MatthewDixon

No content yet

MatthewDixon

Why do Traditional Indicators Underperform in Crypto?

#Crypto is:

24/7

Derivatives dominated

Highly reflexive

Liquidity driven

Whale manipulated

News/macro reactive

Indicators lag.

Crypto moves on:

Stop hunts

Liquidations

Orderbook imbalances

Funding extremes

Liquidity pools

INDICATORS REACT AFTER THOSE MOVES.

RAW STRUCTURE (ELLIOTT WAVE) AND LIQUIDITY MAPPING WINS EVERY TIME (when properly understood) IMO

#Crypto is:

24/7

Derivatives dominated

Highly reflexive

Liquidity driven

Whale manipulated

News/macro reactive

Indicators lag.

Crypto moves on:

Stop hunts

Liquidations

Orderbook imbalances

Funding extremes

Liquidity pools

INDICATORS REACT AFTER THOSE MOVES.

RAW STRUCTURE (ELLIOTT WAVE) AND LIQUIDITY MAPPING WINS EVERY TIME (when properly understood) IMO

- Reward

- like

- Comment

- Repost

- Share

Are you worried?

“THE WORLD IS IN PERIL” warned the former head of Anthropic’s Safeguards Research team as he headed for the exit. A researcher for OpenAI, similarly on the way out, said that the technology has “a potential for manipulating users in ways we don’t have the tools to understand, let alone prevent.”

They’re part of a wave of artificial intelligence researchers and executives who aren’t just leaving their employers — they’re loudly ringing the alarm bell on the way out, calling attention to what they see as bright red flags.

“THE WORLD IS IN PERIL” warned the former head of Anthropic’s Safeguards Research team as he headed for the exit. A researcher for OpenAI, similarly on the way out, said that the technology has “a potential for manipulating users in ways we don’t have the tools to understand, let alone prevent.”

They’re part of a wave of artificial intelligence researchers and executives who aren’t just leaving their employers — they’re loudly ringing the alarm bell on the way out, calling attention to what they see as bright red flags.

- Reward

- like

- Comment

- Repost

- Share

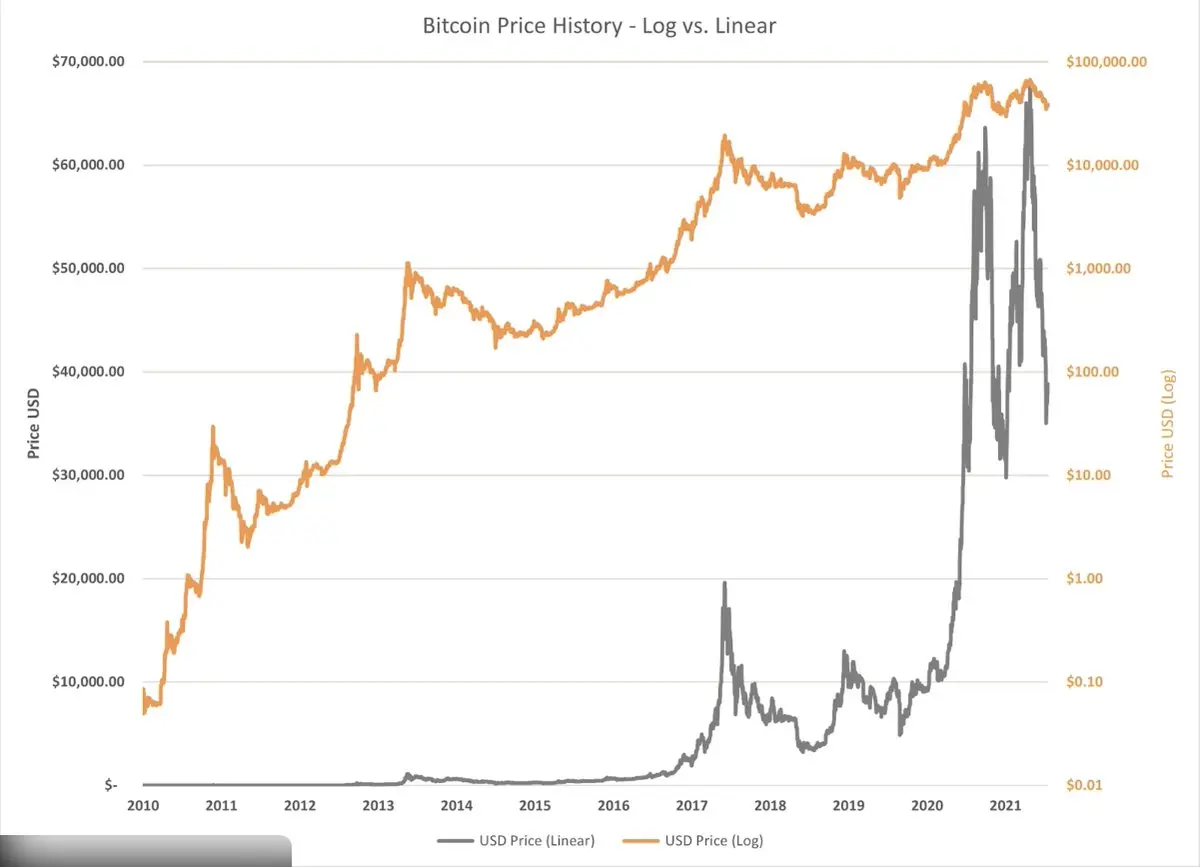

PermaBulls are always saying you MUST use Log scale for #Crypto.

I respectfully disagree. I believe it is just a tool to justify sky high price predictions.

What Log Scale Actually Does -

Linear scale means, equal vertical distance = equal price change

Whereas Log scale means, equal vertical distance = equal % change

In assets that compound (#stocks, #gold), log scale is usually preferred for long-term charts because markets move in percentages, not #dollars.

However, early Crypto Was Price Discovery, Not Growth

In early #Bitcoin (2010–2013 especially)

I respectfully disagree. I believe it is just a tool to justify sky high price predictions.

What Log Scale Actually Does -

Linear scale means, equal vertical distance = equal price change

Whereas Log scale means, equal vertical distance = equal % change

In assets that compound (#stocks, #gold), log scale is usually preferred for long-term charts because markets move in percentages, not #dollars.

However, early Crypto Was Price Discovery, Not Growth

In early #Bitcoin (2010–2013 especially)

BTC-2,75%

- Reward

- like

- Comment

- Repost

- Share

Hopefully Non Farm Payrolls will give us a nice run up in 90 mins time.

#BTC could well give a decent leg higher from here

#BTC could well give a decent leg higher from here

BTC-2,75%

- Reward

- like

- Comment

- Repost

- Share

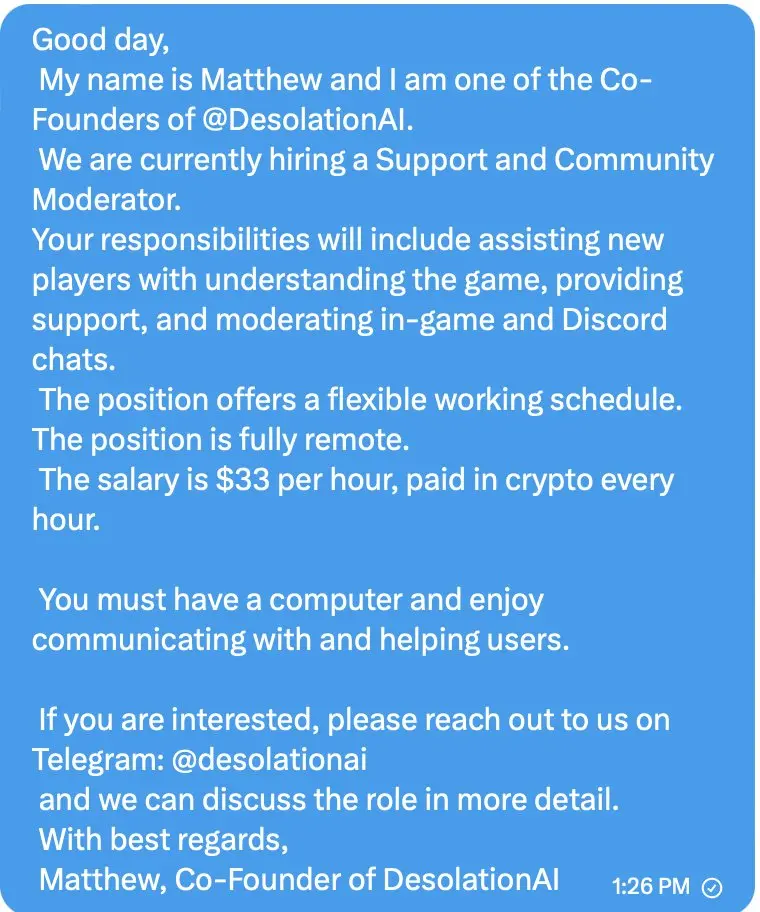

ONCE AGAIN WARNING - THIS IS A SCAM AS I WAS HACKED - PLS IGNORE

I have received around 200 DMs and replied to ALL saying its a SCAM

I have received around 200 DMs and replied to ALL saying its a SCAM

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Well we did hit an ATL of 6, so at least we are up 50% from there but still a long way to go until the market feels any degree of comfort.

Traditionally such low readings represented good buying levels but I think its prudent to hang fire before diving back in to #BTC or #Crypto

Traditionally such low readings represented good buying levels but I think its prudent to hang fire before diving back in to #BTC or #Crypto

BTC-2,75%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

Lions_Lionish :

:

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵Pls give me your thoughts ....

Ive been thinking about the risks that derivatives pose for #BTC considering the fact that $BTC value relies to a large extent on 21M limited supply - Derivatives INFLATE that supply.

You could say the same for #Gold #XAU but -

BTC derivatives are extremely reflexive

because of 24/7 global trading, with high leverage.

Liquidations create violent feedback loops

Price moves are often driven by margin mechanics, NOT fundamentals

Spot follows derivatives, not the other way around.

Gold derivatives are large, but:

Leverage is lower

Trading hours are constrained

Volat

Ive been thinking about the risks that derivatives pose for #BTC considering the fact that $BTC value relies to a large extent on 21M limited supply - Derivatives INFLATE that supply.

You could say the same for #Gold #XAU but -

BTC derivatives are extremely reflexive

because of 24/7 global trading, with high leverage.

Liquidations create violent feedback loops

Price moves are often driven by margin mechanics, NOT fundamentals

Spot follows derivatives, not the other way around.

Gold derivatives are large, but:

Leverage is lower

Trading hours are constrained

Volat

BTC-2,75%

- Reward

- like

- Comment

- Repost

- Share

Pls give me your thoughts ....

Ive been thinking about the risks that derivatives pose for #BTC considering the fact that $BTC value relies to a large extent on 21M limited supply - Derivatives INFLATE that supply.

You could say the same for #Gold but -

BTC derivatives are extremely reflexive

because of 24/7 global trading, with high leverage.

Liquidations create violent feedback loops

Price moves are often driven by margin mechanics, NOT fundamentals

Spot follows derivatives, not the other way around.

Gold derivatives are large, but:

Leverage is lower

Trading hours are constrained

Volatility

Ive been thinking about the risks that derivatives pose for #BTC considering the fact that $BTC value relies to a large extent on 21M limited supply - Derivatives INFLATE that supply.

You could say the same for #Gold but -

BTC derivatives are extremely reflexive

because of 24/7 global trading, with high leverage.

Liquidations create violent feedback loops

Price moves are often driven by margin mechanics, NOT fundamentals

Spot follows derivatives, not the other way around.

Gold derivatives are large, but:

Leverage is lower

Trading hours are constrained

Volatility

BTC-2,75%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#BTC most #Crypto & #ALTs are progressing exactly as anticipated in a final b wave before c down to finalise a large WXY correction. Once complete we should then move aggressively higher (perhaps due to easing monetary conditions)

BTC-2,75%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Could be a good time to jump into #SOL with some tight stop-losses in place.We may well get a decent bounce from here imo

SOL-3,15%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share