MrAsifAli

No content yet

MrAsifAli

BTC Analysis: February 11, 2026

Bitcoin is currently struggling to stabilize near $69,000 following a significant monthly downturn. While the RSI indicates an oversold bounce is possible, the overall trend remains bearish, with prices pinned below key moving averages and the critical $70,000 psychological level.

Possible Next Move

The market is currently in a high-volatility "liquidation hunt."

Bullish Scenario: A sustained daily close above $71,500 would signal a short-term trend reversal, potentially targeting $74,500.

Bearish Scenario: If BTC fails to reclaim $70,000, a move toward the majo

Bitcoin is currently struggling to stabilize near $69,000 following a significant monthly downturn. While the RSI indicates an oversold bounce is possible, the overall trend remains bearish, with prices pinned below key moving averages and the critical $70,000 psychological level.

Possible Next Move

The market is currently in a high-volatility "liquidation hunt."

Bullish Scenario: A sustained daily close above $71,500 would signal a short-term trend reversal, potentially targeting $74,500.

Bearish Scenario: If BTC fails to reclaim $70,000, a move toward the majo

BTC-4,53%

- Reward

- like

- 1

- Repost

- Share

GateUser-190093e6 :

:

Should I buy long or short?ETH Analysis: February 11, 2026

Ethereum is currently hovering around $2,010, attempting to find a base after a sharp 4% daily drop. The structure remains bearish as the price stays trapped within a descending channel. While whales are accumulating, retail selling pressure persists, keeping the momentum neutral-to-weak.

Possible Next Move

The immediate outlook suggests sideways consolidation with a slight bearish bias.

Bullish Scenario: If ETH holds above $2,000 and reclaims the $2,080 level with volume, a relief rally toward $2,150 is likely.

Bearish Scenario: Failure to hold psychological su

Ethereum is currently hovering around $2,010, attempting to find a base after a sharp 4% daily drop. The structure remains bearish as the price stays trapped within a descending channel. While whales are accumulating, retail selling pressure persists, keeping the momentum neutral-to-weak.

Possible Next Move

The immediate outlook suggests sideways consolidation with a slight bearish bias.

Bullish Scenario: If ETH holds above $2,000 and reclaims the $2,080 level with volume, a relief rally toward $2,150 is likely.

Bearish Scenario: Failure to hold psychological su

ETH-5,15%

- Reward

- like

- Comment

- Repost

- Share

BTC Analysis: February 10, 2026

Bitcoin is currently in a neutral-to-bearish consolidation phase after a "V-shaped" relief bounce from the $60,000 lows. The market is struggling to maintain momentum above the $70,000 psychological barrier as institutional selling pressure offsets recent dip-buying.

Possible Next Move

The most likely short-term move is range-bound chop between $69,000 and $71,800. Traders are waiting for a decisive break;

failing to hold $70,000 could trigger a retest of the $65,000 support, while a clean daily close above $71,800 is needed to flip the narrative back to bullish

Bitcoin is currently in a neutral-to-bearish consolidation phase after a "V-shaped" relief bounce from the $60,000 lows. The market is struggling to maintain momentum above the $70,000 psychological barrier as institutional selling pressure offsets recent dip-buying.

Possible Next Move

The most likely short-term move is range-bound chop between $69,000 and $71,800. Traders are waiting for a decisive break;

failing to hold $70,000 could trigger a retest of the $65,000 support, while a clean daily close above $71,800 is needed to flip the narrative back to bullish

BTC-4,53%

- Reward

- like

- Comment

- Repost

- Share

Solana (SOL) is currently testing a "make-or-break" floor near $80–$85. While network activity remains high with the upcoming Alpenglow upgrade, technical pressure from recent ETF outflows and legal headlines has pushed the price into a fragile, bearish consolidation phase.

Next Possible Move

Bullish Scenario: A strong bounce from the $80 demand zone could lead to a relief rally toward the $95 resistance.

Bearish Scenario: A daily close below $78 would likely trigger a deeper correction toward the next major psychological support at $50.

Professional Trading Zones

Zone Type,Specific Price Leve

Next Possible Move

Bullish Scenario: A strong bounce from the $80 demand zone could lead to a relief rally toward the $95 resistance.

Bearish Scenario: A daily close below $78 would likely trigger a deeper correction toward the next major psychological support at $50.

Professional Trading Zones

Zone Type,Specific Price Leve

SOL-6,48%

- Reward

- like

- Comment

- Repost

- Share

Today, Ethereum (ETH) is navigating a high-volatility environment after a sharp 3% sell-off yesterday. While network utility is at record highs, price action is struggling near the psychologically critical $2,000 level. Traders are currently balanced between long-term institutional optimism and short-term bearish technicals.

Next Possible Move

Bullish Scenario: A successful defense of the $2,000 floor could trigger a technical "V-shaped" recovery toward $2,150.

Bearish Scenario: A sustained break below $2,000 may accelerate liquidations, potentially pushing the price toward the next major dema

Next Possible Move

Bullish Scenario: A successful defense of the $2,000 floor could trigger a technical "V-shaped" recovery toward $2,150.

Bearish Scenario: A sustained break below $2,000 may accelerate liquidations, potentially pushing the price toward the next major dema

ETH-5,15%

- Reward

- 1

- Comment

- Repost

- Share

BTC Analysis: February 7, 2026

Bitcoin is currently in a high-volatility recovery phase following a brutal "flash crash" that saw prices dive toward $60,000. While it has since bounced back above $70,000, the overall technical structure remains fragile. The market is currently battling a "risk-off" sentiment as investors weigh macro-economic pressures against local dip-buying.

Technical Zones & Next Move

The possible next move is a period of consolidation between $68,000 and $72,000. If it fails to hold the $70k psychological level, a retest of the lower support is likely.

Professional Strateg

Bitcoin is currently in a high-volatility recovery phase following a brutal "flash crash" that saw prices dive toward $60,000. While it has since bounced back above $70,000, the overall technical structure remains fragile. The market is currently battling a "risk-off" sentiment as investors weigh macro-economic pressures against local dip-buying.

Technical Zones & Next Move

The possible next move is a period of consolidation between $68,000 and $72,000. If it fails to hold the $70k psychological level, a retest of the lower support is likely.

Professional Strateg

BTC-4,53%

- Reward

- 2

- Comment

- Repost

- Share

As of February 7, 2026, SOL is trading under significant pressure, currently hovering near the critical $85–$87 level. After a sharp sell-off from January highs, the market is testing multi-month lows, with sentiment remaining bearish as it stays below major moving averages.

📉 Possible Next Move

The "next move" depends heavily on the defense of the current psychological floor.

Bullish Case: If buyers defend the $85 support, expect a relief rally toward $105.

Bearish Case: A clean break below $85 likely triggers a deeper capitulation toward the $74 or even the $50 "macro pivot" zone.

💡 Pro-Ti

📉 Possible Next Move

The "next move" depends heavily on the defense of the current psychological floor.

Bullish Case: If buyers defend the $85 support, expect a relief rally toward $105.

Bearish Case: A clean break below $85 likely triggers a deeper capitulation toward the $74 or even the $50 "macro pivot" zone.

💡 Pro-Ti

SOL-6,48%

- Reward

- 1

- 1

- Repost

- Share

Unoshi :

:

Thanks for sharingToday, February 7, 2026, Ethereum is showing signs of a volatile recovery after a brutal week. After crashing to a low near $1,755, it has climbed back above the $2,000 psychological barrier, currently trading around $2,040–$2,060. While the short-term momentum is bullish (+8–11%), the broader trend remains fragile as it stays below major daily moving averages.

Possible Next Move

The most likely scenario is a period of consolidation. ETH is caught between a "relief rally" and heavy overhead resistance. If it can hold above $2,000 for a daily close, we may see a push toward the $2,125–$2,200 ra

Possible Next Move

The most likely scenario is a period of consolidation. ETH is caught between a "relief rally" and heavy overhead resistance. If it can hold above $2,000 for a daily close, we may see a push toward the $2,125–$2,200 ra

ETH-5,15%

- Reward

- like

- Comment

- Repost

- Share

Please give me a advice Tell Me your Experience Buy Or Wait For More ???#BuyTheDipOrWaitNow? $BTC

BTC-4,53%

- Reward

- like

- Comment

- Repost

- Share

Today, Ethereum (ETH) is navigating a sharp bearish phase, trading near $2,280 after a nearly 10% intraday drop. Market sentiment is heavily weighed down by a breakdown of symmetrical triangle patterns and a broader sell-off in the tech sector. With consistent lower highs and expanding sell volume, the immediate structure remains defensive rather than recovery-oriented.

Technical Breakdown & Next Move

The breakdown below the previous structural support has turned former "floors" into "ceilings."

Possible Next Move: Analysts anticipate a test of the $2,100–$2,200 multi-year support zone. If bul

Technical Breakdown & Next Move

The breakdown below the previous structural support has turned former "floors" into "ceilings."

Possible Next Move: Analysts anticipate a test of the $2,100–$2,200 multi-year support zone. If bul

ETH-5,15%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Such a great postToday, Bitcoin is showing a modest recovery, stabilizing around $78,300 after a sharp weekend sell-off. While it has gained approximately 1.2% in the last 24 hours, the overall sentiment remains bearish due to persistent selling pressure and four consecutive months of red closes.

The Next Move

The market is currently in a "wait-and-see" phase. Analysts suggest the next move depends on whether BTC can reclaim the $80,000 psychological level.

Bullish Case: A breakout above $80,000 could spark a relief rally toward $86,000.

Bearish Case: Failure to hold current levels could lead to a retest of de

The Next Move

The market is currently in a "wait-and-see" phase. Analysts suggest the next move depends on whether BTC can reclaim the $80,000 psychological level.

Bullish Case: A breakout above $80,000 could spark a relief rally toward $86,000.

Bearish Case: Failure to hold current levels could lead to a retest of de

BTC-4,53%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

$BTC is approaching a critical threshold, and the market remains cautious. A breakout above 80K could trigger a relief rally, while failure may bring the 72K–69K range back into play. For now, the market is in “wait-and-see” mode.As of February 3, 2026, Ethereum (ETH) is navigating a volatile recovery phase. After a sharp January decline to the $2,100–$2,200 zone, the price has stabilized around $2,310–$2,350. While on-chain activity remains at record highs, macro pressures like gold's dominance and regulatory uncertainty are currently capping immediate gains.

Possible Next Move

The short-term trend is a cautious rebound. Analysts suggest that if ETH can decisively break and hold above the $2,396 level, it could trigger a "Change of Character"

(CHoCH), leading to a rally toward $2,600 and eventually $2,800. However, fa

Possible Next Move

The short-term trend is a cautious rebound. Analysts suggest that if ETH can decisively break and hold above the $2,396 level, it could trigger a "Change of Character"

(CHoCH), leading to a rally toward $2,600 and eventually $2,800. However, fa

ETH-5,15%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

Thank you for the helpful and accurate information.Today, Solana (SOL) is navigating a critical "make-or-break" zone. After cracking below the $100 psychological level earlier this week, the price is currently consolidating around $104–$106. While technical indicators like the RSI show SOL is in oversold territory, the overall momentum remains bearish as it trades below its 50-day and 200-day moving averages. Traders are watching for a confirmed base before any trend reversal.

The Possible Next Move

Bullish Case: If SOL holds above $104 and reclaiming the $110 level, it could trigger a "relief rally" toward $118–$124.

Bearish Case: Failure to

The Possible Next Move

Bullish Case: If SOL holds above $104 and reclaiming the $110 level, it could trigger a "relief rally" toward $118–$124.

Bearish Case: Failure to

SOL-6,48%

- Reward

- like

- Comment

- Repost

- Share

Today, Bitcoin (BTC) is experiencing significant downward pressure, dropping over 6% to reach a two-month low around $82,500–$83,000. The trend is technically bearish as price has broken below major moving averages (50-day and 200-day EMA). Massive ETF outflows and a "Strong Sell" signal across technical oscillators suggest that while the market is oversold, the momentum remains firmly with the sellers.

Possible Next Move: Expect a period of consolidation or a "dead cat bounce" toward $86,000 as the RSI is currently in oversold territory ($<30$). However, if $83,000$ fails to hold on a daily c

Possible Next Move: Expect a period of consolidation or a "dead cat bounce" toward $86,000 as the RSI is currently in oversold territory ($<30$). However, if $83,000$ fails to hold on a daily c

BTC-4,53%

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

Today, Ethereum (ETH) is under significant pressure, currently trading around $2,810, reflecting a sharp 6.6% decline. The market is reacting to a cocktail of macroeconomic tension and technical triggers. After failing to hold the psychological $3,000 level, momentum has shifted to a "Strong Sell" according to most technical indicators.

Possible Next Move

The immediate trend is bearish. If ETH fails to reclaim the $2,850 level quickly, it is likely to test the next major demand zone. A consolidation phase between $2,750 and $2,800 is expected before any attempt to retest $3,000.

Professional T

Possible Next Move

The immediate trend is bearish. If ETH fails to reclaim the $2,850 level quickly, it is likely to test the next major demand zone. A consolidation phase between $2,750 and $2,800 is expected before any attempt to retest $3,000.

Professional T

ETH-5,15%

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Bitcoin is currently consolidating in a tight range between $84,000 and $90,000. Following the Federal Reserve's decision to hold interest rates, the market has shifted to a "sell the news" sentiment. While long-term institutional adoption remains bullish, near-term technicals suggest a cautious "anxiety" phase with significant options expiry pending.

The Immediate Outlook

The Bear Case (Short-term): Technical indicators and Wyckoff analysis suggest a high probability of a further dip toward a "market bottom" sub-$80,000 (potentially $74,000–$78,000) before February.

The Bull Case (Consolidati

The Immediate Outlook

The Bear Case (Short-term): Technical indicators and Wyckoff analysis suggest a high probability of a further dip toward a "market bottom" sub-$80,000 (potentially $74,000–$78,000) before February.

The Bull Case (Consolidati

BTC-4,53%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊Today, January 29, 2026, Gold (XAU) is in a historic, explosive rally, trading near $5,570. Driven by a weakening US Dollar and massive geopolitical tension, it recently cleared the $5,500 milestone. Technicals remain strongly bullish, though the extreme distance from moving averages suggests a "healthy breather" or consolidation is imminent.

Possible Next Move

The immediate trend remains upward toward $5,600. However, with the RSI showing overbought conditions, a short-term "liquidity grab" or pullback to retest the $5,500 level is highly probable before another leg up toward $5,800.

Trader's

Possible Next Move

The immediate trend remains upward toward $5,600. However, with the RSI showing overbought conditions, a short-term "liquidity grab" or pullback to retest the $5,500 level is highly probable before another leg up toward $5,800.

Trader's

XAUT1,13%

- Reward

- 4

- 4

- Repost

- Share

GateUser-d3fb73d3 :

:

Happy New Year! 🤑View More

Today, January 29, 2026, Bitcoin is under pressure, trading around $88,200. The market is in a short-term sideways range after failing to reclaim the $90,000 level. While long-term institutional sentiment remains cautiously optimistic due to ETF inflows, current technical indicators like the RSI and MACD signal a "Strong Sell" or neutral stance as BTC struggles below its 50-day EMA.

Possible Next Move

The price is currently consolidating. If BTC fails to hold the $88,000 psychological support, a drop toward the $85,000–$86,000 zone is likely. Conversely, a confirmed breakout above $90,000 with

Possible Next Move

The price is currently consolidating. If BTC fails to hold the $88,000 psychological support, a drop toward the $85,000–$86,000 zone is likely. Conversely, a confirmed breakout above $90,000 with

BTC-4,53%

- Reward

- 1

- 2

- Repost

- Share

Kamal360bd :

:

HODL Tight 💪View More

SOL Coin Today Analysis

SOL is currently consolidating around $125–$127. While the long-term structure remains bullish with "cup-and-handle" patterns forming, the short-term momentum is neutral-to-bearish as it struggles to reclaim the $133 level. High trading volume ($3.8B+) suggests significant interest, but price action remains compressed within a tight range.

Possible Next Move

Bullish Case: A decisive break and close above $133 could trigger a rapid move toward $145 and eventually $150.

Bearish Case: If SOL fails to hold the $120 floor, we may see a "liquidity hunt" down to the $108–$112

SOL is currently consolidating around $125–$127. While the long-term structure remains bullish with "cup-and-handle" patterns forming, the short-term momentum is neutral-to-bearish as it struggles to reclaim the $133 level. High trading volume ($3.8B+) suggests significant interest, but price action remains compressed within a tight range.

Possible Next Move

Bullish Case: A decisive break and close above $133 could trigger a rapid move toward $145 and eventually $150.

Bearish Case: If SOL fails to hold the $120 floor, we may see a "liquidity hunt" down to the $108–$112

SOL-6,48%

- Reward

- like

- Comment

- Repost

- Share

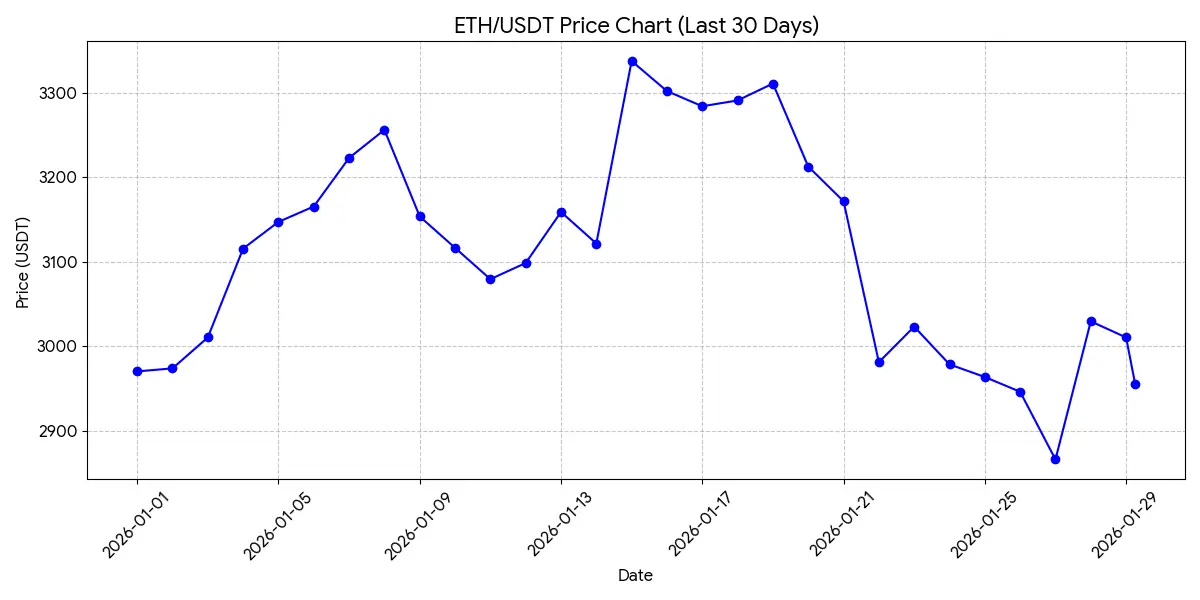

ETH Market Analysis: January 29, 2026

Ethereum is currently hovering around $2,950–$3,000, struggling to break out of a persistent five-month downtrend. While whale accumulation (adding roughly 430,000 ETH recently) suggests long-term confidence, the market remains "on a knife-edge" due to record-high leverage. Sentiment is fragile as traders weigh steady on-chain growth against macro-economic uncertainty and potential liquidations of over-leveraged long positions.

🚀 Possible Next Move

The immediate direction depends on the $3,000 psychological level.

Bullish Case: A clean daily close above $

Ethereum is currently hovering around $2,950–$3,000, struggling to break out of a persistent five-month downtrend. While whale accumulation (adding roughly 430,000 ETH recently) suggests long-term confidence, the market remains "on a knife-edge" due to record-high leverage. Sentiment is fragile as traders weigh steady on-chain growth against macro-economic uncertainty and potential liquidations of over-leveraged long positions.

🚀 Possible Next Move

The immediate direction depends on the $3,000 psychological level.

Bullish Case: A clean daily close above $

ETH-5,15%

- Reward

- like

- Comment

- Repost

- Share