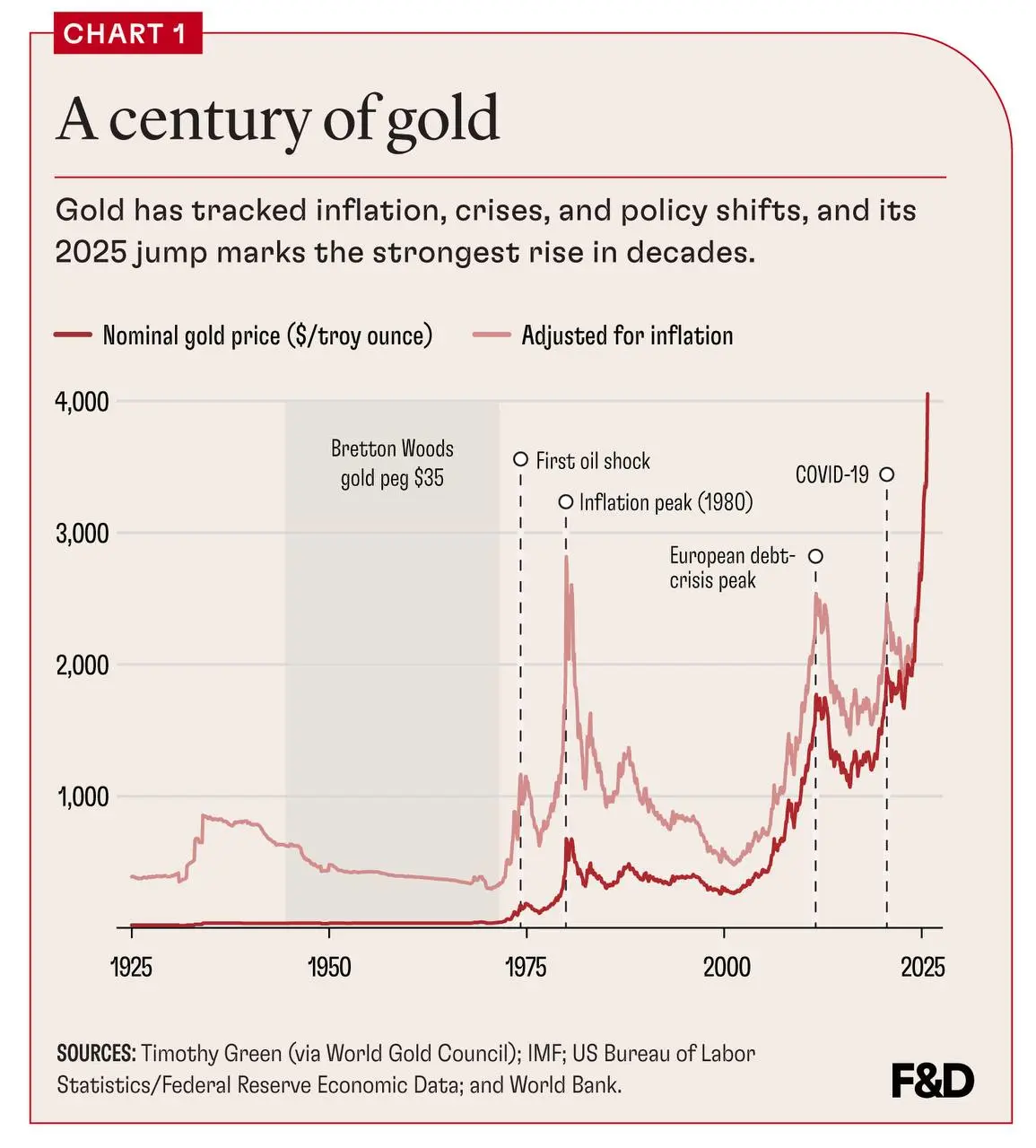

A historical analysis of gold's price growth reveals that it does not increase steadily but rather in bursts during periods of global financial instability.

Key periods include:

- 1970s: Oil shock and inflation led to a dramatic increase, with gold rising approximately 20 times.

- 1980: Peak inflation created a historic growth spike, followed by a prolonged correction.

- 2008-2011: The financial crisis and European debt issues pushed gold above $1,000 per ounce, reaching new highs.

- 2020: The COVID-19 pandemic saw gold prices approach $2,000 per once

- 2025-2026 (projected): A potential surge

Key periods include:

- 1970s: Oil shock and inflation led to a dramatic increase, with gold rising approximately 20 times.

- 1980: Peak inflation created a historic growth spike, followed by a prolonged correction.

- 2008-2011: The financial crisis and European debt issues pushed gold above $1,000 per ounce, reaching new highs.

- 2020: The COVID-19 pandemic saw gold prices approach $2,000 per once

- 2025-2026 (projected): A potential surge

- Reward

- like

- Comment

- Repost

- Share

Market Update - January 26

- Gold surpasses $5,000, Bitcoin drops to $87,000, and altcoins face significant losses amid geopolitical instability.

- The Netherlands plans to tax cryptocurrencies based on unrealized gains starting in 2028, prompting strong community backlash.

- Michael Saylor reveals plans to acquire more Bitcoin this week; his strategy currently holds 709,715 BTC, valued at approximately $62 billion.

- Foundry USA, the world's largest Bitcoin mining pool, reports a 60% decrease in hashrate to around 200 EH/s due to the ongoing mining winter in the U.S.

- Colombia's second-large

- Gold surpasses $5,000, Bitcoin drops to $87,000, and altcoins face significant losses amid geopolitical instability.

- The Netherlands plans to tax cryptocurrencies based on unrealized gains starting in 2028, prompting strong community backlash.

- Michael Saylor reveals plans to acquire more Bitcoin this week; his strategy currently holds 709,715 BTC, valued at approximately $62 billion.

- Foundry USA, the world's largest Bitcoin mining pool, reports a 60% decrease in hashrate to around 200 EH/s due to the ongoing mining winter in the U.S.

- Colombia's second-large

- Reward

- like

- Comment

- Repost

- Share