Safa777

No content yet

$STG

🚨(StargateToken) — SELL ALERT (Nansen Data)

📌 On-chain flow appears very dangerous.

🔻 1) Whale Transfers (24h)

There are consecutive large transfers in Nansen's "Transfers" section:

• 3.76M STG

• 3.76M STG

• 2.90M STG

• 2.80M STG

• 2.00M STG x2

• 1.80M STG

• 1.28M STG

• 1.24M STG

• 1.19M STG

• 1.08M STG

• • multiple additional large transfers

📌 This much "million-dollar" activity usually means distribution/dump preparation.

🔻 2) SELLs are increasing in DEX Trades

In the "DEX Trades" list, one after anot

🚨(StargateToken) — SELL ALERT (Nansen Data)

📌 On-chain flow appears very dangerous.

🔻 1) Whale Transfers (24h)

There are consecutive large transfers in Nansen's "Transfers" section:

• 3.76M STG

• 3.76M STG

• 2.90M STG

• 2.80M STG

• 2.00M STG x2

• 1.80M STG

• 1.28M STG

• 1.24M STG

• 1.19M STG

• 1.08M STG

• • multiple additional large transfers

📌 This much "million-dollar" activity usually means distribution/dump preparation.

🔻 2) SELLs are increasing in DEX Trades

In the "DEX Trades" list, one after anot

STG39,53%

- Reward

- 1

- Comment

- Repost

- Share

$POWER

🚨 $POWER — BIG WHALES CONTROL 95%+ OF SUPPLY (DUMP RISK)

📌 Distribution Score: 33 (Very risky)

➡️ Top 100 wallets hold ~95%+ of total supply.

🐋 Whale concentration is extreme:

• Top 100 balance: 999.95M POWER

• Exchange balance: 39.97M (+65%)

➡️ This could be preparation for a sell.

📉 What holders are doing:

• Massive transfers between wallets (consecutive within 24h)

• Wallets labeled "Token Millionaire" and "High Balance" are active

➡️ This type of pattern often ends in distribution → dump.

⚠️ Market reality:

• Market Cap: ~$76.6M

• Liquidity:

🚨 $POWER — BIG WHALES CONTROL 95%+ OF SUPPLY (DUMP RISK)

📌 Distribution Score: 33 (Very risky)

➡️ Top 100 wallets hold ~95%+ of total supply.

🐋 Whale concentration is extreme:

• Top 100 balance: 999.95M POWER

• Exchange balance: 39.97M (+65%)

➡️ This could be preparation for a sell.

📉 What holders are doing:

• Massive transfers between wallets (consecutive within 24h)

• Wallets labeled "Token Millionaire" and "High Balance" are active

➡️ This type of pattern often ends in distribution → dump.

⚠️ Market reality:

• Market Cap: ~$76.6M

• Liquidity:

POWER7,44%

- Reward

- 1

- Comment

- Repost

- Share

🚨 $ASTER – SELL WARNING (Whale Control)

Selling ASTER is very risky:

• Top 100 wallets hold 48% of the supply

• Distribution Score: 3 → this means "whale controlled"

• In the last 24 hours, large transfers of $3.7M, $3.1M, $1.3M+ have occurred

→ such transfers are usually followed by a dump

❗What happens?

Whales easily manipulate the token:

• pump it up

• then suddenly drain liquidity

• forcing retail to "exit liquidity."

📉 Result

With such centralized tokens:

✅ The pump happens quickly

❌ The dump happens even faster

The risk is high — SELL / Take Profit is more logic

Selling ASTER is very risky:

• Top 100 wallets hold 48% of the supply

• Distribution Score: 3 → this means "whale controlled"

• In the last 24 hours, large transfers of $3.7M, $3.1M, $1.3M+ have occurred

→ such transfers are usually followed by a dump

❗What happens?

Whales easily manipulate the token:

• pump it up

• then suddenly drain liquidity

• forcing retail to "exit liquidity."

📉 Result

With such centralized tokens:

✅ The pump happens quickly

❌ The dump happens even faster

The risk is high — SELL / Take Profit is more logic

ASTER7,13%

- Reward

- 1

- Comment

- Repost

- Share

$KITE

🚨 1) Top 100 holders are decreasing again

As shown in the chart:

• Top 100 Addresses: 9.29B ↓ 0.42% (30D)

This means that even if the price rises, the top 100 wallets are selling/distributing.

⸻

⚠️ 2) Distribution Score is very low

• Distribution Score: 9

• Moreover: Top 100 hold 91% of supply

When this much supply is in top wallets:

✅ manipulation is easy

❌ dumping will be very sharp

⸻

🔥 3) Exchange balance increases slightly

• Exchange: 459.03M ↑ 0.02%

This small increase is significant:

📌 tokens are slowly moving to exchanges → preparing to be sold.

⸻

�

🚨 1) Top 100 holders are decreasing again

As shown in the chart:

• Top 100 Addresses: 9.29B ↓ 0.42% (30D)

This means that even if the price rises, the top 100 wallets are selling/distributing.

⸻

⚠️ 2) Distribution Score is very low

• Distribution Score: 9

• Moreover: Top 100 hold 91% of supply

When this much supply is in top wallets:

✅ manipulation is easy

❌ dumping will be very sharp

⸻

🔥 3) Exchange balance increases slightly

• Exchange: 459.03M ↑ 0.02%

This small increase is significant:

📌 tokens are slowly moving to exchanges → preparing to be sold.

⸻

�

KITE-7,7%

- Reward

- 1

- 1

- Repost

- Share

Safa777 :

:

📌 The price rises, but the Top 100 holders sell. 📌 Whales make significant exits within 24 hours and 7 days.

📌 91% of the supply is in the top 100 → the risk of a dump is very high.

$KITE

1) Top holders are selling (not bullish)

• “Top 100 Addresses: 9.29B ↓0.41%”

• “Exchange: 459.18M ↓0.05%”

• The yellow line on the chart (Top 100 balance) is generally decreasing.

Even if the price rises, large holders are selling off.

2) Balance changes: large outflow

In the Balances section:

• Large outflows of -5.95M (24h) and -7.99M (7D) are visible in the "Token Billionaire" category.

• There are also consecutive red outflows in other "High Balance" wallets.

This indicates that distribution is occurring during the pump.

3) Transfers: large amounts

1) Top holders are selling (not bullish)

• “Top 100 Addresses: 9.29B ↓0.41%”

• “Exchange: 459.18M ↓0.05%”

• The yellow line on the chart (Top 100 balance) is generally decreasing.

Even if the price rises, large holders are selling off.

2) Balance changes: large outflow

In the Balances section:

• Large outflows of -5.95M (24h) and -7.99M (7D) are visible in the "Token Billionaire" category.

• There are also consecutive red outflows in other "High Balance" wallets.

This indicates that distribution is occurring during the pump.

3) Transfers: large amounts

KITE-7,7%

- Reward

- 1

- 1

- Repost

- Share

Safa777 :

:

📌 The price rises, but the Top 100 holders sell. 📌 Whales make significant exits within 24 hours and 7 days.

📌 91% of the supply is in the top 100 → the risk of a dump is very high.

$KITE

🚨 KITE (Nansen) — WARNING: This Looks Like Distribution

Price is pumping, but on-chain data shows something else:

🔻 Top holders are SELLING into the pump

Nansen shows the Top 100 wallets balance is dropping:

• Top 100 Addresses: 9.29B ↓ 0.41% (30D)

This is a classic sign of distribution:

whales reduce exposure while retail buys the green candles.

⸻

🔥 Heavy whale outflows in balances

In the “Balances” tab, multiple large wallets show strong negative changes:

• Token Billionaire wallets: millions of tokens sold / moved out

• Several “High Balance” wallets: consistent red outflows (2

🚨 KITE (Nansen) — WARNING: This Looks Like Distribution

Price is pumping, but on-chain data shows something else:

🔻 Top holders are SELLING into the pump

Nansen shows the Top 100 wallets balance is dropping:

• Top 100 Addresses: 9.29B ↓ 0.41% (30D)

This is a classic sign of distribution:

whales reduce exposure while retail buys the green candles.

⸻

🔥 Heavy whale outflows in balances

In the “Balances” tab, multiple large wallets show strong negative changes:

• Token Billionaire wallets: millions of tokens sold / moved out

• Several “High Balance” wallets: consistent red outflows (2

KITE-7,7%

- Reward

- 1

- 1

- Repost

- Share

Safa777 :

:

📌 The price rises, but the Top 100 holders sell. 📌 Whales make significant exits within 24 hours and 7 days.

📌 91% of the supply is in the top 100 → the risk of a dump is very high.

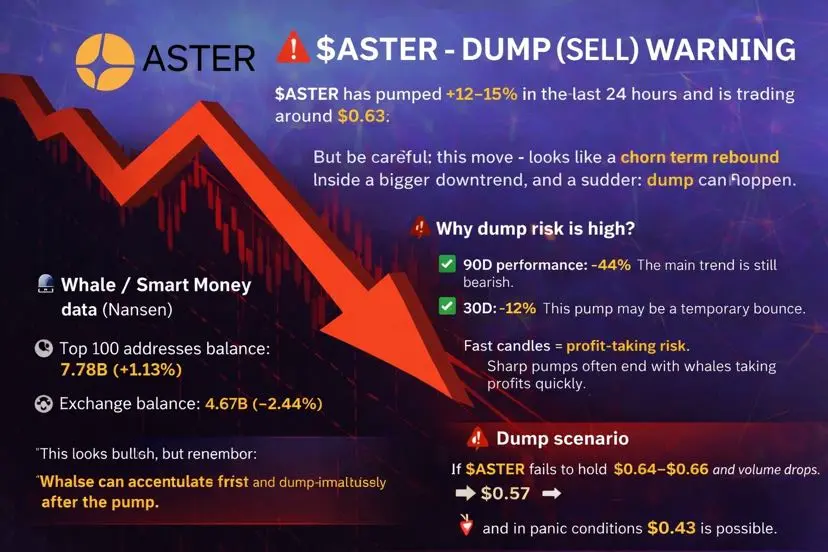

🚨 $ASTER — DUMP (SELL) ALERT

$ASTER has risen +12–15% in the last 24 hours and is currently trading around the $0.63 zone.

But beware: this rise could be a rebound within a larger downtrend and a dump could start at any moment.

📉 Why is the dump risk high?

✅ 90-day performance: -44%

This indicates that the trend is still fundamentally downward.

✅ 30 days: -12%

Meaning buyers were weak for a long time, and now a short-term "pump" is coming.

✅ Very sharp spikes

These sharp spikes often end with profit-taking.

⸻

🐳 What are the Whales / Smart Money doing? (Nansen)

📌 Top 100 address balance:

$ASTER has risen +12–15% in the last 24 hours and is currently trading around the $0.63 zone.

But beware: this rise could be a rebound within a larger downtrend and a dump could start at any moment.

📉 Why is the dump risk high?

✅ 90-day performance: -44%

This indicates that the trend is still fundamentally downward.

✅ 30 days: -12%

Meaning buyers were weak for a long time, and now a short-term "pump" is coming.

✅ Very sharp spikes

These sharp spikes often end with profit-taking.

⸻

🐳 What are the Whales / Smart Money doing? (Nansen)

📌 Top 100 address balance:

ASTER7,13%

- Reward

- 1

- Comment

- Repost

- Share

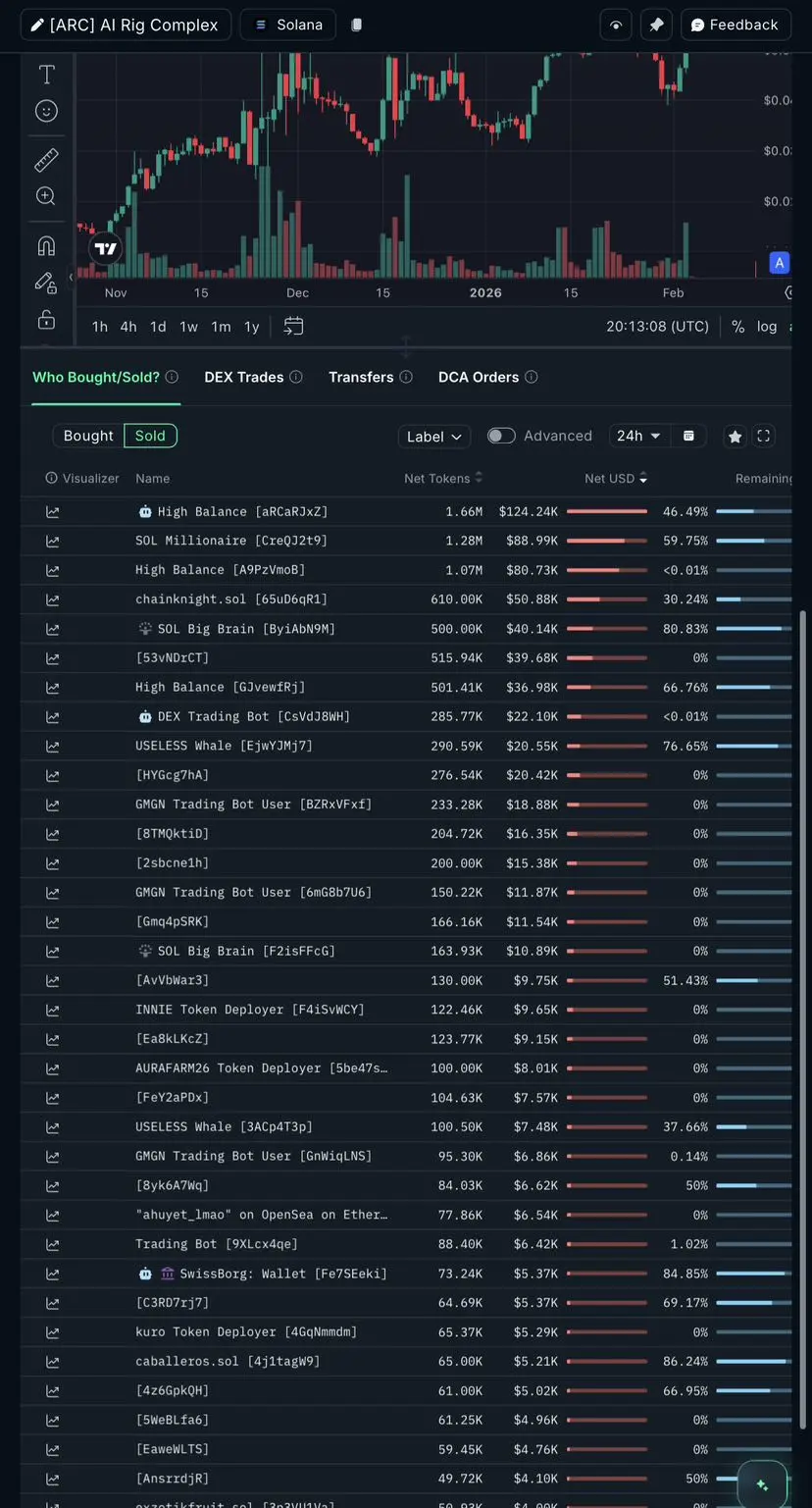

$ARC #ARC

🚨 $ARC — SELL / RISK WARNING

If you’re holding $ARC, watch this carefully.

1) Extreme concentration risk

📌 Gate wallet controls 53.17% (540.03M ARC)

That means ONE entity/exchange wallet can move the entire market.

2) Market makers are the main buyers

In the last 24h, the biggest buyer was:

✅ Wintermute Market Making: 8.21M ARC ($631K)

This is not organic retail demand — this is market making liquidity.

3) Whales are already selling (24h)

Top sellers include:

🔻 High Balance: 1.66M ARC ($124K)

🔻 SOL Millionaire: 1.28M ARC ($89K)

🔻 More whales + bots dumping constantly

4) DEX fe

🚨 $ARC — SELL / RISK WARNING

If you’re holding $ARC, watch this carefully.

1) Extreme concentration risk

📌 Gate wallet controls 53.17% (540.03M ARC)

That means ONE entity/exchange wallet can move the entire market.

2) Market makers are the main buyers

In the last 24h, the biggest buyer was:

✅ Wintermute Market Making: 8.21M ARC ($631K)

This is not organic retail demand — this is market making liquidity.

3) Whales are already selling (24h)

Top sellers include:

🔻 High Balance: 1.66M ARC ($124K)

🔻 SOL Millionaire: 1.28M ARC ($89K)

🔻 More whales + bots dumping constantly

4) DEX fe

ARC3,08%

- Reward

- 1

- Comment

- Repost

- Share

$ARC ARC (AI Rig Complex) —Fast SELL

RISK INCREASE !

ARC has shown rapid momentum (+50%+) in recent days. However, on-chain data clearly shows that medium and large holders have started to unload their positions.

⚠️ CRITICAL RISK SIGNALS:

🔻 7 DAY / 30 DAY SALES

• Gate Wallet:

➜ 7D: significant outflow

➜ 30D: ~45M+ net decrease in ARC

• Raydium / MEXC / HTX:

➜ Consecutive balance decreases during the 7D and 30D periods

• Wintermute Market Making:

➜ 7D: net outflow

➜ 30D: -30M+ ARC → classic distribution signal

📌 These types of sales do not happen in one day; they are ca

RISK INCREASE !

ARC has shown rapid momentum (+50%+) in recent days. However, on-chain data clearly shows that medium and large holders have started to unload their positions.

⚠️ CRITICAL RISK SIGNALS:

🔻 7 DAY / 30 DAY SALES

• Gate Wallet:

➜ 7D: significant outflow

➜ 30D: ~45M+ net decrease in ARC

• Raydium / MEXC / HTX:

➜ Consecutive balance decreases during the 7D and 30D periods

• Wintermute Market Making:

➜ 7D: net outflow

➜ 30D: -30M+ ARC → classic distribution signal

📌 These types of sales do not happen in one day; they are ca

ARC3,08%

- Reward

- 1

- Comment

- Repost

- Share

$ARC #arc #$ARC #ARC #CryptoMarketWatch

🔴 ARC – STRONG SELL ALERT

🚨 Risk zone active

📉 $0.070 – $0.075

→ Strong REJECTION possibility

→ Exchange entry ↑

→ Market Maker + bot payment

⚠️ At this stage, GREED = LOSS

⸻

❌ WHAT HAPPENS?

• Price resists resistance

• Large wallets drain liquidity

• Retail buys, smart side exits

This is a classic FAKE PUMP → DUMP structure.

⸻

🔻 PLAN

• SELL gradually

• Delay TP

• HOLD only if support is regained

📌 If support breaks:

➡️ Below $0.055 = trend breaks

⸻

WALLET FACTS (REAL DATA)

• 🟣 Top 1 Wallet (Gate):

🔴 ARC – STRONG SELL ALERT

🚨 Risk zone active

📉 $0.070 – $0.075

→ Strong REJECTION possibility

→ Exchange entry ↑

→ Market Maker + bot payment

⚠️ At this stage, GREED = LOSS

⸻

❌ WHAT HAPPENS?

• Price resists resistance

• Large wallets drain liquidity

• Retail buys, smart side exits

This is a classic FAKE PUMP → DUMP structure.

⸻

🔻 PLAN

• SELL gradually

• Delay TP

• HOLD only if support is regained

📌 If support breaks:

➡️ Below $0.055 = trend breaks

⸻

WALLET FACTS (REAL DATA)

• 🟣 Top 1 Wallet (Gate):

ARC3,08%

- Reward

- 3

- Comment

- 1

- Share

#RİVER #River #$RIVER #VanEckLaunchesAVAXSpotETF

The $11 area is a very good entry zone for River. This is only a HOLD approach for spot wallets.

Target: $80+ (partial profit can be taken along the way).

Active supply: ~19 million units.

Volume is active, the holder base is broad — suitable for patient spot HOLD.

The $11 area is a very good entry zone for River. This is only a HOLD approach for spot wallets.

Target: $80+ (partial profit can be taken along the way).

Active supply: ~19 million units.

Volume is active, the holder base is broad — suitable for patient spot HOLD.

- Reward

- 2

- Comment

- Repost

- Share

$CLANKER

General indicators

• Value: ~$37.06 (+2.7% in 24 hours)

• Market Cap: ~$36.6 million → medium market cap

• Volume: $17.0 million (+~60%) → active trading

• Liquidity: $2.98 million → quite solid from UAI

• Holders: 11,295 (+1.34%) → expanding base

• Risk Score: 73/100 → medium risk

• Sniper: 15/100 → early entrants present, but not excessive

📊 Technical (1D)

• After a sharp decline, the chart shows compression/consolidation.

• Recent candles show no continuation of panic, indicating stabilization.

• Volume increase → active trading within th

General indicators

• Value: ~$37.06 (+2.7% in 24 hours)

• Market Cap: ~$36.6 million → medium market cap

• Volume: $17.0 million (+~60%) → active trading

• Liquidity: $2.98 million → quite solid from UAI

• Holders: 11,295 (+1.34%) → expanding base

• Risk Score: 73/100 → medium risk

• Sniper: 15/100 → early entrants present, but not excessive

📊 Technical (1D)

• After a sharp decline, the chart shows compression/consolidation.

• Recent candles show no continuation of panic, indicating stabilization.

• Volume increase → active trading within th

CLANKER9,21%

- Reward

- like

- 1

- Repost

- Share

Safa777 :

:

Total Supply: 1,000,000😃RECOMMENDATION (RIVER):

The current price zone appears suitable for gradual accumulation. Although there is short-term volatility, the risk-reward ratio is attractive for the medium and long term.

It is recommended to hold a certain amount in your spot wallet (HOLD) and stay away from leverage.

Strategy: buy in increments, hold patiently, diversify your risk.

No short trades, planned spot approach…

#$RIVER #River #RIVER一個月暴漲50倍 #btc

The current price zone appears suitable for gradual accumulation. Although there is short-term volatility, the risk-reward ratio is attractive for the medium and long term.

It is recommended to hold a certain amount in your spot wallet (HOLD) and stay away from leverage.

Strategy: buy in increments, hold patiently, diversify your risk.

No short trades, planned spot approach…

#$RIVER #River #RIVER一個月暴漲50倍 #btc

BTC-4,47%

- Reward

- 1

- 1

- Repost

- Share

Safa777 :

:

HODL Tight 💪$ZORA

Holder structure – high risk

• Distribution Score: 9 (Highly centralized)

→ The token is concentrated in a small number of large wallets. This means there is a risk of a sharp dump at any moment.

• Top 100 Addresses: 9.34B (+4.3%)

→ Top wallets maintain/increase their share, but this is not always bullish: liquidity is often prepared for exit.

• Exchange balance: 6.96B (-5.11%)

→ A portion is being withdrawn from the exchange, but this is balanced by DEX sells (below).

⸻

• Balance drops sharply at the same time

➡️ This is not "price up, supply out," but rather "price up

Holder structure – high risk

• Distribution Score: 9 (Highly centralized)

→ The token is concentrated in a small number of large wallets. This means there is a risk of a sharp dump at any moment.

• Top 100 Addresses: 9.34B (+4.3%)

→ Top wallets maintain/increase their share, but this is not always bullish: liquidity is often prepared for exit.

• Exchange balance: 6.96B (-5.11%)

→ A portion is being withdrawn from the exchange, but this is balanced by DEX sells (below).

⸻

• Balance drops sharply at the same time

➡️ This is not "price up, supply out," but rather "price up

ZORA0,09%

- Reward

- 1

- Comment

- Repost

- Share

$STABLE #stable #btc #GoldBreaks$5,500 #Sell:

1) General Overview

• Price: ~$0.026

• Market Cap: ~$477M

• Volume: ~$20M (sharp increase – +400%+)

• Liquidity: ~$1.08M (weak relative to MC)

• Risk Score: 70/100 (medium–high risk)

2) Holder structure (most critical factor)

• Top 100 addresses: ~84% of supply → very high concentration

• Top 2–3 wallets hold >55% of supply

• This structure creates a risk of a sharp dump at any moment

3) “What are holders doing?”

• Top 100 balance ↓ (~-9.75%)

• Exchange balance ↓ (~-42%)

• This indicates "sel

1) General Overview

• Price: ~$0.026

• Market Cap: ~$477M

• Volume: ~$20M (sharp increase – +400%+)

• Liquidity: ~$1.08M (weak relative to MC)

• Risk Score: 70/100 (medium–high risk)

2) Holder structure (most critical factor)

• Top 100 addresses: ~84% of supply → very high concentration

• Top 2–3 wallets hold >55% of supply

• This structure creates a risk of a sharp dump at any moment

3) “What are holders doing?”

• Top 100 balance ↓ (~-9.75%)

• Exchange balance ↓ (~-42%)

• This indicates "sel

STABLE-6,97%

- Reward

- 1

- 1

- Repost

- Share

GateUser-719b5b2c :

:

Happy New Year! 🤑$Q $Q #Q #QuackAI$Q #sell Market Cap: ~$69–70M (short-term +40% spike)

• Liquidity: ~$25K → very weak

• Holders: ~23 (very few)

• Risk Score: 70/100 (high risk zone)

• Snipers: 49/62 → aggressive, short-term players

⸻

📉 Price & Technical Outlook

• Strong initial pump → sharp dump

• Followed by sideways trend + sudden spike

• These types of spikes typically end with:

• exit liquidity,

• or market maker/insider selling

• No solid accumulation structure visible

⸻

🧠 Holder structure (most critical part)

• Top 100 addresses ≈

• Liquidity: ~$25K → very weak

• Holders: ~23 (very few)

• Risk Score: 70/100 (high risk zone)

• Snipers: 49/62 → aggressive, short-term players

⸻

📉 Price & Technical Outlook

• Strong initial pump → sharp dump

• Followed by sideways trend + sudden spike

• These types of spikes typically end with:

• exit liquidity,

• or market maker/insider selling

• No solid accumulation structure visible

⸻

🧠 Holder structure (most critical part)

• Top 100 addresses ≈

Q-1,3%

- Reward

- 1

- Comment

- Repost

- Share

❗️Overview ‘’Play’’ 🔻Sell

• Price: ~$0.11482

• Volume: ~$14.5M (+1714% – high potential for artificial or speculative activity)

• Liquidity: ~$757K → at this level, large sales will quickly cause the price to drop

• Holders: 7,558 (weak growth)

• Risk Score: 70/100 → medium risk, but high distribution risk.

Holder structure – the main problem

🔴 Top 100 wallets = 94% of supply

This is a very dangerous concentration. It is not a real market, but a "controlled market."

• 1 wallet: ~74.8% (≈748M PLAY)

• Top 5 wallets > 92%

➡️ This means dumping is possible at any moment

T

• Price: ~$0.11482

• Volume: ~$14.5M (+1714% – high potential for artificial or speculative activity)

• Liquidity: ~$757K → at this level, large sales will quickly cause the price to drop

• Holders: 7,558 (weak growth)

• Risk Score: 70/100 → medium risk, but high distribution risk.

Holder structure – the main problem

🔴 Top 100 wallets = 94% of supply

This is a very dangerous concentration. It is not a real market, but a "controlled market."

• 1 wallet: ~74.8% (≈748M PLAY)

• Top 5 wallets > 92%

➡️ This means dumping is possible at any moment

T

- Reward

- 1

- Comment

- Repost

- Share