#WhiteHouseTalksStablecoinYields A New Era in the Global Financial Landscape

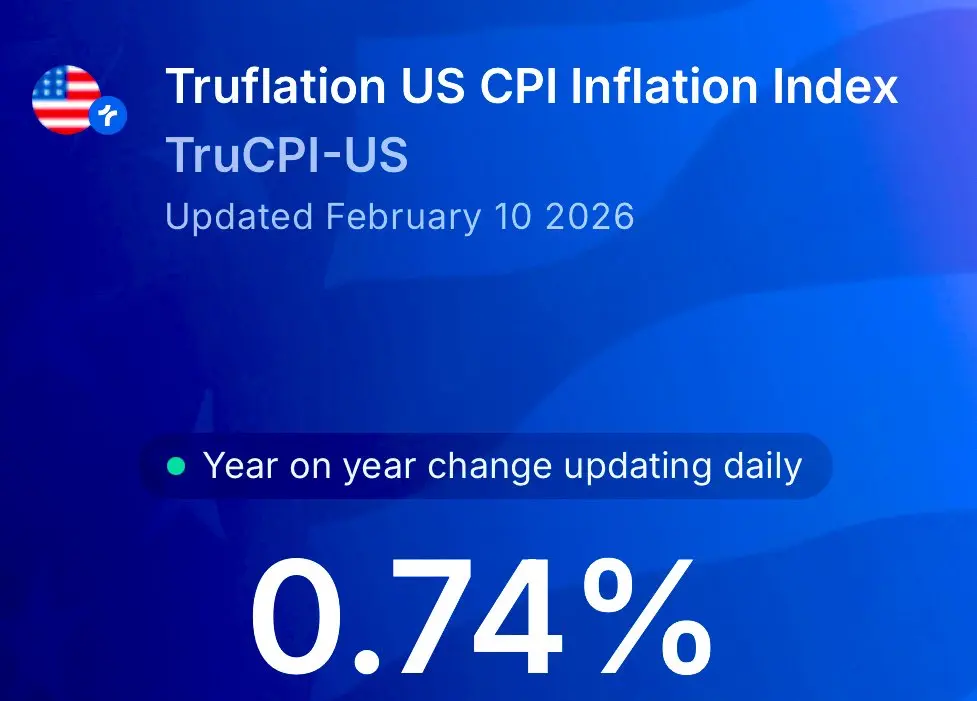

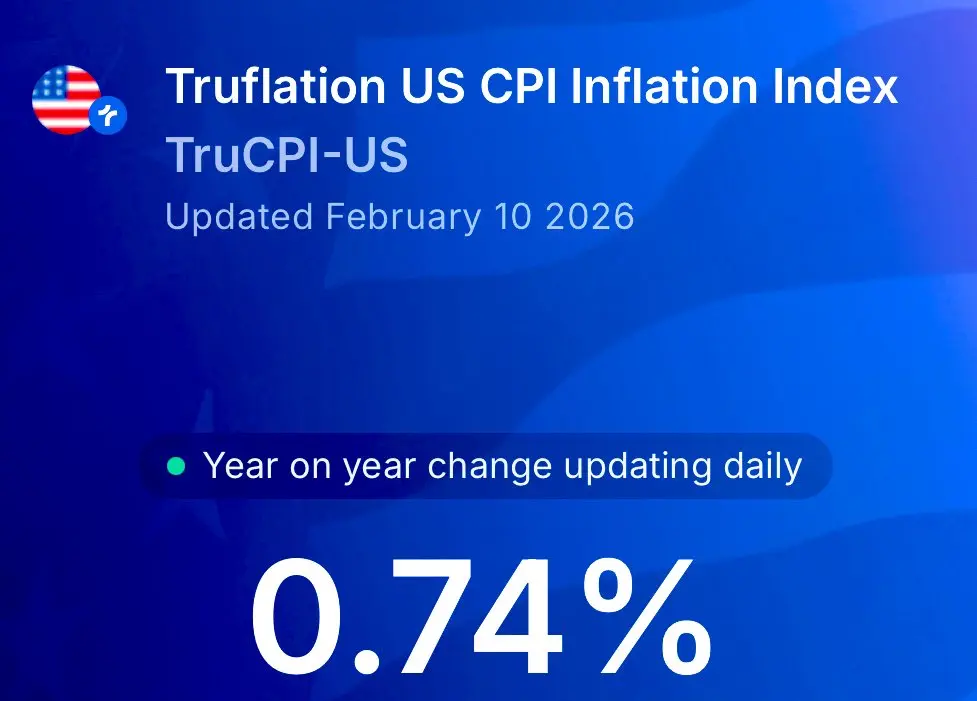

The frost between traditional banking and the digital asset ecosystem is beginning to thaw, driven by pivotal discussions hosted at the White House. As of February 2026, stablecoin yields have emerged as a primary agenda item in Washington, reaching a scale that impacts not only crypto investors but global financial stability at large.

The Quest for Consensus and Core Disagreements

Closed-door meetings organized by the White House Crypto Council aim to smooth out the friction surrounding the CLARITY Act and the GENIUS Act. At the heart of these discussions lies the critical question: Do the "interest-like" rewards offered by stablecoins pose a fundamental risk to traditional bank deposits?

The Banking Front: Representatives from giants like JPMorgan Chase and Bank of America warn that stablecoin yields could trigger a "deposit flight." From the banks' perspective, these uninsured, high-yield digital assets could spark a liquidity crisis by shrinking the volume of available credit.

The Crypto World: Advocacy groups like Coinbase and the Blockchain Association argue that these yields are a necessity for innovation. They emphasize that restricting such returns would cause the United States to lag in global competition and stifle financial freedom.

Future Scenarios

Statements from the Treasury Department indicate that the U.S. aims to strike a balance: preserving the autonomy offered by the crypto world while strengthening federal oversight. One of the most striking ideas on the table is the potential for regulated stablecoins to serve as a significant funding source for the federal government.

While a final agreement has yet to be signed, parties are expected to find common ground by the end of February. The decisions emerging from this process will ultimately clarify whether stablecoins are to be classified primarily as a medium of exchange or an investment instrument.

#我在Gate广场过新年 #CelebratingNewYearOnGateSquare